Introduction

Navigating the complexities of Social Security attorney fees can feel overwhelming. We understand that many individuals seeking benefits may find themselves unsure about the financial implications of legal representation. This understanding is crucial, as it can significantly impact the overall success of your claim.

Fortunately, innovative AI-powered advocacy tools, like Turnout, are here to help. These resources simplify the process, ensuring you receive the support you need without the burden of upfront costs. It's common to feel uncertain about the fees you might encounter, but you're not alone in this journey.

As the landscape of legal fees evolves, you may wonder:

- How can you make informed decisions about these costs?

- What strategies can you employ to maximize your chances of securing the benefits you deserve?

Let's explore these questions together, so you can feel empowered and supported every step of the way.

Turnout: AI-Powered Advocacy for Social Security Benefits

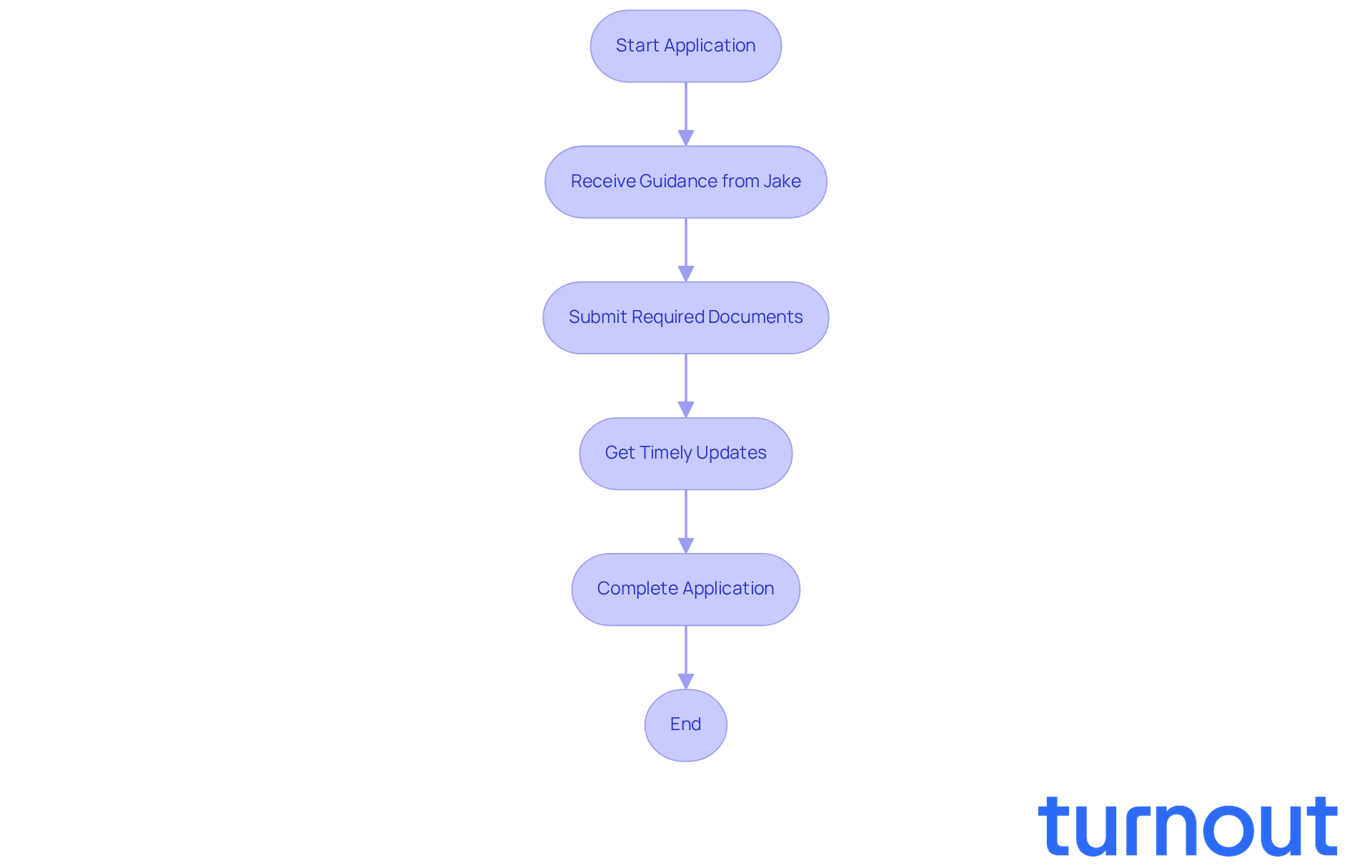

Navigating the application process for Security benefits can feel overwhelming. We understand that many individuals face challenges and uncertainties along the way. That’s where Turnout comes in, harnessing the power of AI technology to transform this journey into a more manageable experience.

At the heart of this initiative is Jake, our AI case quarterback. Jake is dedicated to ensuring you receive timely updates and support throughout your application journey. This innovative approach not only clarifies the often confusing landscape of government benefits but also empowers you to navigate it with confidence.

It’s important to note that Turnout is not a legal practice. By automating administrative tasks, our trained nonlawyer advocates can focus on high-leverage strategies that lead to better outcomes for those seeking Security benefits. Recent advancements in AI have shown great promise in improving the efficiency of benefit applications, streamlining processes, and enhancing communication.

As industry leaders recognize, integrating AI into legal representation is about more than just speed. It’s about ensuring you receive the support you need to overcome bureaucratic hurdles effectively. Remember, you are not alone in this journey; we’re here to help you every step of the way.

