Introduction

Navigating the complex world of long-term disability and social security benefits can feel overwhelming. Many individuals face significant challenges along the way, and it’s completely understandable to feel lost. This article shares ten essential insights that not only clarify these benefits but also empower you to maximize your financial support.

We understand that questions about eligibility, offsets, and retirement age can arise, making the need for clarity even more important. How can you effectively coordinate long-term disability with social security benefits to achieve the best possible outcome? The answers lie within this guide, offering a pathway through the confusion and towards informed decision-making. Remember, you are not alone in this journey; we’re here to help.

Turnout: Your Advocate for Long-Term Disability and Social Security Benefits

Navigating the complex world of long-term disability and social security assistance can feel overwhelming. We understand that many people face significant challenges in this process. That’s where we come in.

By harnessing the power of AI technology, our company simplifies the application journey. We’re here to help you secure the support you need, free from the usual bureaucratic hurdles. With advocates working alongside our AI, you can expect personalized guidance tailored to your unique situation, making the path to securing benefits much more manageable.

While some of Turnout's services are offered at no cost, please note that others may involve service fees. Additionally, any government fees required by agencies must be settled before we can submit paperwork on your behalf.

To ensure a seamless experience, all communications will be sent electronically. This includes notices, agreements, and disclosures, allowing you to focus on what truly matters - pursuing the financial assistance you deserve. Remember, you are not alone in this journey; we’re here to support you every step of the way.

Understanding the Interaction Between Long-Term Disability and Social Security Benefits

