Introduction

Navigating the complexities of tax obligations can feel overwhelming, especially when it comes to long-term payment plans with the IRS. We understand that for many consumers, grasping these arrangements is vital not just for financial stability but also for peace of mind. This article aims to shed light on essential insights surrounding IRS long-term payment plans, offering a comprehensive overview of their benefits, eligibility requirements, and application processes.

But what happens when unforeseen circumstances arise? Or when individuals make common mistakes that jeopardize their agreements? It's common to feel anxious about these challenges. By exploring these issues, we hope to illuminate the path toward informed decision-making and effective management of your tax responsibilities. Remember, you are not alone in this journey, and we're here to help.

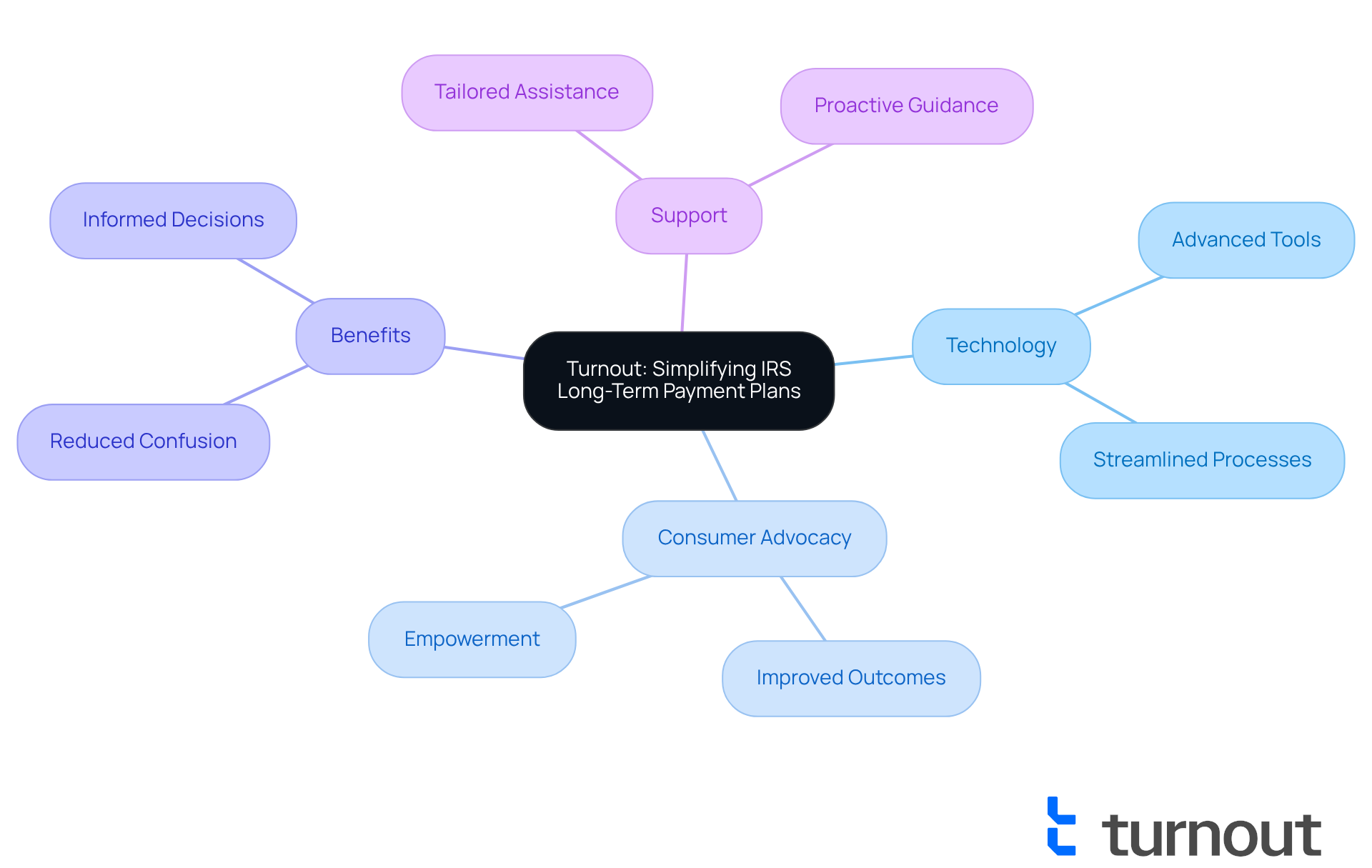

Turnout: Simplifying IRS Long-Term Payment Plans for Consumers

We understand that dealing with the IRS can be overwhelming, especially when it comes to establishing a long term payment plan with the IRS. Turnout is here to help transform how you interact with tax obligations. By harnessing advanced technology and offering tailored support, we demystify the complexities of taxes, making it easier for you to navigate your options.

This innovative approach not only reduces confusion but also empowers you to take charge of your financial circumstances. Imagine feeling confident and informed about your tax responsibilities. As financial consultants highlight, effective consumer advocacy can greatly improve your IRS settlement experience, leading to better outcomes when facing tax difficulties.

With Turnout's streamlined processes, you can manage your tax responsibilities with ease. You're not alone in this journey; we're here to support you every step of the way. Let us help you ensure that you remain proactive and informed in your financial journey.

