Introduction

Navigating the world of tax settlement can feel overwhelming, and we understand that. With so many companies vying for your attention, it’s easy to feel lost. As you seek relief from tax burdens, choosing the right tax settlement company is crucial. This article offers ten essential tips designed to empower you in making informed decisions, helping you find a reputable firm that truly meets your unique needs.

But with countless options available, how can you tell which companies genuinely deliver on their promises? It’s common to feel uncertain in this situation. We’re here to help you navigate these waters with confidence.

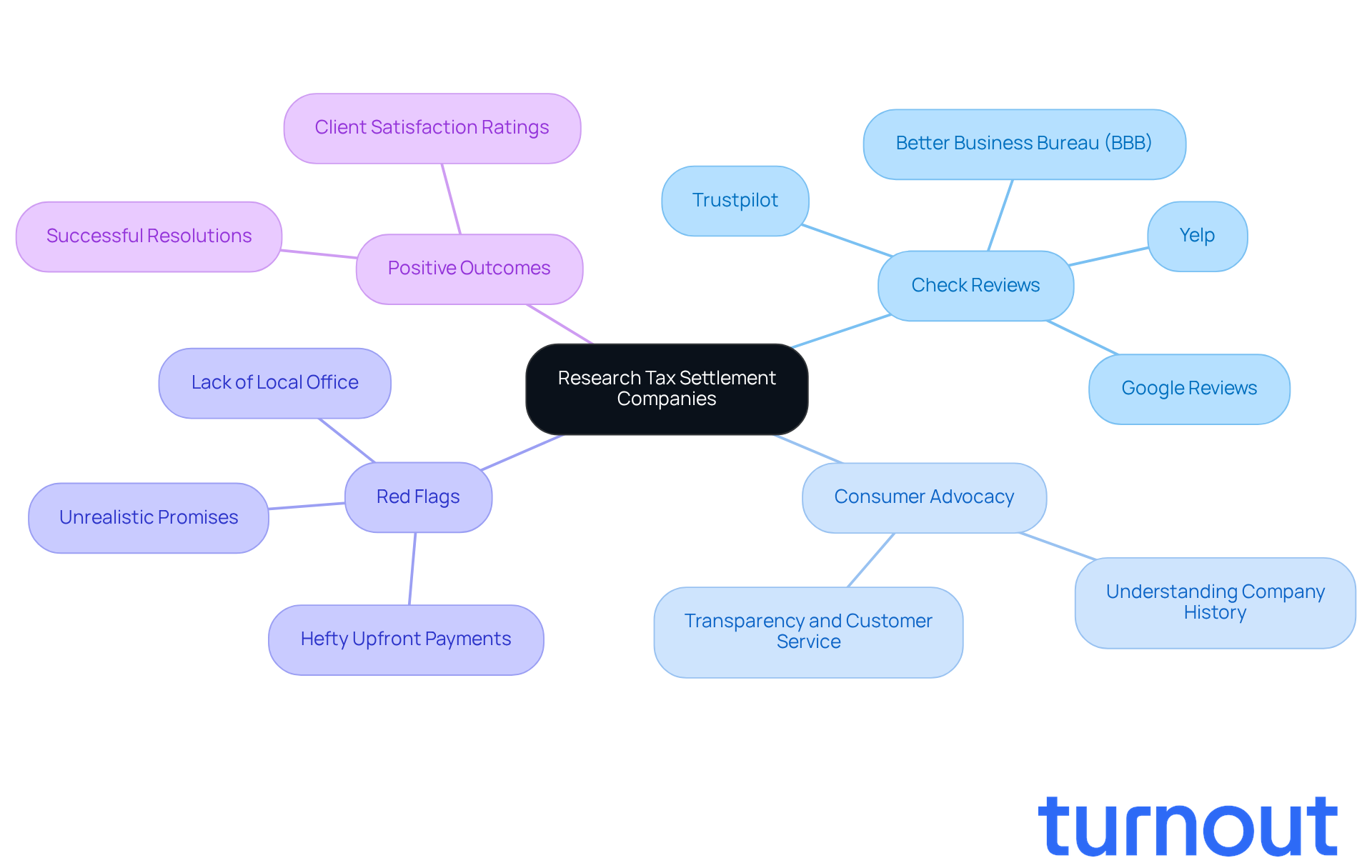

Research the Reputation of Tax Settlement Companies

Before you engage with a tax settlement company, we understand that it’s essential to do your homework. Start by checking reviews on platforms like Trustpilot, the Better Business Bureau (BBB), and other consumer advocacy sites. Pay close attention to any complaints or negative feedback; these can be red flags. A reputable firm, such as Optima Tax Relief, typically has a track record of positive results and satisfied clients, which is crucial for effectively addressing your tax concerns.

Consumer advocates, like Weisberg, emphasize that understanding a company’s history can significantly influence your decision-making process. In 2026, many successful tax settlement companies have received praise for their transparency and customer service, reflecting high consumer satisfaction ratings. It’s common to feel overwhelmed, but knowing that some firms prioritize their clients can be reassuring.

Be cautious of companies that ask for hefty upfront payments; this could be a warning sign of potential scams. By focusing on firms with positive reviews and proven outcomes, you can improve your chances of a favorable resolution to your tax issues. Remember, you are not alone in this journey, and we’re here to help.

