Introduction

Navigating the complexities of disability benefits can often feel like an uphill battle. We understand that the landscape of Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) is constantly evolving, which can add to the confusion. With so many factors influencing the amount of assistance you might receive, it’s crucial to understand these elements to maximize your benefits.

As you grapple with eligibility criteria, work history implications, and the impact of cost-of-living adjustments, you may wonder: how can you effectively navigate this intricate system to secure the support you need? This article delves into ten key factors that determine disability benefit amounts. We’re here to offer insights and strategies that empower you on your journey.

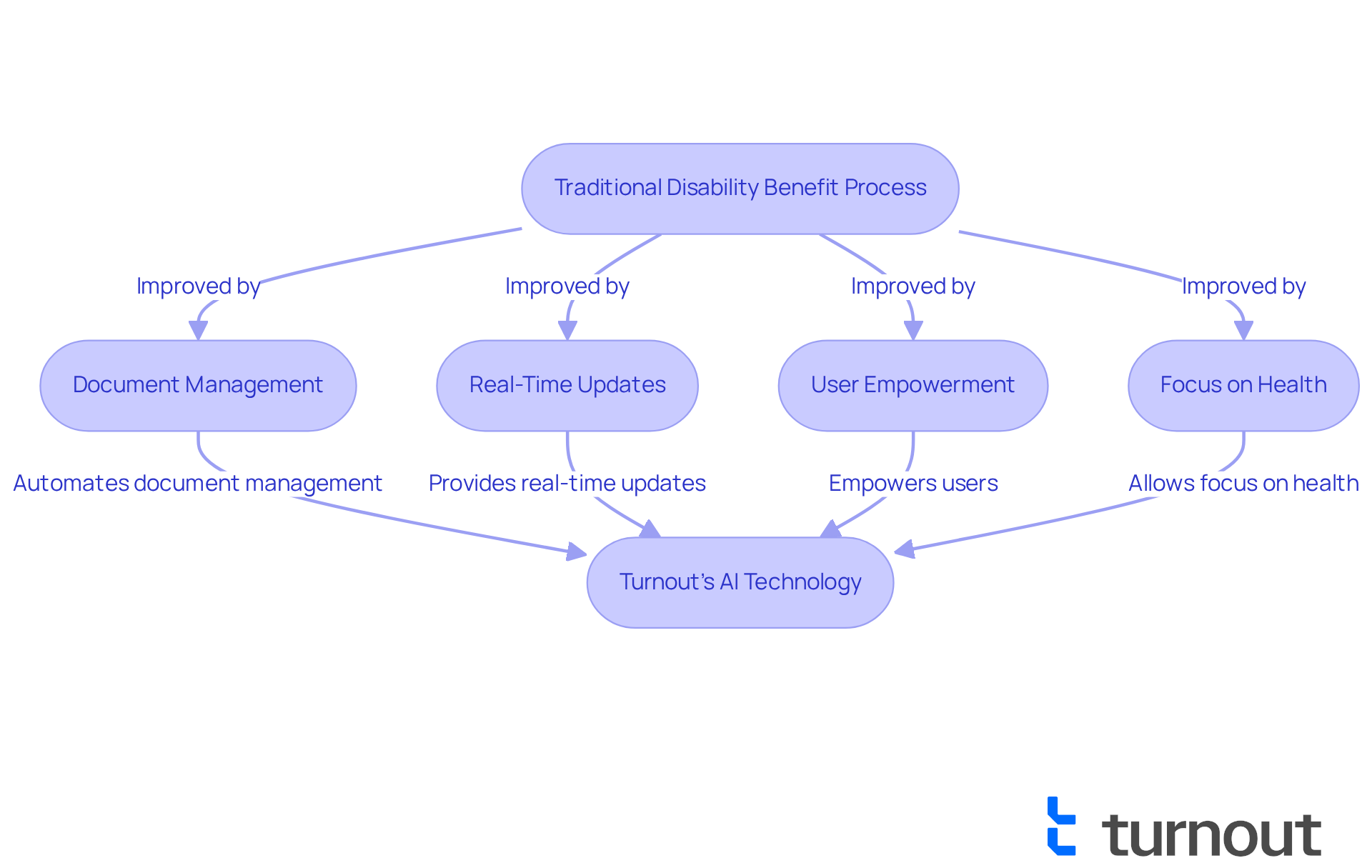

Turnout: Streamlining Your Disability Benefit Calculation Process

Navigating the world of disability compensation can feel overwhelming. We understand that the process is often complex and stressful. That's where Turnout comes in.

Turnout utilizes advanced AI technology to simplify the disability compensation calculation process, making it more accessible for you. By automating document management and providing real-time updates, we empower you to navigate this landscape with confidence.

Imagine being able to focus on your health and recovery instead of being bogged down by paperwork. This innovative approach not only speeds up the process but also alleviates the stress typically associated with traditional methods.

The integration of AI in consumer advocacy is transforming how people approach their claims. It’s making the system more user-friendly and efficient. You are not alone in this journey; we're here to help you every step of the way.

