Introduction

Navigating the complexities of tax obligations can feel overwhelming, especially for individuals with disabilities. We understand that accessing the support you need can be a unique challenge. Thankfully, there are highly-rated tax relief companies dedicated to providing tailored assistance. These organizations empower individuals to manage their financial responsibilities effectively.

As the demand for accessible tax services grows, you might wonder: which companies truly stand out in their commitment to compassionate advocacy? This article explores the top-rated tax relief providers, highlighting their innovative approaches and the invaluable support they offer. Remember, you are not alone in this journey; help is available.

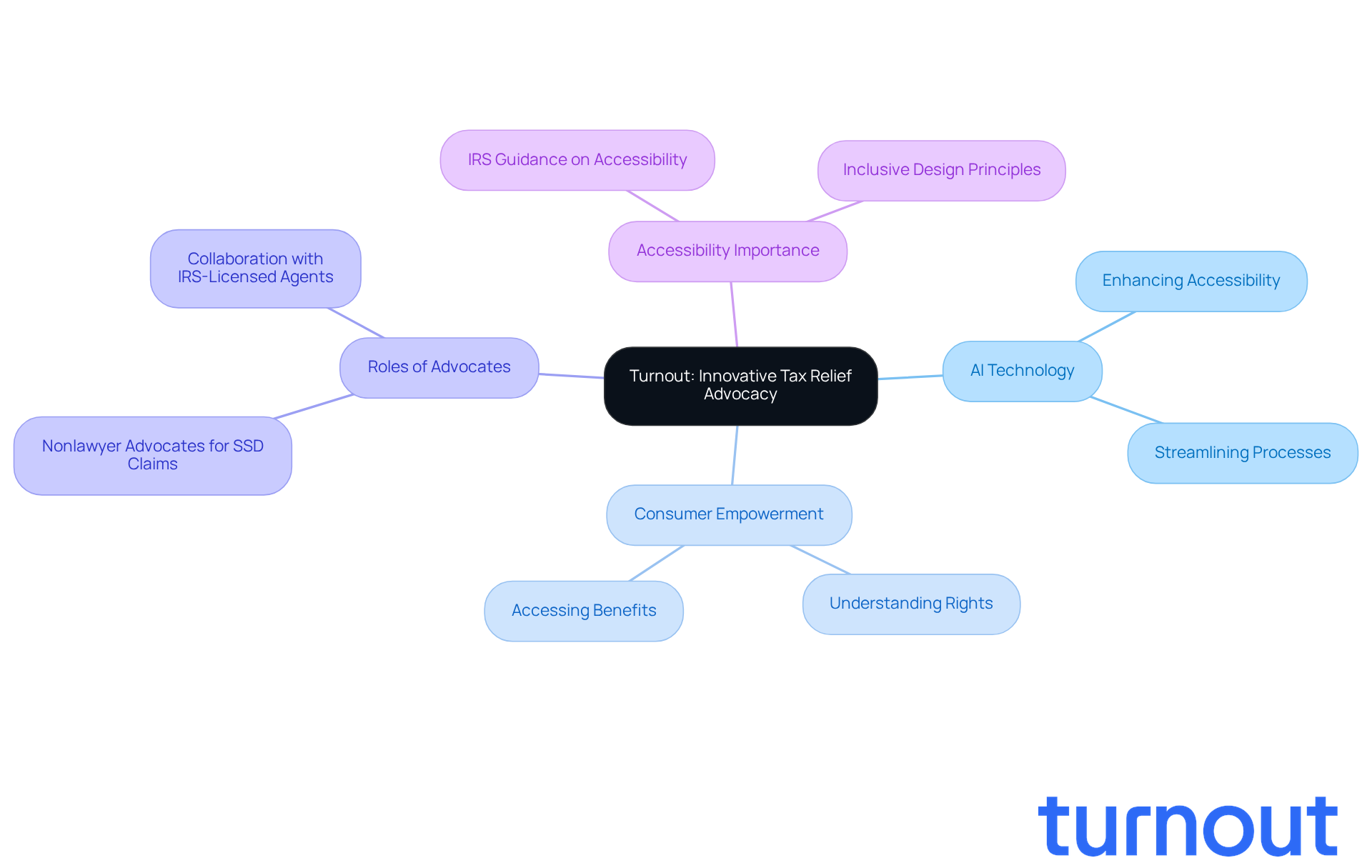

Turnout: Innovative Tax Relief Advocacy for Consumers

Turnout is changing the game in tax advocacy by leveraging AI technology to support consumers, particularly those with disabilities. We understand that navigating the complex world of tax responsibilities can be overwhelming. That’s why Turnout clarifies this often intricate landscape, making it accessible and manageable for everyone.