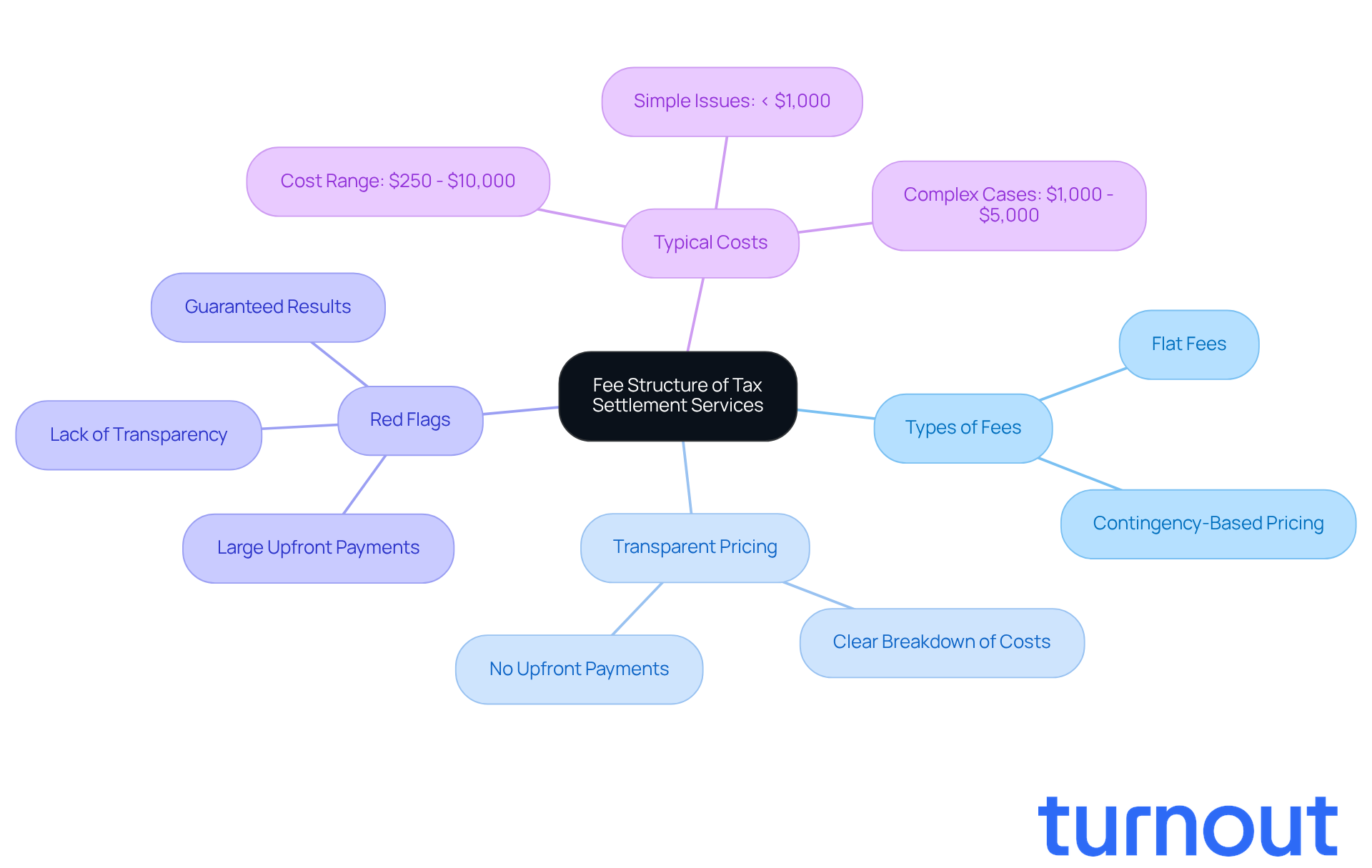

Understand the Fee Structure of Tax Settlement Services

When it comes to evaluating a tax settlement company, we understand that navigating this process can be overwhelming. It's essential to grasp their fee structure clearly. Reputable companies will provide a transparent breakdown of expenses during your initial consultations. Be cautious of firms that demand upfront fees without clearly explaining the services they offer.

Look for companies that utilize flat fees or contingency-based pricing. This means you only pay if they successfully address your tax concerns. Notably, many firms in the industry offer this type of pricing, which can bring you peace of mind as you tackle your tax challenges.

Interacting with organizations that prioritize transparency in their pricing can help you avoid unnecessary costs and ensure you receive the support you need. It's common to feel uncertain about these decisions, but knowing the typical costs associated with a tax settlement company - ranging from $250 to $10,000 - can empower you to make informed choices.

Additionally, be on the lookout for red flags, such as companies demanding large upfront payments. This can often indicate potential scams. Remember, you are not alone in this journey; understanding these aspects can help you find the right support.