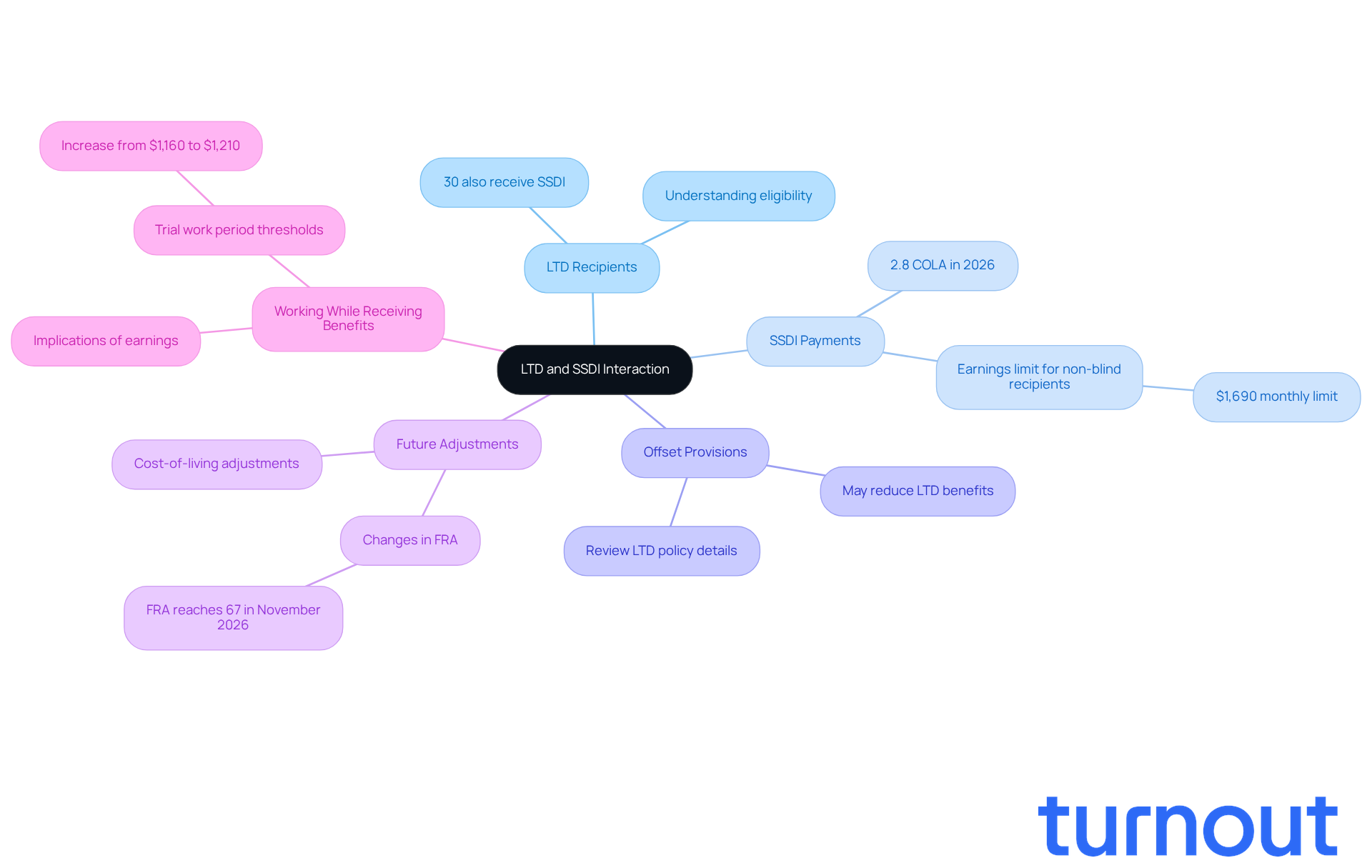

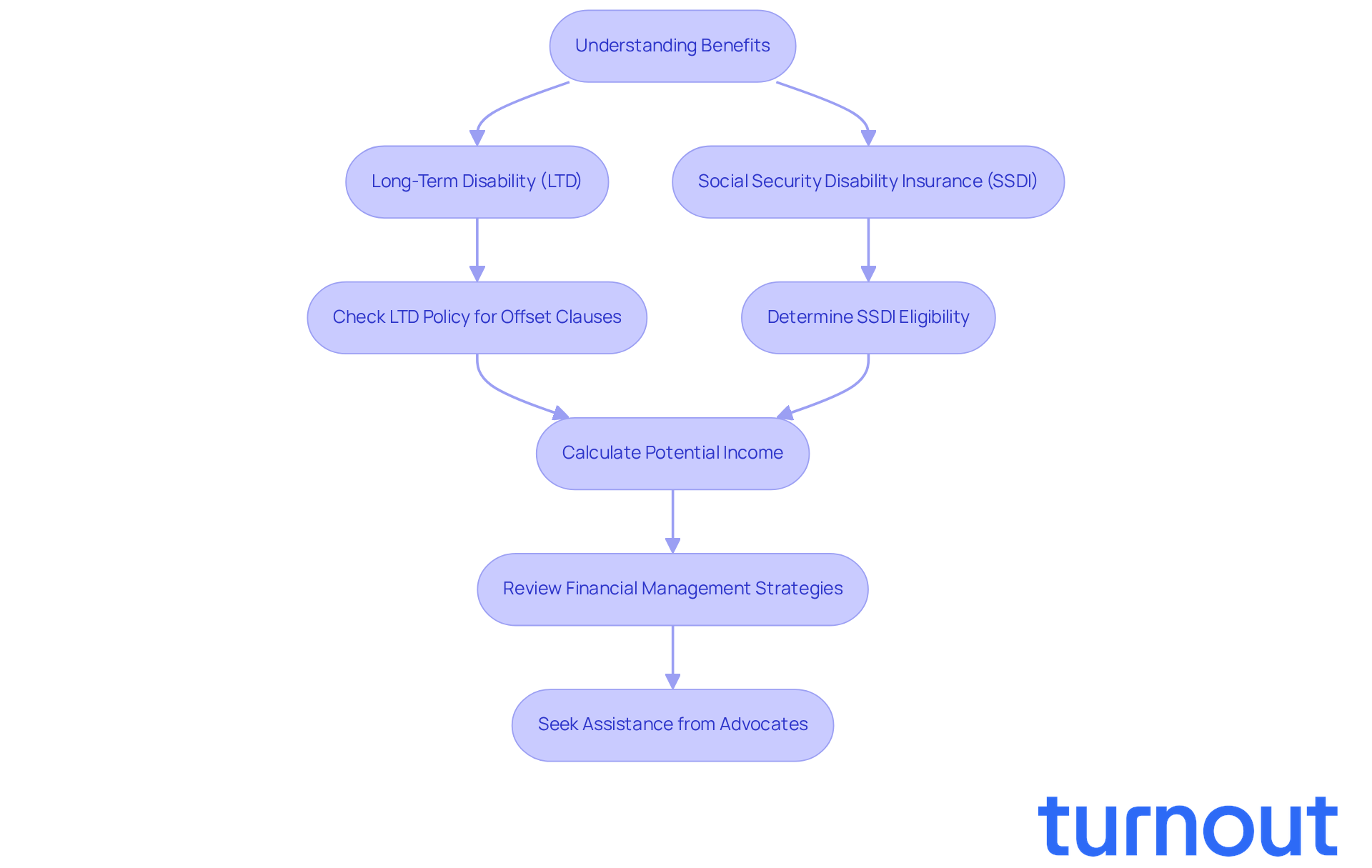

We understand that navigating the interaction between long-term disability (LTD) assistance and Social Security Disability Insurance (SSDI) can feel overwhelming, especially when considering if you can collect long-term disability and social security. It’s important to know that roughly 30% of LTD recipients also receive disability payments, highlighting the possibility for dual support. However, many LTD policies include offset provisions, which may reduce your LTD benefits by the amount you receive from SSDI, raising the question: can you collect long-term disability and social security? This means that while you may qualify for both, it raises the question of can you collect long-term disability and social security, and the total income you receive could be less than you expect if you’re not aware of these offsets.

For instance, a financial consultant might emphasize how crucial it is to understand how LTD advantages can affect your disability income eligibility. They often encourage clients to closely review their LTD policy details to avoid any surprises. As we look ahead to 2026, when disability insurance recipients will receive a 2.8% cost-of-living adjustment (COLA), it’s vital to consider how this increase interacts with any long-term disability payments you may be receiving.

Moreover, the complexities of these benefits can lead to misunderstandings, especially when considering the implications of working while receiving disability benefits. For example, in 2026, non-blind SSDI recipients can earn up to $1,690 monthly without affecting their assistance. This can be a crucial factor for those receiving LTD as well. Understanding these nuances is essential for maximizing your financial support and ensuring you are fully informed about your rights and options, including if you can collect long-term disability and social security.

Remember, you’re not alone in this journey. We’re here to help you navigate these challenges and make the most of the support available to you.