IRS Long-Term Payment Plan: Key Features and Benefits

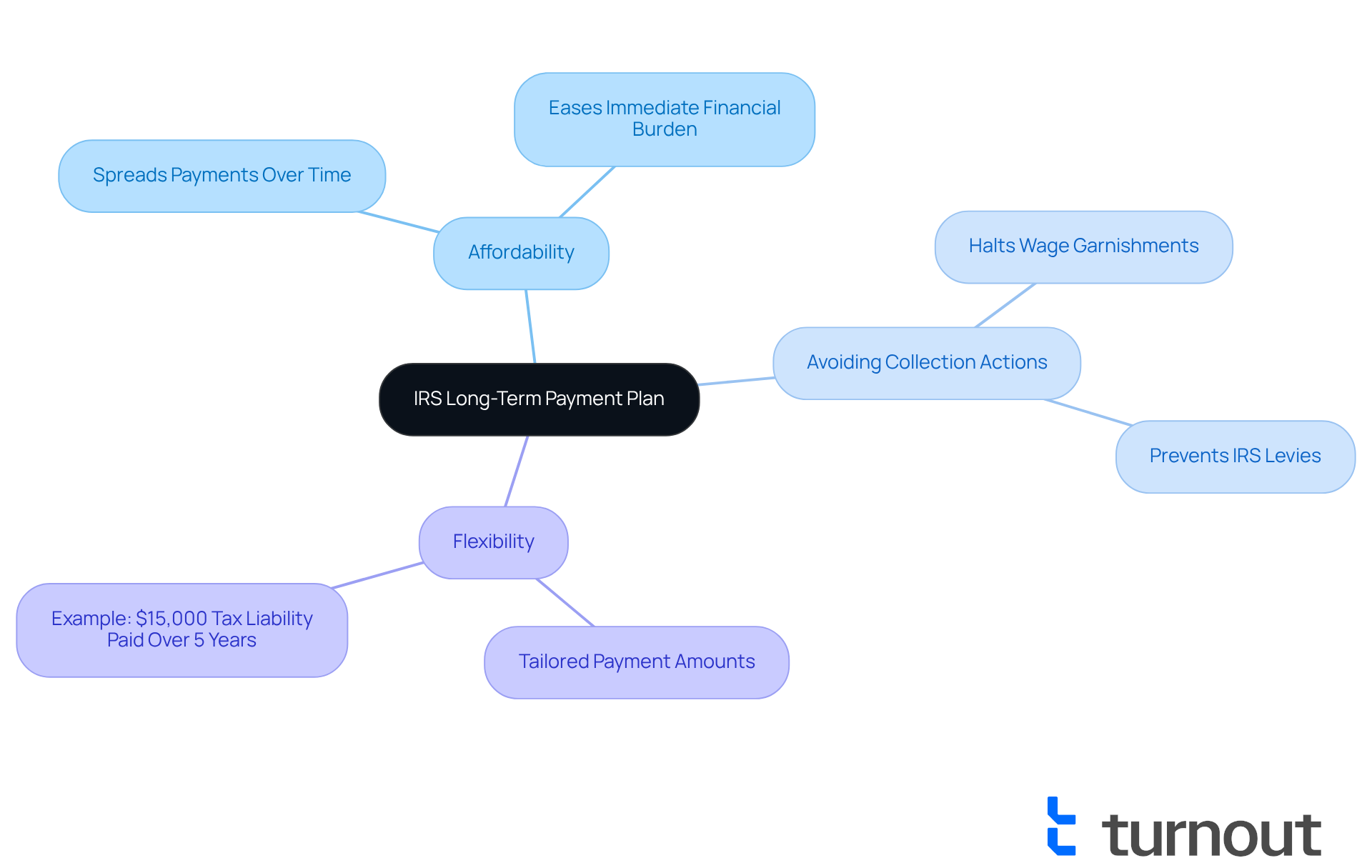

The long term payment plan IRS, commonly known as an installment agreement, provides a compassionate solution for individuals seeking to manage their tax obligations over an extended period - typically up to 72 months. This arrangement comes with several key benefits that can truly make a difference:

- Affordability: By spreading payments over time, you can manage your financial obligations more effectively, easing the immediate burden of a lump-sum payment.

- Avoiding Collection Actions: Enrolling in this plan halts aggressive IRS collection actions, such as wage garnishments and levies, giving you peace of mind during the repayment process.

- Flexibility: You have the option to tailor your payment amounts according to your financial situation, ensuring you can meet your obligations without undue hardship.

We understand that facing overwhelming tax debts can be incredibly stressful. Tax professionals often emphasize that these agreements can be a lifeline. For example, consider a recent case where an individual successfully negotiated an installment agreement, allowing them to pay off a $15,000 tax liability over five years. This approach not only alleviated immediate financial stress but also enabled them to maintain their standard of living while fulfilling their obligations.

Furthermore, the IRS established more than 3.4 million new installment agreements in the last reporting period, highlighting the growing reliance on this option. With interest rates compounding daily at 8%, and penalties and interest continuing to accumulate until the balance is settled in full, the importance of timely payments cannot be overstated. We encourage you to file your returns on time, even if you can’t pay in full, to avoid additional penalties and interest. You can initiate the Installment Agreement process by calling the IRS or submitting Form 9465.

In summary, the long term payment plan IRS serves as an essential resource for individuals aiming to manage their tax liabilities efficiently. It provides a structured and supportive route to financial recovery, reminding you that you are not alone in this journey.