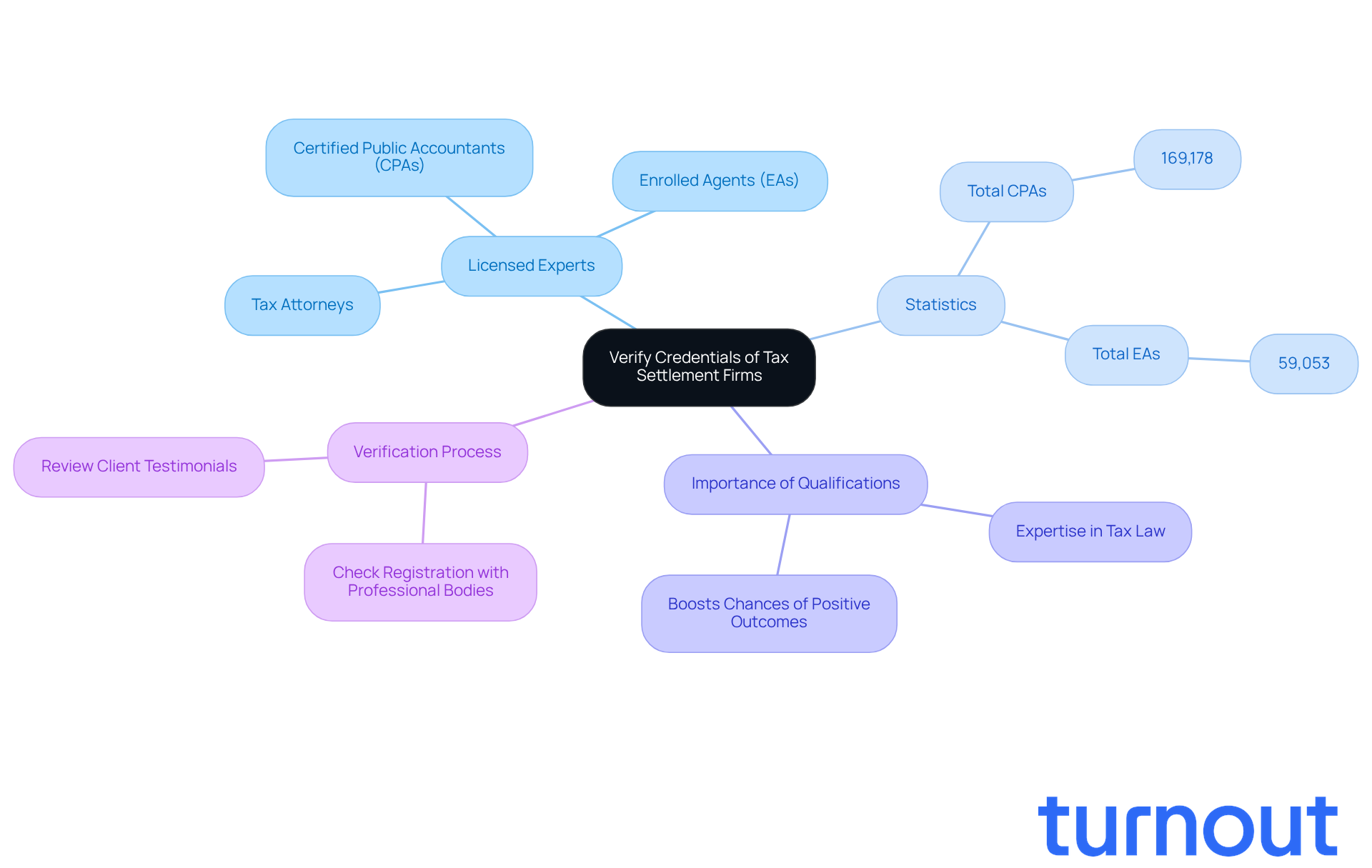

Verify Credentials and Qualifications of Tax Settlement Firms

Choosing a tax settlement company can be overwhelming, and we understand that. It's essential to confirm the credentials and qualifications of the professionals who will guide you through this process. Look for licensed experts, such as Certified Public Accountants (CPAs), Enrolled Agents (EAs), or tax attorneys. These individuals have the expertise needed to navigate the complexities of tax law.

As of 2026, there are around 169,178 CPAs and 59,053 EAs available to assist you. This highlights the wealth of qualified professionals ready to help. Be sure to check their educational background, certifications, and any disciplinary actions to ensure their legitimacy. According to Scott Artman, CEO of the National Association of Tax Professionals, "These credentials are about more than testing knowledge." This emphasizes how crucial these qualifications are in achieving favorable outcomes.

A qualified expert not only understands the intricacies of tax regulations but also significantly boosts your chances of positive results in tax agreements. In fact, many tax settlement companies employ CPAs or EAs, which leads to more effective advocacy and resolution of tax issues.

To verify the credentials of tax professionals, consider checking their registration with relevant professional bodies and reviewing client testimonials. Remember, you are not alone in this journey; we're here to help you find the right support.

