Introduction

Navigating the world of life insurance can often feel like traversing a maze. With countless options and terminology, it’s common to feel overwhelmed, even for the most diligent consumers.

We understand that as you strive to secure your financial future, questions arise. How can you effectively assess your needs? How do you make informed choices amidst the complexities of coverage types, premiums, and the underwriting process?

This article aims to demystify the essential life insurance FAQs that every consumer should know. We’re here to provide clarity and guidance in a landscape that is constantly evolving. You are not alone in this journey; together, we can navigate these complexities.

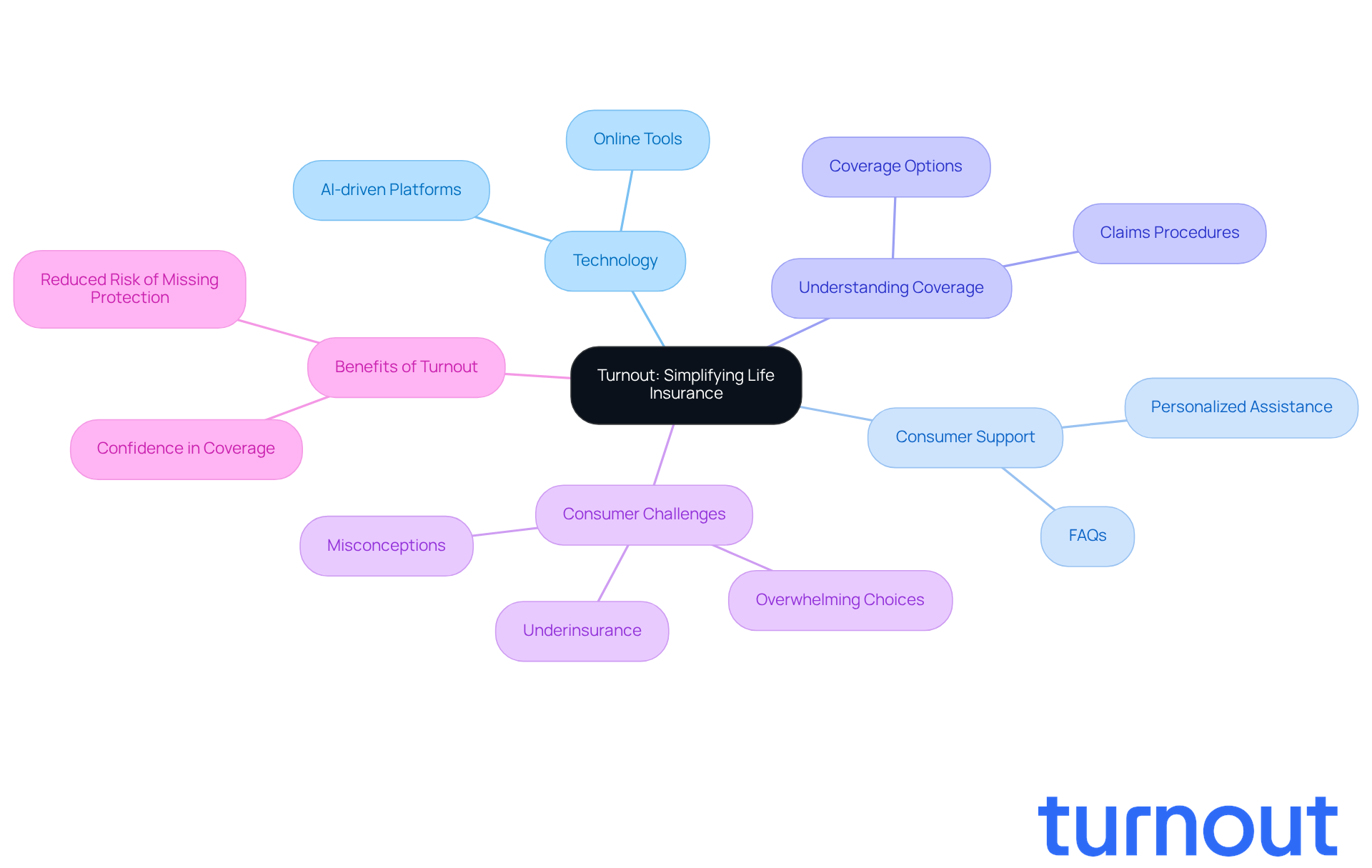

Turnout: Simplifying Life Insurance Navigation for Consumers

Turnout is changing the way you interact with financial products, using technology and personalized support to make the process easier. We understand that many consumers, over 40%, feel overwhelmed by the sheer number of coverage options available, which is often reflected in their life insurance FAQs. By simplifying the complexities of coverage agreements and claims procedures, Turnout helps you navigate these systems with confidence, reducing the risk of missing out on essential protection and benefits.

Technology is at the heart of this transformation. AI-driven platforms are being embraced to streamline applications and enhance your experience. Industry leaders emphasize that making life coverage simpler is vital for accessibility. As one expert noted, "The vast majority of life claims result in payment, with under 1% of claims rejected." This highlights how reliable these products can be when you fully understand the life insurance FAQs.

Moreover, advancements in technology not only help you find your way but also empower you to make informed choices. You can find online tools and life insurance FAQs to assist you in evaluating your coverage needs and comparing plans with ease. As the landscape of coverage evolves, Turnout is committed to ensuring that you can confidently secure the protection you deserve.

Remember, you’re not alone in this journey. We’re here to help you every step of the way.

What Are the Different Types of Life Insurance Policies?