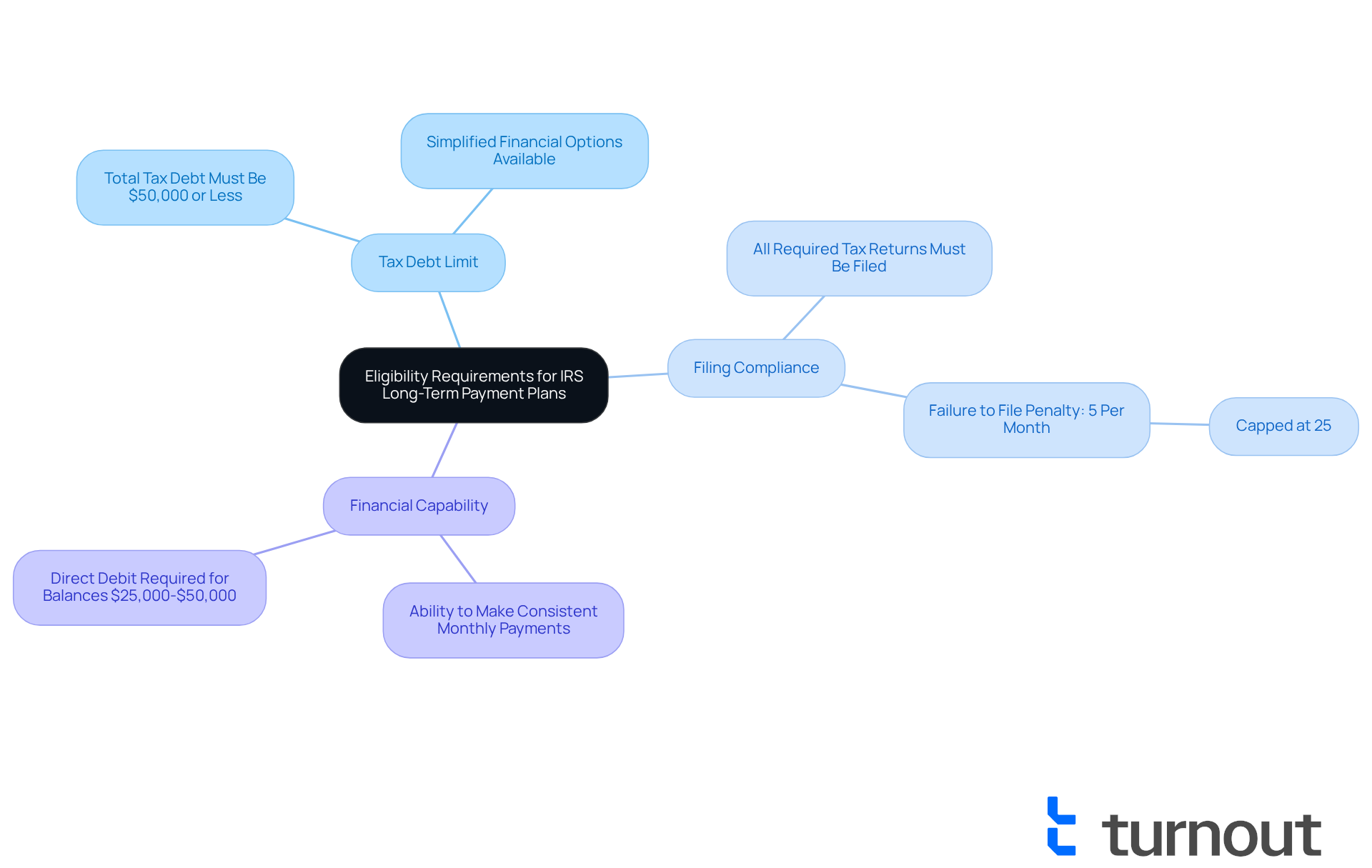

Eligibility Requirements for IRS Long-Term Payment Plans

Navigating tax debt can be overwhelming, but understanding the requirements for a long-term payment plan with the IRS can help ease your worries. Here’s what you need to know:

- Tax Debt Limit: To qualify, your total tax debt, including penalties and interest, must be $50,000 or less. This limit is crucial as it opens up simplified financial options for you.

- Filing Compliance: It’s essential that all your required tax returns are filed. If you haven’t submitted your returns, you might find yourself ineligible for a financial arrangement. Remember, failing to file on time can lead to a penalty of 5% of the tax due for each month your return is overdue, up to a maximum of 25%.

- Financial Capability: You’ll need to show that you can make consistent monthly payments. This requirement is in place to help you manage your debts without incurring further penalties.

Understanding these requirements is vital for assessing your eligibility and preparing for the application process. Did you know that around 88% of single filers owe less than $25,000? This makes many of them ideal candidates for the long term payment plan IRS. Plus, keep in mind that interest on unpaid taxes compounds daily, which highlights the importance of addressing tax debts as soon as possible.

The good news is that the IRS has made the process easier. You can receive immediate approval by completing the online application through the Online Payment Agreement (OPA). This method requires no paperwork or direct contact with the agency, making it a significant advantage for those managing tax debt. Remember, you’re not alone in this journey; we’re here to help.

