Introduction

Navigating the complexities of tax relief can feel overwhelming. Many individuals find themselves uncertain and anxious about the process. But understanding the essential qualities of effective tax relief professionals can make this journey much more manageable.

What are these vital characteristics? They not only enhance the effectiveness of tax relief agents but also foster trust and satisfaction among clients. When these professionals combine their expertise with compassion and proactive strategies, they create a supportive environment.

Imagine a scenario where your tax issues are resolved, and you feel empowered to reclaim your financial stability. This is not just about fixing problems; it’s about building lasting relationships that nurture your confidence.

We understand that seeking help can be daunting, but you are not alone in this journey. With the right support, you can navigate these challenges and find peace of mind.

Turnout: AI-Powered Tax Relief Advocacy

Navigating tax processes can feel overwhelming, and we understand that. Turnout is here to help. By harnessing the power of artificial intelligence, we offer a user-friendly platform designed to simplify these complex tasks. Our goal is to ensure you receive timely updates and personalized assistance, making your journey through tax support much more manageable.

Imagine having trained nonlawyer advocates by your side for Social Security Disability (SSD) claims, along with tax relief professionals and IRS-licensed enrolled agents ready to assist with tax debt relief. This creative approach not only enhances your experience but also increases your chances of achieving favorable outcomes in tax discussions. You are not alone in this journey; tax relief professionals are available to guide you through the complexities of government benefits and financial aid.

We believe that everyone deserves access to the support they need. Let us help you take the next step toward a brighter financial future.