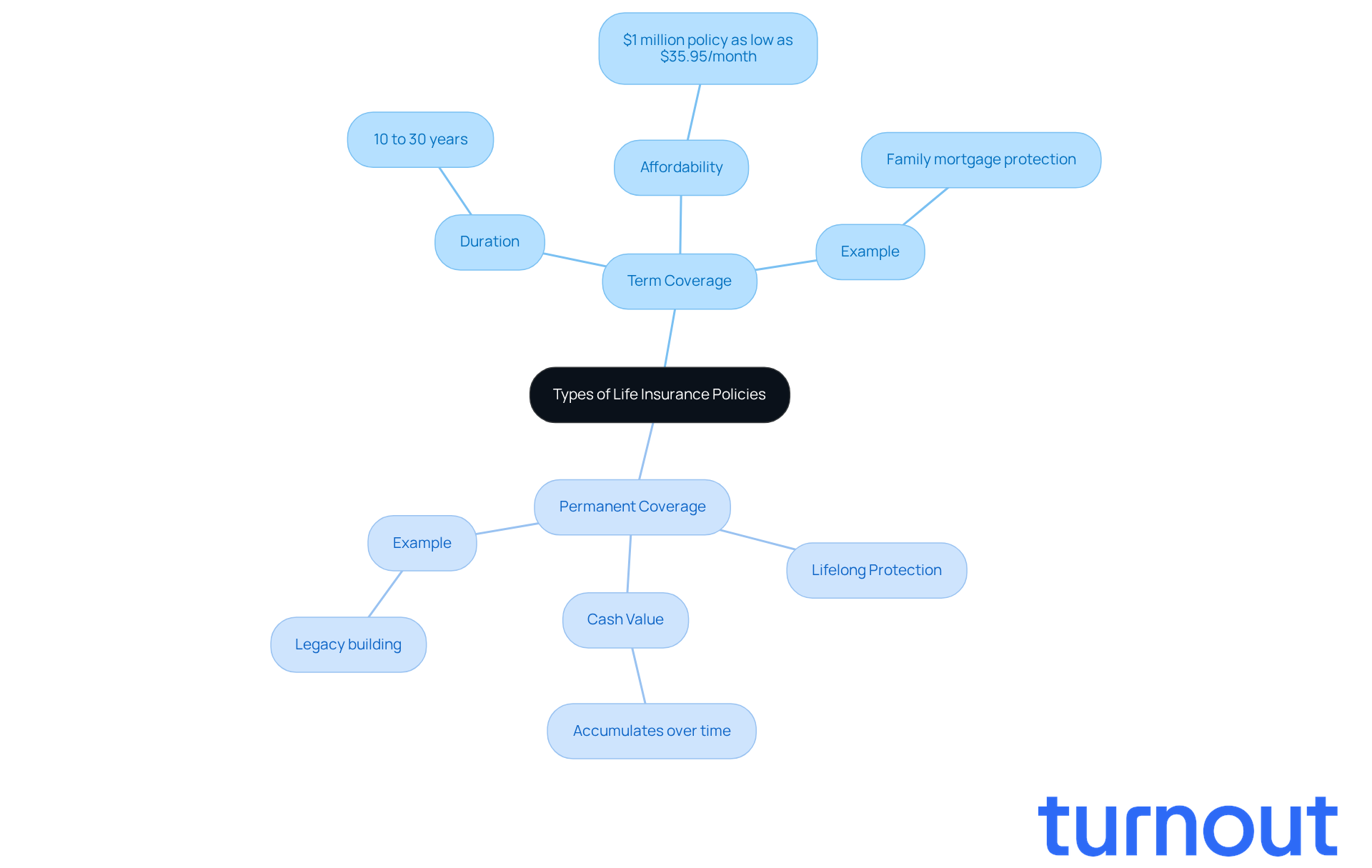

Life coverage agreements can feel overwhelming, but understanding the two primary types-term coverage and permanent coverage-can help you make informed decisions. Term coverage offers protection for a defined duration, usually 10 to 30 years, and pays a death benefit if the insured dies within that period. Many people prefer this option for its affordability; for instance, a $1 million term plan can cost as little as $35.95 per month. On the other hand, permanent coverage, which includes whole and universal plans, provides lifelong protection and may accumulate cash value over time. Each type serves different financial goals and needs, so it’s essential to assess your personal circumstances before selecting a policy.

Consider real-world examples:

- A family might choose term coverage to protect their mortgage while raising children, ensuring security if the main provider passes away.

- Conversely, individuals looking to create a legacy or build savings may opt for permanent coverage, which guarantees a death benefit and offers a cash value element that grows over time.

Experts emphasize the importance of understanding life insurance FAQs and the options they present. Many advisors recommend term insurance for those with temporary needs, while permanent coverage is often suggested for individuals focused on long-term planning. It’s important to note that 42% of American adults feel they need additional coverage or lack sufficient protection. This statistic highlights the ongoing relevance of life insurance FAQs in discussions about financial planning. As we look ahead to 2025, the market share of term coverage is expanding, reflecting a growing awareness among consumers about the necessity for affordable protection.

As the landscape evolves, it’s crucial to recognize the advantages and drawbacks of each type. You’re not alone in this journey; many are navigating similar decisions. By understanding your unique economic situation and goals, you can make choices that align with your needs. Remember, we’re here to help you every step of the way.

How Much Life Insurance Coverage Do You Really Need?