Eligibility Requirements for Long-Term Disability and Social Security Benefits

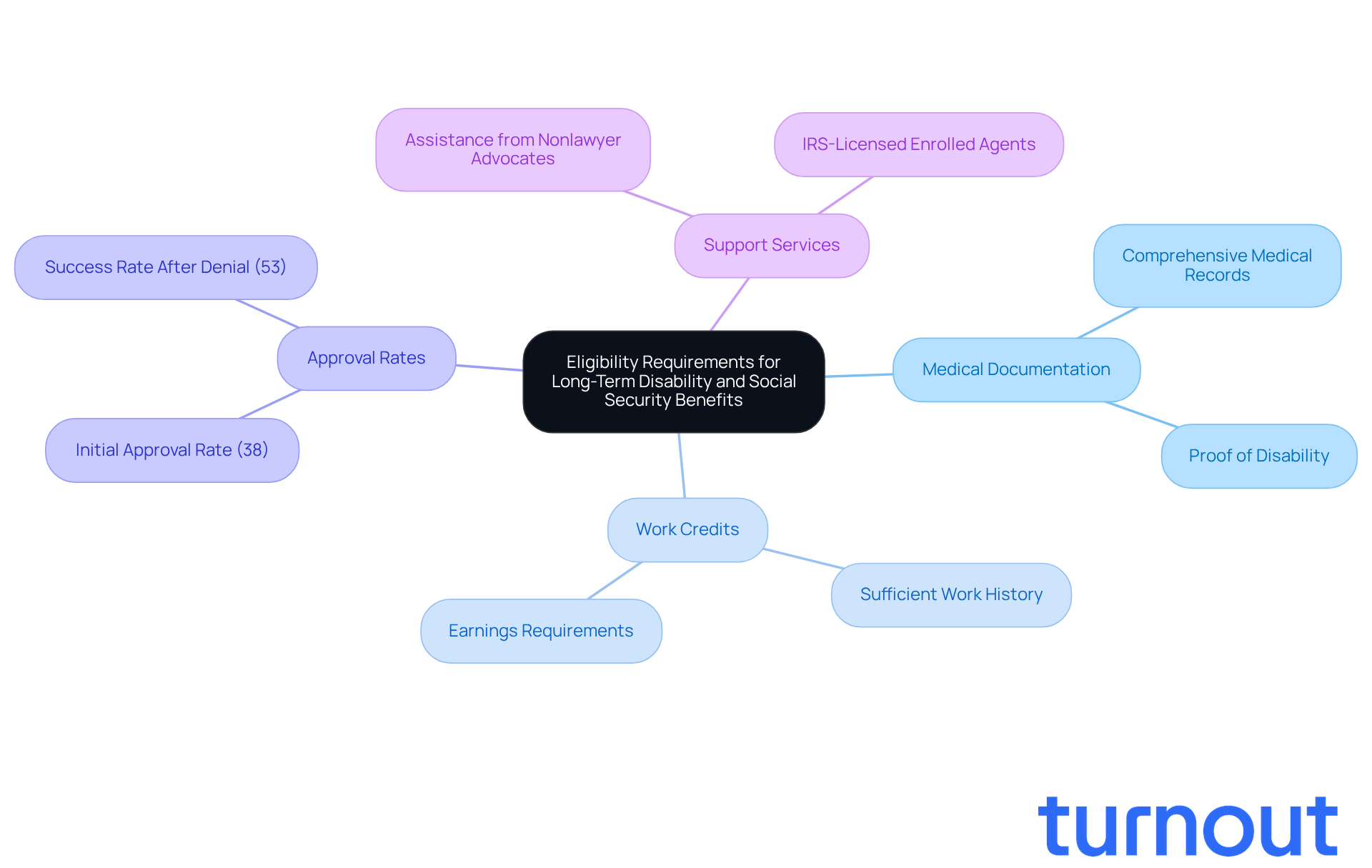

Navigating the long-term disability assistance process raises the question, can you collect long term disability and social security, which can feel overwhelming. We understand that proving you’re unable to work due to a medical condition is a significant hurdle. Typically, applicants need to provide comprehensive medical documentation and grasp the specific policy terms.

For those seeking Social Security assistance, an important question is, can you collect long term disability and social security if you have worked a certain number of years and earned sufficient work credits? You also need to demonstrate that your disability meets the strict criteria set by the Social Security Administration. In 2026, the approval rate for initial applications is notably low, with only about 38% of applicants meeting the technical requirements being accepted initially. That means approximately two out of every five applicants are approved after passing these requirements.

However, there’s hope. Fifty-three percent of those who challenge an initial denial ultimately obtain assistance. This underscores the importance of thorough documentation and persistence. Remember, you are not alone in this journey.

Turnout offers valuable assistance in navigating these complex processes. They utilize trained nonlawyer advocates for SSD claims and work with IRS-licensed enrolled agents for tax debt relief. As Social Security Commissioner Frank J. Bisignano stated, "The cost-of-living adjustment is a vital part of how Social Security delivers on its mission."

Understanding these requirements is crucial for successfully navigating the application process. We’re here to help you every step of the way.

Potential Offsets Between Long-Term Disability and Social Security Benefits

When considering your benefits, it's important to understand how long-term disability (LTD) insurance policies often come with offset clauses that can significantly impact the payments you receive, and can you collect long term disability and social security, especially if you qualify for Social Security Disability Insurance (SSDI). For instance, if your LTD policy provides $2,000 each month and you’re eligible for $1,000 in SSDI, your LTD payouts might be reduced to $1,000. This effectively caps your total monthly income at $1,000, which can create financial strain, particularly for those relying on these benefits for essential expenses.

We understand that navigating these offsets can be challenging. That’s why it’s crucial to grasp how they work for effective financial management. Financial planners stress the importance of being proactive in this area. They recommend keeping thorough records of all income sources and regularly reviewing your benefits to ensure you’re maximizing your entitlements.

Turnout offers valuable tools and services to help consumers like you navigate these complex financial systems. They provide assistance in understanding how SSDI affects your LTD benefits. This includes support from trained nonlawyer advocates who can guide you through SSDI claims and IRS-licensed enrolled agents for tax debt relief. Real-life stories highlight the struggles individuals face with offsets. One person, who received both LTD and social security benefits, discovered that their total income fell short of their pre-disability earnings, making it tough to cover basic living expenses. Unfortunately, this situation is not uncommon; statistics reveal that many injured workers experience significant reductions in their LTD payments due to offsets from SSDI, with average decreases often exceeding 60% of their previous earnings.

As we look ahead to 2026, the impact of SSDI on long-term disability assistance remains a pressing concern. Many beneficiaries report that the financial implications of receiving disability benefits can lead to unpredictable income streams, complicating budgeting and increasing stress during an already difficult time. Nicholas Feden, partner and Chair of the Long-Term Disability Group at Pond Lehocky, notes, "Offsets are a tool insurers use to lessen the payments they owe an injured worker by deducting support the worker receives from other sources regarding the same disability." It’s essential for you to understand how SSDI can help answer the question of whether you can collect long term disability and social security assistance. Remember, you’re not alone in this journey; seeking advice from organizations like Turnout can help you manage these offsets effectively.

Necessary Documentation for Long-Term Disability and Social Security Applications