By prioritizing compassion and efficiency, Turnout empowers individuals to understand their rights and access the benefits they deserve. This includes assistance with Social Security Disability (SSD) claims and support for tax debt. It’s important to note that Turnout is not a law office and does not provide legal counsel. Instead, we employ trained nonlawyer advocates for SSD claims and collaborate with IRS-licensed enrolled agents for tax debt assistance.

This innovative approach not only speeds up the application process but also ensures that consumers feel informed and supported at every step of their journey. With nearly 90% of disability service providers reporting staffing shortages in 2025, effective advocacy is more crucial than ever.

As Dr. Victor Santiago Pineda, a disability rights advocate, wisely states, "When designed with accessibility in mind, AI becomes a powerful equalizer." Moreover, the IRS's recent guidance on accessibility enhancements highlights the importance of making tax assistance more achievable for individuals with disabilities. This reinforces Turnout's mission to empower consumers as they navigate these challenges. Remember, you are not alone in this journey; we’re here to help.

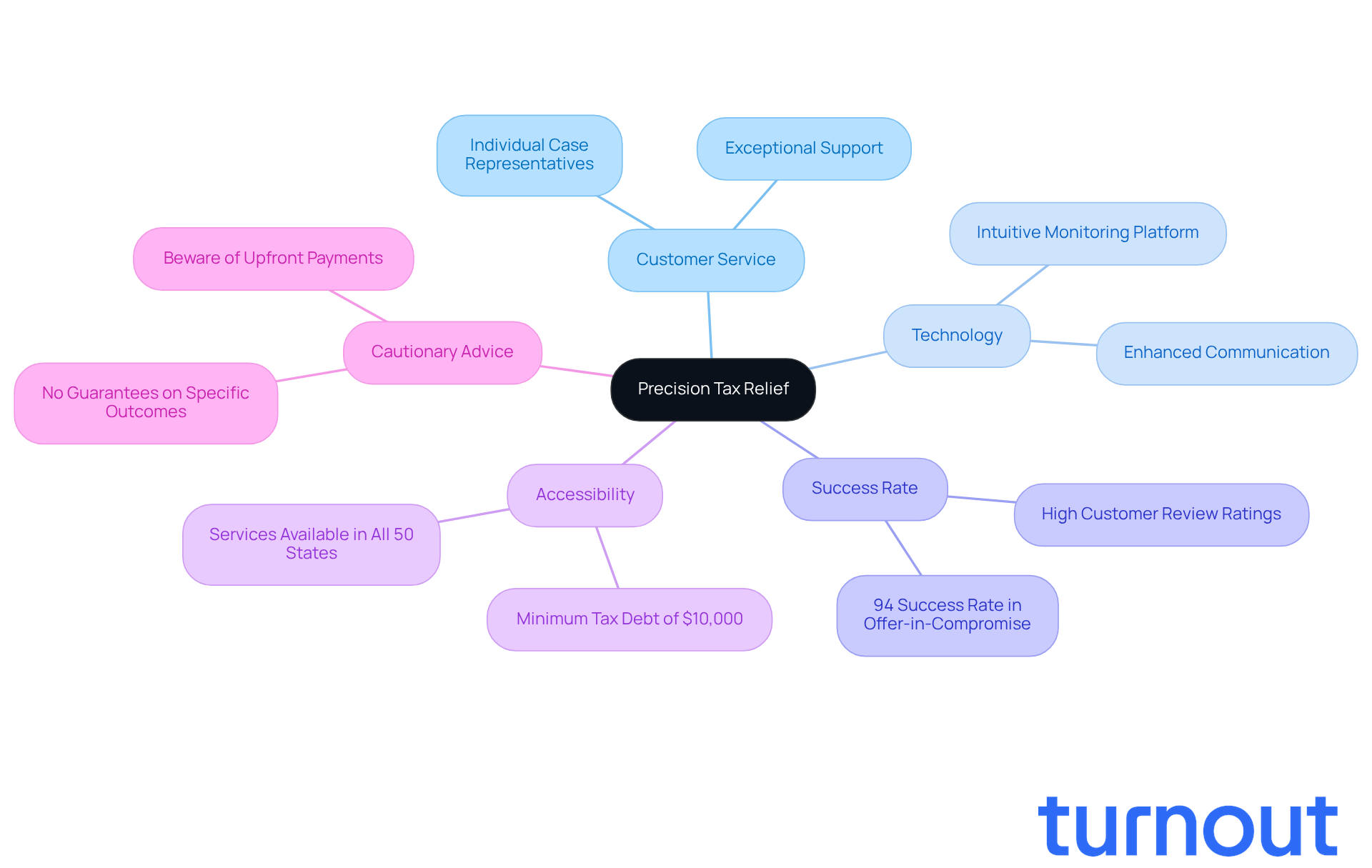

Precision Tax Relief: Best for Customer Service and Technology

At Precision Tax Relief, we understand that dealing with tax issues can be overwhelming. That’s why we’re committed to providing exceptional customer service and utilizing cutting-edge technology to support you every step of the way. Our intuitive platform allows you to easily monitor your cases and connect with tax experts, ensuring transparency and peace of mind, especially for those who may need extra help managing their tax situations.

