Introduction

Navigating the maze of tax obligations can feel overwhelming, and it’s completely normal to seek help from IRS debt relief companies. In this article, we’ll explore ten exceptional firms dedicated to easing your tax burdens, providing innovative solutions and personalized support. We understand that as taxpayers face the complexities of financial responsibilities, the pressing question arises: which company can truly offer the relief you need to regain your financial footing? Join us as we delve into these top-rated services and discover how they can turn your tax challenges into manageable solutions.

Turnout: AI-Powered Tax Debt Relief Advocacy

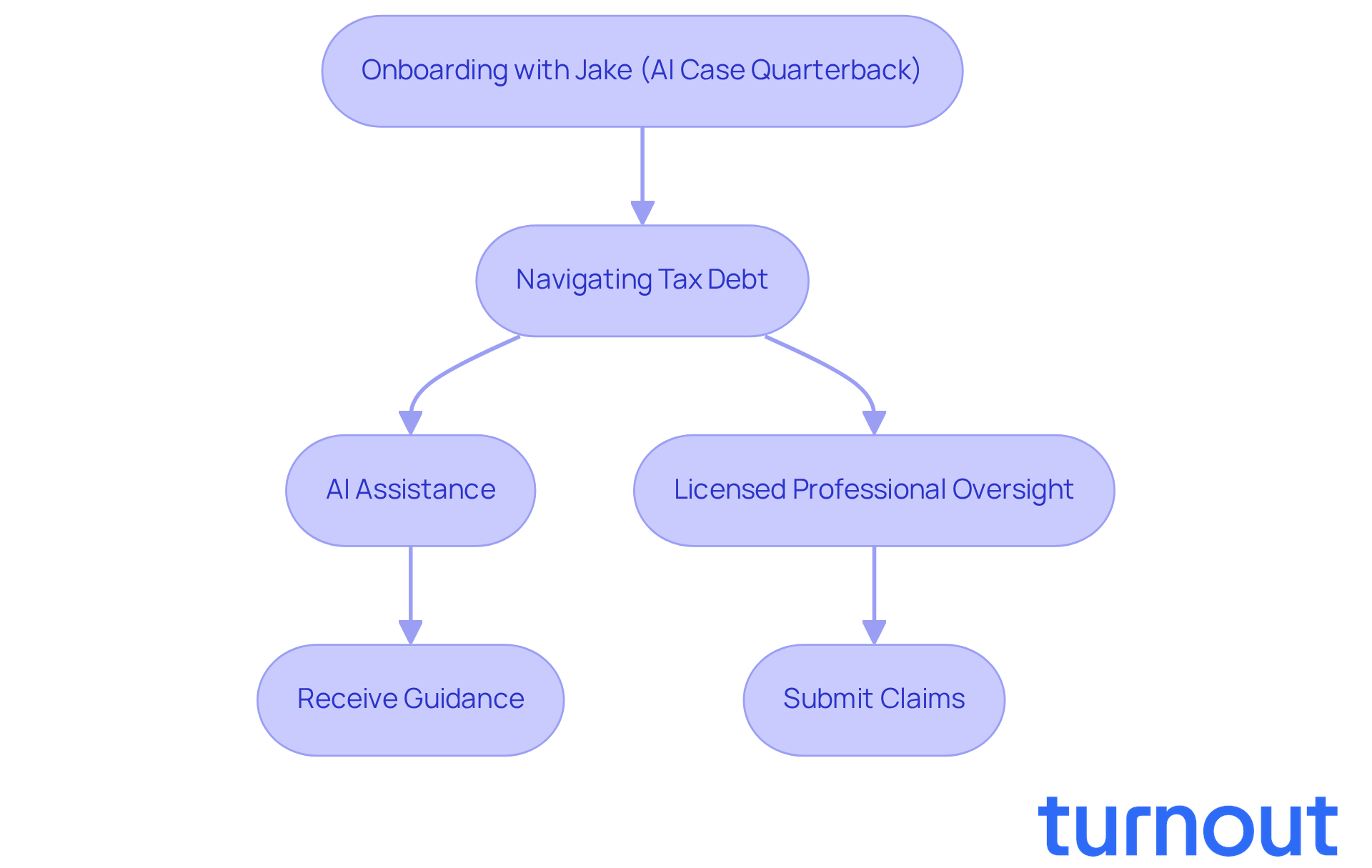

Turnout is changing the way we think about tax obligation relief, thanks to the innovative use of AI technology. Meet Jake, our AI case quarterback. This platform is designed to simplify the advocacy process, helping you navigate the complexities of tax debt with ease. We understand that dealing with tax issues can be overwhelming, and Jake is here to enhance your onboarding experience, ensuring you stay informed every step of the way.

By combining AI capabilities with the expertise of licensed professionals, who oversee critical stages of the process, Turnout offers a unique solution. We empower you to face your tax challenges with confidence and efficiency. It’s important to note that Turnout is not a law office and does not provide legal counsel. Instead, we partner with IRS-licensed enrolled agents to ensure you receive qualified assistance throughout your journey.

For those seeking SSD claims, we also utilize trained nonlawyer advocates, making our services even more accessible. In less than a year, Turnout has helped facilitate over $40 million in benefits for Americans, showcasing the real impact of our AI-driven approach. This dual strategy not only streamlines interactions but also significantly reduces the time and errors often associated with traditional tax advocacy.