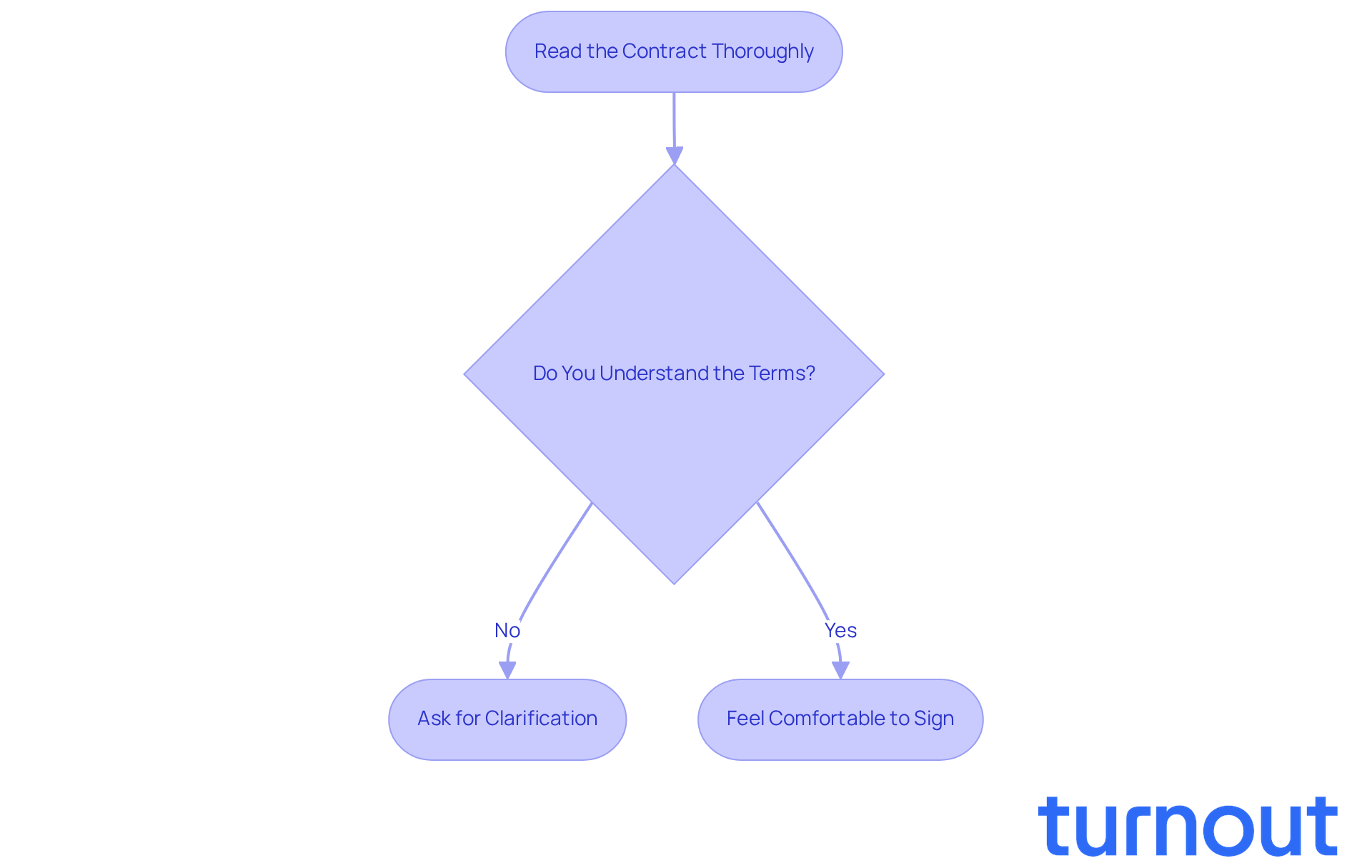

Read and Understand the Contract Thoroughly

Before you sign any agreement, it’s important to take a moment to read and truly understand the contract. We know that contracts can be overwhelming, and it’s common to feel uncertain about the terms of service, fees, and clauses that might impact your rights. If something doesn’t make sense, don’t hesitate to ask for clarification.

A reputable firm will be more than willing to explain the contract in detail. They want to ensure you feel comfortable and confident with the terms before you move forward. Remember, you’re not alone in this journey; we’re here to help you navigate through it.