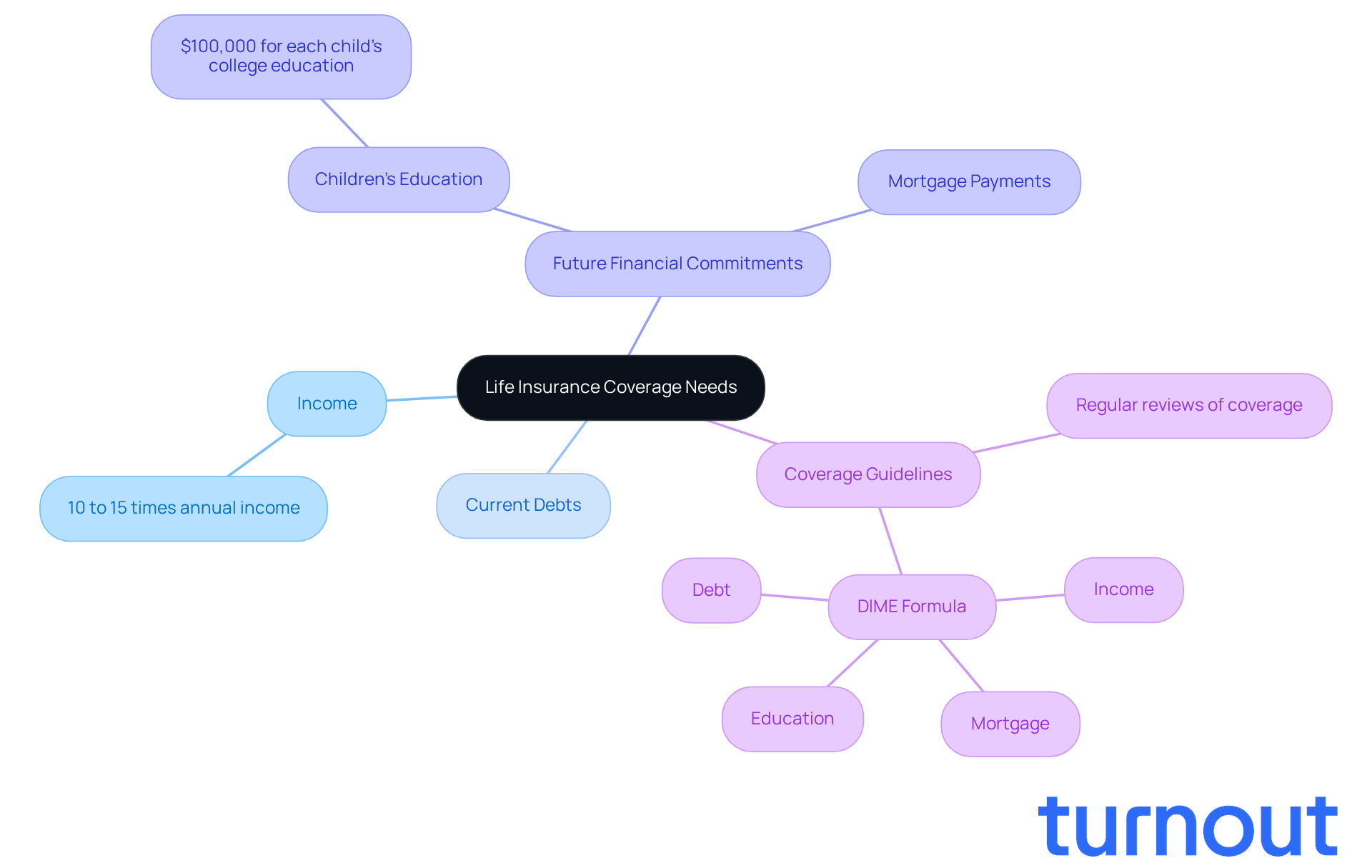

Assessing the right level of coverage can feel overwhelming, but it’s essential to consider a few key elements, such as your income, current debts, and future financial commitments, as explained in life insurance FAQs. A common guideline suggests aiming for coverage that is 10 to 15 times your annual income. For example, if you earn $50,000 a year, seeking a policy between $500,000 and $750,000 could provide the financial support your loved ones need.

Beyond just your income, think about future expenses, such as your children’s education and mortgage payments. Adding $100,000 for each child’s college education to your coverage estimate can help ensure those educational costs are taken care of if something happens to you.

It’s important to note that nearly 41% of adult Americans feel they need more coverage, which translates to about 106 million people. This highlights a significant protection gap. Additionally, almost 25% of families would struggle financially within a month if a breadwinner were to pass away. This underscores the necessity of securing enough coverage. Tools like coverage calculators can assist you in tailoring your protection needs based on your unique situation. These calculators typically ask for details like income, debts, and your dependents' needs, giving you a clearer picture of the coverage you require.

Experts recommend regularly reviewing your coverage plan in the context of life insurance FAQs to ensure it aligns with your changing financial circumstances. The DIME formula - Debt, Income, Mortgage, and Education - can also be a helpful tool for evaluating your life coverage needs. By actively assessing your situation and utilizing available resources, you can effectively secure the financial future of your loved ones. Remember, you’re not alone in this journey; we’re here to help.

What Factors Affect Life Insurance Premiums?