We know how frustrating it can be to navigate bureaucratic systems. As Itai Hirsch, the founder of Turnout, emphasizes, our goal is to become the 'AI for everyone.' We’re here to make the complexities of government processes accessible to all. Remember, you are not alone in this journey; we’re here to help.

H&R Block: Comprehensive Tax Preparation and Relief Services

H&R Block stands out as a trusted leader in tax preparation, offering a variety of services, including specialized tax assistance options. We understand that managing tax responsibilities can be overwhelming, but their team of experienced tax specialists is here to provide personalized support. This tailored assistance helps clients navigate their tax obligations with confidence. With a user-friendly platform designed for both simple and complex tax situations, H&R Block has become a go-to choice for many Americans seeking relief from tax burdens.

Customer reviews consistently highlight H&R Block's responsive customer support, especially when it comes to tackling tax debt. Many clients have shared their success stories, showcasing how the firm’s expertise has led to positive outcomes in resolving their tax issues. In fact, H&R Block boasts an impressive average success rate in tax assistance, underscoring its effectiveness in guiding clients through challenging financial times.

Moreover, a recent case involving H&R Block, which resulted in a $7 million settlement for consumers affected by unlawful practices, reflects the company's commitment to accountability and transparency. This case, along with insights from Commissioner Andrew N. Ferguson, emphasizes the importance of ethical practices in tax preparation, further solidifying H&R Block's reputation as a reliable ally in tax assistance.

If you're seeking help with government benefits and financial support, consider Turnout as well. Turnout provides access to resources and services that assist individuals in navigating complex financial and governmental systems, including support for Social Security Disability (SSD) claims and tax obligations. While Turnout is not a law practice and does not offer legal representation, they employ trained nonlawyer advocates for SSD claims and partner with IRS debt relief companies that include licensed enrolled agents for tax debt assistance. Understanding Turnout's fee structure is crucial, as some services are free while others may incur charges, and government fees must be settled separately before any documents can be submitted on behalf of clients. This comprehensive approach ensures that individuals with disabilities can find the support they need to navigate their financial challenges.

Remember, you are not alone in this journey. We're here to help you every step of the way.

Jackson Hewitt: Expert Tax Relief and Preparation Assistance

At Jackson Hewitt, we understand that dealing with tax challenges can be overwhelming. That’s why we excel in providing expert services through IRS debt relief companies, prioritizing personalized support for individuals like you. Our team of knowledgeable tax professionals is dedicated to helping you comprehend your unique tax situation and discover effective solutions tailored just for you.

With a strong commitment to customer service, we ensure you receive the guidance necessary to navigate tax debt and achieve favorable outcomes. Our Maximum Refund Guarantee is designed with your best interests in mind, assuring you the highest possible refund. If another service offers a larger refund, we’ll give you an extra $100. This dedication to maximizing your benefits is reflected in our positive reviews, showcasing our reputation as a trusted partner in tax preparation.

Moreover, with over 5,000 locations, including many in Walmart stores, we provide convenient access to personalized tax support. We’re here to make it easier for you to receive the assistance you need during tax season. You are not alone in this journey.

Additionally, firms like Turnout offer essential tools for managing government-related procedures, including SSD claims and services from IRS debt relief companies. They employ trained nonlawyer advocates and IRS-licensed agents to assist you effectively. Remember, we’re here to help you every step of the way.