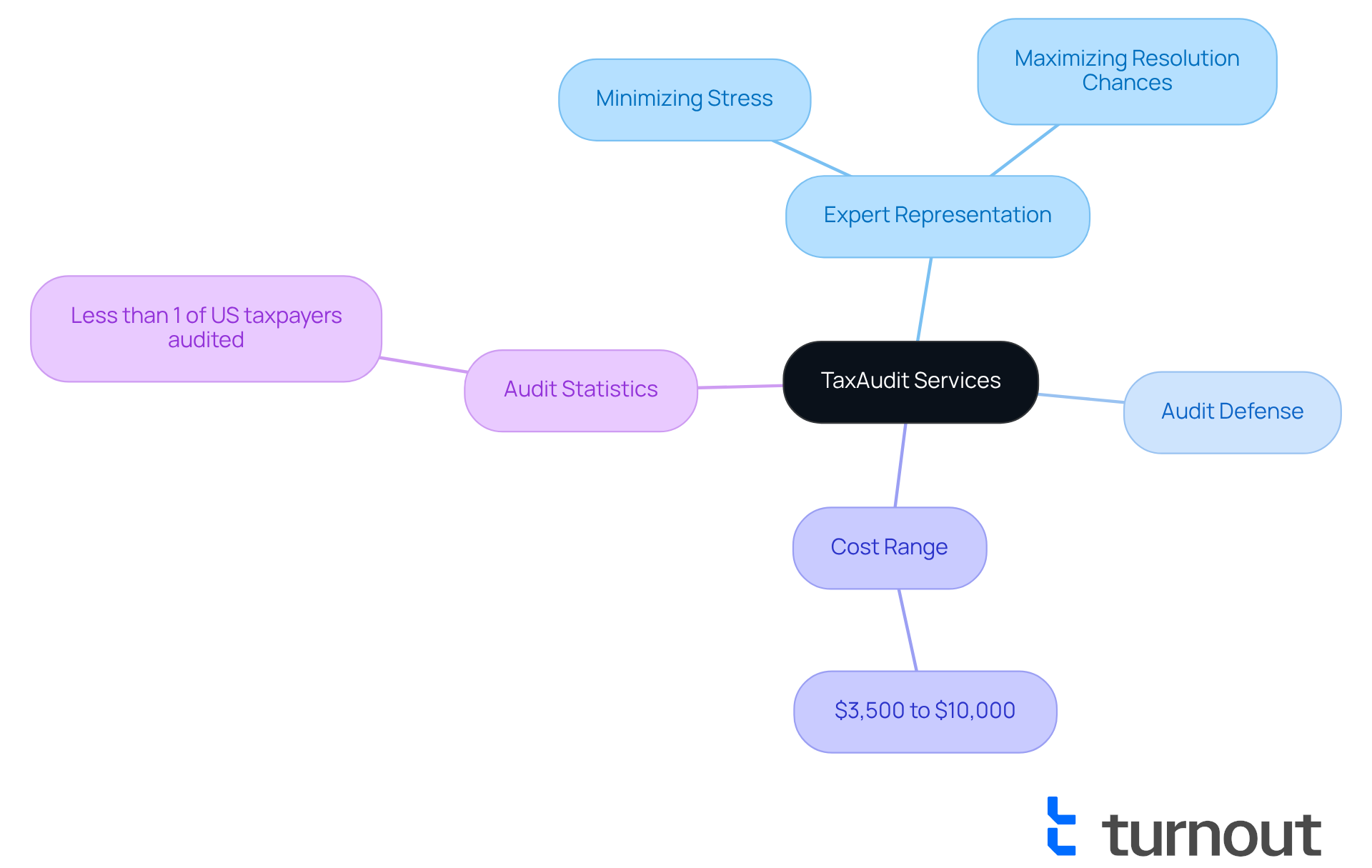

TaxAudit: Expert Tax Representation and Audit Defense

Facing an IRS audit can be overwhelming. We understand that the stress of such situations can weigh heavily on you. That’s where TaxAudit comes in. Specializing in expert representation during audits, we ensure you have knowledgeable advocates by your side.

Our services include comprehensive audit defense and support throughout the entire process. This support is crucial for minimizing stress and maximizing your chances of a favorable resolution. Research shows that many customers experience heightened anxiety during audits, which makes the role of tax relief professionals invaluable.

While the costs for tax audit representation typically range from $3,500 to $10,000, it’s important to consider the peace of mind that comes with having tax relief professionals on your side. And remember, less than 1% of US taxpayers are audited each year, which might ease some of your concerns about the process.

With TaxAudit, you benefit from our extensive experience and deep understanding of IRS procedures. This knowledge can significantly impact the outcome of your case. By preparing you thoroughly and keeping you informed, we not only alleviate anxiety but also empower you to face audits with confidence. You are not alone in this journey; we’re here to help.

Federal Tax Management Inc.: Comprehensive Client Protection Services

At Federal Tax Management Inc., we understand that dealing with tax issues can be overwhelming, which is why we recommend consulting tax relief professionals. That's why we specialize in a comprehensive suite of protection services designed just for you. Our offerings include:

- Tax negotiation

- Penalty abatement

- Audit representation

Each solution is customized to meet your unique tax challenges, ensuring you feel supported every step of the way. With our focus on thorough customer care, we empower you to navigate the complexities of tax obligations effectively, helping you achieve peace of mind.

In 2025, we refined our tax negotiation strategies to better serve you. Our personalized solutions adapt to the ever-changing landscape of tax regulations. Many of our clients have shared their success stories, reporting average resolution times of just a few months for tax negotiation cases. This significantly reduces the stress associated with tax liabilities, allowing you to breathe a little easier.

Tax relief professionals emphasize the importance of negotiation and penalty reduction. A well-coordinated strategy can lead to substantial savings. As one expert wisely noted, "Effective negotiation is not merely about minimizing liabilities; it's about rebuilding trust in the financial future of those we serve." This holistic approach not only addresses your immediate tax concerns but also lays the groundwork for long-term financial stability.

Remember, you are not alone in this journey. We're here to help you find the best path forward.

Clear Communication: Essential for Client Trust

Transparent communication is essential for tax relief professionals in their assistance services. It fosters trust and understanding between experts and customers. At Turnout, we recognize that tax relief professionals can find navigating tax issues overwhelming. Our tax relief professionals simplify intricate details into clear, understandable terms. This way, you can feel confident about your choices and the steps involved in accessing government benefits.