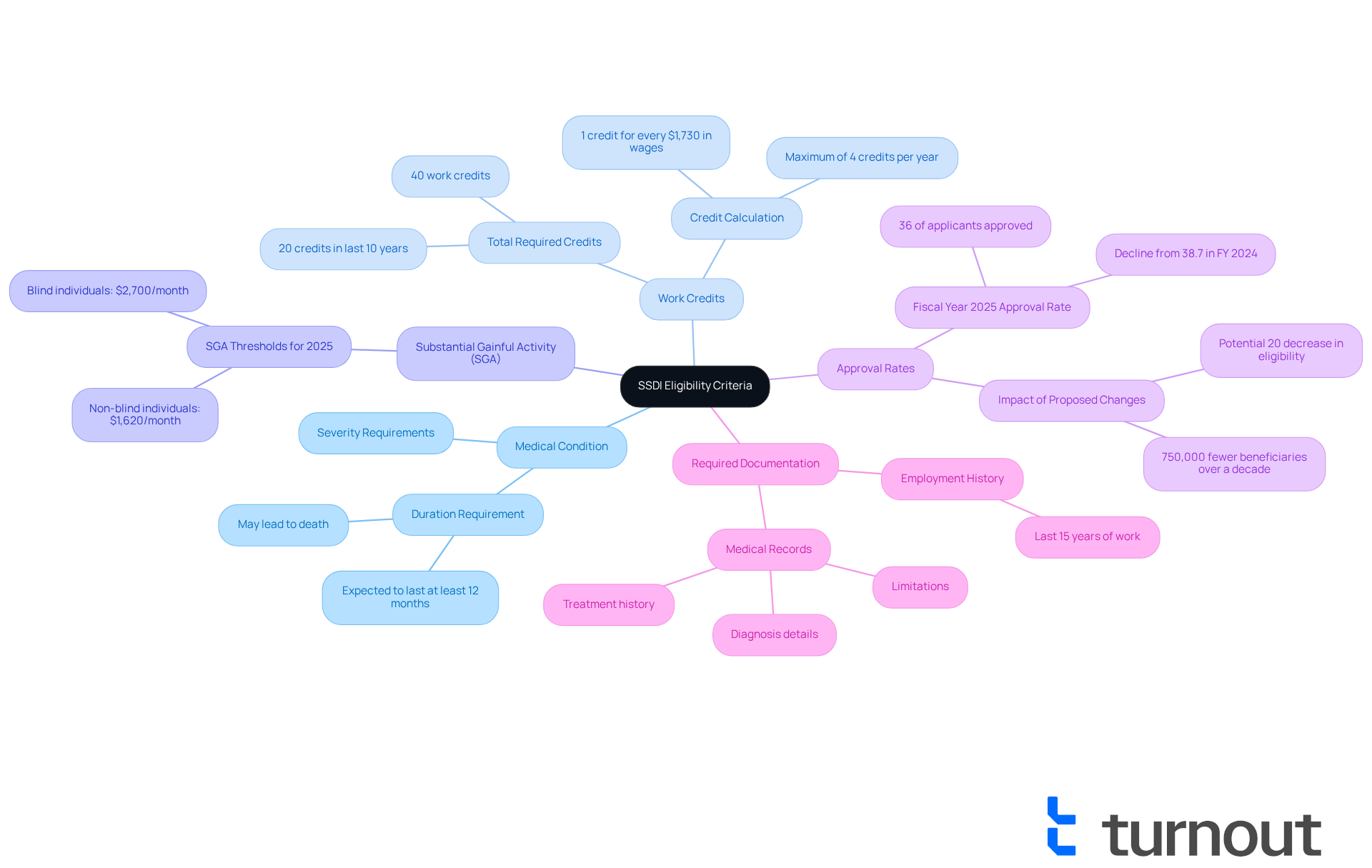

Social Security Disability Insurance (SSDI) Eligibility Criteria

Navigating the Social Security Disability Insurance (SSDI) process can feel overwhelming, especially when you're facing health challenges. To qualify for SSDI, you need to meet specific requirements that demonstrate your inability to engage in substantial gainful activity due to a medical condition. This condition should be expected to last at least 12 months or lead to death. Typically, applicants must have earned at least 40 work credits, with a minimum of 20 credits accumulated in the last 10 years before their disability began. In 2025, the substantial gainful activity (SGA) threshold is set at $1,620 per month for non-blind individuals and $2,700 for those who are blind.

We understand that the application process can be daunting. Recent data reveals that the approval rate for SSDI claims has dropped, with only about 36 percent of applicants receiving benefits in fiscal year 2025, down from 38.7 percent the previous year. This decline underscores the importance of thoroughly understanding the eligibility requirements. You’ll need to provide comprehensive documentation, including:

- Medical records that detail your diagnosis, treatments, and limitations

- Your employment history for the last 15 years

Real-life stories highlight the hurdles many face. Even individuals with conditions that meet the SSA's criteria often encounter difficulties in securing approval due to the stringent evaluation process. As the Social Security Administration continues to refine its criteria, it’s crucial for applicants to stay informed about the requirements and prepare their applications with care. Remember, you are not alone in this journey; we’re here to help you every step of the way.

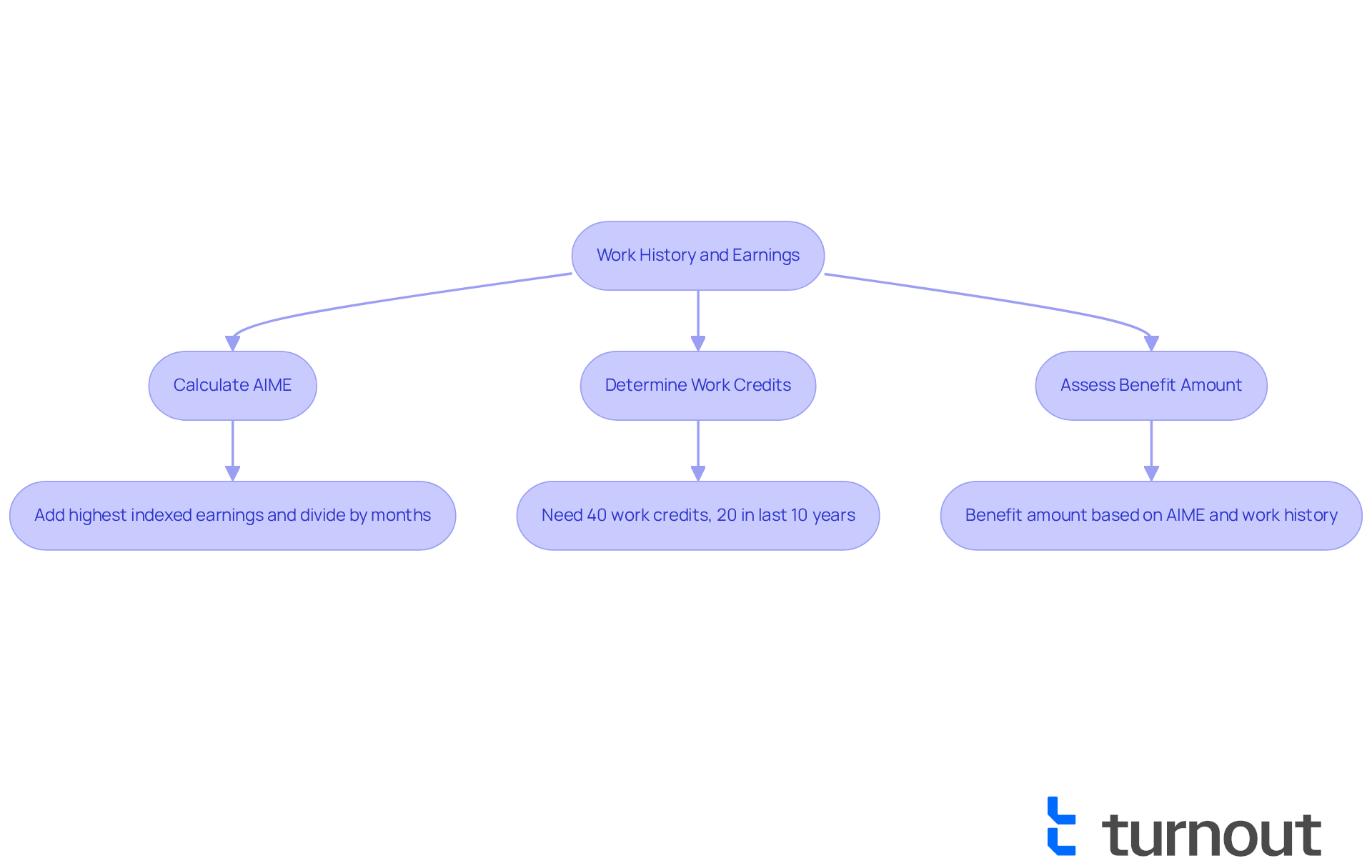

Work History and Earnings Impact on Benefit Amounts

Navigating the world of Social Security Disability (SSD) claims can feel overwhelming. We understand that the amount of assistance, or disability benefit amount, you receive is closely tied to your Average Indexed Monthly Earnings (AIME), which reflects your highest-earning years. The Social Security Administration (SSA) uses a formula that evaluates your total earnings over your working life, focusing on the 35 years where you earned the most. This means that if you've had higher lifetime earnings, you can expect your disability benefit amount to be higher. For instance, in 2025, the highest potential support payment for newly eligible individuals is around $3,822 per month. This highlights just how significant your earnings can be in determining your benefits.