Tax Defense Network: Specialized Representation for Tax Issues

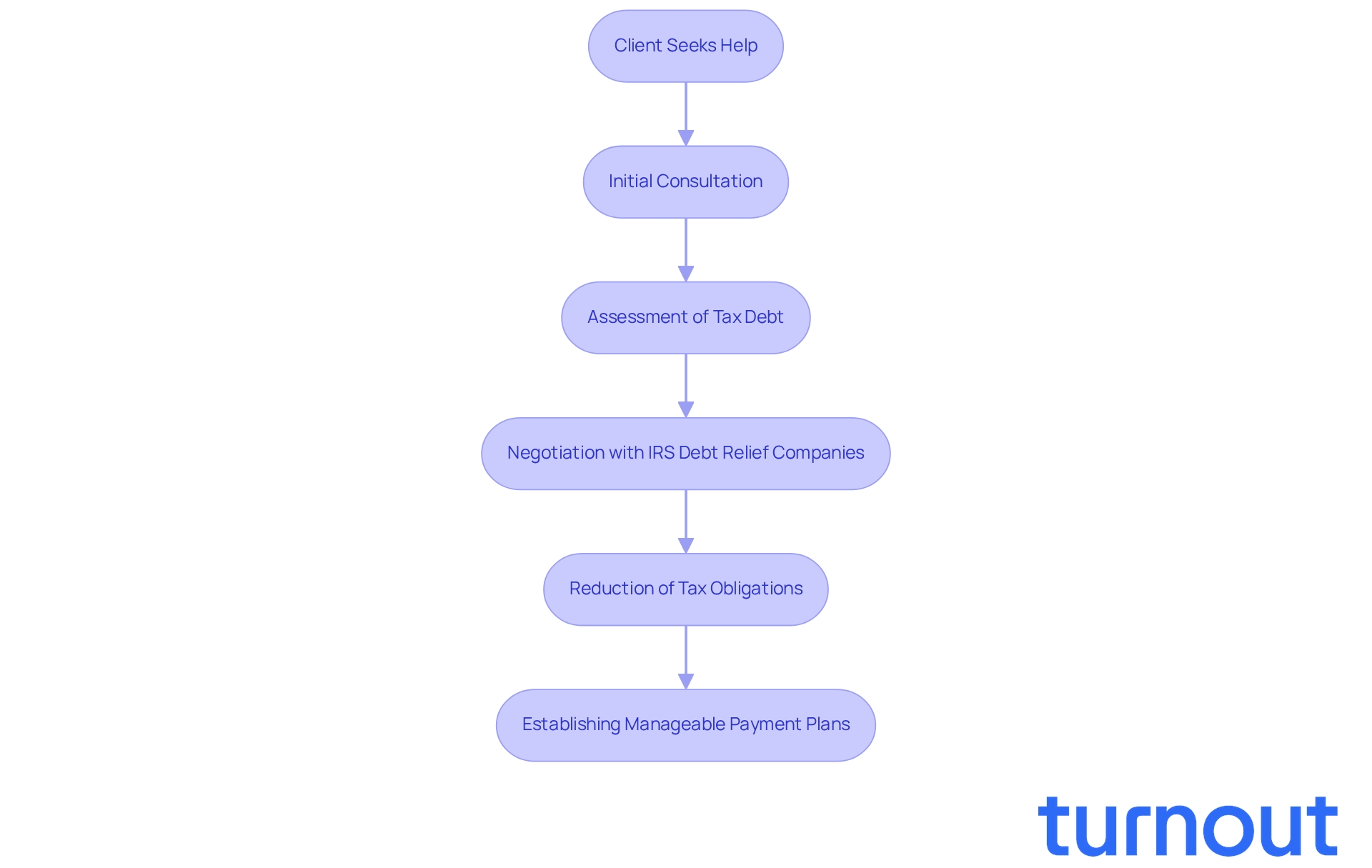

Are you feeling overwhelmed by tax issues? You’re not alone. Tax Defense Network understands the stress that comes with grappling with tax problems, and they’re here to help, just like other IRS debt relief companies. Specializing in tailored representation, their dedicated team works closely with you to create customized strategies that aim to resolve your tax debts, often in collaboration with IRS debt relief companies to navigate the complexities of IRS challenges.

This personalized approach not only alleviates the burden of tax issues but also ensures you feel supported throughout the resolution process. Typically, individuals can expect their tax matters to be settled within six to twelve months. As they say, "the process can differ based on the complexity of your tax situation and how quickly you organize your paperwork."

Imagine the relief of seeing significant decreases in your tax obligations. Many individuals have shared their success stories, highlighting a more seamless resolution experience. One representative emphasized, "Our aim is to enhance tax defense transparency," showcasing their commitment to clear communication and customer satisfaction.

If you’re ready to take the next step, remember: you don’t have to face this journey alone. Tax Defense Network is here to guide you every step of the way.