We understand that seeking help can feel daunting. That’s why we employ trained nonlawyer advocates for Social Security Disability (SSD) claims and tax relief professionals who are IRS-licensed enrolled agents for tax debt assistance. This approach not only enhances clarity but also ensures you have the support you need every step of the way.

Frequent updates and open lines of communication are vital. They can significantly boost your satisfaction and trust in the tax relief professionals you choose. At Turnout, we’re dedicated to simplifying your access to financial support. Remember, you are not alone in this journey; we’re here to help.

Tax Law Expertise: Navigating Complex Regulations

Navigating the complexities of the tax system can feel overwhelming. We understand that many individuals face challenges when it comes to understanding tax laws and regulations. That’s where the expertise of tax relief professionals becomes essential.

These tax relief professionals possess a deep understanding of tax laws, which allows them to recognize potential issues and support your rights. They create strategies that align with current tax legislation, ensuring you receive the best possible guidance.

Ongoing education in tax law is crucial for tax relief professionals. It helps them stay updated and ready to assist you effectively. Remember, you are not alone in this journey.

If you’re feeling uncertain about your tax situation, reaching out for help can make a significant difference. We’re here to help you navigate these challenges with care and expertise.

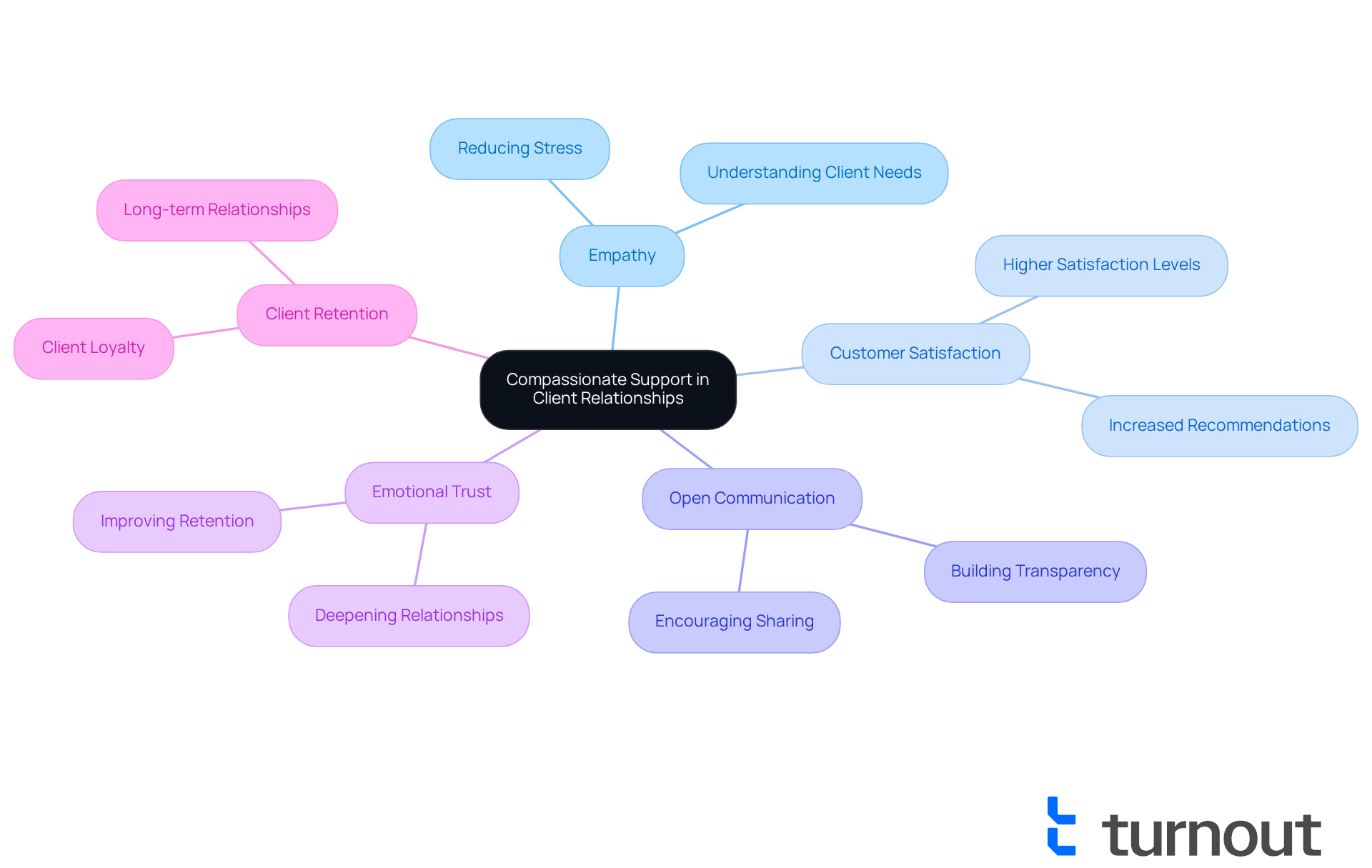

Compassionate Support: Building Client Relationships

Empathetic assistance is crucial for tax relief professionals. We understand that individuals often face considerable stress and anxiety regarding their tax situations. By showing compassion and comprehension, experts can foster strong connections with clients, making them feel appreciated and supported.

This compassionate approach not only enhances customer satisfaction but also encourages open communication, which is essential for effective advocacy. Have you ever felt overwhelmed by your tax circumstances? Individuals who feel understood are more inclined to share their concerns and challenges. This openness enables tax professionals to tailor their strategies effectively.

As noted by industry experts, building emotional trust is a strategic asset that deepens relationships and improves retention. In practice, case studies show that individuals who receive empathetic support report higher satisfaction levels. They are also more likely to recommend services to others.

This highlights the essential role of empathy in resolving tax issues with the assistance of tax relief professionals and in building enduring relationships with clients. Remember, you are not alone in this journey. We're here to help.

Proactive Strategies: Anticipating Client Needs

We understand that navigating tax relief can feel overwhelming. Effective tax relief professionals are here to help, utilizing caring strategies to anticipate your needs before they become urgent. By conducting regular check-ins, they nurture strong relationships with you, allowing for timely adjustments as tax laws evolve.

This ongoing dialogue is crucial. It not only provides you with valuable insights into potential tax implications but also helps mitigate risks. You deserve to feel supported and informed throughout this process.

Such proactive customer service is vital in managing the complexities handled by tax relief professionals. Remember, you are not alone in this journey. With the right support, you can navigate these challenges with confidence.