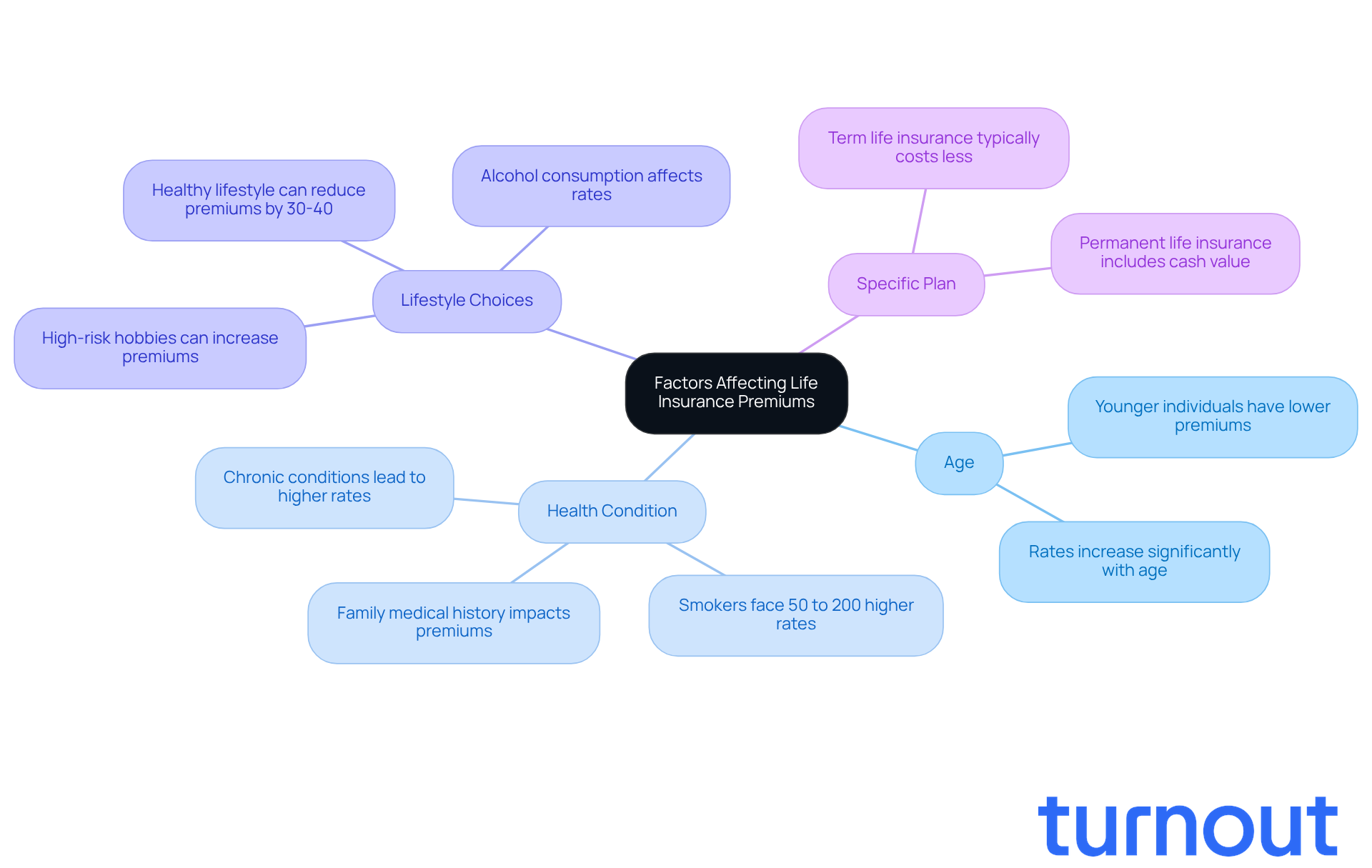

Understanding life coverage costs can feel overwhelming, but we’re here to help you navigate this journey. Several factors influence these costs, including:

- Age

- Health condition

- Lifestyle choices

- The specific plan you choose

Generally, younger and healthier individuals enjoy lower premiums. For instance, the average yearly rate for a 30-year term life coverage is about $579 for men and $255 for women. This highlights the significant cost differences based on age and gender.

Your health status is a key player in determining premiums. If you have chronic conditions or a history of serious illnesses, you might face higher rates. For example, smokers often see premiums that are 50% to 200% higher than non-smokers. On average, a $500,000 coverage can cost as much as $2,475 for men and $1,750 for women over a 30-year period.

Lifestyle choices, like smoking and alcohol consumption, also greatly impact coverage expenses. Smokers are placed in specific 'smoker' groups, leading to premiums that can be nearly double those of non-smokers. On the flip side, individuals who embrace a healthy lifestyle-regular exercise and a balanced diet-can secure lower premiums, often 30-40% less than those with unhealthy habits.

Take John, for example. He’s a 35-year-old dad and marathon runner who secured a policy with significantly reduced premiums due to his commitment to health and fitness. In contrast, Mark, a 45-year-old with a history of alcohol-related health issues, faced much higher premiums, prompting him to rethink his lifestyle choices.

We understand that comprehending these elements is crucial when looking at life insurance FAQs before purchasing coverage. By being informed, you can make knowledgeable choices to secure the best possible rates. Remember, you’re not alone in this journey; we’re here to support you every step of the way.