Turnout is here to help you navigate the SSD claims process. Our trained nonlawyer advocates assist clients in understanding how their work history impacts their entitlements. Maintaining a consistent work history is crucial for maximizing your potential benefits. Each year of stable employment contributes to the work credits you need for disability assistance eligibility. Generally, you’ll need 40 work credits, with at least 20 earned in the last 10 years. This underscores the importance of not just working, but ensuring that your jobs contribute to Social Security.

Calculating your AIME involves adding your highest indexed earnings and dividing by the total number of months in those years. This ensures that your benefits reflect changes in wage levels over time. For example, if a worker with maximum-taxable earnings retires at age 62 in 2026, their AIME would be $14,358, leading to a Primary Insurance Amount (PIA) of $4,216.90.

Financial advisors often stress the importance of understanding how your work history affects your disability benefit amount. They recommend keeping detailed records of your work and income, as this documentation can significantly enhance the disability benefit amount in your applications. Additionally, part-time work can help with eligibility for disability benefits, provided you meet the income thresholds.

By managing your work history and income strategically, you can improve the disability benefit amount, ensuring you receive the assistance you need during challenging times. Turnout empowers clients to navigate these complexities effectively, and we also provide guidance on tax relief options to further support you on your financial journey. Remember, you are not alone in this process; we’re here to help.

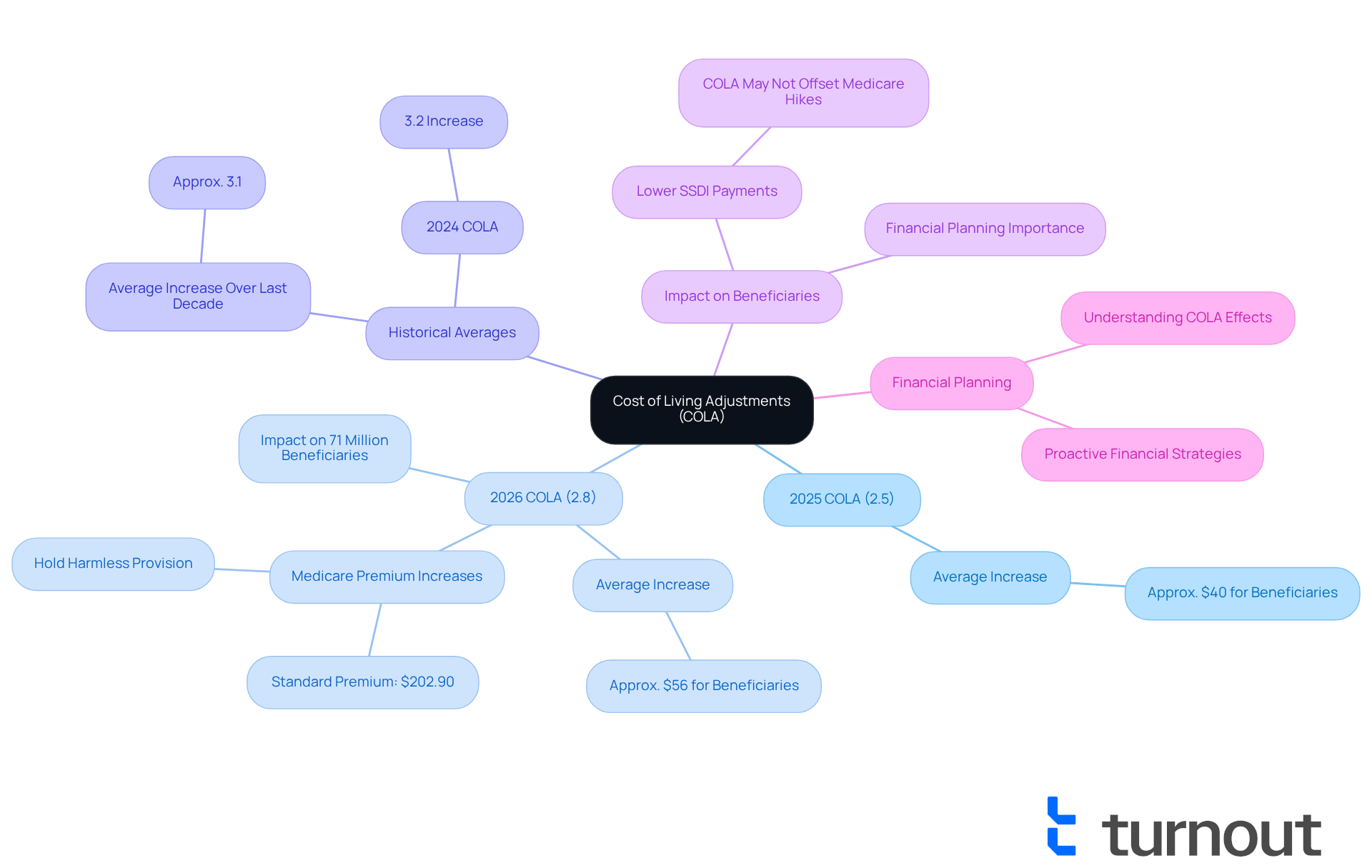

Cost of Living Adjustments (COLA) and Their Effect on Benefits

Cost of Living Adjustments (COLA) are vital yearly increments in Social Security Disability Insurance (SSDI) payments that influence the disability benefit amount, helping you keep pace with inflation. For 2025, the Social Security Administration (SSA) announced a 2.5% COLA, which translates to an average increase of about $40 for beneficiaries. This adjustment is crucial as it helps counterbalance rising living expenses, ensuring that the purchasing power of your aid remains intact over time.

Looking ahead, the SSA has also announced a 2.8% COLA for 2026, impacting nearly 71 million beneficiaries starting in January 2026. This upcoming adjustment is particularly significant as it coincides with expected increases in Medicare premiums, which could affect the net benefits many receive. Thankfully, the hold harmless provision will protect certain Social Security recipients from losing assistance due to these Medicare premium hikes, ensuring that your COLA adjustments effectively support your financial needs.

Historically, COLA adjustments have varied, with the average increase over the past decade being around 3.1%. For example, in 2024, beneficiaries received a 3.2% increase in the disability benefit amount, reflecting the ongoing economic pressures many face. As inflation continues to impact daily expenses, understanding how COLA affects the disability benefit amount in your monthly payments is essential for effective financial planning.