Optima Tax Relief: Negotiation and Settlement Services for Taxpayers

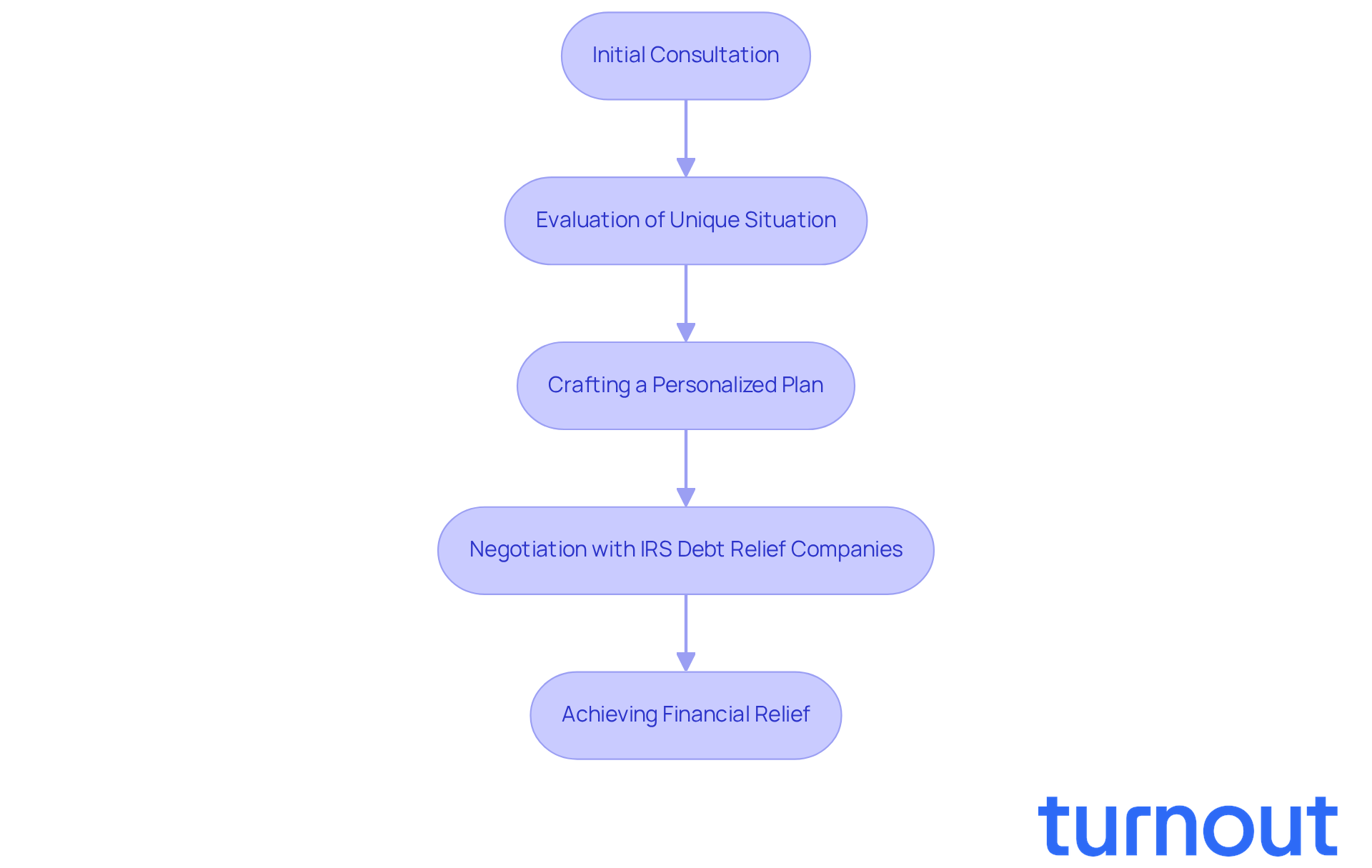

At Optima Tax Relief, we understand that dealing with tax debt can be overwhelming. Many individuals feel anxious and uncertain about their financial futures. That’s why our dedicated team specializes in working with IRS debt relief companies to help you settle your debts for less than what you owe.

We take the time to evaluate your unique situation, crafting a personalized plan that addresses your specific needs. Our experienced professionals work diligently to ensure you have a clear path toward financial relief. By focusing on negotiation and settlement, we aim to provide you with not just solutions, but also peace of mind through the services of IRS debt relief companies.

You’re not alone in this journey. We’re here to help you navigate the complexities of tax resolution. Imagine the relief of finally putting your tax worries behind you. Let us support you in taking that crucial step toward a brighter financial future.

Community Tax: Comprehensive Support for Tax Audits and Relief

Are you feeling overwhelmed by tax audits or struggling with tax debts? You’re not alone, and Community Tax is here to help. Our dedicated team of specialists understands the complexities of tax-related issues and is committed to providing the support you need to navigate these challenges.