Understanding the Structure of Social Security Attorney Fees

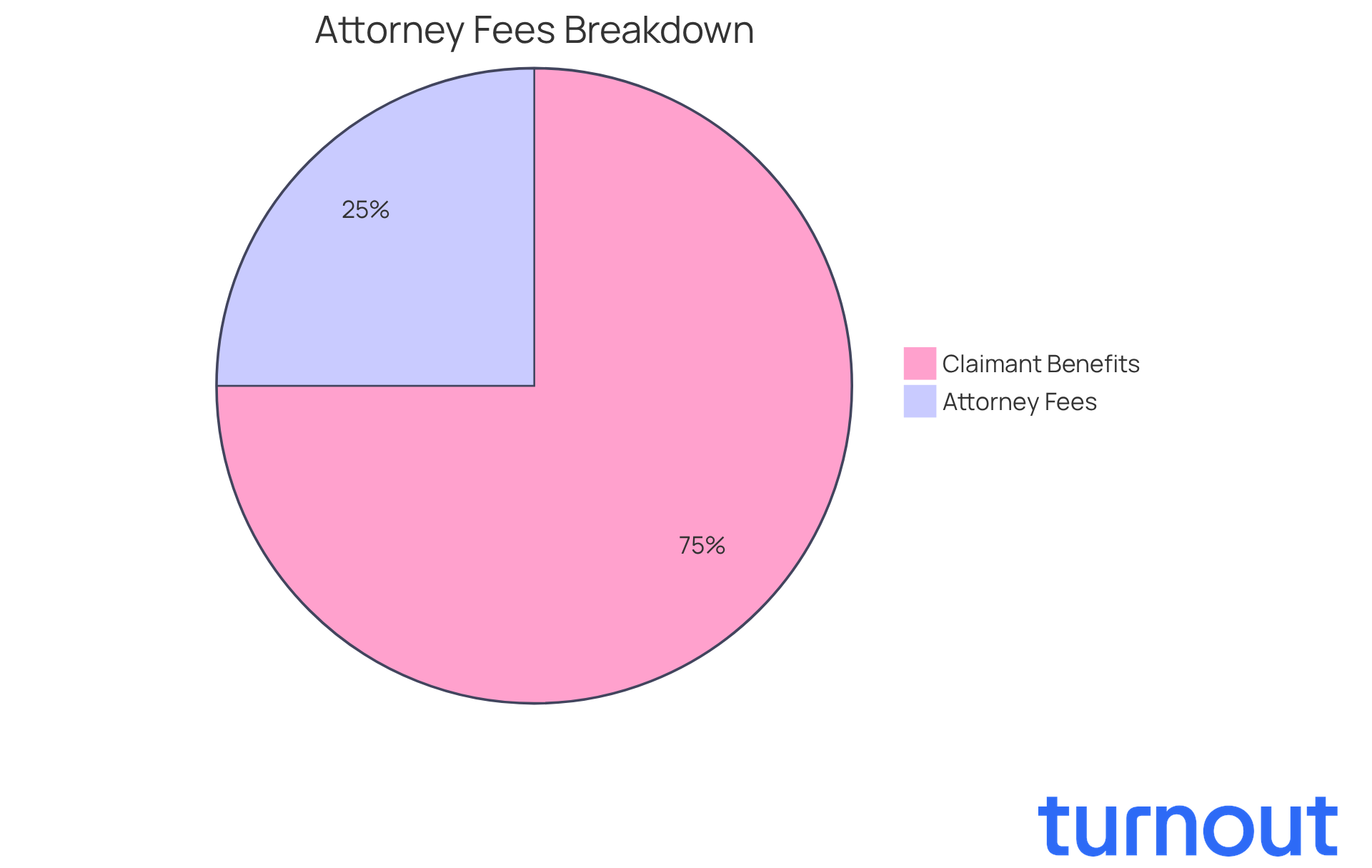

Navigating the legal costs associated with Social Security can feel overwhelming. We understand that many individuals face challenges in affording the upfront social security attorney fees. That’s where the contingency payment structure comes in, allowing lawyers to receive compensation only if their clients succeed in their cases. This approach makes legal representation more accessible, ensuring that you don’t have to worry about costs unless you obtain benefits.

Typically, social security attorney fees are charged at 25% of any past-due benefits awarded, with a cap set at $7,200, a change that took effect on November 30, 2022. This means you can focus on your health and recovery without the added stress of legal expenses. In fact, over 62% of initial disability claims are denied, often due to minor errors in the application process. Having legal representation can significantly boost your chances of approval - by as much as three times - compared to submitting your claim alone.

It’s common to feel uncertain about the claims process, but remember, you’re not alone in this journey. The contingency fee structure allows you to concentrate on what truly matters - your well-being - while your lawyer navigates the complexities of the Social Security Administration (SSA) process. This arrangement not only alleviates financial pressure but also empowers you to pursue your rightful benefits with confidence.

Many Security claimants choose legal representation through contingency fee arrangements, recognizing the value of expert assistance in the often daunting disability claims environment, which can include social security attorney fees. If you’re feeling overwhelmed, know that there are professionals ready to help you every step of the way. You deserve support and guidance as you seek the benefits you need.

