Introduction

Navigating the complexities of tax debt can feel overwhelming, especially as financial pressures build and options appear scarce. We understand that this journey can be daunting. Fortunately, the IRS provides a variety of debt relief programs aimed at easing these burdens, offering individuals pathways to regain control over their financial situations.

With options ranging from Offers in Compromise to Innocent Spouse Relief, it’s common to wonder: how can you identify and leverage the right program to secure the relief you truly need? You're not alone in this. Many have faced similar challenges and found their way through.

Let’s explore these options together, so you can take the first step toward a brighter financial future.

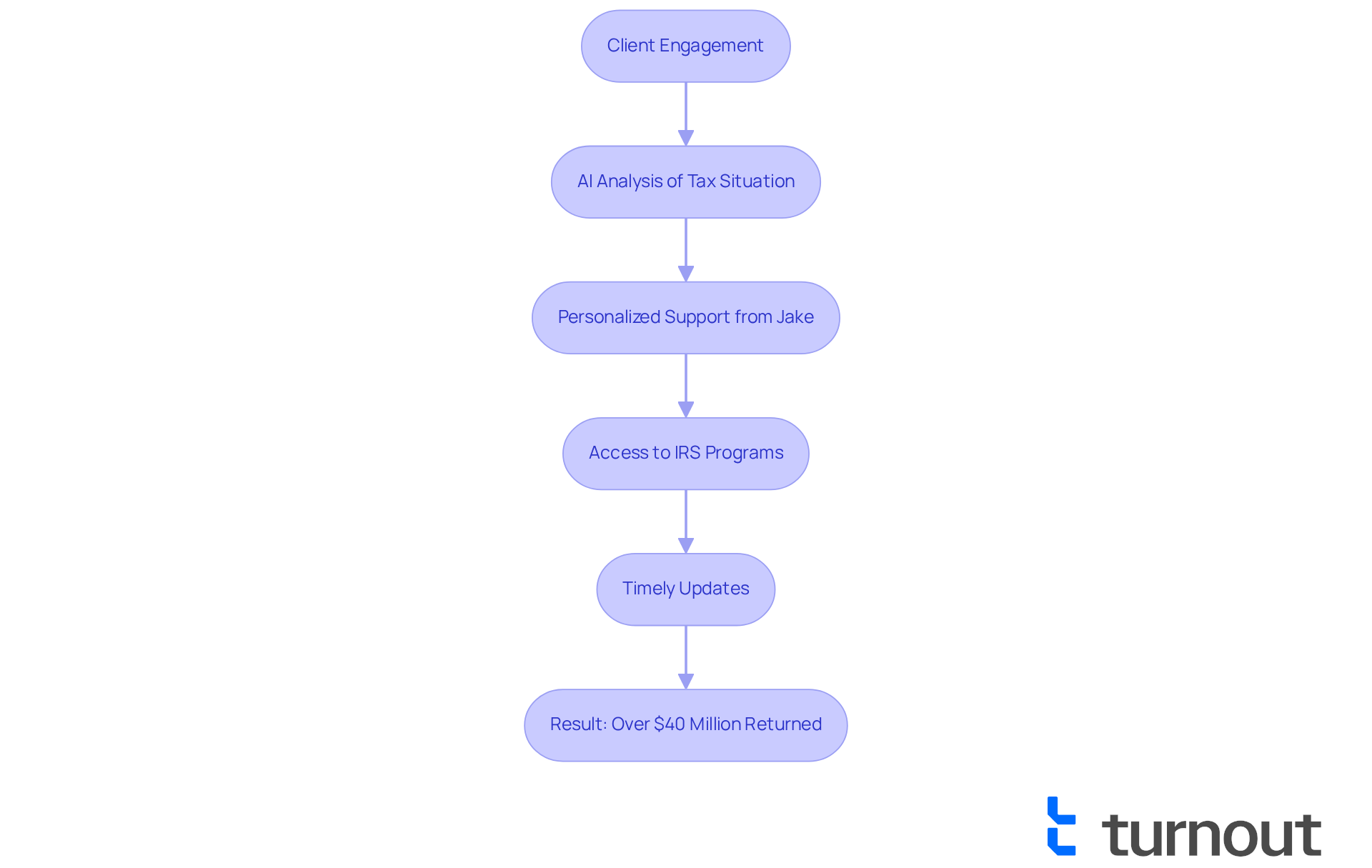

Turnout: AI-Powered Tax Debt Relief Solutions

Navigating tax debt can feel overwhelming, but Turnout is here to help. By harnessing cutting-edge AI technology, we simplify the tax debt relief process, making it easier for you to understand and access IRS debt relief programs. With Jake, our AI case quarterback, you’ll receive timely updates and personalized support every step of the way.

We understand that dealing with tax issues can be stressful. That’s why our progressive approach not only boosts operational efficiency but also empowers you to take control of your financial situation. In just 10 months, Turnout has successfully returned and applied over $40 million to Americans, showcasing the real difference our AI-driven solutions can make in your life.

As the IRS increasingly embraces AI to improve service delivery and audit processes, Turnout is leading the charge in transforming consumer advocacy in IRS debt relief programs. You are not alone in this journey; we’re committed to ensuring you can confidently tackle your tax burdens. Let us support you in regaining your peace of mind.