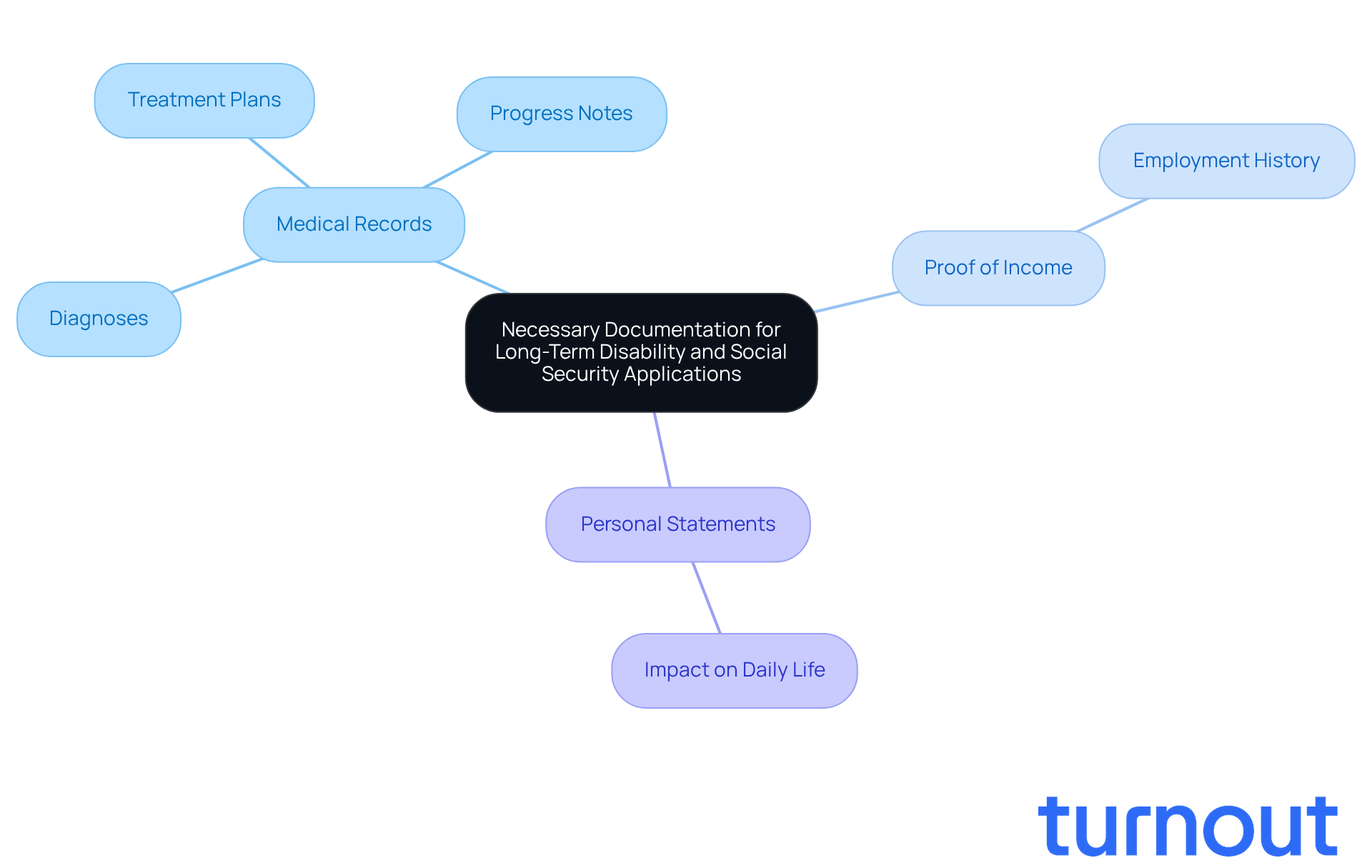

Gathering comprehensive documentation is essential when you can collect long-term disability and social security benefits. We understand that this process can feel overwhelming, but having the right documents can make a significant difference. Key documents include:

- Detailed medical records that outline your diagnoses, treatment plans, and progress notes.

- Proof of income and employment history.

- Personal statements describing how your disability impacts your daily life.

When applying for Social Security Disability Insurance (SSDI), you might wonder, can you collect long term disability and social security by providing thorough information about your work history and the nature of your disability, which is vital? Remember, complete and accurate documentation significantly improves the likelihood of a successful claim. It's common to feel uncertain, but know that trained nonlawyer advocates are available to assist you through this process.

It's important to note that Turnout is not a law firm and does not provide legal representation. As we look ahead to 2026, with the anticipated increase in SSDI payments from $2,500 to $2,570, ensuring all required documents are in order will be more important than ever. If someone is helping you with your claim, a power of attorney may be necessary.

Claims supported by comprehensive documentation have higher success rates. So, take the time to prepare meticulously. You're not alone in this journey, and we're here to help you every step of the way.

Appealing Denials of Long-Term Disability Benefits

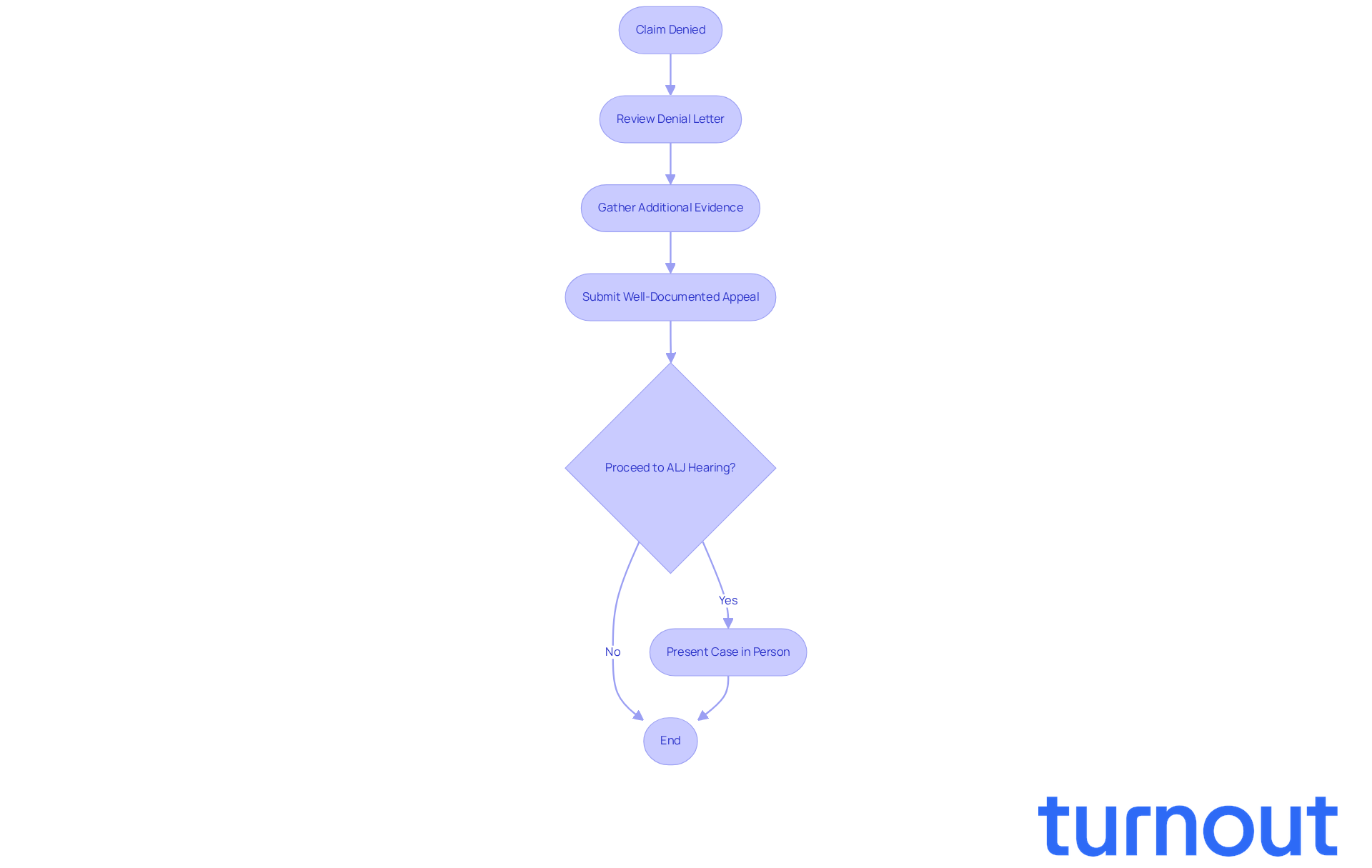

If your long-term disability claim has been denied, we understand how disheartening that can be. It’s essential to stay proactive and pursue your right to appeal. Start by carefully reviewing the denial letter to pinpoint the specific reasons for rejection. This understanding is crucial, as many claims are denied due to incomplete documentation or technical errors.