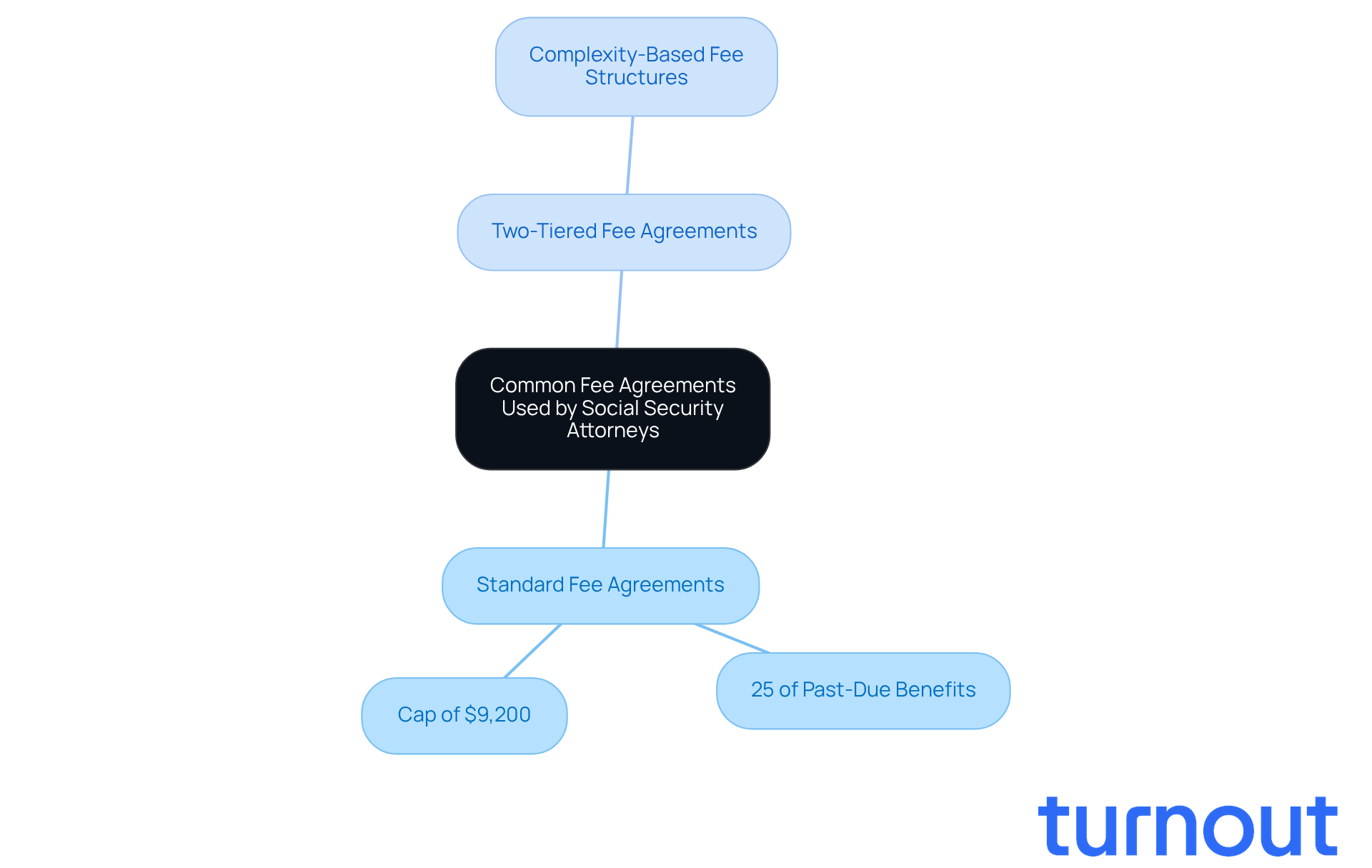

Common Fee Agreements Used by Social Security Attorneys

Navigating legal fee agreements can feel overwhelming, and we understand that. Lawyers typically use two main types of fee arrangements:

- Standard fee agreements

- Two-tiered fee agreements

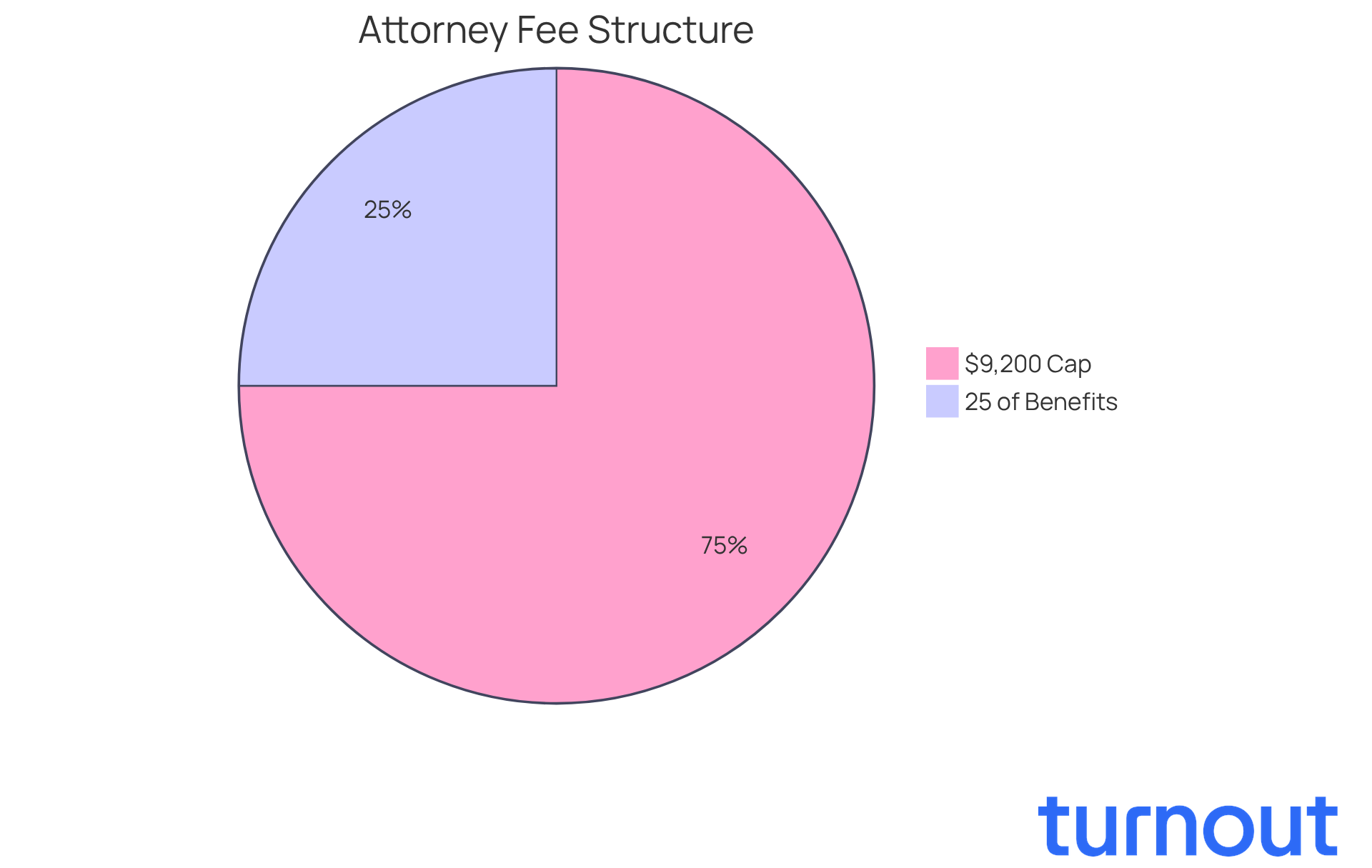

A standard fee agreement allows the lawyer to charge social security attorney fees that are equal to 25% of the past-due benefits awarded, with a cap set by the Social Security Administration (SSA). As of November 30, 2024, the cap related to social security attorney fees has risen to $9,200. This change highlights the growing expenses and inflation that legal professionals face.