With an impressive 94% success rate in offer-in-compromise agreements, we not only deliver effective solutions but also prioritize responsiveness. This positions us among the highest rated tax relief companies for anyone seeking assistance. We know that incorporating technology into tax assistance can significantly enhance your experience. Many firms, including ours, have reported improved communication and case management capabilities, which means you can expect better support.

As technology continues to evolve, we remain at the forefront, dedicated to ensuring that individuals, including those with disabilities, receive the clarity and assistance they deserve in managing their tax obligations. Additionally, our partner, Turnout, enhances these services by helping individuals with SSD claims and tax assistance processes through trained nonlawyer advocates and IRS-licensed enrolled agents. This means you can receive valuable support without the need for legal representation.

It’s important to note that we require a minimum tax debt of $10,000 unless there are multiple years of unfiled taxes. This makes our services accessible to many individuals who need help. However, we urge you to be cautious of tax assistance firms, including the highest rated tax relief companies, that ask for payment upfront or promise specific results. Remember, you are not alone in this journey, and we’re here to help you navigate your tax challenges with care and understanding.

Community Tax: Affordable Solutions for Tax Relief

Community Tax understands the challenges many individuals with disabilities face, especially when it comes to financial difficulties. That’s why they’re dedicated to providing affordable tax assistance solutions. If you’re feeling overwhelmed by tax preparation or negotiations with the IRS, know that you’re not alone. Community Tax offers a comprehensive suite of services at competitive rates, making it a perfect option for those who need support.

It’s common to feel that the costs of services from the highest rated tax relief companies are just too high, especially for low-income consumers. Community Tax, one of the highest rated tax relief companies, recognizes this struggle and prioritizes cost-effectiveness. Their commitment to addressing tax issues with the help of the highest rated tax relief companies means you can get the assistance you need without adding to your financial burden.

By focusing on affordability, Community Tax empowers individuals with disabilities to navigate their tax obligations with confidence. Imagine alleviating some of the stress that comes with financial constraints. You deserve assistance that respects your situation and helps you move forward. If you’re ready to take the next step, Community Tax is here to help you every step of the way.

Optima Tax Relief: User-Friendly Mobile Solutions

Optima Tax Assistance truly cares about making your tax experience easier. Their user-friendly mobile app is designed to simplify the tax assistance process, especially for those who may find it challenging to visit offices in person. We understand that navigating tax issues can be overwhelming, and this app is here to help.

Imagine having the tools you need right at your fingertips. With this app, you can easily monitor your case's progress, upload necessary documents, and stay connected with tax experts. It’s all about making your journey smoother and less intimidating.

Mobile technology enhances convenience, allowing you to manage your tax situation anytime, anywhere. This means you have access to vital services when you need them most. Optima Tax Assistance illustrates how mobile solutions can truly transform the landscape of tax support for individuals with disabilities.

You are not alone in this journey. With Optima, you have a partner who understands your needs and is committed to supporting you every step of the way.

Anthem Tax Services: Nationwide Support and Reliability

At Anthem Tax Services, we understand that navigating tax issues can be overwhelming, especially for those who may need extra support. With our nationwide reach and dependable assistance, we ensure that you have access to the help you need, no matter where you are. This reliability is particularly important for individuals with disabilities who may require ongoing guidance and reassurance throughout their tax journey.

Our commitment to customer satisfaction and effective communication sets us apart in the industry. We’re here to help you feel confident and supported every step of the way. Similarly, Turnout provides valuable tools and services designed to help you navigate the often complex financial and governmental systems. Whether you need assistance with SSD claims or tax debt relief, Turnout is dedicated to making the process easier for you.

By utilizing trained nonlawyer advocates and IRS-licensed enrolled agents, Turnout ensures that you receive qualified support without the need for legal representation. This approach enhances the options available for individuals seeking benefits, allowing you to focus on what truly matters-your well-being. Remember, you are not alone in this journey; we’re here to support you.

Victory Tax Lawyers: Expertise in Complex Tax Cases

At Victory Tax Lawyers, we understand that navigating tax issues can be especially challenging for disabled individuals. You’re not alone in this journey. Our dedicated team of experienced lawyers is here to help you tackle the complexities of tax regulations with compassion and expertise.