To strengthen your case, gather additional evidence. Updated medical records and expert opinions can really help substantiate your claim. For example, expert testimonies - especially from medical and vocational professionals - can significantly enhance your appeal. This is particularly true in complex cases involving conditions like Myalgic Encephalomyelitis/Chronic Fatigue Syndrome, where detailed medical evaluations are vital.

Submitting a well-documented appeal within the required timeframe - typically within 180 days of the denial - is critical. Did you know that approval rates increase significantly at the Administrative Law Judge (ALJ) hearing level? More than 58% of applicants who proceed to the ALJ hearing stage are ultimately approved when they present their cases in person. This stage allows for the introduction of medical and vocational expert testimonies, which can be pivotal in demonstrating the legitimacy of your claim.

Consider the success stories of individuals who have successfully appealed their denials by providing comprehensive documentation and expert support. For instance, a senior corporate executive recovered their short-term disability support after presenting further medical assessments that clarified their condition, as highlighted in the case study titled 'Victory for Senior Corporate Executive.' Such examples underscore the importance of not only appealing but doing so with a robust and well-supported case.

Keep in mind, the appeals process can be prolonged. But with proper preparation and support, you can enhance your chances of obtaining the advantages you deserve. Remember, you are not alone in this journey; we’re here to help.

Timeline for Receiving Long-Term Disability and Social Security Benefits

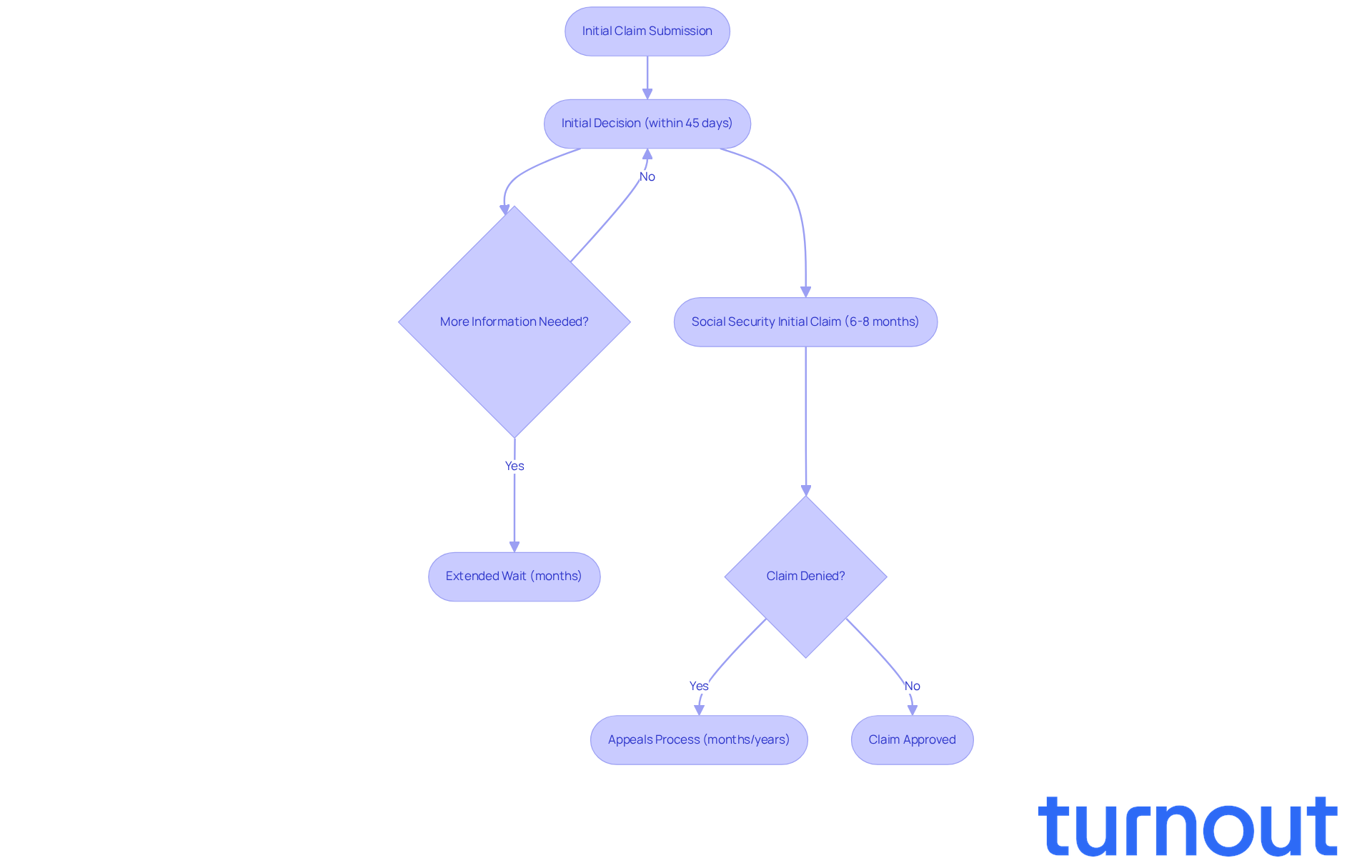

Navigating the timeline for long-term disability assistance raises the question, can you collect long term disability and social security? We understand that each situation is unique, and the process can vary significantly based on your insurer and personal circumstances. Typically, an initial decision is made within 45 days. However, if more information is needed, this period can stretch to several months.

When it comes to Social Security assistance, the average processing time for an initial claim is about six to eight months. If your claim is denied, the appeals process can add several more months or even years to your wait. It is crucial for effective financial planning to know if you can collect long term disability and social security. Delays can impact your ability to manage expenses during this waiting period.