Jennifer Cronenberg, Senior Counsel and Director of Legal Information, reminds us that 'there is no one way to structure a fee agreement as long as it meets the statutory conditions of the Act.' On the other hand, a two-tiered fee agreement offers different fee structures based on the complexity of the case, which can be particularly beneficial for those with more intricate claims.

Understanding these agreements is crucial for consumers. It ensures that you enter into fair and transparent arrangements. However, recent surveys show that many consumers are unclear about these fee structures. This underscores the importance of having thorough discussions with your attorney about social security attorney fees before signing any agreements.

O’Neil and Bowman Disability Group states, 'We believe in building personal relationships with the individuals we serve to better understand their needs and represent them.' This sentiment emphasizes the need for clear communication regarding fee agreements, which can significantly impact your satisfaction and trust during the claims process.

Additionally, many legal professionals include an 'accelerator clause' in their fee agreements. This clause allows fees to be paid at the current maximum fee cap rate, even if the agreement was signed at a lower rate.

Remember, you are not alone in this journey. We're here to help you understand your options and make informed decisions.

Percentage-Based Fees: What to Expect from Your Attorney

Navigating the world of Social Security can be challenging, and understanding the social security attorney fees is crucial. Social Security representatives typically charge 25% of the past-due benefits they help secure, with a maximum fee currently set at $9,200. For instance, if you receive $10,000 in back pay, the legal fee would amount to $2,500.

This fee is deducted directly from your awarded back pay, so you won’t face any upfront costs. We understand that financial concerns can be overwhelming, especially when dealing with back pay that exceeds $36,800. In such cases, the legal fee remains capped at $9,200, ensuring that you won’t be burdened by excessive legal expenses.

Comprehending social security attorney fees is vital for anyone maneuvering through the complexities of Social Security claims. Remember, you are not alone in this journey. We're here to help you understand every step of the process.

Upfront Fees: Are They Common in Social Security Cases?

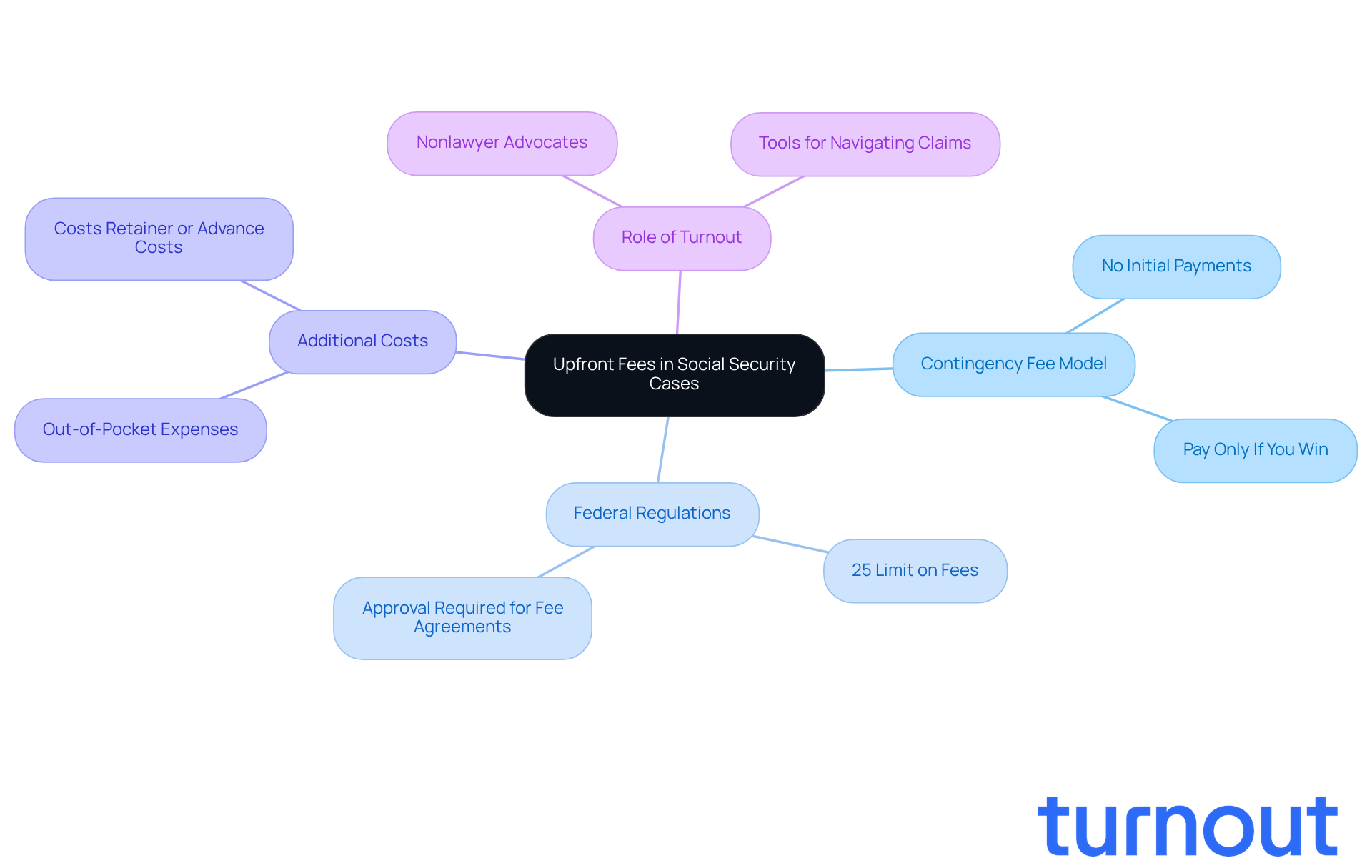

Navigating the world of Social Security can be overwhelming, and we understand that many individuals face financial challenges related to social security attorney fees when seeking legal help. That’s why respected Social Security lawyers typically don’t require initial payments. They operate on a contingency fee model, meaning you only pay social security attorney fees if they win your case. This approach is vital for making legal representation accessible to those who might struggle to pay upfront.

Under federal regulations, social security attorney fees are limited to 25% of past-due benefits, ensuring that services remain affordable. However, it’s important to be aware that some legal representatives may charge social security attorney fees for specific out-of-pocket expenses, like obtaining medical records or other necessary documentation. These costs should be clearly outlined in the fee agreement to avoid any surprises.