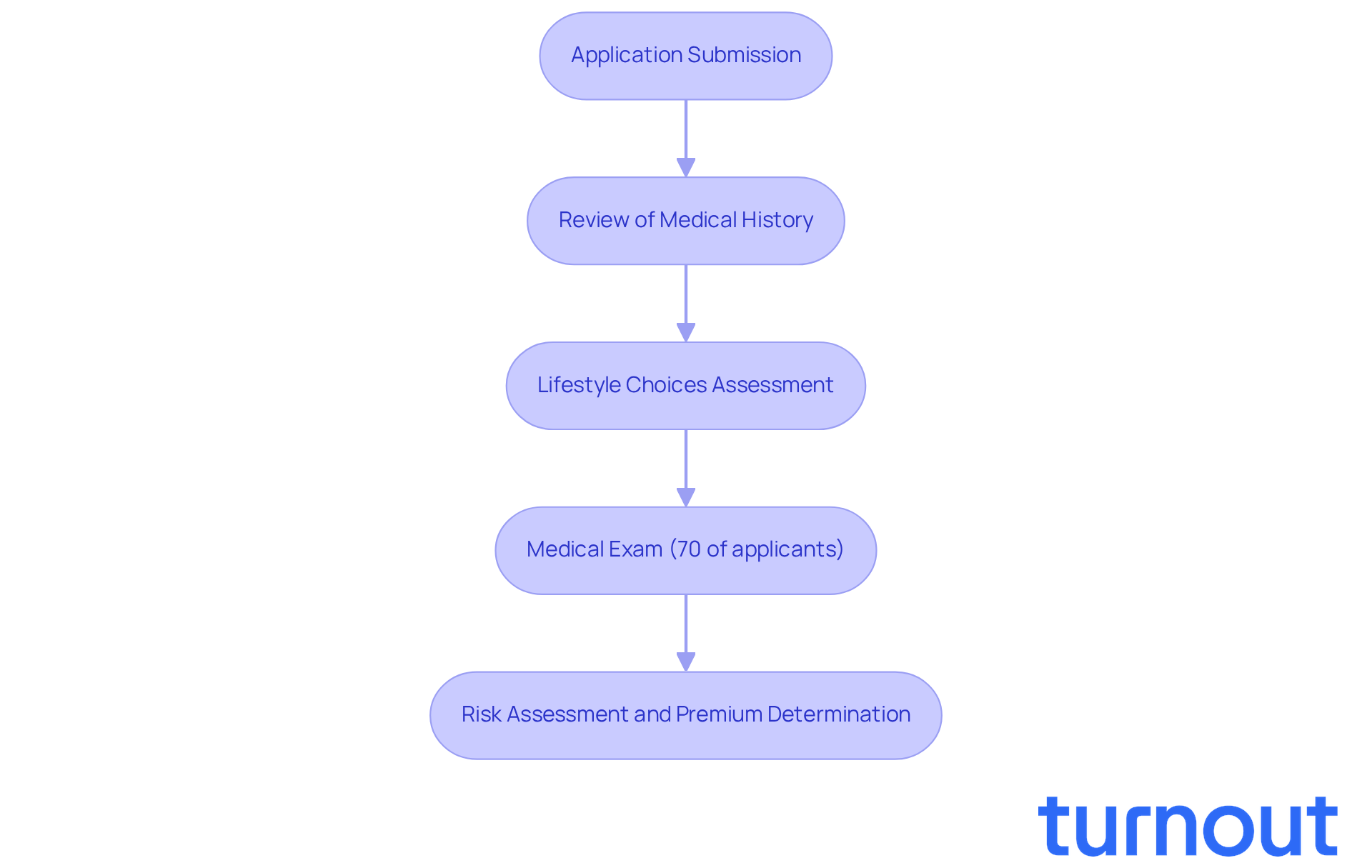

What Is the Underwriting Process for Life Insurance?

The underwriting process is a crucial step in how providers assess the risks associated with covering an applicant. We understand that this can feel overwhelming. Typically, it involves a thorough review of the applicant's medical history, lifestyle choices, and often, a medical exam. Underwriters carefully analyze this information to determine eligibility and establish premium rates. Did you know that about 70% of applicants undergo medical exams during underwriting? This can significantly influence the decision-making process. As one underwriter shared, "A comprehensive understanding of an applicant's health and lifestyle is essential for accurate risk assessment."

To enhance your chances of approval, especially if you're facing unique challenges as a disabled individual, it's important to prepare. Gathering accurate information and necessary documentation can streamline the underwriting process. Thankfully, advancements in technology have made this process more efficient. Insurers are increasingly adopting AI-driven capabilities to automate and expedite administrative tasks, leading to faster decision-making and improved customer experiences.

As the industry evolves, underwriters emphasize the importance of a thorough risk assessment. A well-prepared applicant can facilitate a smoother underwriting experience, ultimately benefiting both the insurer and the insured. We recognize that understanding the specific challenges faced by disabled individuals can further enhance this process, ensuring that your unique needs are addressed effectively. Remember, you are not alone in this journey, and we're here to help.