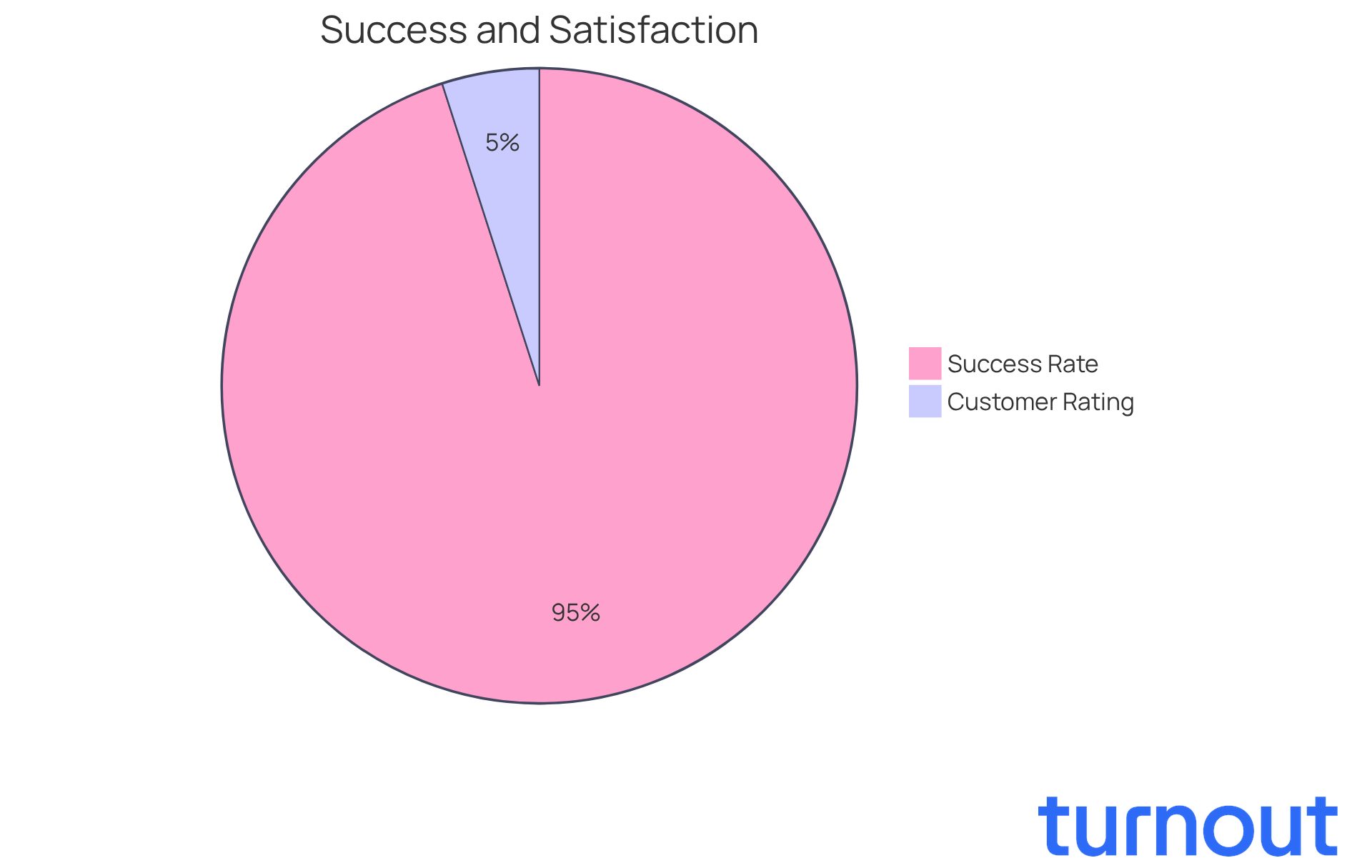

With a focus on transparency and open communication, we empower you to take control of your tax situation. In 2025, our customers reported an impressive success rate of 94%. Many found relief and favorable outcomes through our tailored strategies and personalized support offered by IRS debt relief companies.

Your satisfaction is our priority, and it shows in our high ratings - averaging 4.9 out of 5 on TrustPilot. We’re proud to assist individuals like you in overcoming tax challenges and obtaining the help you deserve.

Please note, we require a minimum debt of $7,500 for our services, along with an investigation fee of:

- $295 for individuals

- $595 for businesses

Remember, you don’t have to face this journey alone; we’re here to support you every step of the way.

Tax Relief Advocates: Personalized Solutions for IRS Challenges

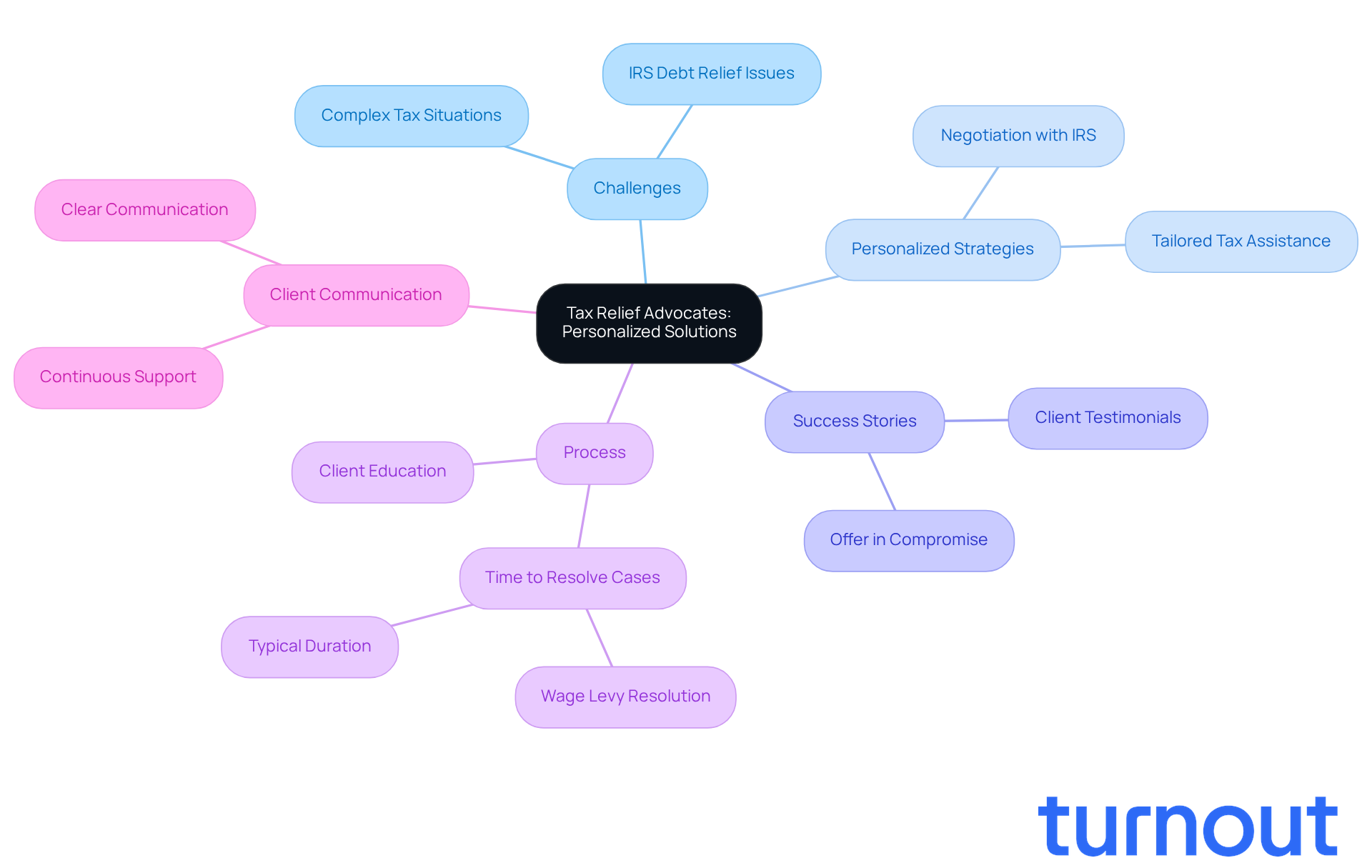

Tax Relief Advocates understands the challenges you face when dealing with issues related to IRS debt relief companies. We know that navigating these complexities can feel overwhelming, and that’s why our dedicated team is here to help. We work closely with you to assess your unique situation and create personalized strategies for tax assistance provided by IRS debt relief companies. This tailored approach not only enhances the effectiveness of our solutions but also empowers you to regain your financial stability.