For instance, many attorneys may ask for a costs retainer or advance costs, expecting reimbursement at the end of the case. Transparency in these agreements is essential for building trust and clarity between you and your legal representative.

It’s also crucial to clarify that Turnout is not a law firm and does not provide legal representation. Instead, Turnout offers tools and services designed to assist you in navigating the complexities of Security Disability claims, utilizing trained nonlawyer advocates to support you along the way.

Understanding the fee structure is key as you navigate the intricacies of Security claims. As Susan M. O'Malley, a North Carolina State Bar Board Certified Specialist in Disability law, highlights, being informed can empower you in this journey. Remember, you are not alone in this process, and we’re here to help.

Fee Caps: Protecting Consumers from Excessive Charges

The Social Security Administration (SSA) understands that navigating the complexities of legal representation can be overwhelming. To protect consumers like you from excessive costs, they impose a limit on social security attorney fees that legal representatives can charge. As of 2025, the maximum social security attorney fees that a lawyer can charge is 25% of the past-due benefits awarded or $9,200, whichever is lower. This cap is designed to ensure that you retain a larger portion of your awarded benefits, alleviating some of the financial burdens during the claims process.

It's common to feel uncertain about fee agreements, but understanding this cap is essential. Legal experts emphasize that capping social security attorney fees is a critical consumer protection measure, especially for many disabled individuals who face challenges in securing quality representation. However, it's important to note that this stagnant fee cap has not been adjusted for inflation since 2009, making it increasingly difficult for attorneys to sustain their practices. This situation could limit access to the necessary legal support you deserve.

Awareness of these fee structures is vital as you navigate the complexities of Social Security claims. Remember, Turnout is not a law firm and does not provide legal advice or representation. Instead, we offer access to trained nonlawyer advocates who are here to help you with your Disability (SSD) claims. You are not alone in this journey; we ensure that you can navigate the system without the need for expensive legal representation.

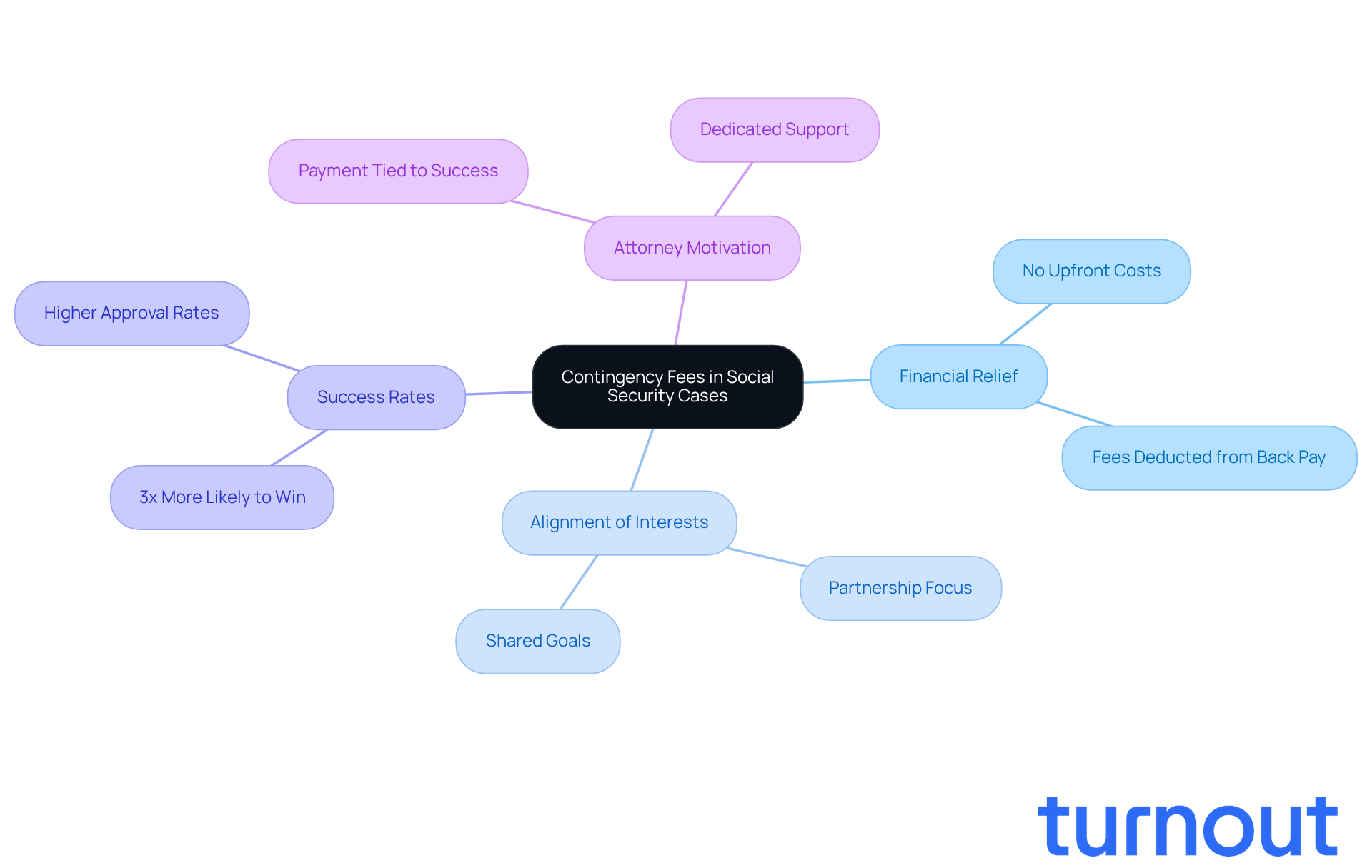

Contingency Fees: How They Work in Social Security Cases

Contingency payments are a common compensation arrangement in Social Security cases, enabling individuals to cover social security attorney fees only if they succeed in their claim. We understand that financial burdens can be overwhelming, and this arrangement significantly eases that pressure. You won’t have to worry about upfront fees. When your claim is successful, the legal fee is typically deducted from the back pay you receive, which can be a substantial amount. For instance, if you receive $40,000 in back pay, the legal fee would be capped at $9,200, ensuring you don’t face out-of-pocket costs.