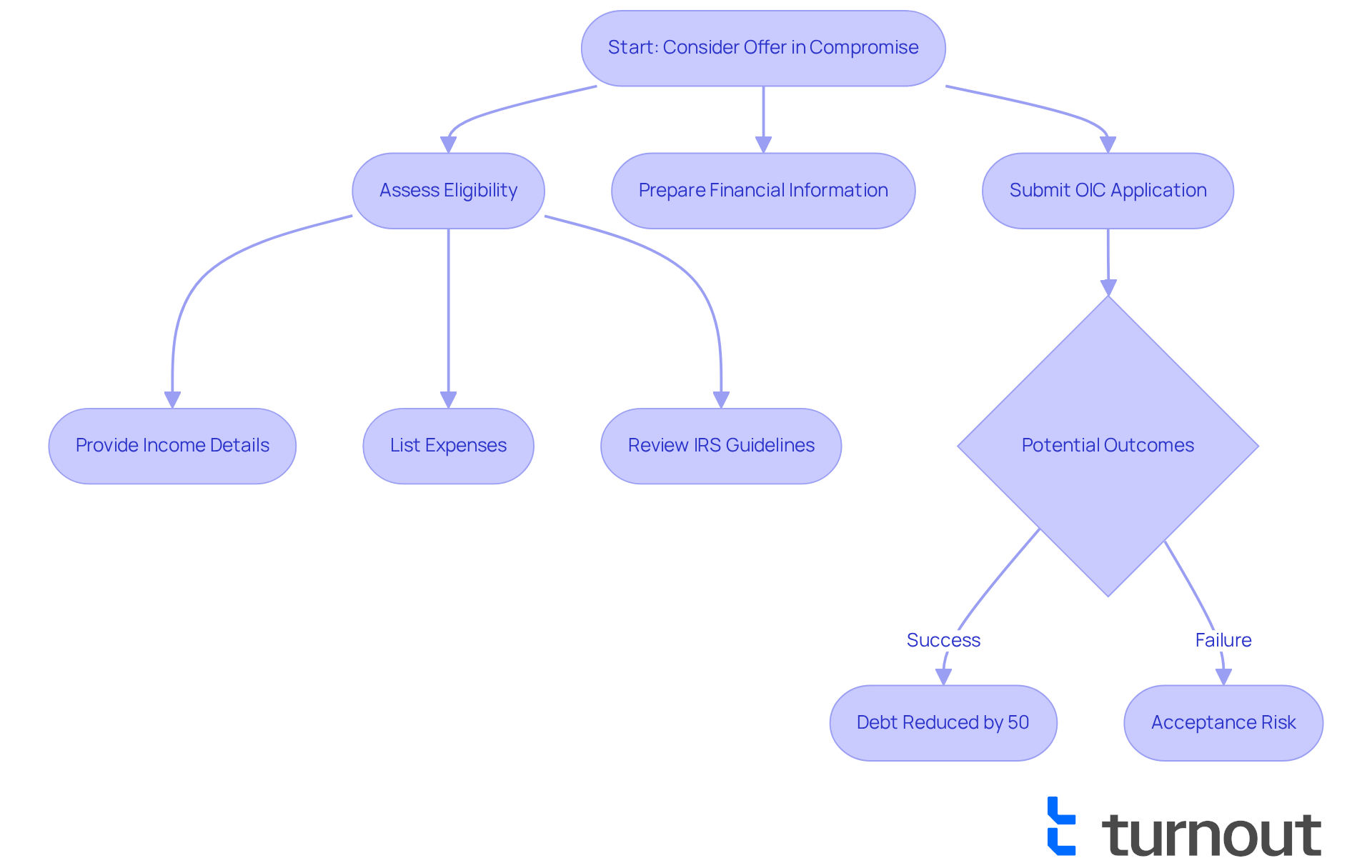

Offer in Compromise (OIC): Settle Your Tax Debt for Less

The Offer in Compromise (OIC) program, part of the IRS debt relief programs, is a valuable opportunity for those facing economic hardship, allowing qualified individuals to settle their tax obligations for less than what they owe. We understand that financial struggles can be overwhelming, and this program offers a lifeline. To qualify, you’ll need to show your financial situation by providing detailed information about your income, expenses, and asset equity. The IRS will evaluate your offer based on your unique circumstances, which can lead to significant reductions in your tax burden.

In 2025, the OIC program underwent updates that broadened eligibility criteria, focusing more on an individual’s ability to pay rather than just the amount of their debt. This change aims to make the IRS debt relief programs more accessible for those who truly need relief. Financial advisors often highlight that while the OIC process can feel daunting, it’s worth it for many qualifying individuals seeking IRS debt relief programs, as it can lead to substantial debt reduction.

Real-world examples can illustrate just how effective the OIC program can be. Take Mike, for instance. He successfully settled a $35,000 debt for only $10,000 through an OIC, showcasing the potential for significant savings. Similarly, Elyse, a single parent, qualified for an OIC due to her minimal net equity and low disposable income. She managed to negotiate a lump-sum payment of just $1,000 to resolve her $67,912 tax liability.

Typically, individuals can expect to see a reduction of about 50% of their overall tax obligations through IRS debt relief programs, making it a feasible choice for many facing financial difficulties. However, it’s essential to approach the application process with thorough preparation and, if possible, seek professional guidance to improve your chances of acceptance. Remember, the IRS’s approach to reviewing OICs can change based on economic conditions and enforcement priorities, and only one in three OIC resolutions are approved.

It’s important to stay compliant with tax obligations for five years after your OIC is accepted, or you risk having your full tax debt reinstated. Additionally, the IRS will hold any refunds for tax periods until your offer is accepted, which can impact your finances during the OIC process. To avoid delays, we recommend reviewing the latest version of the OIC Booklet and being mindful that the payment method for OICs can influence the offer amount. Lastly, be cautious of OIC mills that may mislead you and lead to unnecessary financial loss. Remember, you are not alone in this journey; we’re here to help.