With a proven track record, Tax Relief Advocates has successfully resolved numerous challenges posed by IRS debt relief companies. Typically, the time to resolve a tax assistance case ranges from six months to two years. Our specialists excel at negotiating with IRS debt relief companies, ensuring that all submissions meet necessary guidelines to minimize delays. For example, wage levy issues can often be resolved much faster-sometimes within just one week-demonstrating our commitment to swift and effective resolutions.

Client success stories from 2025 truly highlight the transformative impact of our services. One individual, feeling overwhelmed by tax debt, was able to settle their obligations for significantly less than owed through an Offer in Compromise, thanks to the assistance of IRS debt relief companies. This case illustrates how our personalized approach not only alleviates immediate financial burdens but also fosters long-term compliance and peace of mind, with over 90 percent of cases resolved successfully.

We emphasize the importance of clear communication and continuous support throughout the assistance process. Our dedication to educating clients ensures that you are well-informed about each step, enhancing your confidence as you navigate the complexities of tax resolution. As one of our team members noted, "Understanding each customer's unique situation is what sets Tax Relief Advocates apart in the tax relief arena."

Remember, you are not alone in this journey. We’re here to help you every step of the way.

Freedom Tax Relief: Settling Tax Debts with Expert Guidance

Are you feeling overwhelmed by your tax obligations? You’re not alone. Many individuals find themselves navigating the complex world of tax resolution, often seeking assistance from IRS debt relief companies, and it can be daunting. At Freedom Tax Relief, we understand the emotional toll this can take, and we’re here to help.

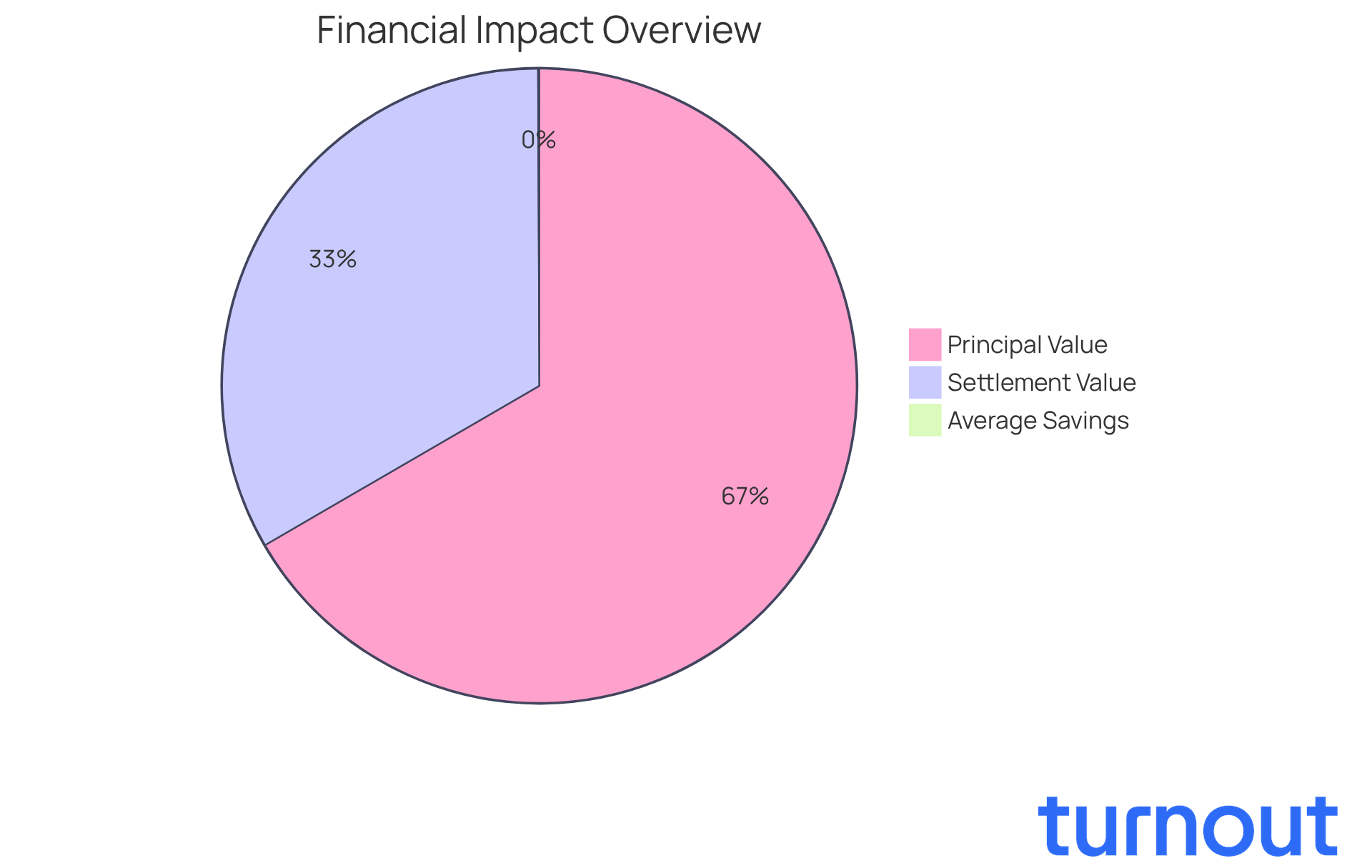

Our experienced team is dedicated to guiding you through your options, providing personalized assistance every step of the way. With a focus on strategic guidance, we’ve achieved remarkable success in helping individuals alleviate their tax burdens. In 2022 alone, we resolved over 1.2 million financial accounts, totaling a principal value of $5.6 billion and a settlement value of $2.8 billion. This showcases our commitment to helping you regain your financial stability.