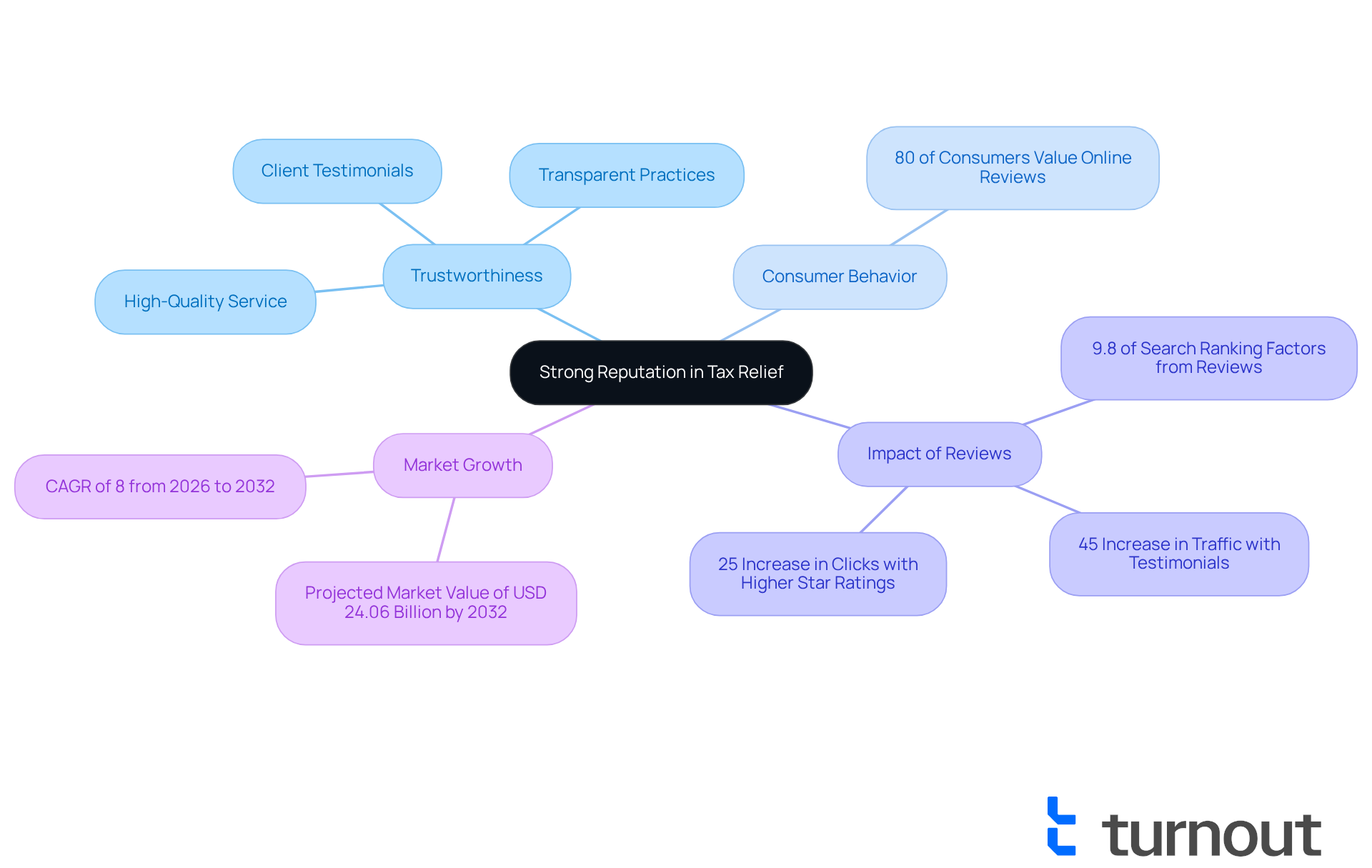

Strong Reputation: Trustworthiness in Tax Relief

A strong reputation is more than just a key asset for tax relief professionals; it serves as a lifeline that fosters trust and guides decision-making among their customers. We understand that building and maintaining a positive reputation can feel daunting, but it’s achievable through consistent, high-quality service, transparent practices, and heartfelt testimonials from satisfied clients.

Research shows that over 80% of consumers consider online reviews to be 'important' or 'very important' when evaluating financial service providers. This statistic underscores just how critical reputation is in our industry. A solid reputation not only attracts new customers but also nurtures loyalty among existing ones, creating a sustainable business model.

Consider this: firms boasting higher star ratings see up to a 25% increase in clicks on Google. That’s a tangible benefit of cultivating a trusted reputation! As Claire Randall wisely noted, "Few strategies are more effective than ensuring tax affairs are immune from criticism in the first place." In an industry where trust is essential, tax relief professionals who prioritize transparency and quality service are more likely to thrive and retain customers over the long haul.

With the Tax Relief Services Market projected to reach USD 24.06 Billion by 2032, maintaining a strong reputation is increasingly vital in this growing landscape. Remember, you are not alone in this journey; we’re here to help you navigate these challenges and build a reputation that resonates with your clients.

Accessibility: Timely Support for Clients

Accessibility is crucial in the services offered by tax relief professionals, especially when individuals find themselves in urgent and stressful situations. We understand that navigating Social Security Disability (SSD) claims or dealing with tax debt can feel overwhelming. That’s where Turnout comes in, ensuring you have prompt access to the support you need.