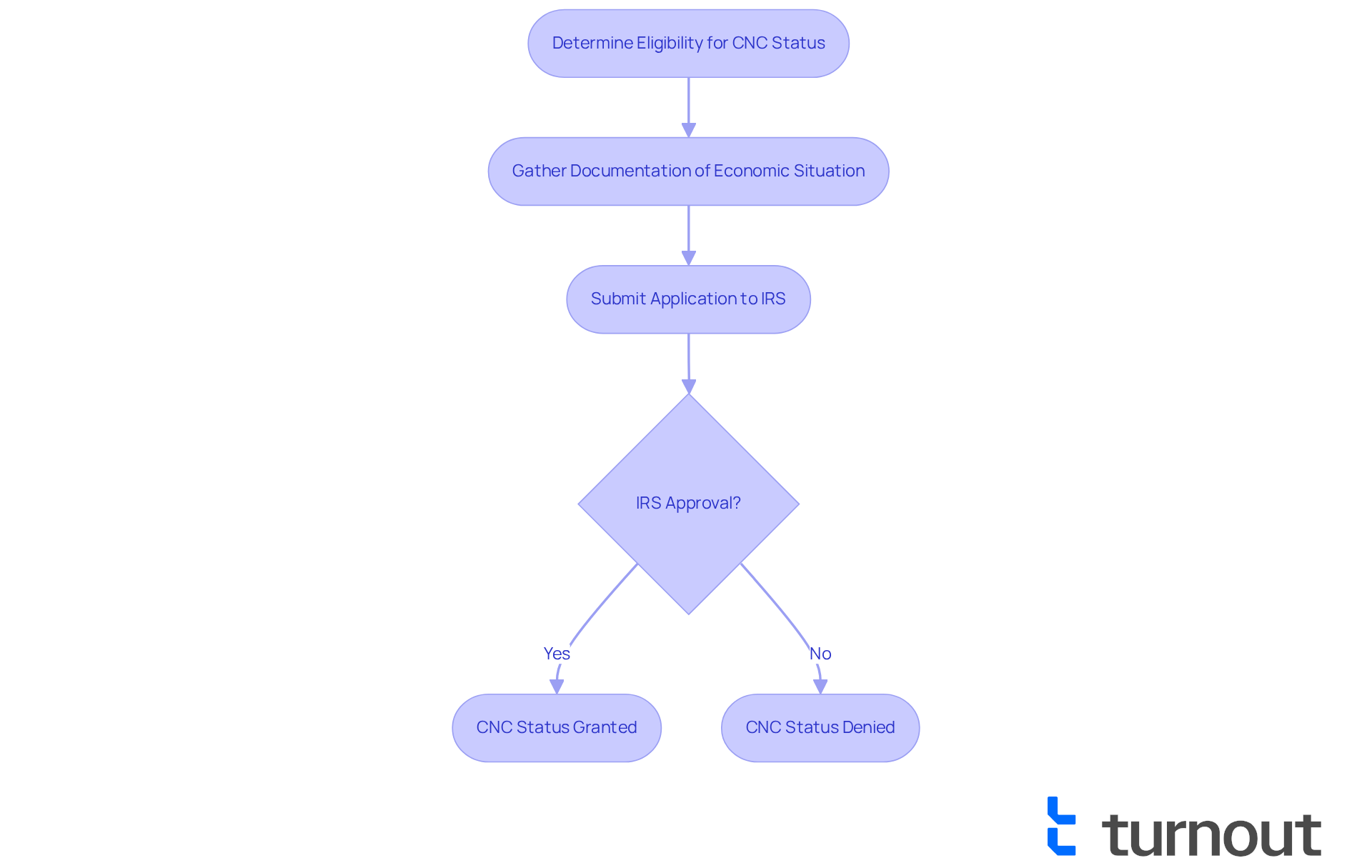

Currently Not Collectible (CNC): Temporary Relief from IRS Collections

If you're struggling to pay your tax debt without compromising your basic living expenses, you might qualify for Currently Not Collectible (CNC) status. This designation can temporarily halt IRS collection actions, giving you the breathing room you need to stabilize your finances. To apply, you'll need to provide the IRS with documentation of your economic situation, showing that paying your tax debt would cause significant hardship.

It's important to know that around 25% of individuals qualify for CNC status, reflecting the economic challenges many face. For example, those dealing with job loss, serious illness, or unexpected financial setbacks have successfully attained CNC status, gaining crucial relief from IRS collections. As Tammy Graham, an Enrolled Agent, wisely points out, "CNC can be a smart short-term shield if you truly can’t pay, but it’s not a permanent fix."

This status serves as an essential pressure relief mechanism, allowing you to focus on restoring your economic stability without the constant worry of collection efforts. However, remember that while CNC status can provide vital temporary relief, it doesn’t erase your tax debt; interest and penalties will continue to accrue during this time, potentially increasing your overall debt burden. Additionally, the IRS conducts yearly assessments of your economic situation to determine ongoing eligibility for CNC status, making it crucial to stay compliant with your tax responsibilities.

If you believe you qualify for CNC status, consider reaching out to the IRS directly or consulting a tax professional for guidance on the application process. At Turnout, we're here to help you navigate these processes through our IRS-licensed enrolled agents, ensuring you receive the support you need without the complexities of legal representation.