The Social Security Administration has made strides in reducing backlogs, with the initial claims backlog dropping to its lowest level since 2022. Still, many applicants face lengthy waits. Financial advisors emphasize the importance of preparing for these potential delays to ensure that you understand if you can collect long term disability and social security benefits.

If you’re dealing with severe health conditions, options like Quick Disability Determinations and Compassionate Allowances can help expedite your claims. We’re here to support you through this process. Our organization offers access to trained nonlawyer advocates who can help you navigate the complexities of SSD claims, ensuring you have the support you need during this challenging time.

Please remember, Turnout is not a law firm and does not provide legal representation. We also offer services related to tax debt relief, further supporting you on your financial journey. You are not alone in this journey; we’re here to help.

Impact of Retirement Age on Long-Term Disability and Social Security Benefits

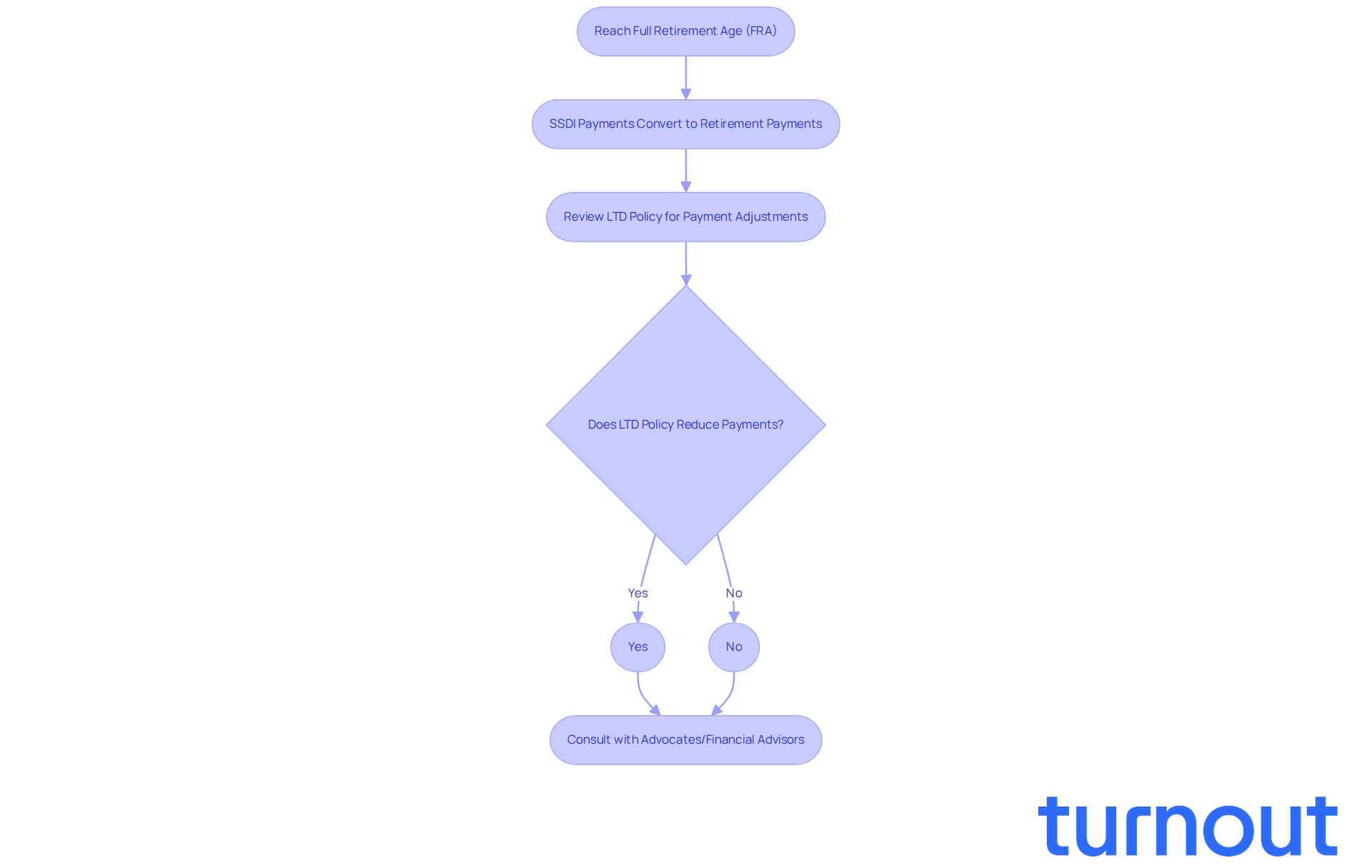

Reaching retirement age can feel overwhelming, especially when you wonder can you collect long term disability and social security benefits. We understand that this transition can bring up many questions. When you hit full retirement age (FRA), your Social Security Disability Insurance (SSDI) payments automatically convert to retirement payments. This change can affect the amount you receive. For instance, many disability recipients notice their payments adjust to align with retirement assessments, which might differ from their previous disability compensation. In 2026, the average SSDI payment is expected to rise by 2.8%, adding about $44 per month. This increase can help ease your transition into retirement.

If you're receiving LTD payments, you may wonder, can you collect long term disability and social security, making it crucial to review your policy. Many policies have specific terms about how payments are impacted when you retire. The question arises, can you collect long term disability and social security, as some may reduce LTD payments once you start receiving Social Security retirement benefits, while others might not. Understanding these details is vital for effective financial planning.

Turnout, which is not a law firm, offers access to trained nonlawyer advocates who can help you navigate the complexities of SSD claims and tax debt relief. These advocates ensure you understand how your benefits may change as you move into retirement. Real-life stories show that many individuals who transition from disability payments to retirement support experience a smoother financial adjustment, especially when they consult with advocates or financial advisors. Staying informed about the conversion process can significantly enhance your financial stability during retirement.

As the landscape of Social Security evolves, particularly with the projected increase in the FRA to 67 for those born in 1960 or later, being proactive in understanding these changes is essential for securing your financial future. For beneficiaries reaching FRA in 2026, the earnings limit is set at $65,160, with $1 withheld for every $3 earned above this threshold until FRA is reached. Remember, you are not alone in this journey, and we're here to help.