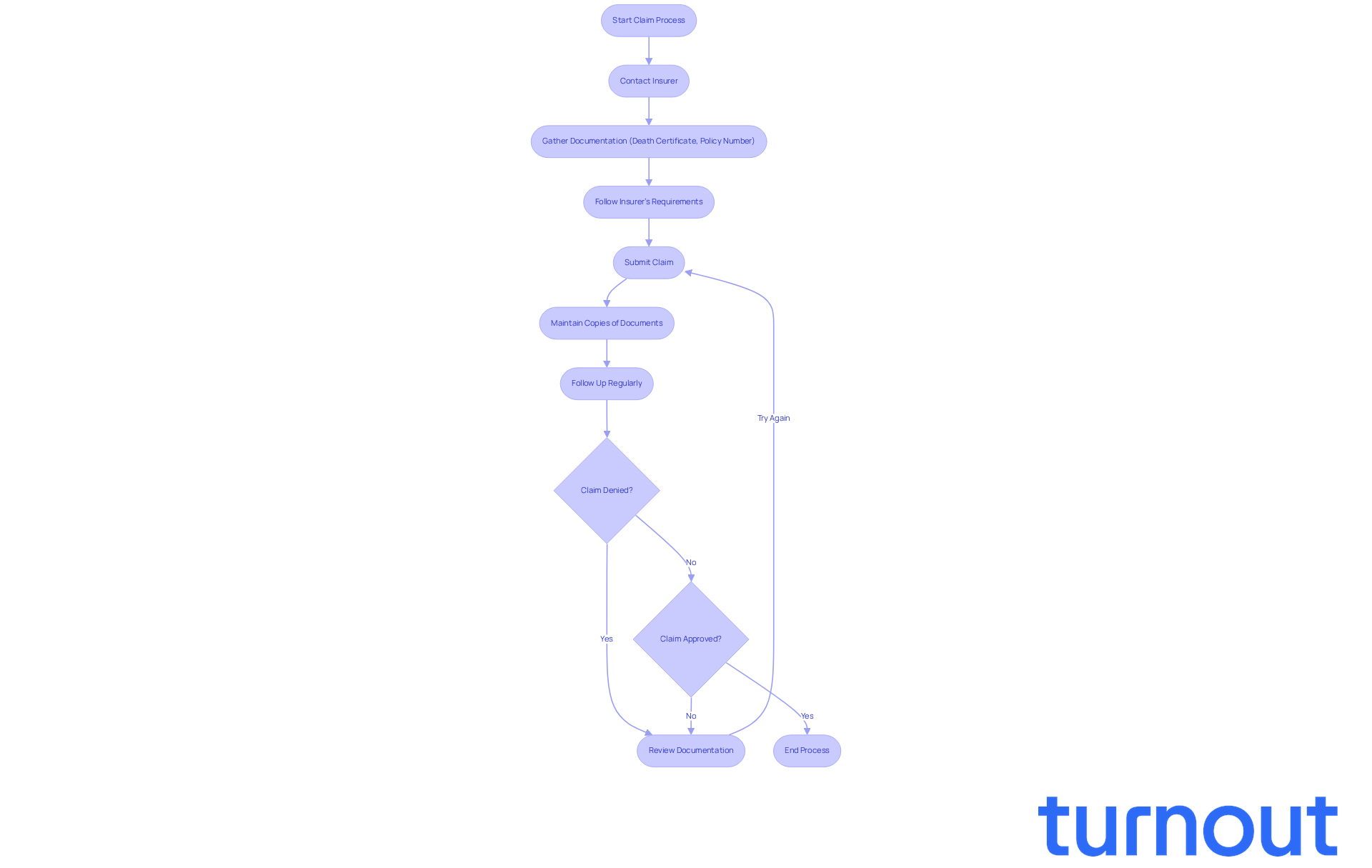

How Do You File a Life Insurance Claim?

When it comes to submitting a claim for a policy, we understand that this can be a challenging time for beneficiaries. The first step is reaching out to the provider directly. Essential documentation typically includes the death certificate and the policy number. Remember, each insurer may have a unique claims process, so it’s important to follow their specific requirements closely.

To help ensure a smooth process, keep copies of all submitted documents and maintain regular follow-ups with the insurer. It’s common to feel overwhelmed, but staying organized can make a significant difference. Did you know that about 70% of claim denials stem from misstatements or non-disclosure of medical history? This highlights just how crucial it is to provide accurate information.

Efficient claims processing can often lead to payouts within just 10 days for straightforward claims. This underscores the value of thorough preparation and proactive communication. Additionally, around 12% of claims for policies are submitted due to suicide, which comes with specific payout stipulations. It’s also worth noting that 25% of disagreements arise from insufficient evidence, emphasizing the necessity for thorough documentation.

You are not alone in this journey; we’re here to help you navigate these steps with care and understanding.

How Do Pre-Existing Conditions Impact Life Insurance Eligibility?

We understand that pre-existing conditions can create significant challenges when it comes to finding coverage. It’s common to feel overwhelmed by the thought that insurers may view applicants with serious health issues as higher risks. This perception can lead to higher premiums or even denial of coverage, which can be disheartening.

However, there’s hope! Many insurers offer specialized plans designed specifically for individuals with pre-existing conditions. This means that you have options available to you. It’s crucial to shop around and compare these options to find the best fit for your needs.

Remember, you are not alone in this journey. We’re here to help you navigate through the choices and find a plan that works for you. Take the time to explore your options, and don’t hesitate to reach out for assistance.