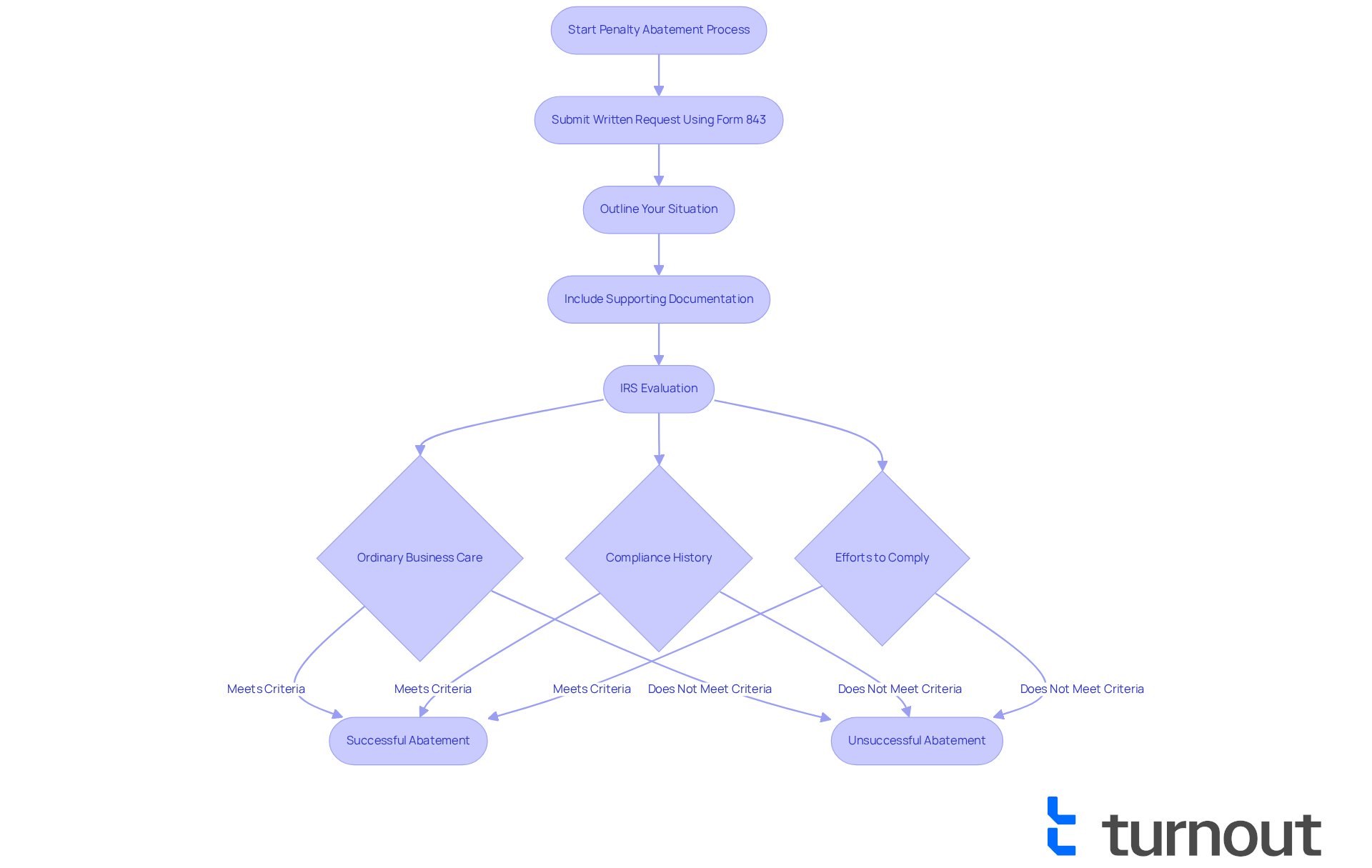

Penalty Abatement: Eliminate IRS Penalties for Good Cause

We understand that dealing with tax obligations can be overwhelming, especially when life throws unexpected challenges your way. If you’ve faced serious illness, natural disasters, or relied on incorrect advice from a tax professional, you might qualify for penalty abatement. It’s comforting to know that many individuals in similar situations have successfully received relief by providing thorough documentation of their circumstances.

To start the abatement process, you’ll need to submit a written request to the IRS using Form 843. In this request, outline your situation and include any supporting documentation. Remember, while financial inability to pay is often not enough for abatement, extreme circumstances can make a difference. This structured approach not only clarifies your position but also boosts your chances of a favorable outcome. The IRS evaluates reasonable cause requests based on:

- Ordinary business care

- Compliance history

- Your efforts to comply

Successfully obtaining IRS debt relief programs can significantly reduce your overall tax liability, making them a vital option for those struggling with IRS penalties. If you haven’t had any previous penalties in the last three years, you may also qualify for First-Time Abatement (FTA), which can provide additional motivation to explore this option.

To improve your chances of success, ensure that your documentation is thorough and clearly outlines your circumstances. Remember, you are not alone in this journey; we’re here to help you navigate through these challenges.

IRS Fresh Start Program: Comprehensive Debt Relief Options

Dealing with tax debt can be overwhelming, but the IRS debt relief programs offer a range of options designed to help you regain control. With streamlined installment agreements and the Offer in Compromise (OIC), this initiative aims to simplify your tax obligations, making it easier for you to find financial stability. By expanding eligibility criteria and streamlining the application process, the Fresh Start Program becomes a vital resource for those facing significant tax burdens.

In 2024, around 100,000 Offers in Compromise were accepted, which is less than 35% of all applications submitted. This highlights the program's selectivity and the challenges many individuals encounter. However, it also shows the potential for significant relief. Tailored solutions, like installment agreements, allow for manageable monthly payments, helping you stay compliant while addressing your debts.

We understand that navigating the Fresh Start Program can be complex. Financial advisors stress the importance of grasping its nuances, as it’s not just a single program but a collection of options, each with specific eligibility requirements and application processes. Consulting with seasoned tax experts can greatly improve your chances of success. They can guide you through the intricacies of IRS procedures and help you avoid common pitfalls.

Many individuals report encouraging success rates after utilizing the Fresh Start Program, often finding themselves in better financial situations. However, it’s crucial to file all applicable unfiled tax returns before seeking relief options, as this is a key requirement. By taking proactive steps and leveraging the resources provided by the IRS, you can effectively manage your tax burdens and work towards a more stable financial future.

Remember, the Fresh Start options are ongoing and not just limited-time offers. This means you have access to these valuable resources whenever you need them. You are not alone in this journey; we’re here to help you every step of the way.