Common Misconceptions About Long-Term Disability and Social Security Benefits

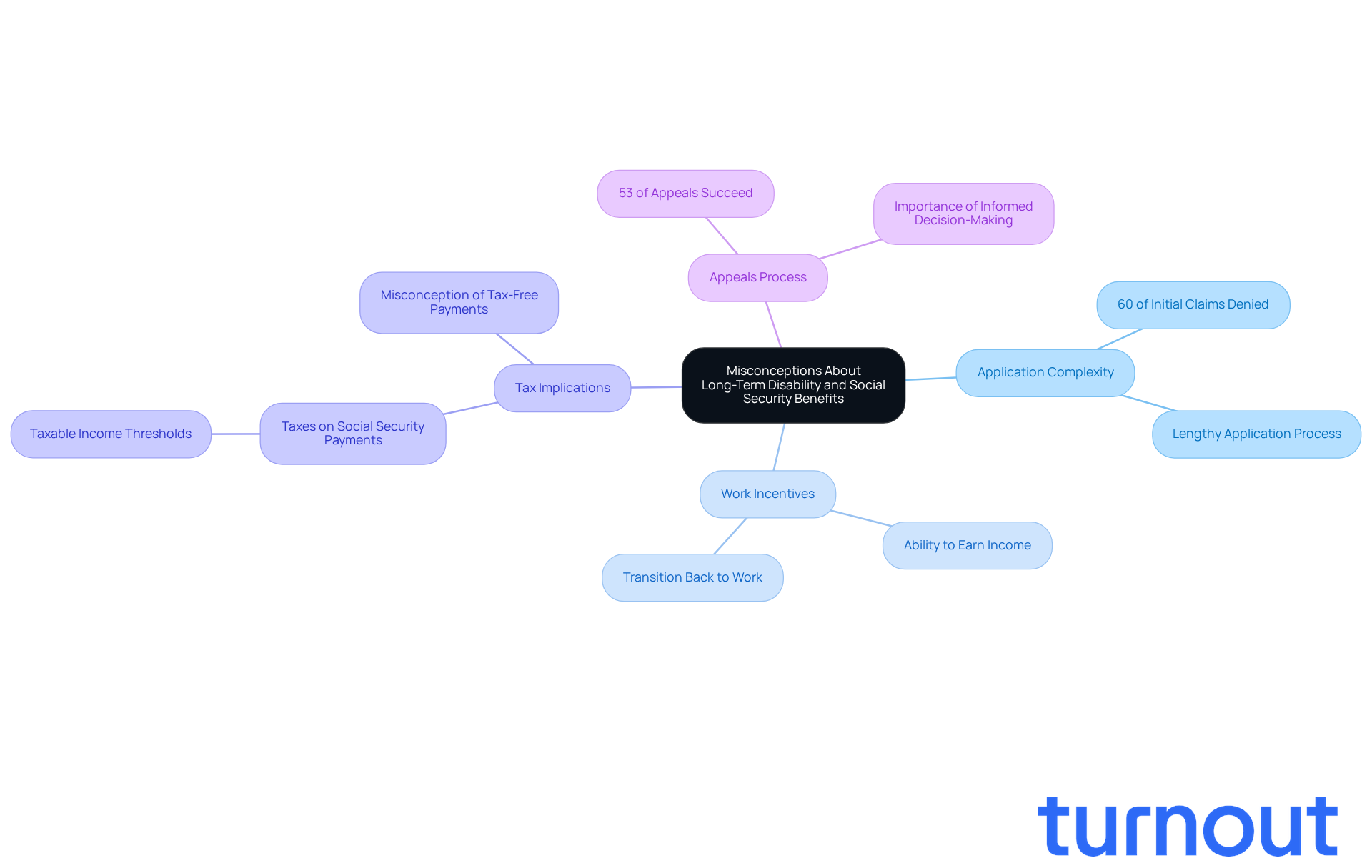

Many people face confusion when it comes to whether they can collect long term disability and social security benefits. It’s common to think that applying for Social Security Disability Insurance is straightforward, but did you know that about 60% of initial claims are denied? This high denial rate highlights just how complex the application process can be, often requiring you to navigate detailed technical requirements.

We understand that you might be worried about your rights and options. It’s important to clarify that Turnout is not a law firm and doesn’t provide legal advice. Another misconception is that beneficiaries can’t work while receiving SSDI. In reality, there are work incentives in place that allow you to earn income without jeopardizing your support. This can make it easier for you to transition back to work if you’re able.

You might also believe that Social Security payments are tax-free, but since 1984, taxes can apply to these payments based on your income. Understanding these misconceptions is crucial for answering the question: can you collect long term disability and social security while effectively navigating the benefits landscape. We want to ensure you’re well-informed about your rights and choices.

Additionally, Turnout offers tax debt relief services, which can be a significant help for those managing financial obligations. It’s also essential to recognize the importance of the appeals process. Statistics show that 53% of applicants who challenge an initial denial eventually receive assistance. This underscores the value of informed decision-making in this challenging landscape.

Remember, you are not alone in this journey. We’re here to help you every step of the way.