This model not only alleviates financial stress but also aligns the interests of both you and your lawyer, creating a partnership focused on achieving a successful outcome. With legal representation, individuals are nearly three times more likely to be awarded benefits compared to those who navigate the process alone. It’s common to feel uncertain about the process, but having a skilled legal representative can make all the difference in presenting your case effectively and addressing any challenges that may arise.

Moreover, the contingency fee structure motivates attorneys to build a compelling case, as their payment is directly tied to your success. This ensures you receive dedicated support throughout the claims process, from gathering essential medical documentation to preparing for hearings. Ultimately, social security attorney fees structured as contingency fees provide a pathway for individuals pursuing Social Security benefits to access quality legal representation without the burden of upfront costs. Remember, you are not alone in this journey; we’re here to help.

Winning or Losing: How It Affects Your Attorney Fees

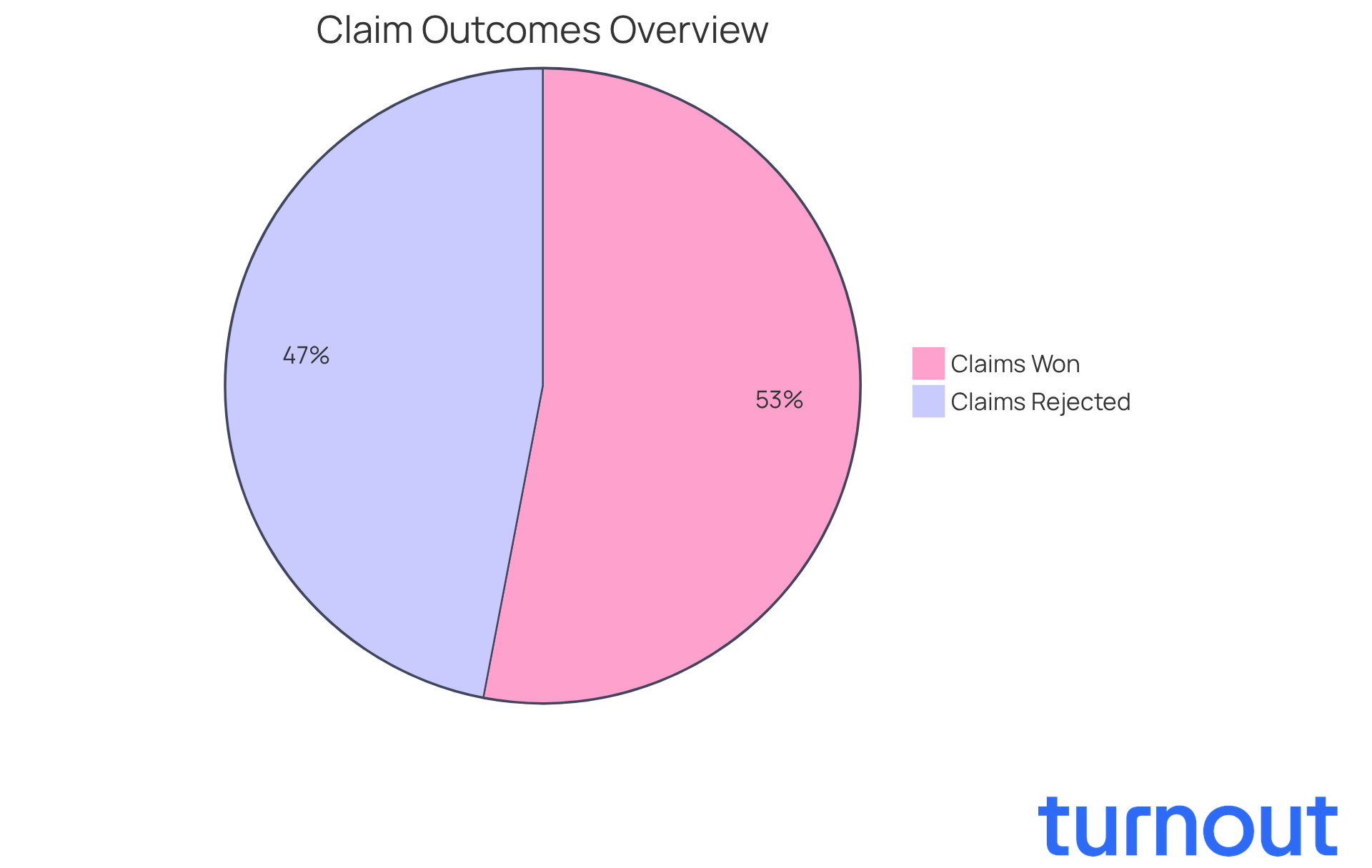

Navigating Social Security cases can be daunting, and we understand that the financial implications of claim outcomes weigh heavily on individuals. When you win your claim, the social security attorney fees are deducted directly from the back pay granted to you. This means you only incur social security attorney fees if you succeed, which can bring a sense of relief.

On the flip side, if your claim is rejected, you won’t owe any social security attorney fees. This arrangement significantly reduces the financial strain often associated with hiring a social security attorney due to attorney fees. It’s a crucial safety net that allows you to pursue your claims without the fear of incurring costs if things don’t go as planned.

Legal professionals emphasize how important this structure is. It enables you to seek the benefits you deserve without risking your financial stability. For instance, applicants who have legal representation enjoy a much higher success rate. In fact, statistics show that around 53% of those who challenge initial rejections eventually gain approval.

Understanding these financial dynamics is essential for anyone considering legal assistance. It highlights the potential for favorable outcomes while minimizing financial risk. Remember, you are not alone in this journey, and we’re here to help you every step of the way.