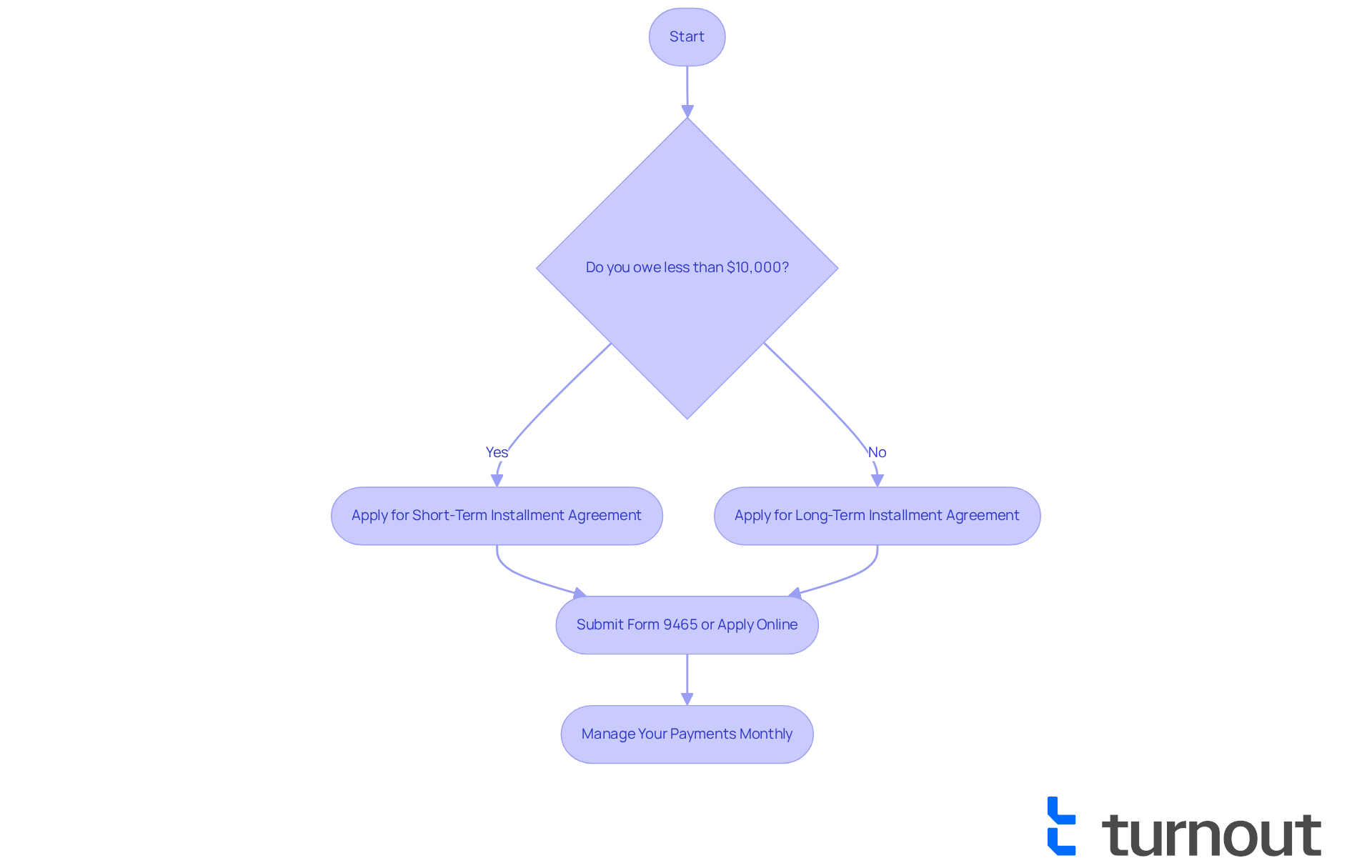

Tax Installment Agreements: Manage Your Payments Over Time

Tax installment agreements can be a lifeline for those feeling overwhelmed by tax debts. We understand that managing these financial obligations can be stressful, and the IRS debt relief programs provide several options to help ease this burden. Whether you owe a little or a lot, there are short-term and long-term installment agreements available to suit your needs.

To set up an installment agreement, you can apply online or simply submit Form 9465. This process is designed to help you avoid aggressive collection actions, allowing you to pay off your debt in manageable monthly payments. Remember, you are not alone in this journey; many have found relief through IRS debt relief programs and similar agreements.

If you're feeling uncertain about the next steps, take a moment to reflect on how this option could provide you with peace of mind. We're here to help you navigate this process and support you every step of the way.