We know that each situation is unique, which is why we take the time to create tailored solutions for your specific needs. Our extensive understanding of tax laws allows us to provide you with the support you deserve. This specialized approach not only enhances your representation but also significantly boosts your chances of achieving a positive outcome in your tax assistance efforts.

With a proven track record of success, Victory Tax Lawyers stands out as a reliable ally. We’re committed to being by your side as you navigate the intricacies of tax law. Remember, you are not alone in this journey; we’re here to help you every step of the way.

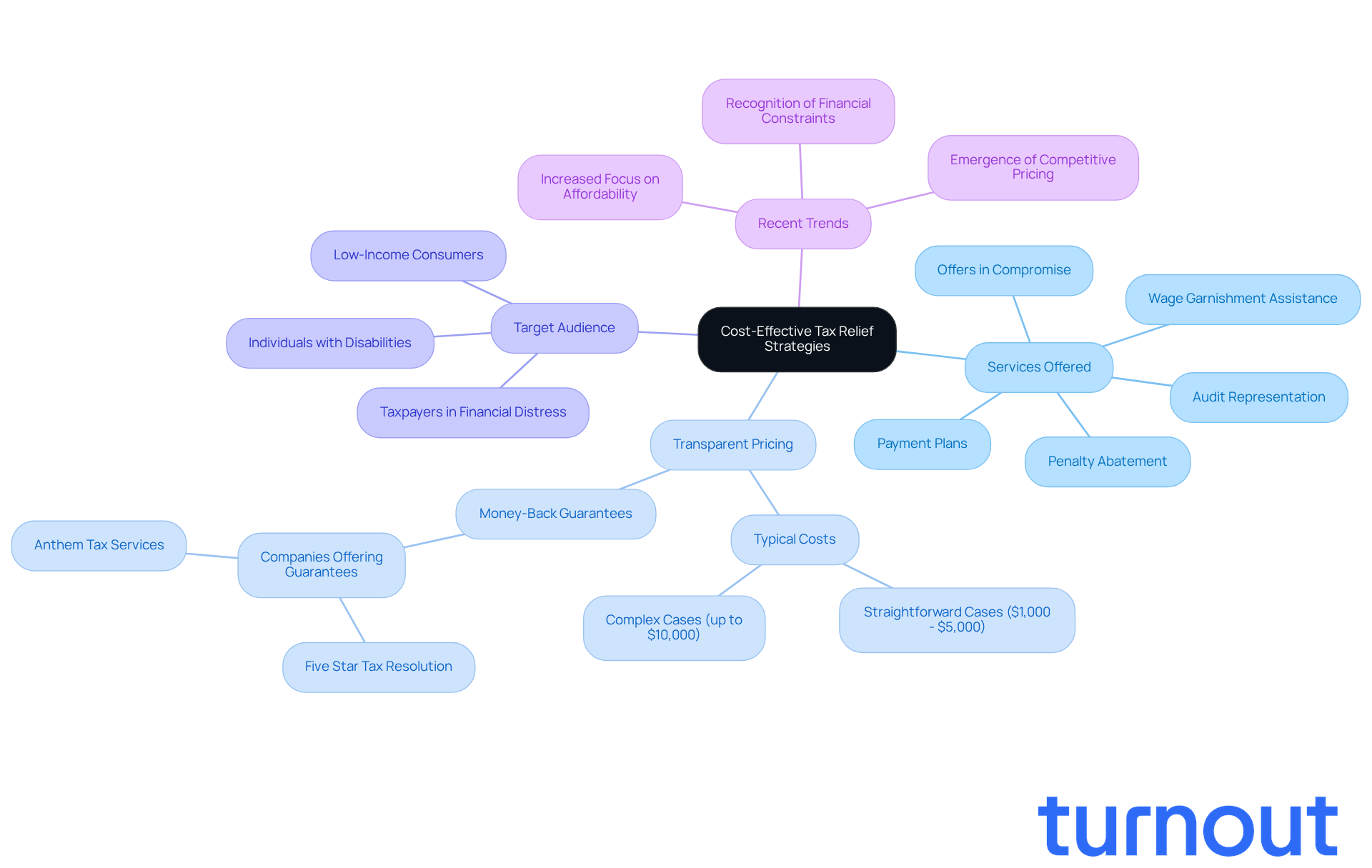

Larson Tax Relief: Cost-Effective Strategies for Relief

At Larson Tax Relief, we truly understand the challenges you face when dealing with tax issues. Our commitment to affordability means we offer a range of services designed to help you resolve your tax concerns without breaking the bank. This focus on budget-friendly strategies is especially important for individuals with disabilities, who often navigate financial constraints while managing their tax responsibilities.