It’s important to note that Turnout is not a law firm and does not provide legal representation. Instead, our trained nonlawyer advocates are here to assist you with SSD claims, while tax relief professionals, including IRS-licensed enrolled agents, provide help with tax debt assistance. Our dedicated professionals are always available to answer your questions and provide the support you deserve.

We’re committed to being there for you, offering multiple communication channels like phone, email, and chat to accommodate your preferences. By providing prompt assistance, Turnout significantly enhances customer satisfaction and builds confidence in our tax relief professionals. You are not alone in this journey; we’re here to help you access government benefits and financial aid.

Continuous Education: Staying Updated with Tax Laws

Ongoing education is vital for tax relief professionals. We understand that staying updated on the latest tax laws and regulations can feel overwhelming. However, by engaging in continuous training and development, you can enhance your knowledge and skills. This not only helps tax relief professionals navigate complex tax issues but also ensures they provide precise and efficient services to their clients.

Imagine the confidence you'll gain as you become a trusted advisor in their eyes. Continuous learning positions you to address their concerns effectively, making a real difference in their lives. You're not alone in this journey; many professionals face similar challenges.

So, take that step forward. Embrace ongoing education and watch how it transforms your practice. Remember, we're here to help you succeed.

Conclusion

Navigating the complexities of tax relief can feel overwhelming, and we understand that. It requires a unique set of qualities from professionals in the field. The effectiveness of tax relief experts hinges on their ability to blend expertise, empathy, and proactive strategies. This ensures that you feel supported and informed throughout your financial journey.

Key qualities such as:

- Clear communication

- Tax law expertise

- Compassionate support

- A strong reputation

are essential. These attributes foster trust between you and your tax relief professional, enhancing your overall experience in managing tax obligations. Accessibility and continuous education are also vital components that enable these professionals to stay effective in an ever-changing landscape of regulations and client needs.

Ultimately, the role of tax relief professionals goes beyond mere representation; it’s about building lasting relationships founded on trust and understanding. As the tax relief services market continues to grow, prioritizing these essential qualities will be crucial for those aiming to provide exceptional support. Embracing these principles not only empowers you but also cultivates a more resilient and trustworthy industry.

Seeking help is the first step toward navigating tax challenges successfully. With the right guidance, you can look forward to a brighter financial future. Remember, you are not alone in this journey; we’re here to help.

Frequently Asked Questions

What is Turnout and how does it assist with tax relief?

Turnout is an AI-powered platform that simplifies the tax process by providing personalized assistance and timely updates. It offers support from trained nonlawyer advocates for Social Security Disability claims and tax relief professionals to help with tax debt relief.

Who can I expect to assist me through Turnout?

Turnout provides access to trained nonlawyer advocates, tax relief professionals, and IRS-licensed enrolled agents who are ready to assist you with tax discussions and navigating government benefits.

What services does TaxAudit offer?

TaxAudit specializes in expert representation during IRS audits, providing comprehensive audit defense and support throughout the entire audit process to minimize stress and maximize favorable resolutions.

How much does tax audit representation typically cost?

The costs for tax audit representation generally range from $3,500 to $10,000, depending on the complexity of the case and the services provided.

What is the likelihood of being audited by the IRS?

Less than 1% of US taxpayers are audited each year, which may help alleviate concerns about the audit process.

How does Federal Tax Management Inc. support clients with tax issues?

Federal Tax Management Inc. offers a comprehensive suite of protection services, including tax negotiation, penalty abatement, and audit representation, all tailored to meet individual tax challenges.

What improvements have been made to tax negotiation strategies at Federal Tax Management Inc.?

In 2025, Federal Tax Management Inc. refined its tax negotiation strategies to better serve clients, resulting in average resolution times of just a few months for tax negotiation cases.

Why is effective negotiation important in tax relief?

Effective negotiation not only minimizes liabilities but also helps rebuild trust in the financial future of clients, leading to substantial savings and long-term financial stability.