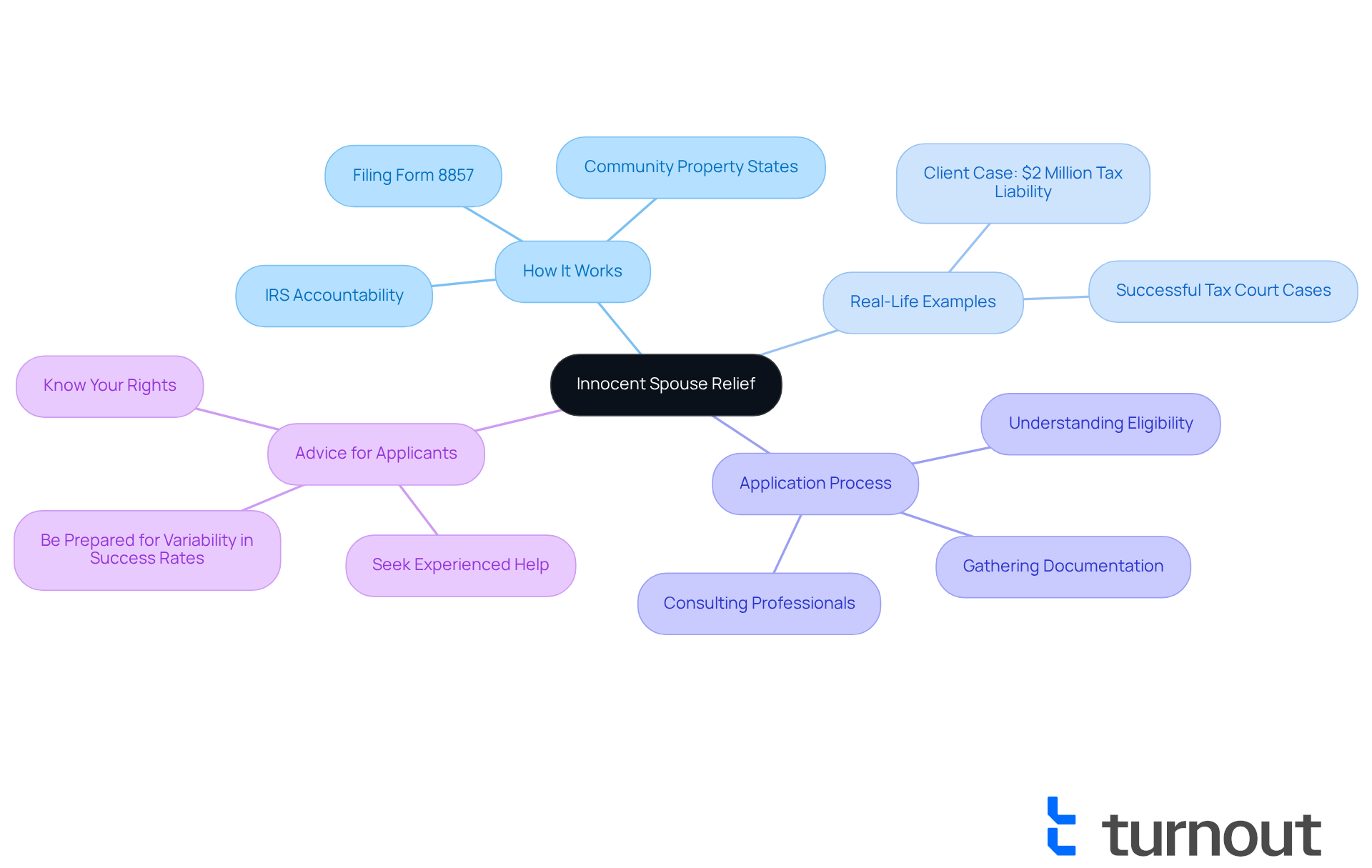

Innocent Spouse Relief: Protect Yourself from Joint Tax Liabilities

Innocent Spouse Relief is a vital provision that can help you escape liability for taxes incurred due to your spouse's actions, like underreporting income or making errors on a joint tax return. If you find yourself in this situation, you can file Form 8857 to show that you were unaware of the tax issues that led to this liability. This process not only shields you from significant financial repercussions but also ensures you aren’t held accountable for your spouse's tax mistakes.

Real-life stories highlight the power of Innocent Spouse Relief. For example, one woman faced a staggering $2 million tax liability because her husband didn’t disclose his income. Initially, her case was mishandled by an inexperienced tax professional. However, after reaching out to a knowledgeable team, she successfully obtained Innocent Spouse Relief in Tax Court, freeing her from that burden. This relief is especially relevant in community property states, where both spouses might be liable for joint tax returns.

While the success rates for Innocent Spouse Relief applications can vary, many individuals have found relief through this path, particularly when they can clearly demonstrate their lack of knowledge about the tax discrepancies. The IRS holds only the spouse responsible for the errors accountable, reinforcing the effectiveness of this relief program. Recent updates in joint tax liabilities relief show a growing recognition of the need for protections against unfair tax burdens stemming from a spouse's actions.

If you believe you qualify for Innocent Spouse Relief, we encourage you to consult with a knowledgeable tax professional. Gather all necessary documentation to support your claim. By understanding and utilizing Innocent Spouse Relief, you can effectively protect yourself from the economic fallout of joint tax liabilities. Remember, you are not alone in this journey, and we're here to help.

IRS Taxpayer Advocate Service: Your Ally in Tax Disputes

Navigating the complexities of the IRS can be daunting, but the IRS Taxpayer Advocate Service (TAS) is here to help. As an independent entity, TAS is dedicated to addressing the challenges individuals face, especially during tough financial times. They offer a range of services designed to speed up cases, support citizen rights, and ensure fair treatment throughout the process.

If you’re struggling with tax debt or disputes, the IRS debt relief programs can play a crucial role in guiding you through these challenges. Their personalized support helps you understand your options and navigate the often overwhelming tax system. TAS advocates work tirelessly to resolve tax issues, making sure you feel informed and empowered every step of the way.

Many success stories highlight the effectiveness of TAS in achieving positive outcomes for the public. Countless individuals have shared their relief from tax burdens after reaching out to TAS, demonstrating the service's commitment to advocacy and the effectiveness of IRS debt relief programs. The impressive success rates of cases managed by TAS reflect their ability to foster positive change, giving you the reassurance you need to tackle your tax concerns.

Beyond direct assistance, TAS emphasizes the importance of knowing your rights. They ensure that you are aware of your protections under the tax code. This focus on rights not only enhances your experience but also promotes a more transparent and accountable IRS. By advocating for improvements in IRS procedures and communication, TAS strives to create a fairer system for everyone obligated to pay taxes.

Remember, you are not alone in this journey. If you’re feeling overwhelmed, reach out to TAS for the support you deserve.