We believe that everyone deserves access to the help they need. That’s why we provide transparent pricing structures and various options, ensuring that low-income consumers can find the support they require. Recent trends indicate that the highest rated tax relief companies are recognizing the importance of affordability. Some even offer services that can save you significant amounts on your tax obligations. For straightforward cases, clients can expect to pay between $1,000 and $5,000, making professional assistance more accessible than ever.

As financial advisor Steve O. Oniya points out, a tax assistance company can be a lifeline for those feeling overwhelmed by their tax situations, especially when other options seem out of reach. This highlights the vital role that affordable tax relief services play in helping individuals with disabilities achieve financial stability. Remember, you are not alone in this journey. We’re here to help you navigate these challenges and find the relief you deserve.

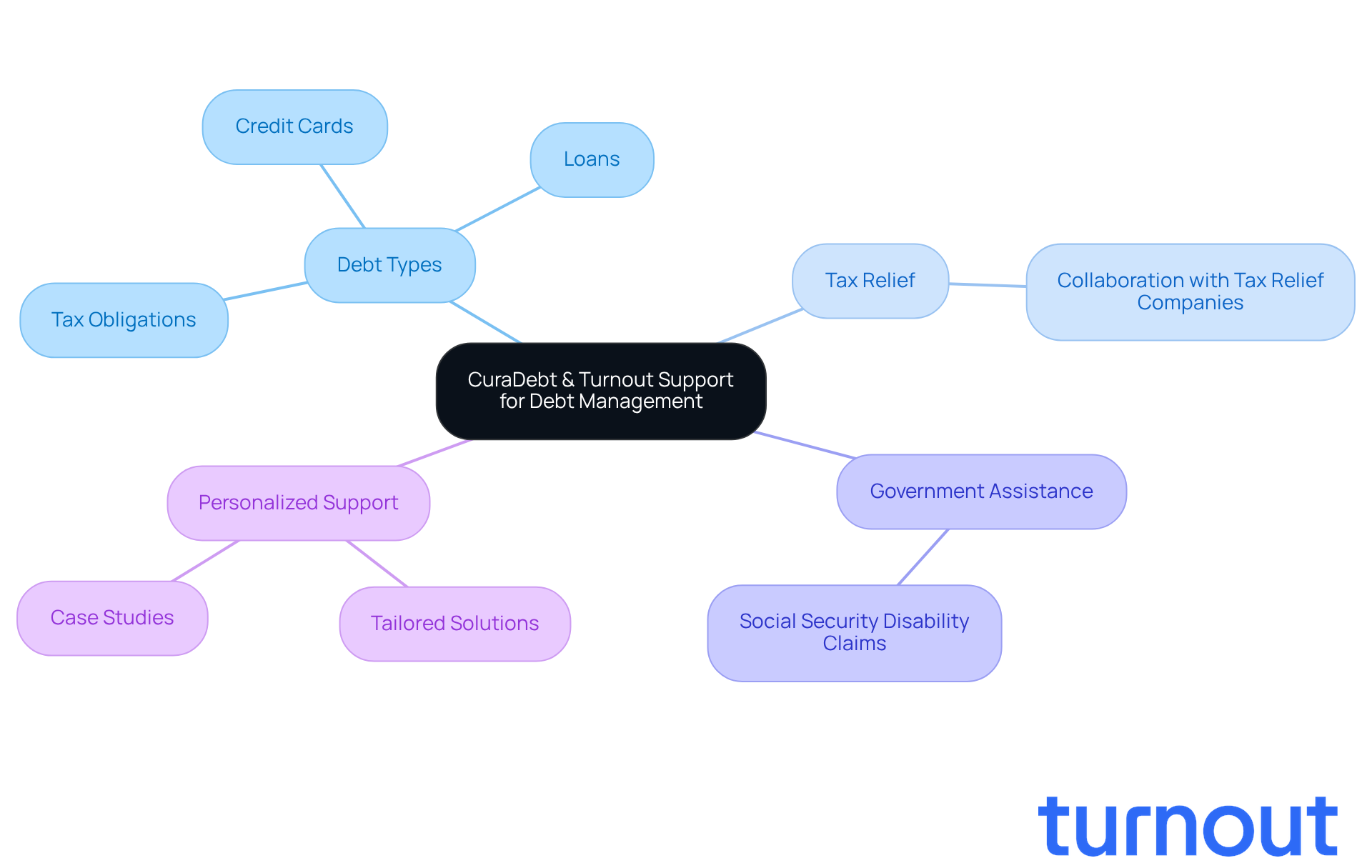

CuraDebt: Specialized Help for Multiple Debt Situations

CuraDebt understands the unique challenges that disabled individuals face when it comes to managing debt. We know that navigating financial difficulties can feel overwhelming, but you’re not alone in this journey. Their dedicated team specializes in addressing a wide range of debt issues, including tax obligations, by working with the highest rated tax relief companies to ensure that each person receives solutions tailored to their specific needs.