Transparency in Fee Agreements: What to Look For

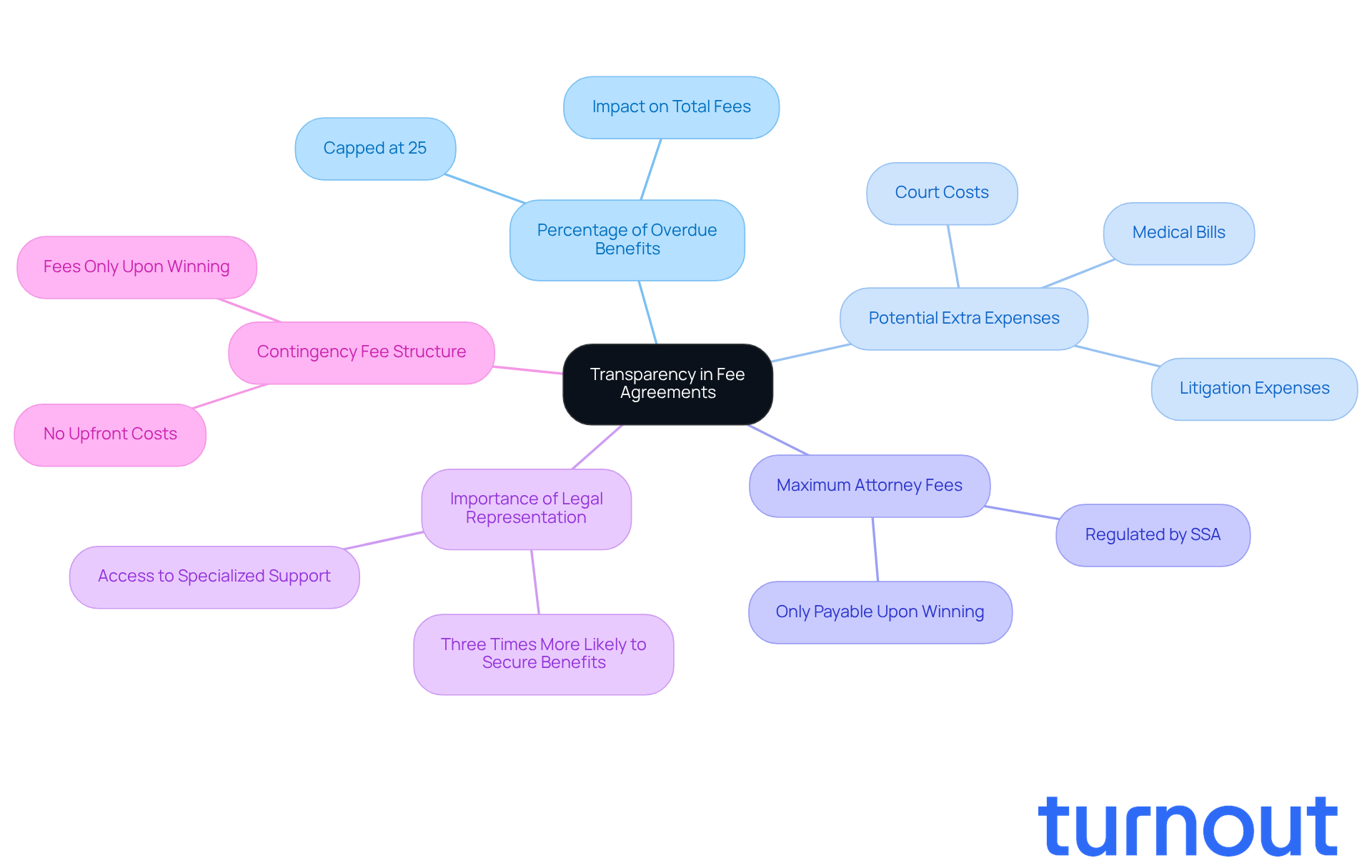

When entering into a fee agreement with a Social Security attorney, it’s essential to prioritize clarity and transparency regarding the social security attorney fees. We understand that navigating these agreements can be overwhelming, so let’s break it down together. Key factors to consider include:

- The percentage of overdue benefits assessed

- Any potential extra expenses

- The maximum social security attorney fees, which is set by the Security Administration at 25% of overdue benefits

A well-structured fee agreement should clearly outline the details regarding social security attorney fees. This ensures you are fully informed of your financial obligations before proceeding with legal representation. Research shows that individuals with legal representation are three times more likely to secure Social Security Disability benefits compared to those without specialized support. This underscores the importance of understanding fee agreements.

As lawyer Gary Green emphasizes, 'Grasping the fee arrangement is essential for individuals to make knowledgeable choices regarding their legal representation.' Additionally, the contingency fee structure allows clients to access legal help without upfront costs. It’s crucial to seek clarity in your agreements, as this can make a significant difference in your journey.

Remember, you are not alone in this process. We’re here to help you navigate these complexities with confidence.