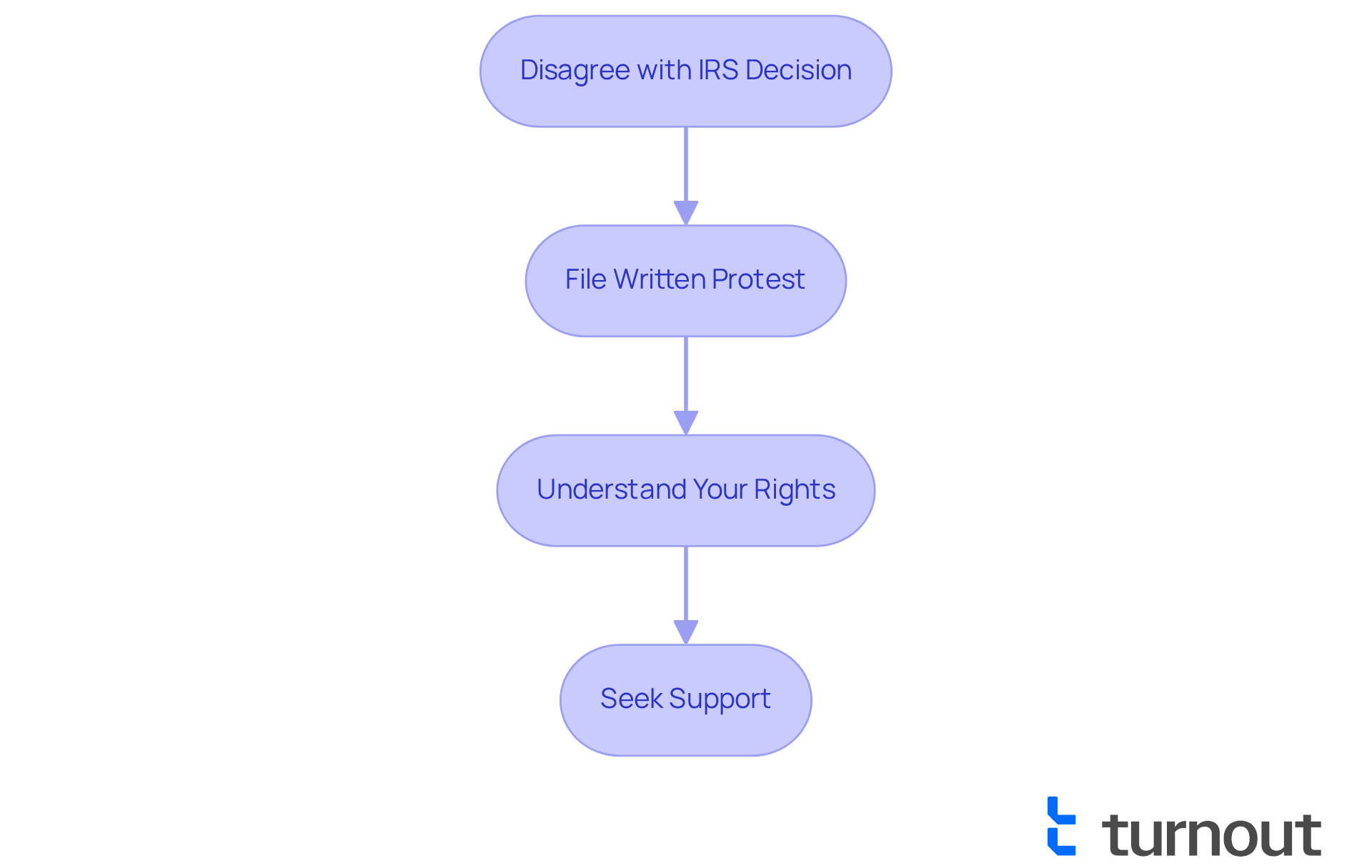

IRS Appeals Process: Challenge IRS Decisions Effectively

If you find yourself disagreeing with an IRS decision, know that you have the right to appeal. We understand that dealing with such matters can be overwhelming, but the appeals process allows you to contest IRS determinations without the stress of going to court.

To get started, you’ll need to file a written protest that outlines your case and submit it to the IRS. This step is crucial, and we’re here to help you through it. Understanding your rights and the appeals process can empower you to navigate disputes effectively and seek a fair resolution.

Remember, you are not alone in this journey. Many have faced similar challenges, and with the right support, you can find your way through. Take that first step today, and let’s work together towards a resolution.