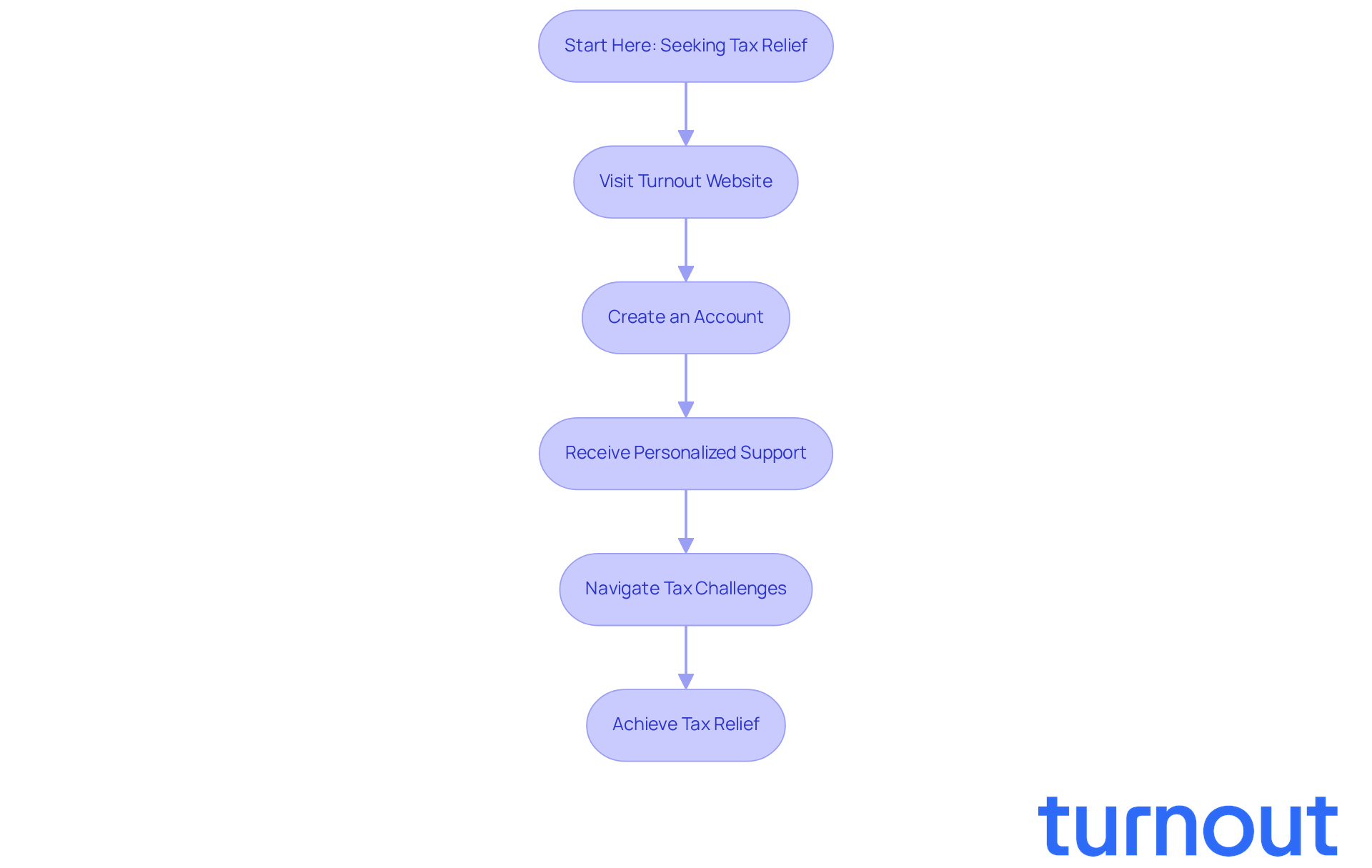

Explore Alternative Tax Relief Options Like Turnout

If you’re feeling overwhelmed by tax issues, you’re not alone. Many people struggle with navigating the complexities of tax resolution. That’s where alternative options like Turnout come in.

Turnout is a groundbreaking advocacy platform that uses AI to simplify the tax resolution process. It’s designed to make things easier and more accessible for you. With advanced technology at its core, Turnout provides personalized support and guidance, helping you tackle your tax challenges with confidence.

Imagine having a partner by your side, guiding you through each step. Turnout focuses on enhancing your experience, ensuring you receive the assistance you need without the usual frustrations of dealing with bureaucratic systems.

We understand that seeking help can be daunting, but with Turnout, you can feel empowered. This modern platform exemplifies how technology can transform the journey of seeking tax relief. You deserve support that truly understands your needs, and Turnout is here to provide just that.

Take the first step towards relief today. You’re not alone in this journey, and we’re here to help.