Many beneficiaries have adapted to these changes in different ways. For instance, those receiving lower SSDI payments might find that the COLA increase doesn’t fully offset the rise in their Medicare premiums, which are expected to increase significantly in 2026. This situation highlights the importance of being proactive in your financial planning, especially if you’re on a fixed income.

Economists emphasize that the goal of COLA is to maintain the purchasing power of Social Security and Supplemental Security Income (SSI) payments amid inflationary pressures. As the cost of living rises, these adjustments play a critical role in ensuring that you can meet your basic needs without falling behind financially. Understanding the historical context of COLA adjustments can also provide insight into how these changes may evolve in the future, helping you navigate your financial landscape more effectively.

Supplemental Security Income (SSI) Factors in Benefit Calculation

Supplemental Security Income (SSI) is a vital program designed to support individuals with limited income and resources. For 2025, the disability benefit amount is set at a maximum of $967 per month for individuals, while couples can receive up to $1,450, an increase from $1,415 in 2024. Unlike Social Security Disability Insurance (SSDI), which depends on work history, SSI eligibility is based on financial need. Understanding these differences is crucial for applicants navigating this process.

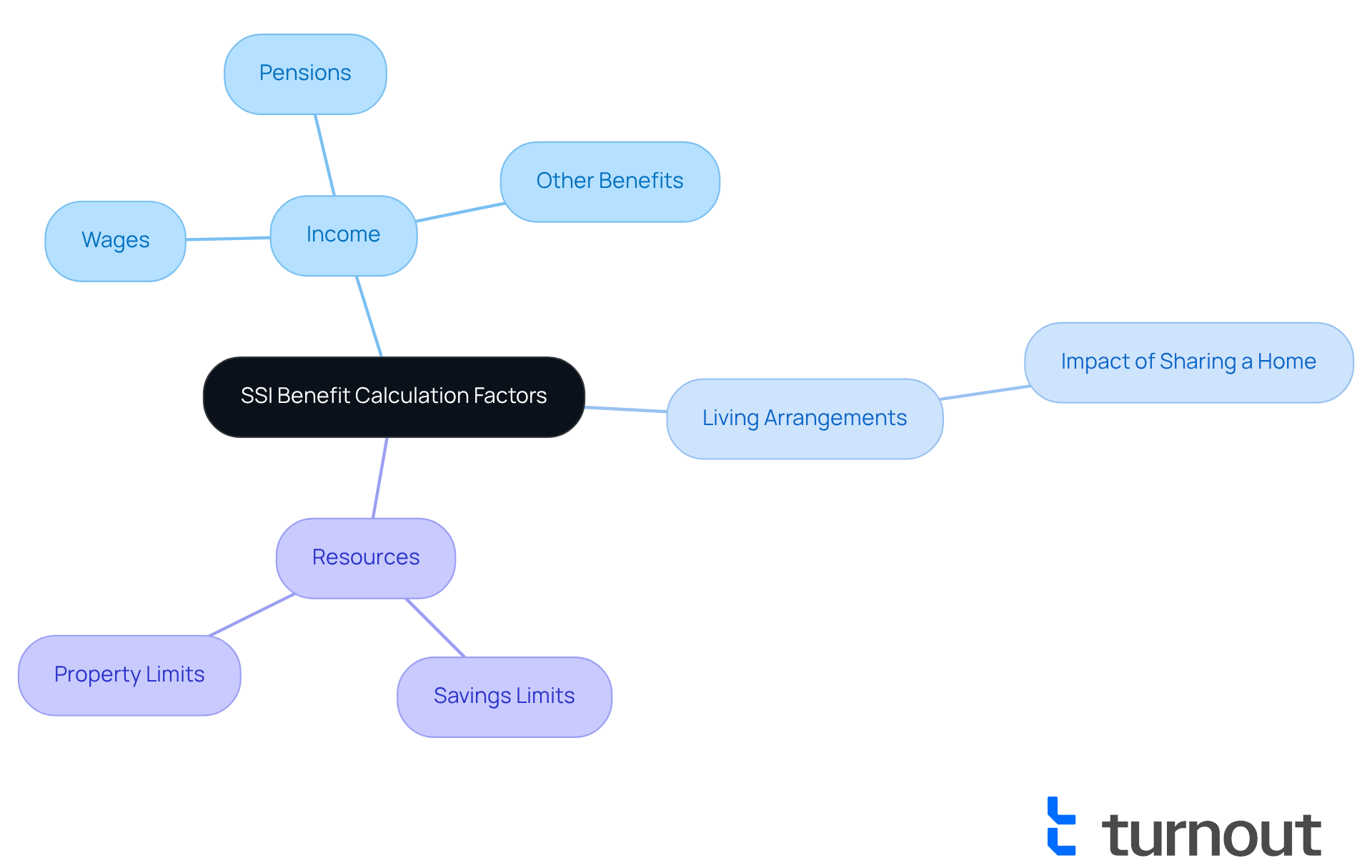

We understand that financial assessments can feel overwhelming. SSI calculations consider several key factors:

- Income: All sources of income, including wages, pensions, and other benefits, are taken into account. Generally, higher income leads to lower SSI payments, as the Social Security Administration (SSA) evaluates countable income against set limits.

- Living Arrangements: Your living situation can impact payment amounts. For example, sharing a home with others may reduce benefits due to shared expenses.

- Resources: The SSA reviews your resources, such as savings and property, to determine eligibility. To qualify for SSI, individuals must have limited resources.

It's common to feel uncertain about how these factors affect the disability benefit amount you receive. For instance, if someone has a monthly income of $1,000, their disability benefit amount from SSI assistance might decrease significantly based on their overall countable income and resources. Additionally, many states and the District of Columbia provide extra payments, which can enhance the total amount received.

Experts stress the importance of understanding these calculations. As one expert noted, "The financial environment for SSI applicants is complex, and being informed can make a significant difference in securing the help you need." With the maximum federal assistance increasing due to a 2.5% cost-of-living adjustment (COLA) in 2025, it’s essential for potential recipients to stay updated on how these elements interact to influence their financial aid.

Moreover, if you find yourself in a financial crisis, new applicants may qualify for emergency advance payments. These provide immediate support while you await your SSI payments. Remember, you are not alone in this journey; we’re here to help you navigate these challenges.