This comprehensive approach not only helps you manage your debt effectively but also empowers you to take charge of your financial future. Many individuals with disabilities have found stability through CuraDebt’s support, which reflects a deep commitment to helping those who often encounter additional barriers in the financial landscape. Did you know that 37% of individuals with disabilities rely on credit cards and loans for everyday expenses? This statistic highlights the urgent need for accessible debt support services.

CuraDebt’s impact is evident in numerous case studies, showcasing how personalized assistance has enabled individuals to regain their financial freedom. Additionally, Turnout offers crucial support with government-related processes, such as Social Security Disability claims and connects clients to the highest rated tax relief companies for tax debt assistance. Their trained nonlawyer advocates and IRS-licensed enrolled agents are here to guide you through these complex systems.

It’s important to remember that Turnout is not a law firm and does not provide legal representation, which helps clarify the nature of the support available. This collaboration between CuraDebt and Turnout enhances the resources available to individuals with disabilities, ensuring you have access to both debt relief and essential government benefits. As many have successfully navigated the debt forgiveness process, the importance of comprehensive assistance cannot be overstated. We’re here to help you every step of the way.

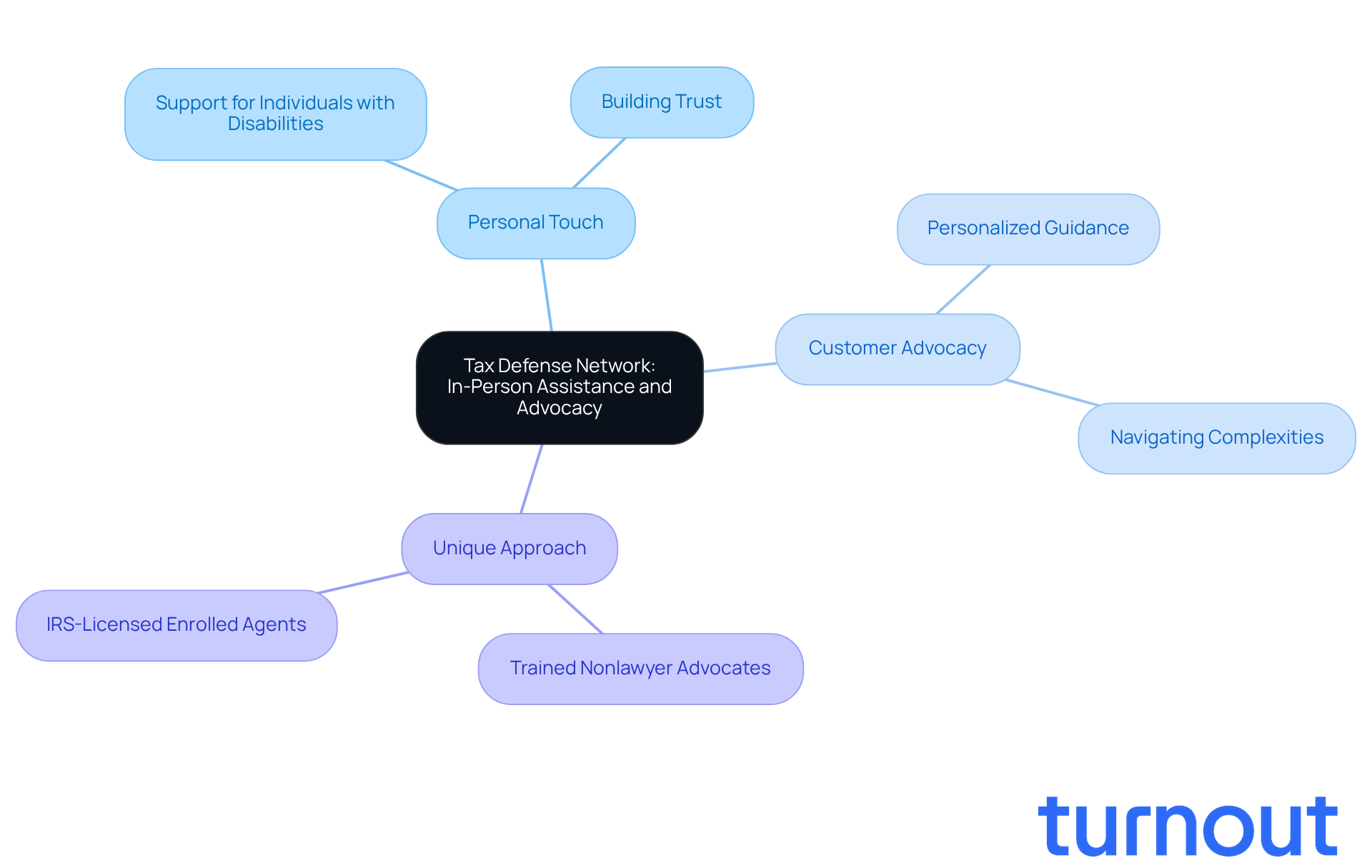

Tax Defense Network: In-Person Assistance and Advocacy

At Tax Defense Network, we truly understand the challenges you face when dealing with tax issues. Our commitment to face-to-face support means you can connect directly with tax experts who genuinely care about your concerns. This personal touch is especially beneficial for individuals with disabilities, who often find comfort in discussing their tax matters in person.

We prioritize customer advocacy, ensuring you receive personalized guidance throughout your tax assistance journey. This approach fosters trust and understanding, which are essential when navigating the complexities of tax matters. By emphasizing personal interactions, we strive to make the often daunting process of tax assistance more accessible and manageable for you.

Additionally, it’s important to highlight that Turnout offers a unique approach by utilizing trained nonlawyer advocates and IRS-licensed enrolled agents. They are here to support individuals with SSD claims and tax debt relief. While Turnout is not a law firm and does not provide legal representation, their expertise allows disabled individuals to navigate these complex systems with confidence, without the need for legal counsel.

Remember, you are not alone in this journey. We’re here to help you every step of the way.