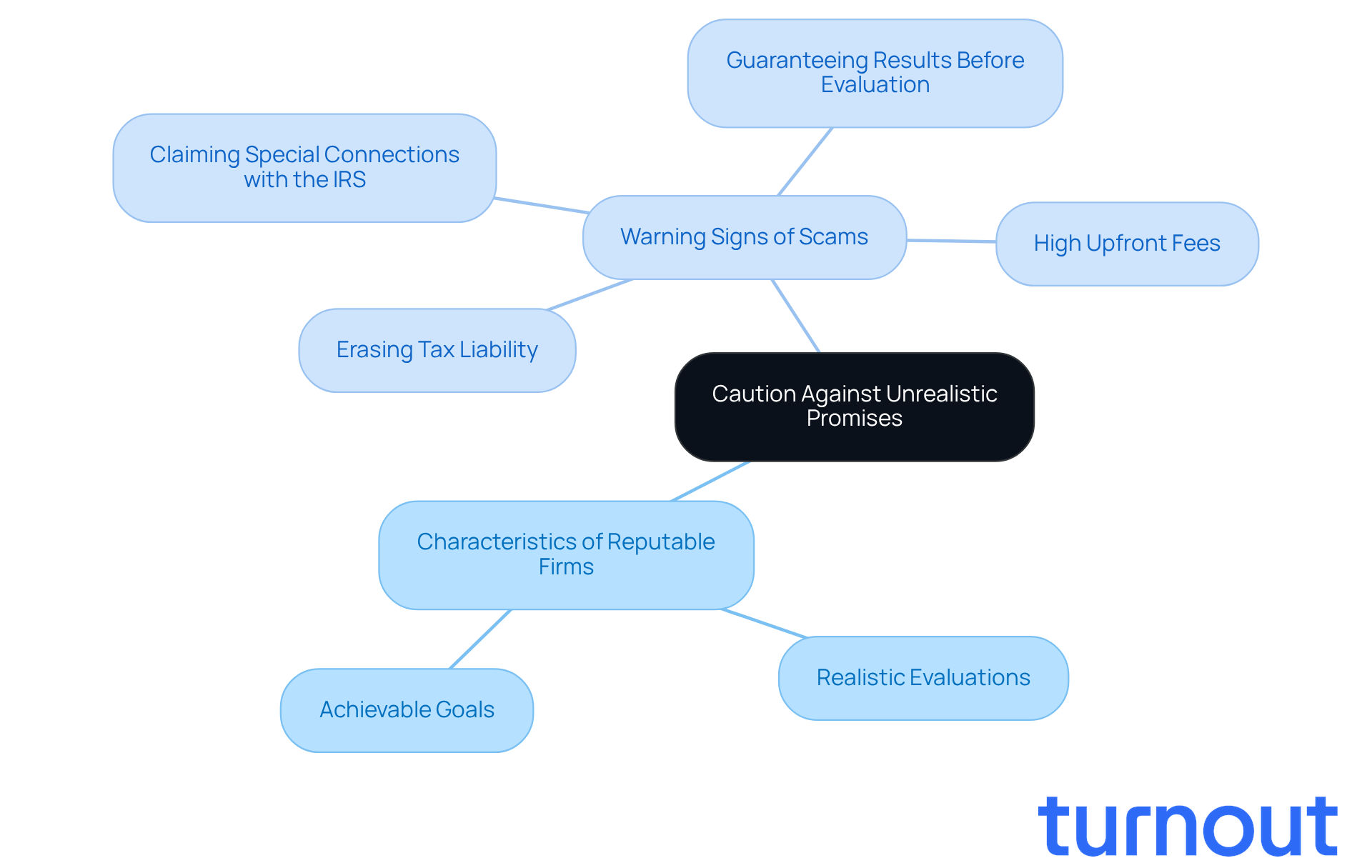

Be Cautious of Unrealistic Promises from Firms

We understand that navigating tax issues can be overwhelming. It's crucial to be cautious of tax settlement companies that make unrealistic promises, like erasing your tax liability or claiming special connections with the IRS. These often signal potential scams.

A respected tax settlement company will take the time to evaluate your situation realistically. They’ll outline achievable goals tailored to your unique circumstances. Remember, you are not alone in this journey. We're here to help you find the right path forward.

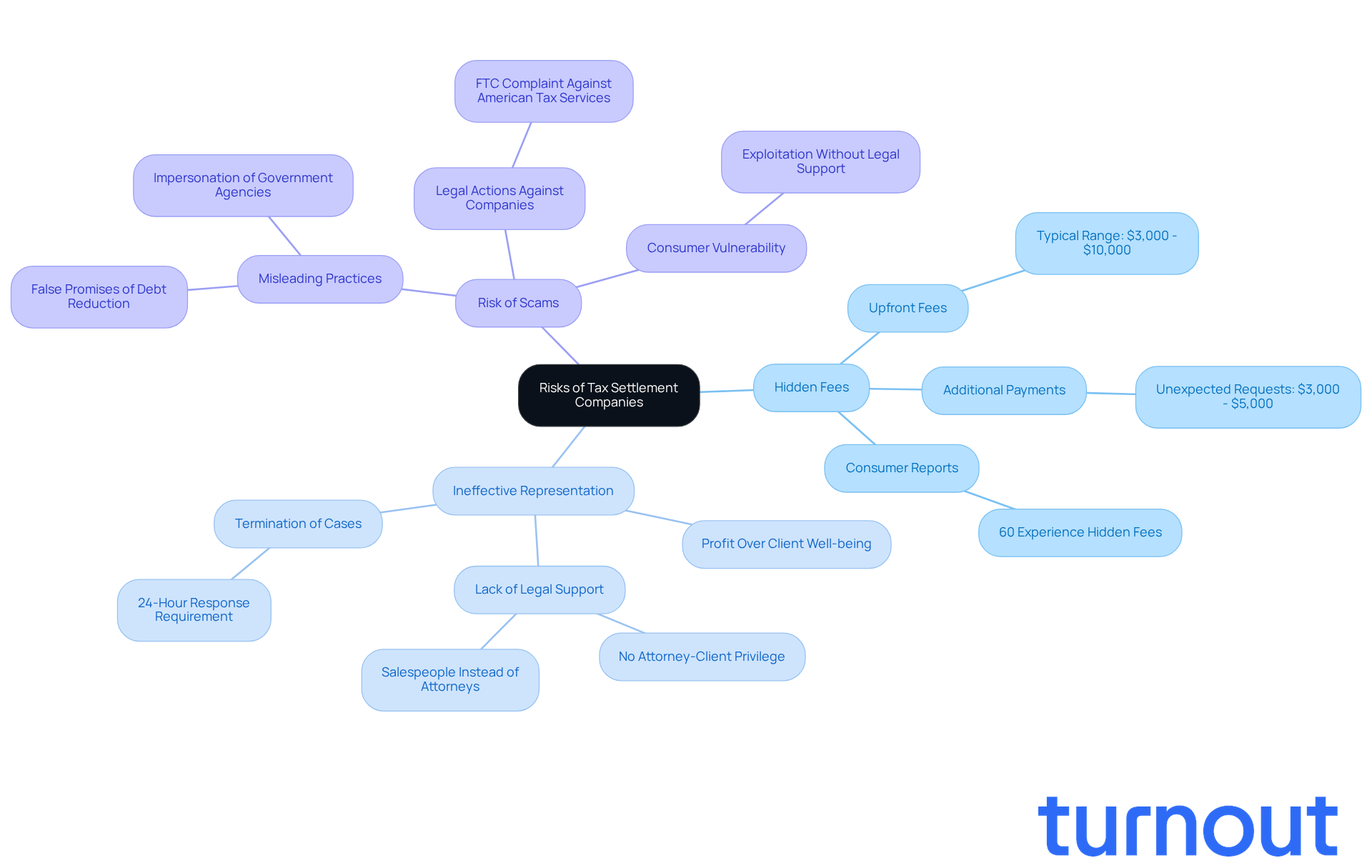

Understand the Risks of Using Tax Settlement Companies

Engaging with a tax settlement company can feel overwhelming, and it’s important to consider the risks involved. One major concern is the hidden fees that can catch you off guard. Many tax relief firms charge hefty upfront fees, often between $3,000 and $10,000, before even reviewing your IRS transcripts. As your case unfolds, you might face unexpected requests for additional payments, sometimes adding another $3,000 to $5,000 to your financial burden.

It’s common to worry about ineffective representation as well. Some companies may prioritize their profits over your well-being, leaving you with unresolved tax issues. Reports suggest that a significant number of consumers - potentially as high as 60% - experience hidden fees in services provided by a tax settlement company, which can leave you in a worse financial position than before.