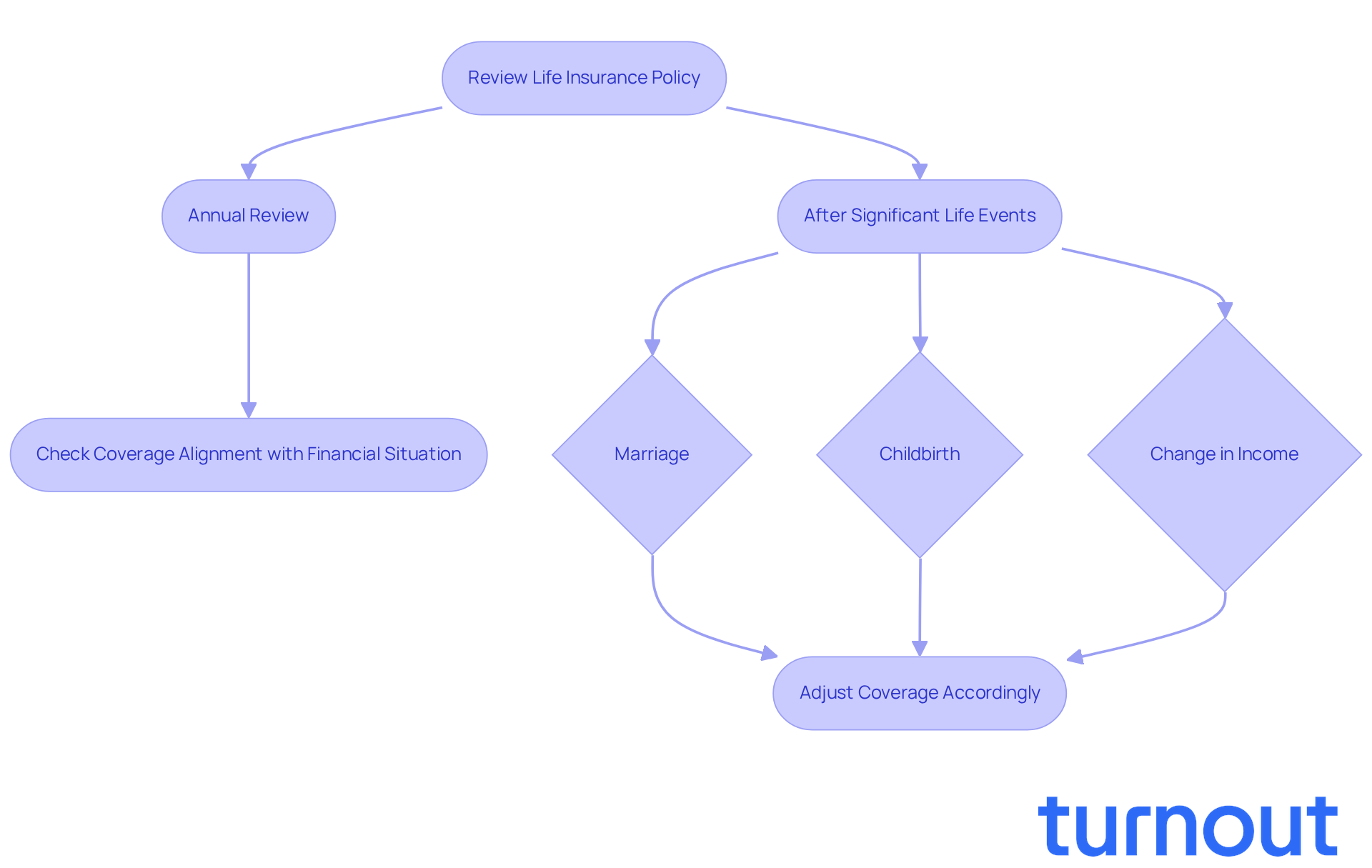

How Often Should You Review Your Life Insurance Policy?

Reviewing your life insurance agreement is crucial. Ideally, you should do this at least once a year or after significant life events like marriage, childbirth, or changes in income. We understand that these milestones can shift your financial responsibilities and family dynamics, making it essential to adjust your coverage accordingly.

For instance, the birth of a child often means you need increased coverage to secure their future. Similarly, a change in income might affect your ability to maintain existing policies. Regular evaluations ensure that your coverage aligns with your current financial situation and family needs. This way, you can make informed adjustments as necessary.

Experts emphasize that this proactive approach not only protects your loved ones but also helps you stay on track with your financial goals. Did you know that 40% of Americans with coverage wish they’d purchased it earlier? This statistic highlights the importance of timely evaluations. By reassessing your strategy each year, you can ensure it remains aligned with your evolving needs and circumstances.

As protection specialist Jeff Root wisely states, "Regular evaluations assist in confirming that the policy stays sufficient and applicable to the person's changing circumstances." Remember, you are not alone in this journey; we're here to help you navigate these important decisions.

Is Life Insurance Only for Older Adults?

Life coverage isn’t just for older adults; it can truly benefit individuals of all ages. Have you ever thought about how young people, especially those with dependents or significant financial responsibilities, can secure lower premiums by getting coverage early? It’s a smart move that can provide peace of mind.

Imagine the reassurance and financial protection life coverage can offer your loved ones, no matter your age. We understand that planning for the future can feel overwhelming, but you’re not alone in this journey. By taking this step, you’re showing care for those who matter most to you.

So, why wait? Consider exploring your options today. We're here to help you navigate this important decision.