Importance of Medical Documentation in Benefit Determination

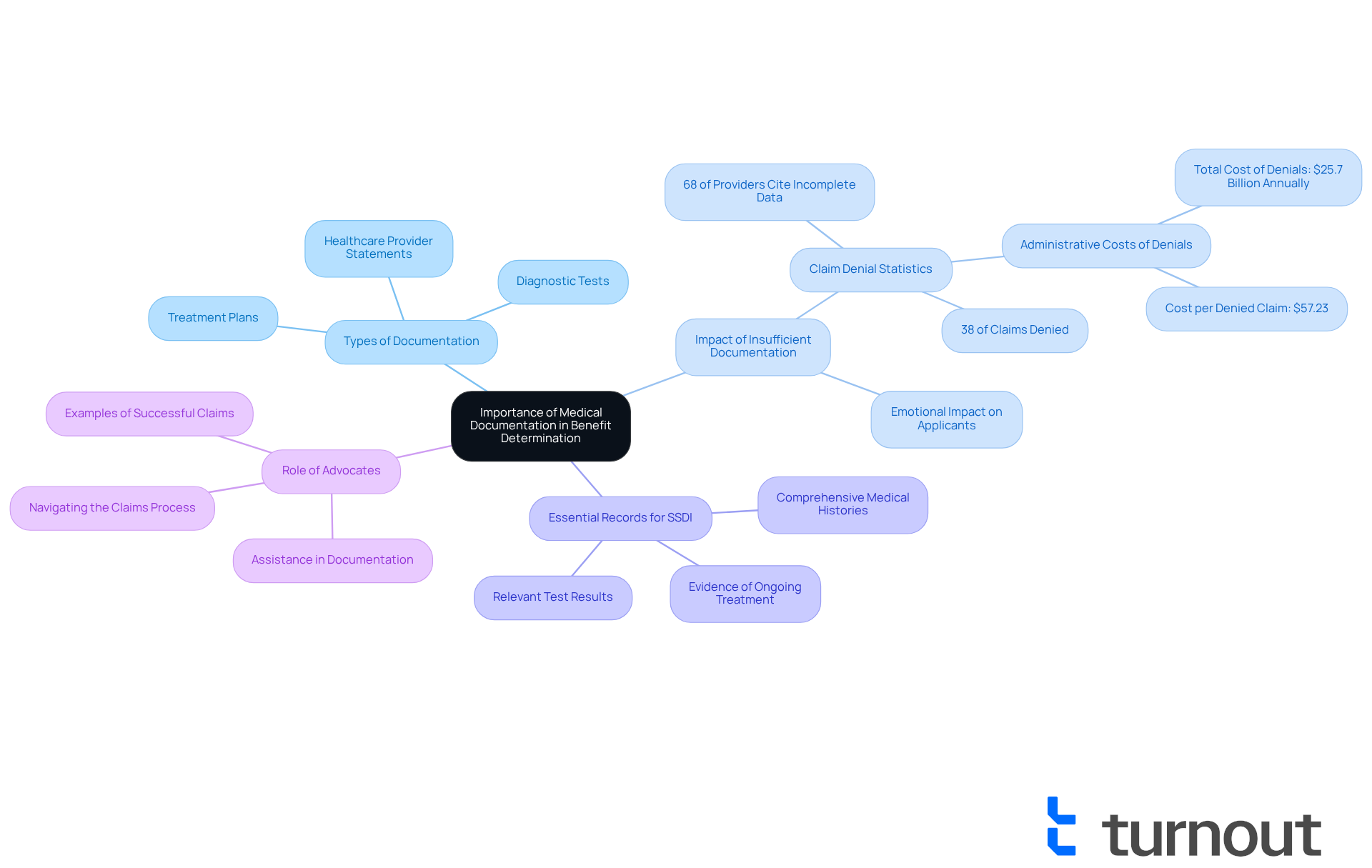

Medical documentation plays a vital role in securing disability assistance. We understand that navigating this process can be overwhelming. Applicants need to submit detailed medical records that clearly outline their condition, treatment history, and how their disability affects their ability to work. This documentation should include diagnostic tests, treatment plans, and statements from healthcare providers.

It's common to feel anxious about the possibility of claim denials. In fact, a significant percentage of claims are rejected due to insufficient documentation. Healthcare professionals emphasize that accurate and complete patient data is crucial, with 68% citing it as a primary driver of denials. Successful disability claims often hinge on robust medical records that clearly demonstrate the severity of the condition and its effects on daily functioning, which can significantly impact the disability benefit amount.

Essential records for Social Security Disability Insurance (SSDI) include comprehensive medical histories, evidence of ongoing treatment, and any relevant test results. By ensuring that all required paperwork is thoroughly organized, you can greatly enhance your chances of obtaining the disability benefit amount that you deserve. Remember, the operational costs associated with denied claims can be substantial, highlighting the need for careful preparation.

At Turnout, we utilize trained nonlawyer advocates to assist clients in navigating the SSD claims process, emphasizing the importance of thorough documentation. Examples of successful disability claims often illustrate how well-prepared medical records can make a significant difference in the outcome. You're not alone in this journey; we're here to help.