Alleviate Tax Relief: Guaranteed Satisfaction and Assurance

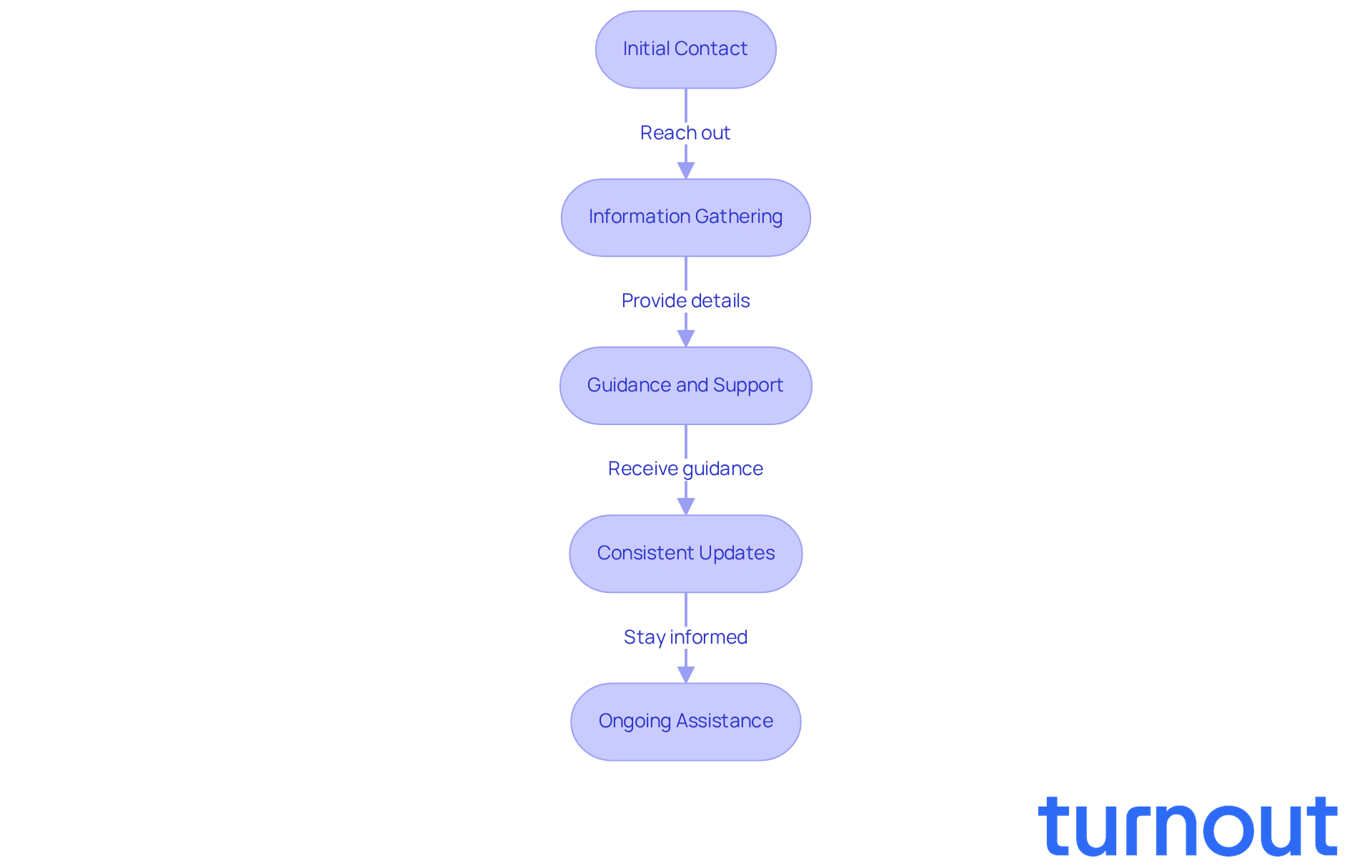

At Alleviate Tax Relief, we truly understand the challenges you face. Our unwavering commitment to your satisfaction and peace of mind sets us apart. We know that navigating tax relief can be daunting, especially for those with disabilities who may have heightened concerns about the effectiveness of these services.

That’s why we emphasize a clear and supportive process. From the moment you reach out, we ensure you’re well-informed and guided every step of the way. It’s common to feel overwhelmed, but with our consistent updates and open dialogue, we foster trust and confidence. You’re not alone in this journey.

Imagine having a partner who empowers you to tackle your tax challenges with assurance. Our approach cultivates a nurturing environment where you can feel secure in your decisions. We’re here to help you navigate this path, providing the support you need to find relief.

Let’s take this journey together. Reach out today, and let us show you how we can make a difference in your tax relief experience.

Conclusion

Navigating tax relief can feel overwhelming, especially for individuals with disabilities. We understand that this journey is often filled with uncertainty and challenges. That’s why it’s so important to highlight the ten highest-rated tax relief companies that truly prioritize accessibility, compassion, and innovative solutions tailored to your unique needs. These companies don’t just offer financial relief; they empower you to understand your rights and access the benefits you deserve.

Key insights from the article reveal that firms like:

- Turnout

- Precision Tax Relief

- Community Tax

are leading the way in providing specialized support and technology-driven solutions. With user-friendly mobile applications and affordable services, each company featured shows a strong commitment to making tax assistance more manageable and accessible for you. Moreover, the collaboration between these companies and advocacy organizations enhances the resources available, ensuring you receive the comprehensive help you need.

In light of the challenges you may face in the tax landscape, seeking reliable support is essential. The services offered by these top-rated companies are not just about resolving tax issues; they represent a vital lifeline for many. By exploring these options, you can take proactive steps toward financial stability and peace of mind. Embracing the assistance available can transform the often overwhelming journey of tax relief into a more navigable and supportive experience. Remember, you are not alone in this journey, and we’re here to help.