Client feedback highlights the professionalism and dedication of our team, reinforcing our reputation as a trusted ally in tax resolution. Many individuals have shared their success stories, reporting average savings of $5,440 over 36 months after fees. Imagine moving forward with confidence and peace of mind.

However, it’s important to remember that forgiven obligations may have tax implications. We encourage you to consider this as you explore your financial options. You don’t have to face this journey alone; IRS debt relief companies are here to support you every step of the way.

The Tax Relief Company: Negotiation Services for Tax Debt Resolution

At The Tax Relief Company, we understand that dealing with tax debt can be overwhelming, which is why many seek help from IRS debt relief companies. That's why we excel in providing negotiation services through IRS debt relief companies to help you resolve your tax obligations. Our skilled team is dedicated to negotiating with IRS debt relief companies on your behalf, aiming to significantly reduce the amounts you owe and establish manageable payment plans.

Imagine the relief of having professionals in your corner, working tirelessly to ease your financial burden. In 2025, our customers reported an average decrease of over 30% in their tax obligations thanks to our efforts. This isn't just a statistic; it's a testament to the tangible benefits our services can provide.

We know that hearing from others who have walked this path can be reassuring. Testimonials from satisfied customers highlight the peace of mind that comes from having experienced professionals support them. You are not alone in this journey; we are here to help you navigate your tax challenges with compassion and expertise.

If you're feeling the weight of tax debt, let IRS debt relief companies guide you toward a brighter financial future. Together, we can create a structured approach to overcoming these challenges. Reach out today, and take the first step toward financial relief.

TaxCure: Connecting Taxpayers with Relief Professionals

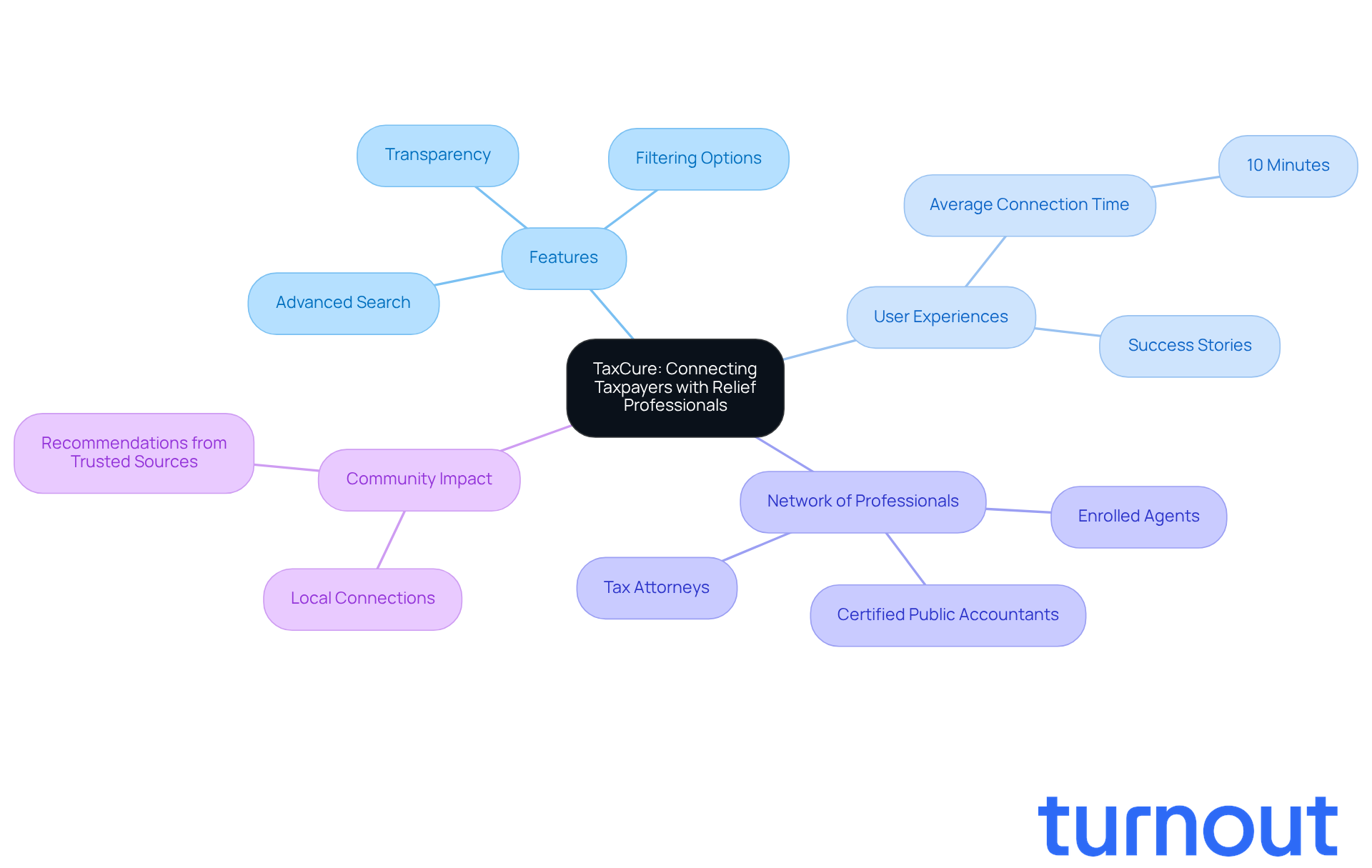

TaxCure is here for you, serving as a vital resource for taxpayers by connecting you with qualified tax assistance professionals right in your community. With advanced search features and filtering options, finding the right expert for your specific tax challenges becomes a breeze. This personalized approach not only simplifies managing your tax obligations but also ensures you receive the guidance and support you truly need.