Appeals Process and Its Impact on Disability Benefits

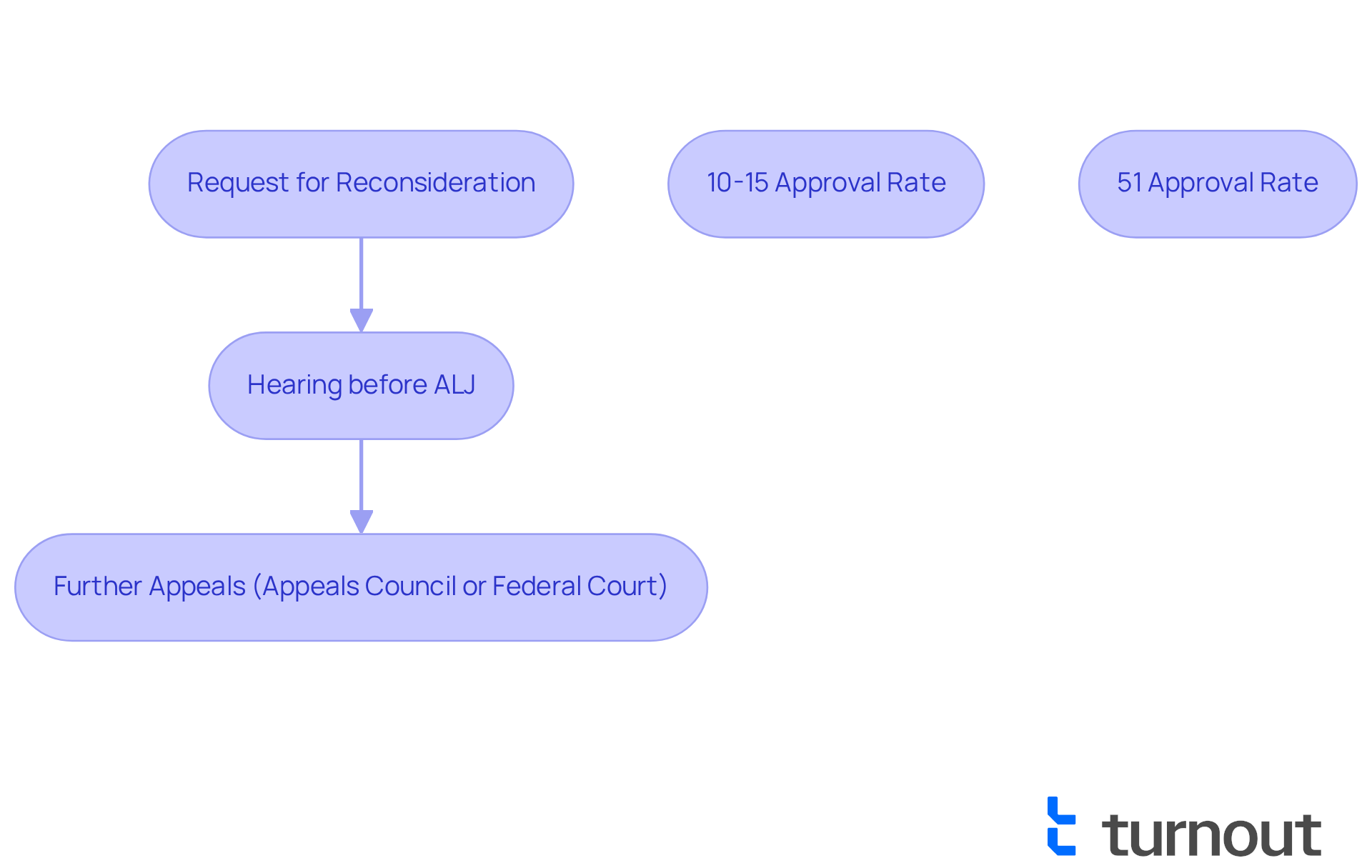

When a disability assistance request is rejected, it’s important to know that you have the right to contest that decision. We understand that this can be a challenging time, and navigating the appeals process can feel overwhelming. It begins with a request for reconsideration, followed by a hearing before an Administrative Law Judge (ALJ), and may even extend to further appeals to the Appeals Council or federal court. Understanding this process is crucial for effectively advocating for your rights and securing the necessary disability benefit amount.

The initial appeal stage, known as reconsideration, often has a low approval rate, typically around 10-15%. However, it’s encouraging to know that the chances of success significantly improve at the ALJ hearing level, where approval rates hover around 51%. This highlights the importance of presenting a well-documented case. Comprehensive medical evidence can increase success rates by up to 40% compared to cases with limited documentation.

Having legal representation can also make a difference. Individuals who are represented often achieve approval rates that are 20-30% higher than those who navigate the process independently. Experts emphasize that strong supporting evidence, including updated medical records and detailed statements about daily life limitations, is essential for a successful appeal.

We recognize that the SSDI appeals process can be lengthy, with individuals waiting an average of seven months and fifteen days for a decision as of November 2023. This prolonged timeline can lead to significant financial and emotional strain. It’s essential to remain organized and proactive throughout this journey. By understanding the appeals process and preparing diligently, you can enhance your opportunities of obtaining the disability benefit amount you deserve. Remember, you are not alone in this journey; we’re here to help.

State-Specific Regulations Affecting Disability Benefits

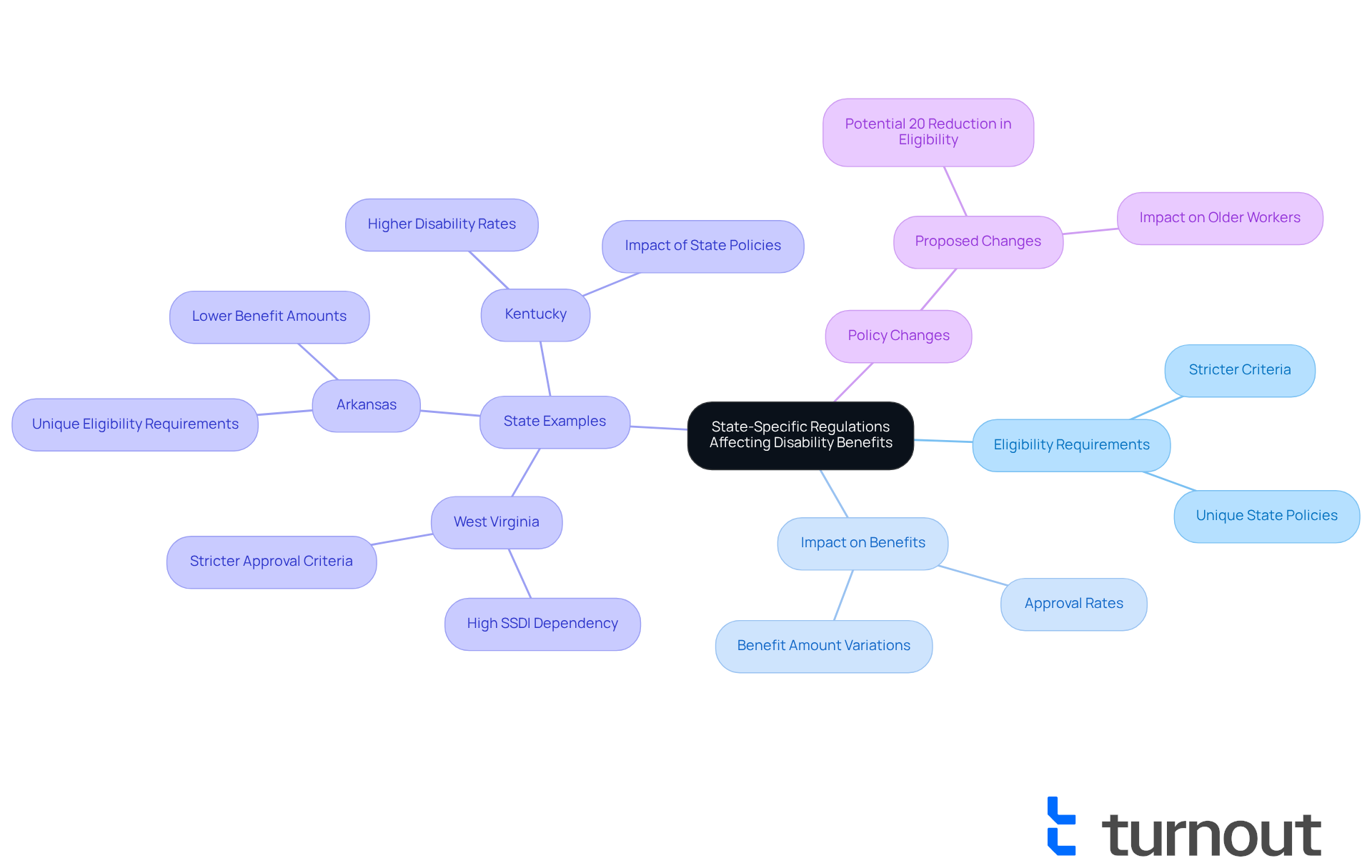

Navigating disability assistance can feel overwhelming, especially when you realize that support varies so much from state to state. We understand that each state has its own regulations and policies, which can create confusion. For instance, some states provide additional advantages or have unique eligibility requirements that can significantly impact the disability benefit amount that applicants receive. In places like West Virginia, Arkansas, and Kentucky, where a larger portion of the population depends on SSDI, the effects of state policies are particularly noticeable. Unfortunately, these states often have stricter criteria, leading to lower approval rates for assistance. On the flip side, states with more supportive policies may offer enhanced benefits, allowing individuals to access the maximum support available.