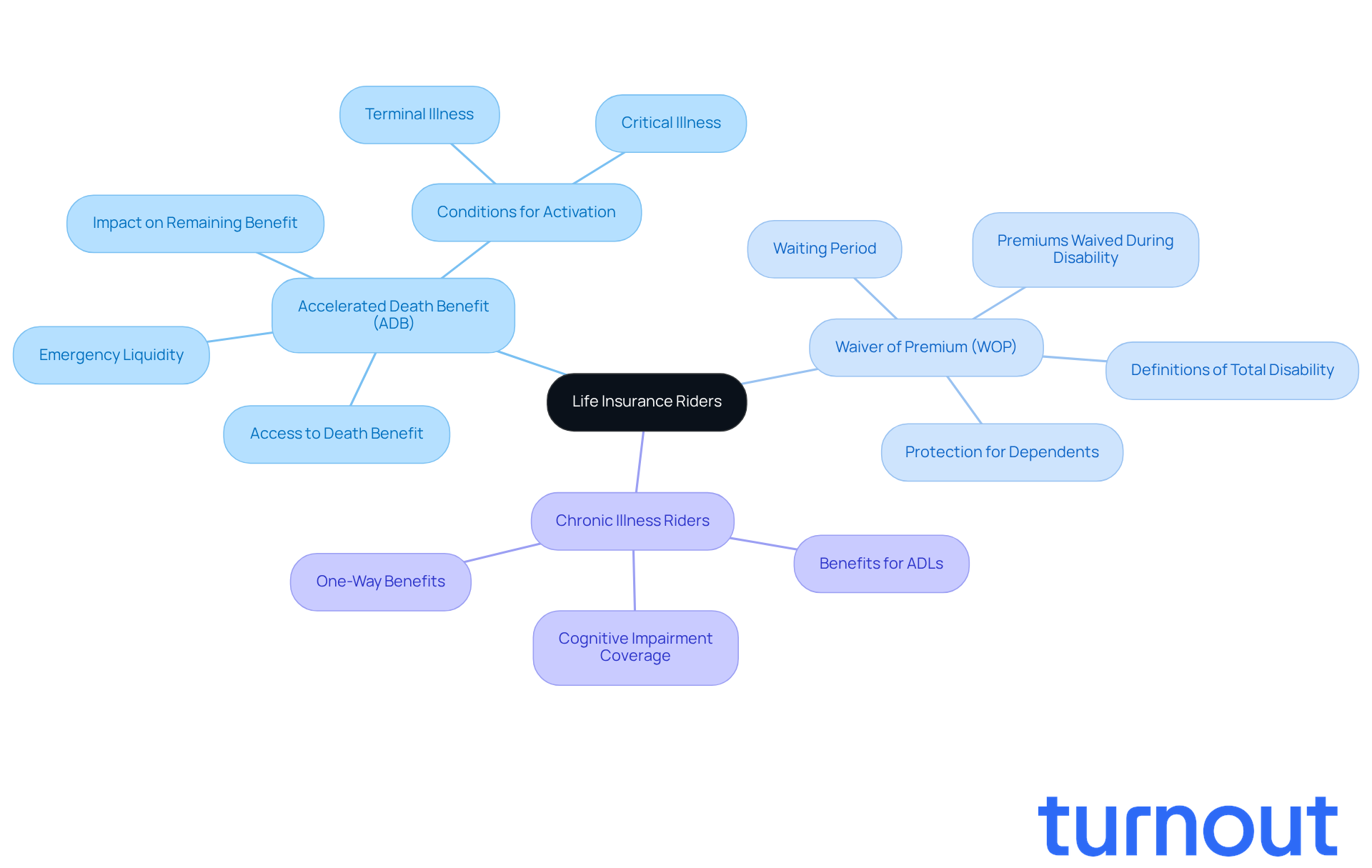

What Are Life Insurance Riders and How Do They Work?

Life insurance riders can be a lifeline, offering optional enhancements that change a contract's coverage. They provide you with greater flexibility and protection when you need it most. Among the most common riders is the Accelerated Death Benefit (ADB) rider. This allows policyholders to access a portion of their death benefit if diagnosed with a terminal illness. Another important option is the Waiver of Premium (WOP) rider, which waives premium payments if the policyholder becomes totally disabled. Additionally, Chronic Illness Riders can accelerate benefits if the insured is permanently unable to perform Activities of Daily Living (ADLs) or suffers from severe cognitive impairment. These riders not only provide prompt monetary assistance during crucial times but also help keep the policy active when the insured can’t make payments.

Imagine the peace of mind that comes with the ADB rider, acting as an emergency liquidity line. It enables families to manage medical expenses without draining their savings during a health crisis. This is especially important, as studies show that a significant percentage of policies now include riders, reflecting a growing awareness of their benefits. The WOP rider is particularly valuable for those with dependents. It protects coverage during periods of disability, ensuring families aren’t left vulnerable. However, it’s essential to remember that WOP typically has a waiting period, and definitions of total disability can vary. Understanding these nuances is crucial for grasping the limitations of this rider.

Industry experts highlight the importance of these riders. One expert noted, "the most compelling riders provide liquidity exactly when economic stress is at its peak." This underscores their significance in effective financial planning. Another expert pointed out, "the most common failure in a client's financial plan occurs when a sudden catastrophic illness forces them to liquidate retirement assets to cover expenses." This emphasizes the critical role of riders in preventing financial distress. As you navigate your insurance options, remember that understanding the various riders available can empower you to make informed decisions that align with your unique needs and circumstances. You're not alone in this journey; we're here to help.

Conclusion

Navigating the complex world of life insurance can feel overwhelming, and we understand that. Grasping essential life insurance FAQs is crucial for making informed decisions. This article highlights the importance of simplifying life insurance for you, emphasizing how technology and personalized support can empower you to find the right coverage tailored to your needs.

Key insights covered include the different types of life insurance policies - term and permanent - along with the factors that influence premiums, such as age, health, and lifestyle. We also discussed the underwriting process, the significance of reviewing policies regularly, and how life insurance riders can enhance your coverage. With many Americans feeling underinsured, it’s vital to actively assess your personal circumstances and coverage needs.

Ultimately, securing the right life insurance isn’t just about financial protection; it’s about peace of mind for you and your loved ones. As the landscape of life insurance continues to evolve, we encourage you to leverage available resources and seek guidance to navigate your options confidently. Taking proactive steps today can ensure that you and your family are well-prepared for the future. Remember, you are not alone in this journey; we’re here to help.

Frequently Asked Questions

What is Turnout and how does it help consumers with life insurance?

Turnout is a platform that simplifies the navigation of financial products, particularly life insurance, by using technology and personalized support. It aims to reduce the overwhelm many consumers feel due to the variety of coverage options available, helping them navigate coverage agreements and claims procedures with confidence.

What are the two primary types of life insurance policies?

The two primary types of life insurance policies are term coverage and permanent coverage. Term coverage provides protection for a specific duration (usually 10 to 30 years) and pays a death benefit if the insured dies within that period. Permanent coverage, which includes whole and universal plans, offers lifelong protection and may accumulate cash value over time.

How much does term life insurance typically cost?

Term life insurance can be very affordable, with a $1 million term plan costing as little as $35.95 per month.

What factors should be considered when determining how much life insurance coverage is needed?

Key factors include your income, current debts, and future financial commitments. A common guideline suggests aiming for coverage that is 10 to 15 times your annual income. Additionally, consider future expenses such as children's education and mortgage payments.

What tools can assist in calculating the appropriate level of life insurance coverage?

Coverage calculators can help tailor your protection needs based on your income, debts, and dependents' needs, providing a clearer picture of the coverage required.

What percentage of American adults feel they need more life insurance coverage?

Nearly 41% of adult Americans feel they need more coverage, which equates to about 106 million people.

Why is it important to regularly review life insurance coverage?

Regularly reviewing your coverage plan ensures that it aligns with your changing financial circumstances and needs. This is crucial for maintaining adequate protection for your loved ones.

What is the DIME formula and how is it used?

The DIME formula stands for Debt, Income, Mortgage, and Education. It is a helpful tool for evaluating life coverage needs, allowing individuals to assess their financial situation and determine the appropriate level of coverage required.