We understand that reaching out for help can feel daunting. Recent user experiences show that the average time to connect with a tax assistance expert through TaxCure is just about 10 minutes. That means you can access the help you need quickly. Many users have shared their success stories, highlighting how they effectively resolved their tax debts through IRS debt relief companies on our platform. TaxCure is committed to enhancing transparency in tax relief services offered by IRS debt relief companies, allowing you to read reviews from real clients. This way, you can make informed decisions when choosing the right professional for your needs.

With over 1,000 verified tax professionals - including Enrolled Agents, Certified Public Accountants, and Tax Attorneys - TaxCure stands out as a trustworthy alternative to larger tax resolution firms. Charles Corsello, a representative from TaxCure, expressed, "Reaching 1,000 verified professionals is a major milestone for TaxCure, and we're really excited about what that can do for taxpayers." This extensive network not only improves access to tailored solutions but also fosters a sense of community among users. Many discover our platform through recommendations from trusted sources, like State Department of Revenue employees. By connecting you with local experts, TaxCure empowers you to tackle your tax challenges with confidence. You are not alone in this journey.

Conclusion

Navigating the complexities of tax debt can feel overwhelming, but you don’t have to face it alone. There are numerous IRS debt relief companies ready to lend a helping hand. From innovative AI-driven platforms like Turnout to trusted names like H&R Block and Jackson Hewitt, these organizations offer tailored support designed to empower you during challenging financial times. Remember, effective solutions are available, and you deserve to find relief.

Each company brings unique offerings to the table:

- Turnout simplifies the process with cutting-edge AI technology.

- H&R Block and Jackson Hewitt focus on personalized service through their extensive networks of tax professionals.

- Companies like Tax Defense Network and Optima Tax Relief specialize in negotiation strategies, ensuring you can settle your debts efficiently.

- Community Tax and Tax Relief Advocates prioritize transparency and communication, fostering trust and confidence in their services.

Each organization is committed not only to alleviating tax burdens but also to empowering you with knowledge and support.

It’s important to recognize the value of seeking professional assistance in tax matters. Whether you choose AI-powered services or traditional tax preparation firms, taking proactive steps toward resolving your tax challenges is crucial. By connecting with qualified professionals, you can navigate your financial obligations with greater ease and confidence. Embracing the resources available to you can lead to a brighter financial future, transforming overwhelming tax debt into manageable solutions. Remember, you are not alone in this journey, and help is just a call away.

Frequently Asked Questions

What is Turnout and how does it assist with tax debt relief?

Turnout is an AI-powered platform designed to simplify the tax debt advocacy process. It combines AI technology with the expertise of licensed professionals to help users navigate tax issues more efficiently.

Who oversees the process at Turnout?

The process at Turnout is overseen by IRS-licensed enrolled agents who provide qualified assistance throughout the journey of addressing tax challenges.

Does Turnout provide legal counsel?

No, Turnout is not a law office and does not provide legal counsel. It offers advocacy services in partnership with licensed professionals.

How has Turnout impacted its clients financially?

In less than a year, Turnout has facilitated over $40 million in benefits for Americans, demonstrating the effectiveness of its AI-driven approach to tax debt relief.

What types of claims can Turnout assist with?

Turnout can assist with Social Security Disability (SSD) claims and tax obligations through trained nonlawyer advocates and IRS-licensed agents.

What is H&R Block known for?

H&R Block is a trusted leader in tax preparation, offering a range of services and personalized support to help clients manage their tax responsibilities effectively.

How does H&R Block ensure customer satisfaction?

H&R Block is known for its responsive customer support and has a high success rate in resolving tax issues, as reflected in positive customer reviews and success stories.

What recent legal case has H&R Block been involved in?

H&R Block was involved in a case that resulted in a $7 million settlement for consumers affected by unlawful practices, highlighting the company's commitment to ethical practices in tax preparation.

How does Jackson Hewitt assist individuals facing tax challenges?

Jackson Hewitt provides expert services through IRS debt relief companies, focusing on personalized support to help clients understand their tax situations and find effective solutions.

What guarantee does Jackson Hewitt offer to its clients?

Jackson Hewitt offers a Maximum Refund Guarantee, ensuring clients receive the highest possible refund or an additional $100 if another service provides a larger refund.

Where can clients find Jackson Hewitt's services?

Jackson Hewitt has over 5,000 locations, including many within Walmart stores, making it convenient for clients to access personalized tax support.

How does Turnout's approach differ from traditional tax advocacy?

Turnout's dual strategy of using AI technology alongside licensed professionals streamlines interactions and reduces the time and errors typically associated with traditional tax advocacy.