It's crucial for candidates to grasp these variations. Did you know that the Center on Budget and Policy Priorities estimates that proposed changes to disability benefits eligibility could reduce the number of qualifying individuals by 20%? This change would hit hardest in states with higher disability rates. Policy analysts emphasize that local regulations can create significant differences in the disability benefit amount. Therefore, it's essential for individuals to explore their state's specific laws and understand how they impact the disability benefit amount for SSDI and SSI payments. This knowledge empowers you to navigate the complexities of the system and advocate for your rights effectively.

Remember, you are not alone in this journey. We're here to help you understand your options and find the support you need.

Family Income and Resources Impact on SSI Benefits

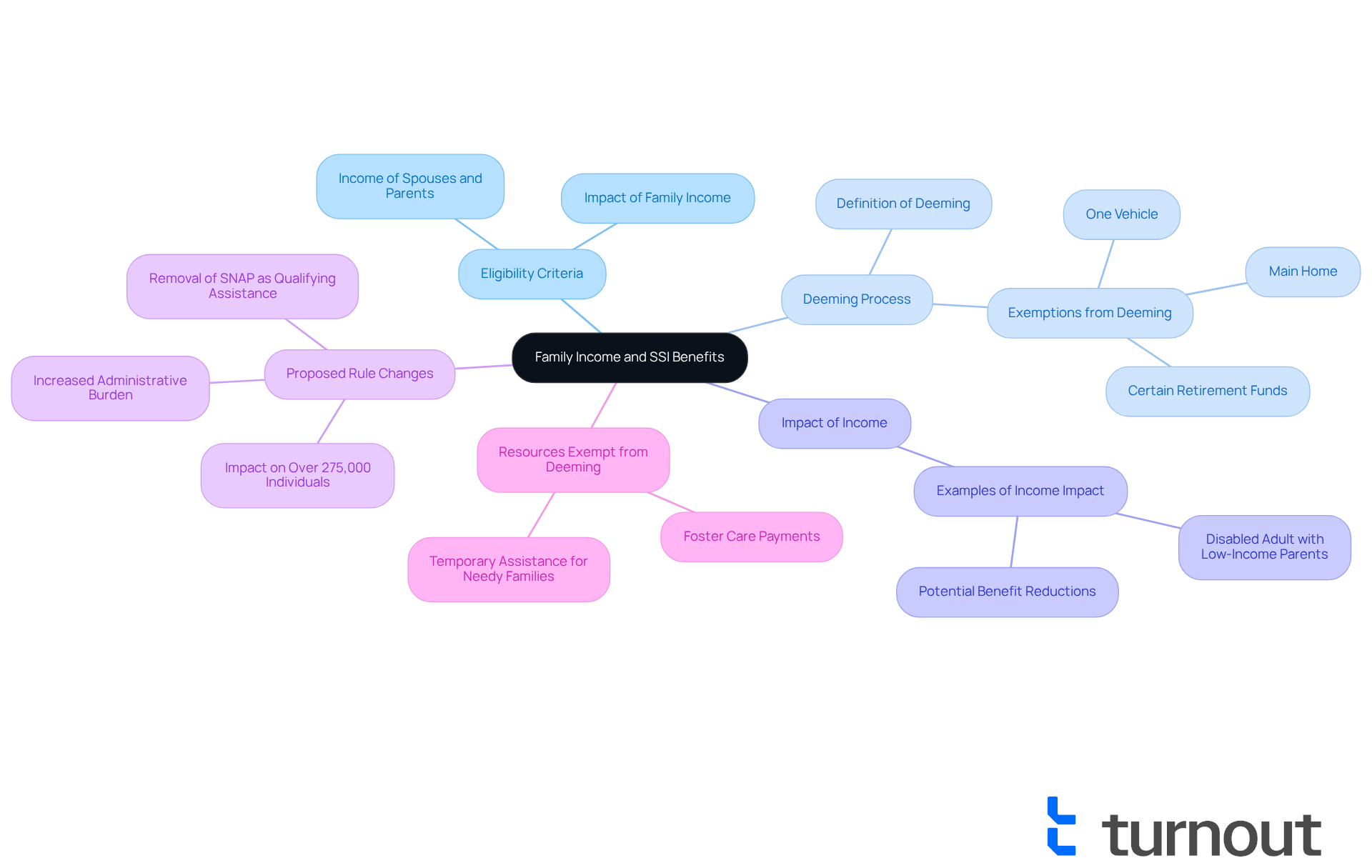

Family income and resources can significantly impact the eligibility and the disability benefit amount for SSI candidates. We understand that navigating these complexities can be overwhelming. The Social Security Administration (SSA) evaluates the income of spouses and parents for applicants under 18. If the total family income exceeds certain limits, it may lead to reductions or even the complete loss of the disability benefit amount provided by SSI assistance.

For example, a disabled adult living with low-income parents might see her disability benefit amount drop to less than $700 due to the deeming process, which takes parental income into account. Statistics indicate that over 275,000 individuals could face reductions under proposed rule changes that would revert SSI criteria to outdated standards set in 1980. This can be a daunting reality for many families.

Financial advisors emphasize the importance of understanding these rules, as they can complicate the application process and affect the support families can provide to their loved ones. It's common to feel lost in this system, but Turnout offers tools and services designed to help families navigate these challenges. They provide access to trained nonlawyer advocates who can guide you through the application process.

Moreover, certain resources, like a main home and one vehicle, are not considered in the deeming process. This means families can retain some assets while still being eligible for assistance. Remember, you are not alone in this journey. Navigating these complexities is crucial for families aiming to secure the financial assistance they need.