The risk of scams is another concern that shouldn’t be overlooked. Recent legal actions, like the FTC's complaint against American Tax Services, highlight the dangers of misleading practices. These companies often promise significant debt reductions without taking the time to evaluate your individual circumstances. Financial experts warn that without proper legal support, you may be vulnerable to exploitation. As Tax Relief Counsel reminds us, "Don’t risk your future on empty promises."

To navigate these challenges, thorough research is essential. Here are some steps you can take:

- Verify attorney-client privilege.

- Seek organizations that offer legal support.

- Ensure clarity in the terms of engagement.

By taking these steps, you can reduce risks and work towards a more favorable outcome in your tax resolution efforts. Remember, you’re not alone in this journey, and we’re here to help.

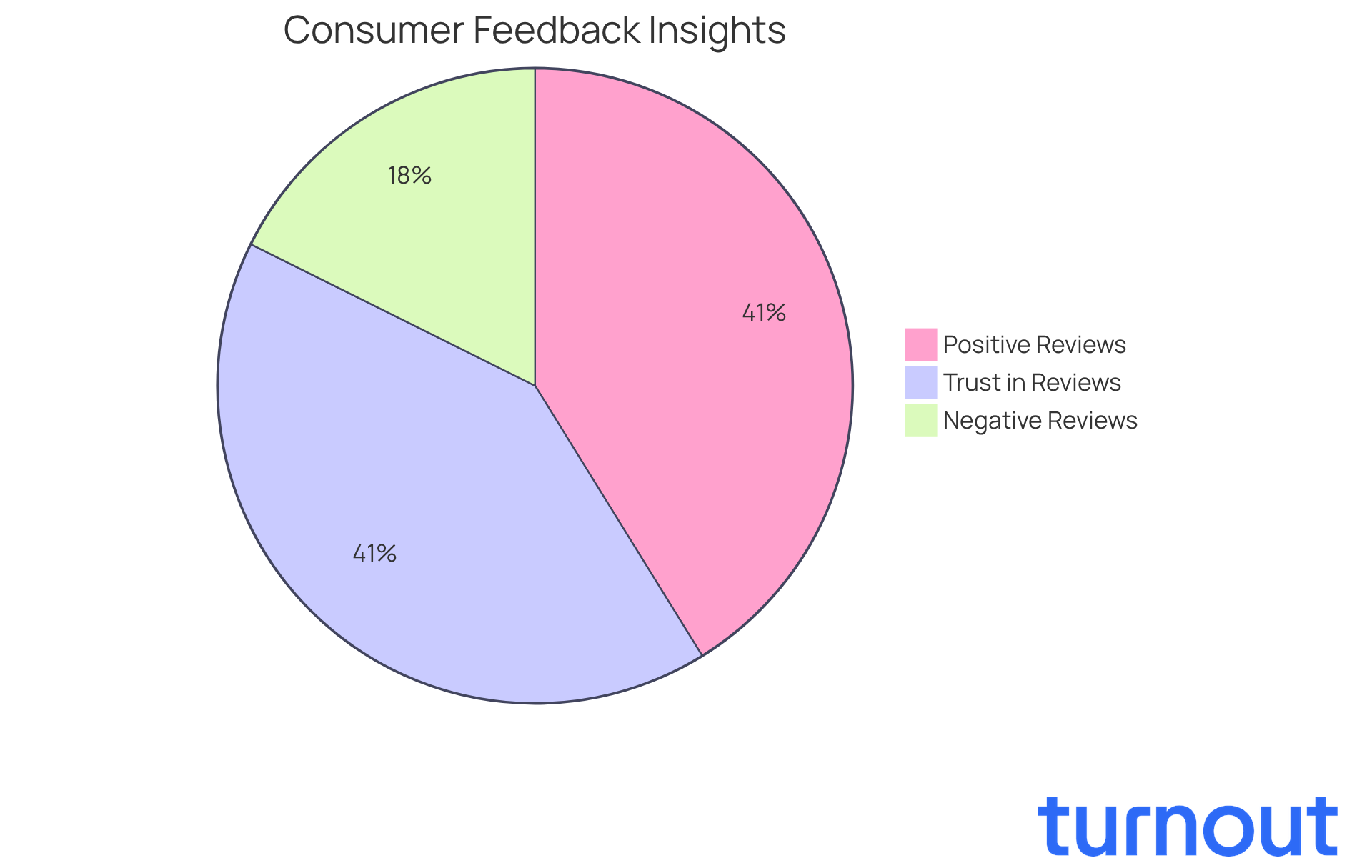

Check Consumer Reviews and Testimonials

When it comes to choosing a tax settlement company, we understand that the process can feel overwhelming. It’s essential to take a moment to review consumer feedback and testimonials. Platforms like Google, Yelp, and the Better Business Bureau (BBB) can be invaluable resources for gathering insights. Positive reviews often reflect a company’s reliability and effectiveness, while negative ones may reveal potential red flags.

As you explore these reviews, look for recurring themes. These patterns can illuminate the strengths and weaknesses of an organization. Research shows that 70% of consumers trust online reviews just as much as personal recommendations. This highlights how impactful testimonials can be in your decision-making process.

Additionally, consider that independent platforms often average a score of 4.8 from thousands of verified clients. This provides a broader context for evaluating testimonials. Successful companies, such as the tax settlement company Alleviate Tax Relief, which has resolved over $400 million in tax debts for clients, frequently showcase positive testimonials. These serve as proof of their credibility.