Questions to Ask Your Attorney About Fees

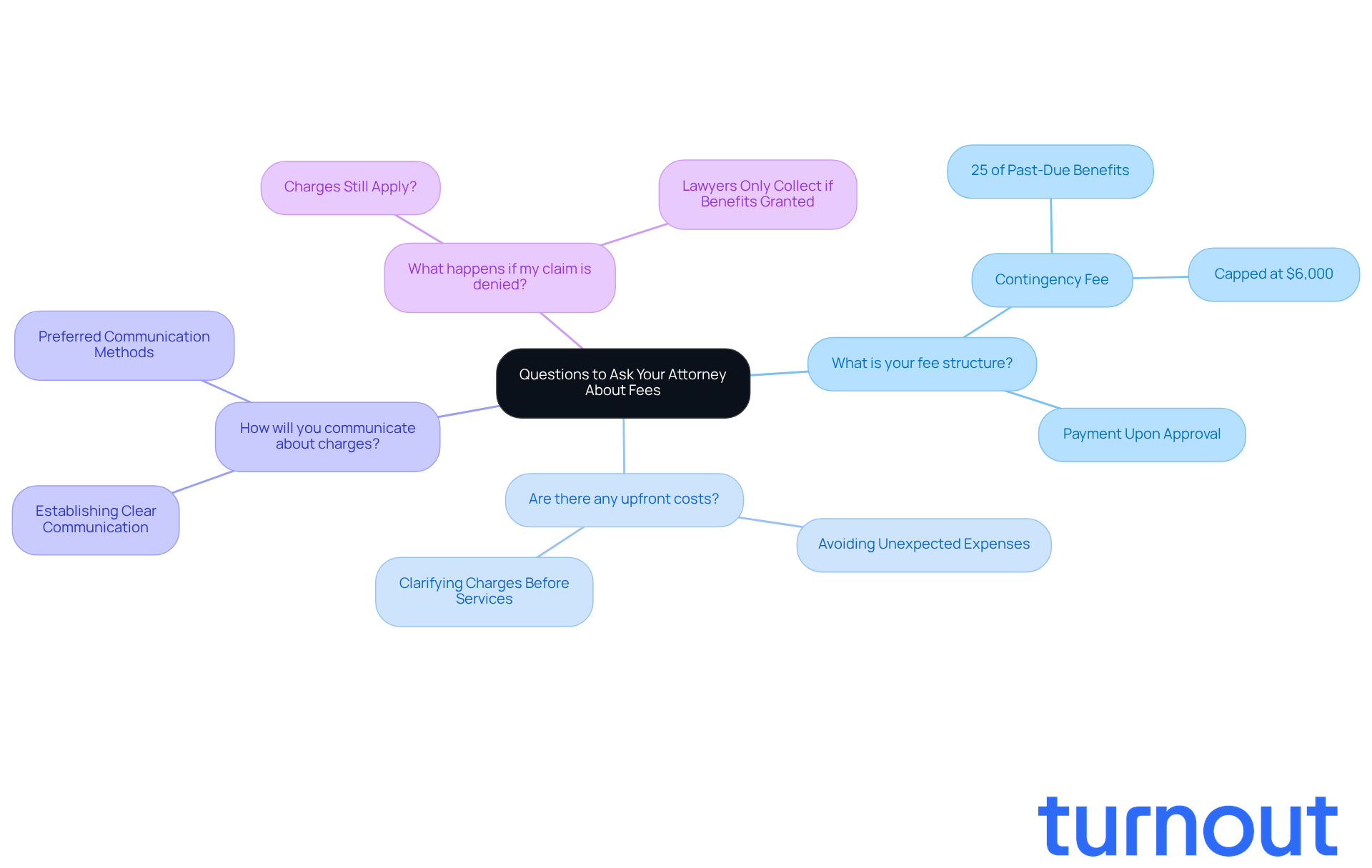

When discussing social security attorney fees with a Social Security lawyer, it’s important to prioritize clarity. We understand that navigating these financial aspects can be overwhelming, so asking the right questions can make a significant difference. Here are some essential inquiries to consider:

- What is your fee structure? It’s crucial to know if the attorney works on a contingency basis, typically charging social security attorney fees of 25% of past-due benefits, capped at a maximum of $6,000. This understanding can help you plan better.

- Are there any upfront costs? Knowing if any charges are required before services begin can help you avoid unexpected expenses.

- How will you communicate about charges throughout the process? Establishing a clear line of communication regarding social security attorney fees can help prevent misunderstandings later on.

- What happens if my claim is denied? Clarifying whether charges still apply in the event of a denial is vital, as many lawyers only collect payments if benefits are granted.

By asking these questions, you can gain a clearer picture of your financial obligations and ensure you’re entering into a fair agreement that includes social security attorney fees. It’s reassuring to know that statistics show applicants represented by lawyers have higher approval rates-over 60% success at the ALJ level. This highlights the importance of having open discussions about social security attorney fees to foster a trusting attorney-client relationship. As Clark DeVere, a Social Security lawyer, emphasizes, "Statistics show that applicants represented by lawyers have higher approval rates." This underscores the value of having legal representation to help you navigate the complexities of the claims process. Remember, you are not alone in this journey; we’re here to help.

Conclusion

Navigating the complexities of Social Security attorney fees can feel overwhelming, but understanding these fees is crucial for anyone seeking benefits. We recognize that financial stress can be a significant concern, which is why it's important to highlight the contingency payment structure. This approach ensures that you only pay if your claims are successful, alleviating some of that burden.

Legal representation can significantly enhance your chances of obtaining benefits. It’s essential for claimants to be informed and proactive in their approach. Key points to consider include:

- The structure of attorney fees

- The types of fee agreements available

- How winning or losing a case impacts your financial obligations

As the landscape of legal representation evolves, particularly with the integration of AI tools, individuals are finding new ways to access support and navigate the application process. Understanding fee caps and the importance of transparency in agreements empowers you to make informed decisions about your legal representation.

Ultimately, this knowledge serves as a vital resource for those pursuing Social Security benefits. By being informed about attorney fees and advocating for clarity in fee agreements, you can ensure that you receive the support you need without unnecessary financial burdens. Embracing these insights fosters confidence as you navigate the often daunting journey of securing your rightful benefits. Remember, you are not alone in this process; we’re here to help.

Frequently Asked Questions

What is Turnout and how does it assist with Social Security benefits?

Turnout is an AI-powered advocacy platform designed to help individuals navigate the application process for Social Security benefits. It uses AI technology to provide timely updates and support throughout the application journey, making the process more manageable.

Who is Jake and what role does he play in Turnout?

Jake is the AI case quarterback at Turnout. His role is to ensure that applicants receive support and updates during their application process, helping to clarify the complexities of government benefits.

Is Turnout a legal practice?

No, Turnout is not a legal practice. It employs trained nonlawyer advocates who automate administrative tasks, allowing them to focus on strategies that improve outcomes for those seeking Social Security benefits.

How do contingency payment structures work for Social Security attorney fees?

Contingency payment structures allow attorneys to receive fees only if their clients win their cases. Typically, attorney fees are charged at 25% of any past-due benefits awarded, with a cap of $7,200 as of November 30, 2022.

Why is having legal representation important in the Social Security claims process?

Legal representation can significantly increase the chances of approval for Social Security claims, with studies showing that representation can boost approval rates by as much as three times compared to claims submitted without legal assistance.

What are the common types of fee agreements used by Social Security attorneys?

The two main types of fee agreements are standard fee agreements, which charge 25% of past-due benefits with a cap (currently $9,200 as of November 30, 2024), and two-tiered fee agreements, which offer different fee structures based on the complexity of the case.

What should consumers know about fee agreements with Social Security attorneys?

Consumers should understand the fee structures to ensure they enter into fair and transparent arrangements. It is important to discuss these agreements thoroughly with the attorney before signing.

What is an "accelerator clause" in a fee agreement?

An accelerator clause allows fees to be paid at the current maximum fee cap rate, even if the agreement was signed at a lower rate. This can be beneficial for both the attorney and the client.

How can individuals seeking Social Security benefits feel supported during the application process?

Individuals can feel supported by utilizing resources like Turnout and seeking legal representation, which can help navigate the complexities of the Social Security Administration process and alleviate financial pressure through contingency fee arrangements.