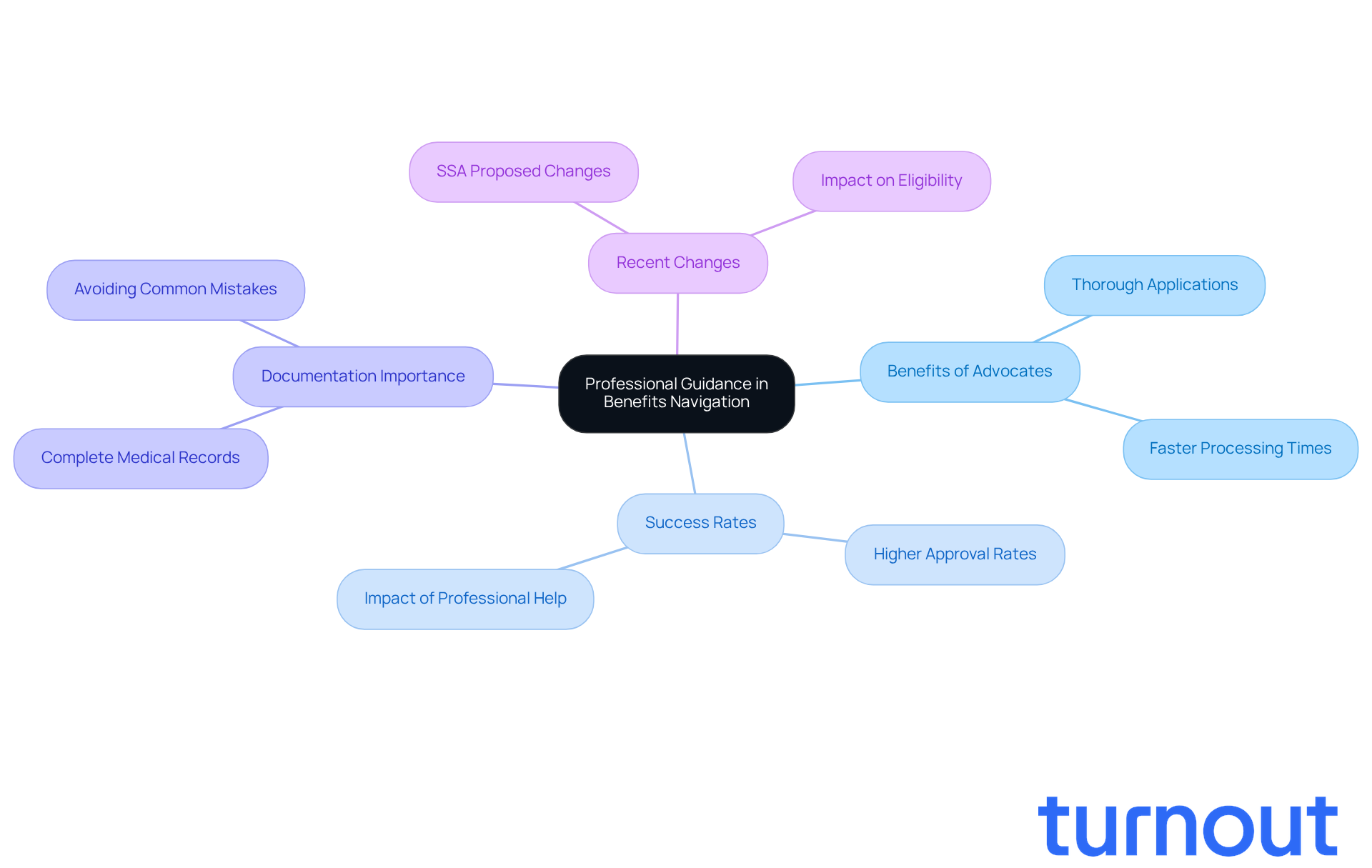

The Importance of Professional Guidance in Navigating Benefits

Navigating the complexities of long-term disability and social security can feel overwhelming. We understand that seeking help in these situations is essential. At our organization, our trained nonlawyer advocates are here to support you with Social Security Disability (SSD) claims and tax debt relief. They provide invaluable assistance, ensuring your applications are thorough and well-documented, which can significantly boost your chances of approval.

Did you know that a well-prepared application can lead to faster processing times? Some claims receive decisions in just a few months! In contrast, applicants without professional help often face frustrating delays due to incomplete documentation or misunderstandings about eligibility criteria.

Data shows that individuals who enlist advocates, like those in our organization, experience higher success rates. Claims prepared with professional assistance are approved at a rate nearly 30% higher than those submitted independently. For example, one applicant who was initially denied assistance sought help from an advocate. With careful gathering of medical records and a persuasive case, they successfully appealed and received the support they urgently needed.

Moreover, our advocates offer critical insights into the ever-changing landscape of disability claims and tax debt relief. Recent changes proposed by the Social Security Administration (SSA) can be confusing, but having a knowledgeable advocate by your side can help you adapt to new requirements and improve your chances of success.

To maximize your chances, ensure your documentation is complete. Remember, you are not alone in this journey. We encourage you to reach out to our advocates for tailored support. In summary, enlisting the help of a professional advocate at Turnout can increase your chances of understanding whether you can collect long term disability and social security benefits, as it simplifies the application process and enhances your likelihood of securing the benefits you deserve.

Conclusion

Navigating the complexities of long-term disability and social security benefits can feel overwhelming. We understand that securing the financial support you need is crucial. This article highlights the importance of being informed about eligibility criteria, potential offsets, necessary documentation, and the significant role of professional advocacy in the application process. By demystifying these elements, you can better prepare for the journey ahead.

Key insights discussed include:

- The possibility of collecting both long-term disability and social security benefits.

- The necessity of thorough documentation and understanding policy specifics to avoid unexpected reductions in benefits.

- The importance of persistence, especially when appealing denied claims.

- The value of seeking professional assistance to navigate the intricacies of the system.

Ultimately, being proactive and informed can significantly enhance your chances of successfully obtaining the benefits you deserve. Empowerment through knowledge, coupled with the support of trained advocates, can make a substantial difference in overcoming the hurdles associated with long-term disability and social security claims. For those embarking on this journey, reaching out for guidance and utilizing available resources is a vital step toward achieving financial stability and peace of mind. You are not alone in this journey; we’re here to help.

Frequently Asked Questions

What services does Turnout provide for long-term disability and social security benefits?

Turnout simplifies the application process for long-term disability and social security benefits by using AI technology and providing personalized guidance from advocates. They aim to help individuals secure the support they need while navigating bureaucratic hurdles.

Are there any costs associated with Turnout's services?

While some of Turnout's services are offered at no cost, others may involve service fees. Additionally, any government fees required by agencies must be paid before Turnout can submit paperwork on your behalf.

How does Turnout communicate with clients?

All communications from Turnout will be sent electronically, including notices, agreements, and disclosures, allowing clients to focus on pursuing their financial assistance.

Can you collect both long-term disability and social security benefits?

Yes, approximately 30% of long-term disability (LTD) recipients also receive Social Security Disability Insurance (SSDI) payments. However, many LTD policies include offset provisions that may reduce your LTD benefits by the amount you receive from SSDI.

What should I consider regarding my LTD policy and SSDI?

It is crucial to review your LTD policy details to understand how benefits may be affected by SSDI payments, as the total income you receive could be less than expected due to these offsets.

What are the eligibility requirements for long-term disability and social security benefits?

Applicants for long-term disability must provide comprehensive medical documentation and understand their specific policy terms. For social security assistance, applicants need sufficient work credits and must demonstrate that their disability meets the strict criteria set by the Social Security Administration.

What is the approval rate for initial applications for Social Security benefits?

In 2026, the approval rate for initial applications is low, with only about 38% of applicants meeting the technical requirements being accepted initially. However, 53% of those who challenge an initial denial ultimately obtain assistance.

How does Turnout assist with the application process?

Turnout employs trained nonlawyer advocates for SSD claims and collaborates with IRS-licensed enrolled agents for tax debt relief, providing valuable assistance in navigating complex processes.