Frequently Asked Questions

What is Turnout and how does it assist consumers?

Turnout is an innovative tax advocacy organization that leverages AI technology to support consumers, particularly those with disabilities, in navigating complex tax responsibilities. It clarifies tax processes and empowers individuals to understand their rights and access benefits, including assistance with Social Security Disability (SSD) claims and tax debt.

Does Turnout provide legal counsel?

No, Turnout is not a law office and does not provide legal counsel. Instead, it employs trained nonlawyer advocates for SSD claims and collaborates with IRS-licensed enrolled agents for tax debt assistance.

What is the significance of Turnout's approach to tax advocacy?

Turnout's approach speeds up the application process for tax assistance and ensures consumers feel informed and supported throughout their journey. This is particularly important given the reported staffing shortages among disability service providers.

What role does technology play in Precision Tax Relief's services?

Precision Tax Relief utilizes cutting-edge technology to enhance customer service and case management. Their intuitive platform allows clients to monitor cases and connect with tax experts, ensuring transparency and improved communication.

What is Precision Tax Relief's success rate for offer-in-compromise agreements?

Precision Tax Relief boasts an impressive 94% success rate in securing offer-in-compromise agreements for clients.

What is the minimum tax debt required to use Precision Tax Relief's services?

Precision Tax Relief requires a minimum tax debt of $10,000 to access their services, unless there are multiple years of unfiled taxes.

How does Community Tax address the financial challenges faced by individuals with disabilities?

Community Tax offers affordable tax assistance solutions aimed at individuals with disabilities who may be experiencing financial difficulties. They provide a comprehensive suite of services at competitive rates to help alleviate the stress of tax preparation and negotiations with the IRS.

Why is affordability a priority for Community Tax?

Community Tax prioritizes cost-effectiveness to ensure that low-income consumers can access the tax assistance they need without adding to their financial burden. This approach empowers individuals with disabilities to navigate their tax obligations confidently.