However, it’s important to evaluate these testimonials critically. We encourage you to consider the context and specifics of each review. By doing so, you can make informed choices that align with your needs. Remember, you are not alone in this journey, and we’re here to help you navigate through it.

Ensure Personalized Service Tailored to Your Needs

When you're choosing a tax settlement company, it’s essential to prioritize those that offer personalized services tailored to your unique circumstances. We understand that a generic, one-size-fits-all approach often falls short in effectively resolving tax issues. Instead, look for a tax settlement company that takes the time to understand your financial situation and craft a customized strategy to tackle your specific challenges.

Tailored strategies not only enhance the likelihood of successful outcomes but also align with what many consumers prefer: individualized support. For instance, organizations that carefully examine your specific tax obligations and financial background can create solutions that meet your needs more efficiently. Financial advisors emphasize that personalized tax relief strategies offered by a tax settlement company can significantly improve resolution outcomes, as they consider the nuances of each case rather than applying a blanket solution.

As we move into 2026, the trend towards customized tax relief strategies continues to grow. This reflects a shift in consumer expectations towards more attentive and responsive service in the tax resolution landscape. Recent cases, like the Temporary Restraining Order against American Tax Services, illustrate the risks associated with non-personalized services, where consumers were misled and left without the promised support.

As IRS Commissioner Danny Werfel noted, while the Offer in Compromise program is legitimate, it requires careful consideration of individual circumstances. This underscores the need for tailored approaches in tax resolution. Remember, you are not alone in this journey; we’re here to help you navigate these challenges with care and understanding.

Seek Companies with Clear Communication and Support

When you're choosing a tax settlement company, it’s essential to prioritize those that truly value clear communication and robust support. We understand that navigating tax issues can be overwhelming, and a reputable firm will keep you informed at every stage. They should provide timely updates and be ready to address any inquiries you might have.

Look for organizations that offer various communication methods - phone, email, and chat - so you can easily reach out when you need help. Did you know that debtors prefer digital channels like SMS and email over traditional mail by a 3:1 ratio? This highlights just how important accessible communication is in your journey.

This approach not only enhances your experience but also ensures you stay engaged and informed throughout the resolution process. Effective support systems are crucial; they can significantly impact your ability to navigate complex tax issues with confidence. Remember, you are not alone in this journey.

As you consider your options, be aware of potential risks, such as high fees or unmet expectations, when choosing a tax settlement company. We're here to help you make the best decision for your situation.

Conclusion

Choosing the right tax settlement company can feel overwhelming, but it’s a crucial step in navigating the complexities of tax resolution. By prioritizing thorough research, understanding fee structures, verifying credentials, and seeking personalized service, you can significantly enhance your chances of a favorable outcome. Remember, it’s important to stay vigilant against unrealistic promises and hidden fees. Make sure the firm you choose aligns with your unique needs and circumstances.

We understand that this process can be daunting. That’s why it’s essential to check consumer reviews, understand the risks involved, and ensure clear communication from the firm. These insights empower you to make informed decisions, fostering confidence in your choice of a tax settlement company. Additionally, exploring alternative options like Turnout can provide innovative support tailored to your specific tax challenges.

Ultimately, the journey toward tax relief doesn’t have to be faced alone. By taking proactive steps to research and evaluate potential firms, you can navigate this process with greater assurance and clarity. The right tax settlement company can truly make all the difference in achieving peace of mind and financial stability. Remember, we’re here to help, and you are not alone in this journey.

Frequently Asked Questions

Why is it important to research the reputation of tax settlement companies?

Researching the reputation of tax settlement companies is essential to ensure you choose a reputable firm. Checking reviews on platforms like Trustpilot and the Better Business Bureau (BBB) can help identify any complaints or negative feedback, which are red flags. A company with a positive track record and satisfied clients is more likely to effectively address your tax concerns.

What should I pay attention to when reviewing tax settlement companies?

Pay close attention to reviews, especially any complaints or negative feedback. Look for companies that have received praise for their transparency and customer service, as these factors contribute to high consumer satisfaction ratings.

What warning signs should I look for when evaluating tax settlement companies?

Be cautious of companies that ask for hefty upfront payments, as this could indicate potential scams. Instead, focus on firms with positive reviews and proven outcomes.

How can I understand the fee structure of tax settlement services?

It's important to clearly understand the fee structure of tax settlement companies. Reputable firms will provide a transparent breakdown of expenses during initial consultations. Look for companies that use flat fees or contingency-based pricing, where you only pay if they successfully resolve your tax issues.

What are the typical costs associated with hiring a tax settlement company?

The typical costs for tax settlement services can range from $250 to $10,000, depending on the complexity of the issues being addressed.

What credentials should I verify when choosing a tax settlement firm?

Confirm the credentials of professionals by looking for licensed experts, such as Certified Public Accountants (CPAs), Enrolled Agents (EAs), or tax attorneys. Ensure they have the necessary expertise and check their educational background, certifications, and any disciplinary actions.

How can I verify the qualifications of tax professionals?

You can verify the qualifications of tax professionals by checking their registration with relevant professional bodies and reviewing client testimonials. This helps ensure their legitimacy and expertise.

Why are credentials important in the tax settlement process?

Credentials are important because qualified experts, such as CPAs or EAs, understand the intricacies of tax regulations and significantly increase your chances of achieving favorable outcomes in tax agreements.