Comprehensive Financial Landscape: Other Benefits and Resources

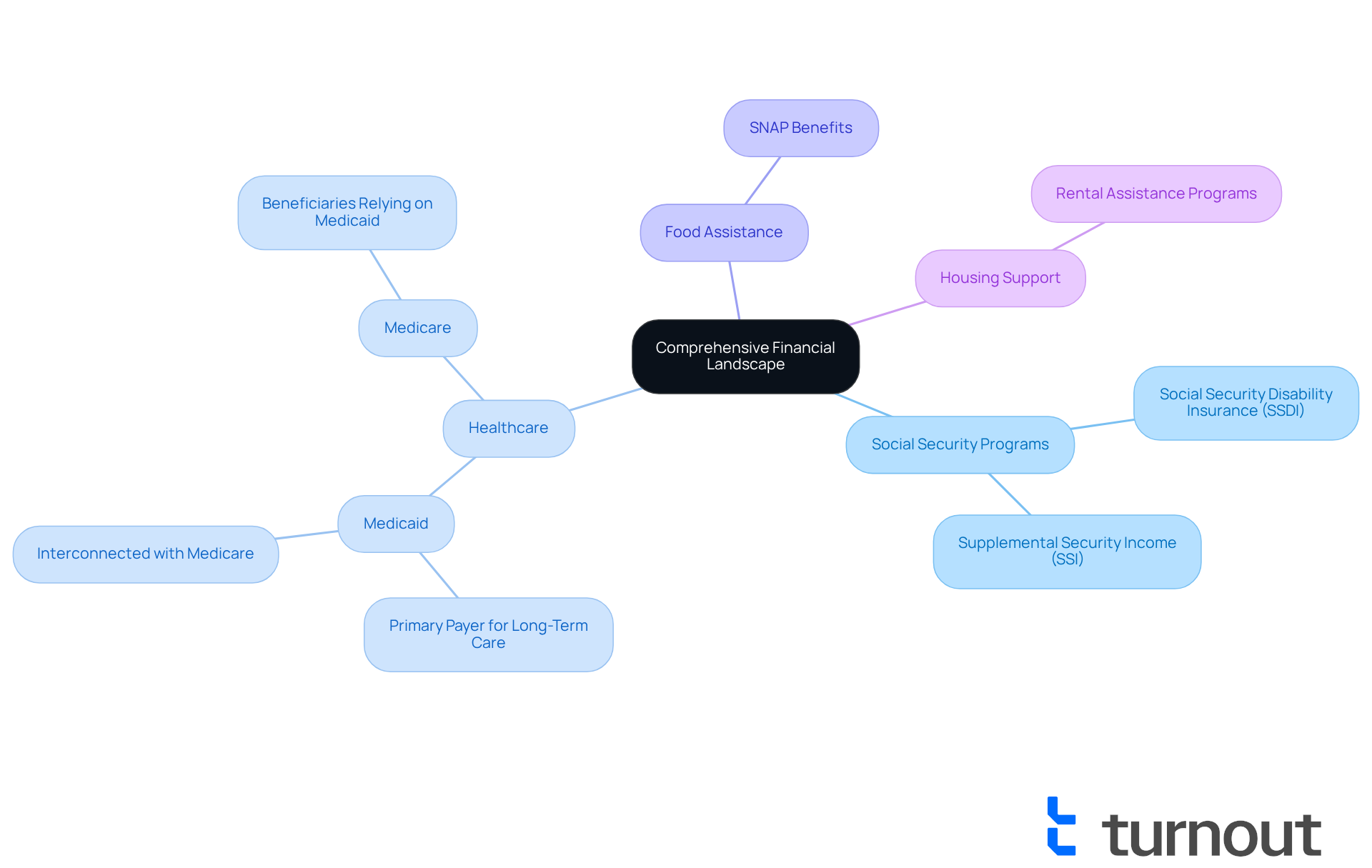

Individuals with disabilities often face significant challenges, but there’s hope. Beyond Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI), many qualify for a range of assistance programs. These include:

- Medicaid

- Medicare

- Food assistance

- Housing support

This creates a comprehensive financial safety net. Did you know that around 12 million Medicare beneficiaries also rely on Medicaid? This highlights how interconnected these programs are. Accessing these resources can truly enhance your financial stability and quality of life.

Organizations like Turnout are here to help you navigate this complex landscape. They provide crucial advice on how to optimize your benefits, ensuring you’re aware of all the resources available to you. Advocacy groups emphasize the importance of self-advocacy, reminding us that, "The only disability in life is a bad attitude." A positive mindset can empower you to overcome challenges.

Many individuals utilizing these resources express that understanding their options is vital for effective financial planning. As one advocacy organization puts it, "We are here to support you in accessing the benefits you deserve." This support is essential, especially as the demand for comprehensive assistance continues to grow. It’s a reminder that informed advocacy is crucial in the disability community. Remember, you are not alone in this journey.

Conclusion

Navigating the complexities of disability benefits can feel overwhelming, and we understand that many individuals are seeking the support they truly deserve. It’s crucial to grasp the key factors that determine disability benefit amounts - like work history, medical documentation, and state-specific regulations. By recognizing how these elements interact, you can prepare your claims more effectively and enhance your chances of approval.

Thorough documentation is vital. This includes your medical records and work history, which play a significant role in your application. Additionally, understanding the impact of Cost of Living Adjustments (COLA) on your benefits can make a difference. Staying informed about eligibility criteria and the appeals process is equally important, as these factors can significantly affect your benefit amounts. With resources like Turnout available to assist you in streamlining the application process, you’re empowered to navigate these challenges with greater ease.

Ultimately, understanding the landscape of disability benefits not only helps you secure necessary financial assistance but also promotes informed advocacy. We encourage you to explore all available resources, from SSDI and SSI to additional support programs. You are not alone in this journey; knowledge and preparation are invaluable tools that can lead to a more stable and supportive future. Remember, we’re here to help you every step of the way.

Frequently Asked Questions

What is Turnout and how does it help with disability benefit calculations?

Turnout is a service that utilizes advanced AI technology to simplify the disability compensation calculation process. It automates document management and provides real-time updates, helping users navigate the complex landscape of disability benefits more confidently and efficiently.

What are the eligibility criteria for Social Security Disability Insurance (SSDI)?

To qualify for SSDI, applicants must demonstrate an inability to engage in substantial gainful activity due to a medical condition expected to last at least 12 months or lead to death. Applicants typically need to have earned at least 40 work credits, with a minimum of 20 credits accumulated in the last 10 years before their disability began.

What is the substantial gainful activity (SGA) threshold for SSDI in 2025?

In 2025, the SGA threshold is set at $1,620 per month for non-blind individuals and $2,700 for those who are blind.

What documentation is required for SSDI applications?

Applicants need to provide comprehensive documentation, including medical records detailing their diagnosis, treatments, and limitations, as well as their employment history for the last 15 years.

How does work history affect the amount of disability benefits received?

The amount of disability benefits is closely tied to the Average Indexed Monthly Earnings (AIME), which reflects the highest-earning years. The Social Security Administration uses a formula that evaluates total earnings over a lifetime, focusing on the 35 highest-earning years.

What is the significance of maintaining a consistent work history for SSD benefits?

Maintaining a consistent work history is crucial for maximizing potential benefits, as each year of stable employment contributes to the work credits needed for disability assistance eligibility.

How is the Average Indexed Monthly Earnings (AIME) calculated?

AIME is calculated by adding the highest indexed earnings and dividing by the total number of months in those years, ensuring that benefits reflect changes in wage levels over time.

What are the potential maximum support payments for SSDI in 2025?

In 2025, the highest potential support payment for newly eligible individuals is around $3,822 per month.

How can Turnout assist clients in understanding their work history and benefits?

Turnout provides trained nonlawyer advocates who assist clients in understanding how their work history impacts their entitlements and helps them navigate the SSD claims process effectively.

What role do financial advisors suggest in managing work history for SSD benefits?

Financial advisors recommend keeping detailed records of work and income, as this documentation can enhance the disability benefit amount in applications. They also note that part-time work can help with eligibility for benefits, provided income thresholds are met.