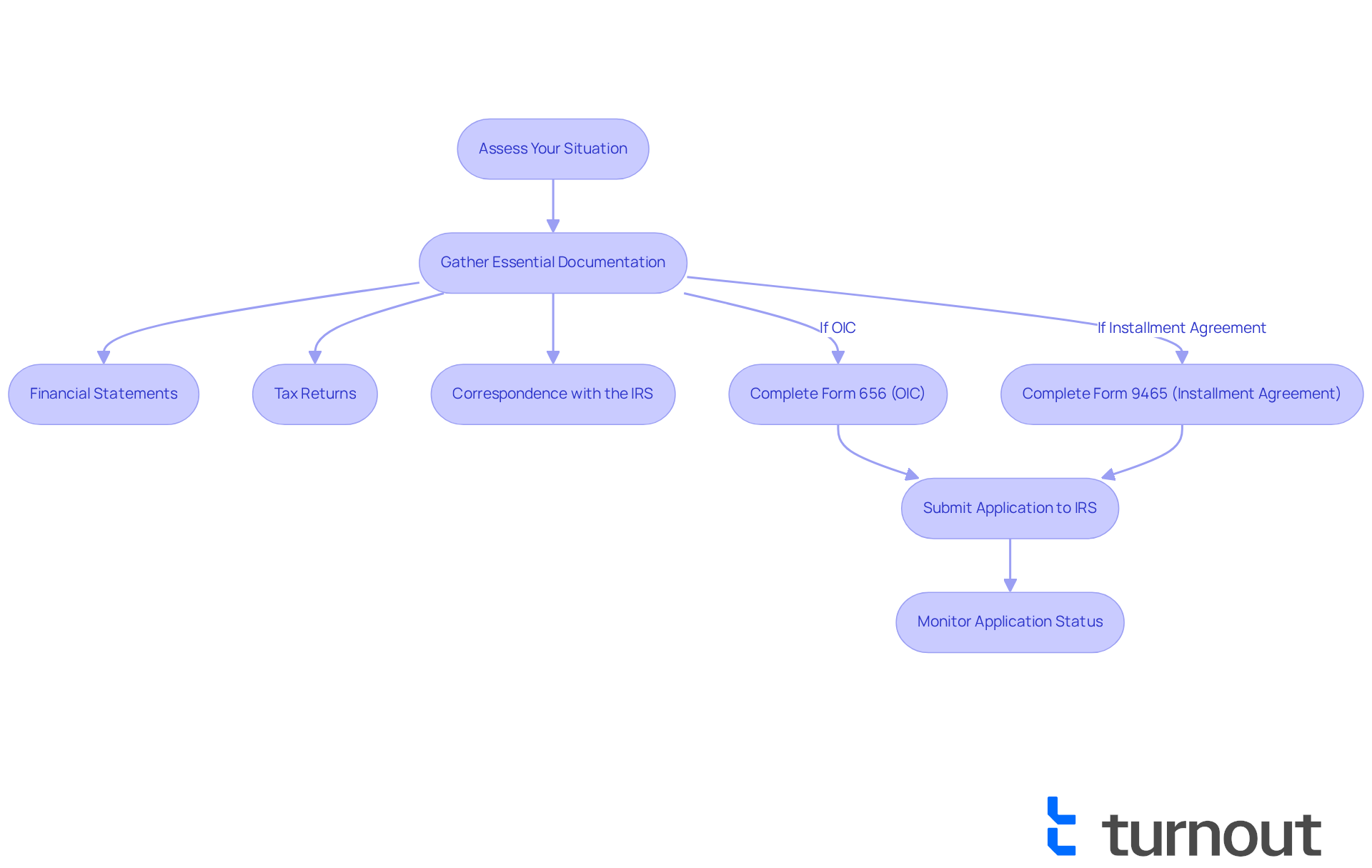

How to Apply for IRS Debt Relief Programs: A Step-by-Step Guide

Navigating IRS debt relief programs might seem overwhelming, but you’re not alone in this journey. We understand that figuring out your eligibility for options like the Offer in Compromise (OIC) or installment agreements can be daunting. Start by assessing your situation and gathering essential documentation, such as:

- Financial statements

- Tax returns

- Any correspondence with the IRS

For the OIC, you’ll need to complete Form 656, while Form 9465 is necessary for installment agreements. Once you’ve filled out the required forms, submit your application to the IRS and keep an eye on its status to ensure timely processing. It’s common to feel confused about eligibility criteria and the complexities of the forms for IRS debt relief programs, but remember, resources like Turnout can help simplify these hurdles and provide valuable assistance.

Take inspiration from successful cases, like Elyse's, who managed to significantly reduce her tax burden with the right documentation and guidance. With the right support, you too can find relief. Don’t hesitate to reach out for help; we’re here to guide you every step of the way.

Conclusion

Navigating tax burdens can feel overwhelming, and it’s completely understandable to be concerned about your financial situation. But remember, you’re not alone in this journey. There are various IRS debt relief programs designed to help you regain control, from the Offer in Compromise to Currently Not Collectible status. These options can provide the essential support you need during tough times.

We understand that the process can be complex, but leveraging innovative solutions, like AI-driven assistance from Turnout, can simplify things and increase your chances of successful debt resolution. Throughout this article, we’ve explored key options for tax relief, highlighting the importance of thorough documentation and the potential for significant reductions in tax liabilities. Programs like penalty abatement and Innocent Spouse Relief can offer you a lifeline.

Additionally, the IRS Taxpayer Advocate Service and the appeals process play crucial roles in ensuring you have the support you need to navigate tax disputes. It’s vital to have a strong support system in place, and we’re here to help you through it.

Ultimately, managing tax burdens doesn’t have to be a solitary endeavor. By taking proactive steps, seeking professional guidance, and utilizing available resources, you can effectively tackle your tax challenges. Embracing these IRS debt relief programs not only provides immediate relief but also lays the groundwork for a more stable financial future.

Taking action today can lead to a brighter tomorrow. Don’t let tax burdens overshadow your potential for financial recovery and peace of mind. You deserve a chance to thrive.

Frequently Asked Questions

What is Turnout and how does it help with tax debt relief?

Turnout is a service that utilizes AI technology to simplify the tax debt relief process, making it easier for individuals to understand and access IRS debt relief programs. It provides personalized support and timely updates through its AI case quarterback, Jake.

How much money has Turnout successfully returned to Americans?

In just 10 months, Turnout has successfully returned and applied over $40 million to Americans facing tax debt.

What is the Offer in Compromise (OIC) program?

The Offer in Compromise (OIC) program allows qualified individuals facing economic hardship to settle their tax obligations for less than the amount owed. It requires detailed financial information to evaluate eligibility based on individual circumstances.

What changes were made to the OIC program in 2025?

The OIC program underwent updates to broaden eligibility criteria, focusing more on an individual’s ability to pay rather than just the amount of their debt, making it more accessible to those in need of relief.

Can you provide examples of successful OIC settlements?

Yes, one example is Mike, who settled a $35,000 debt for only $10,000. Another example is Elyse, a single parent, who negotiated a lump-sum payment of $1,000 to resolve her $67,912 tax liability due to her minimal net equity and low disposable income.

What is the typical reduction in tax obligations through IRS debt relief programs?

Individuals can typically expect to see a reduction of about 50% of their overall tax obligations through IRS debt relief programs.

What are the compliance requirements after an OIC is accepted?

Individuals must stay compliant with tax obligations for five years after their OIC is accepted, or risk having their full tax debt reinstated. The IRS will also hold any refunds for tax periods until the offer is accepted.

What is Currently Not Collectible (CNC) status?

CNC status is a designation that can temporarily halt IRS collection actions for individuals who are struggling to pay their tax debt without compromising basic living expenses.

Who qualifies for CNC status?

Approximately 25% of individuals qualify for CNC status, particularly those facing significant hardships such as job loss, serious illness, or unexpected financial setbacks.

What are the implications of being in CNC status?

While CNC status provides temporary relief from IRS collections, it does not erase tax debt; interest and penalties continue to accrue. The IRS conducts yearly assessments to determine ongoing eligibility for CNC status.

How can individuals apply for CNC status?

To apply for CNC status, individuals need to provide documentation of their economic situation to the IRS. Consulting a tax professional can also help navigate the application process.