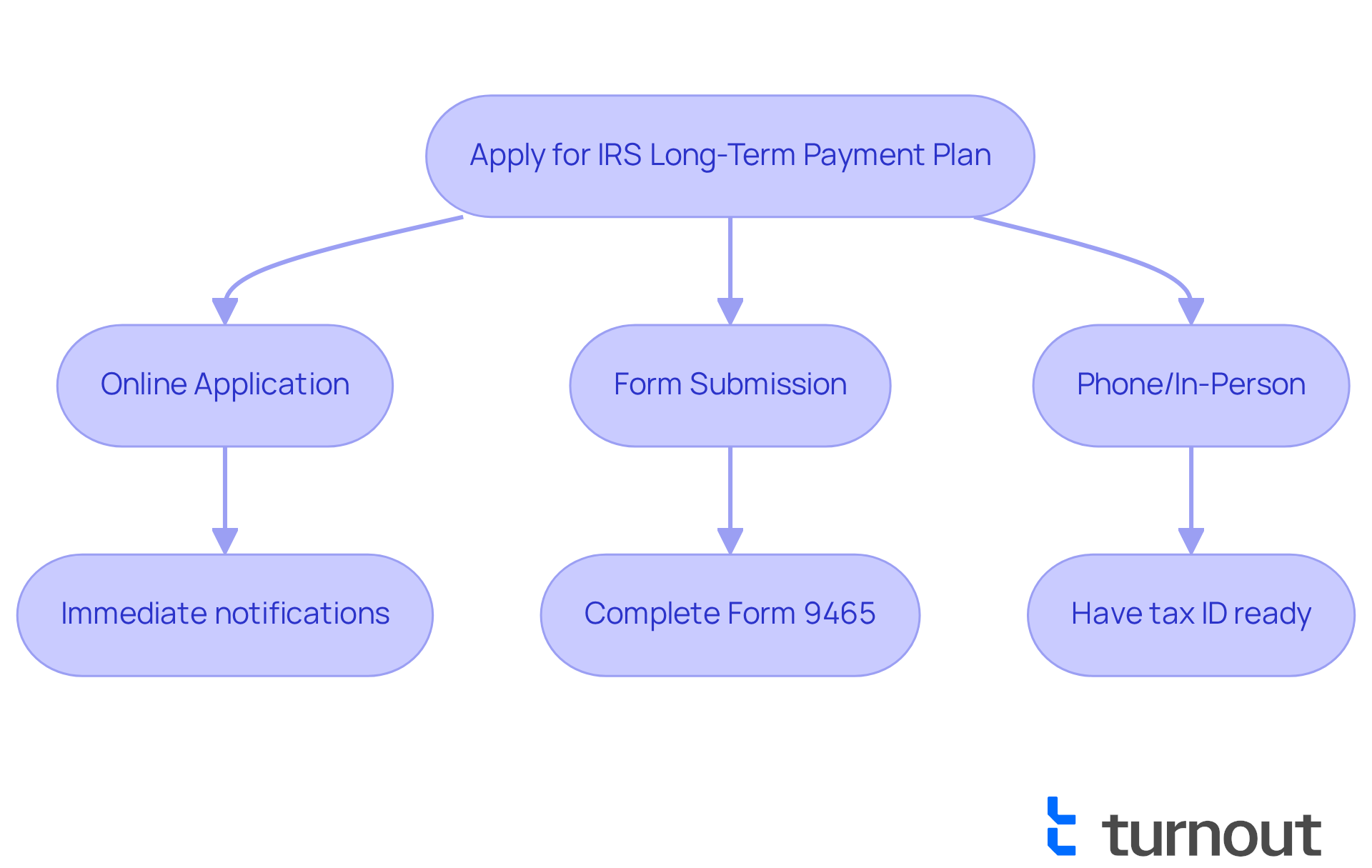

How to Apply for an IRS Long-Term Payment Plan

Applying for an IRS long-term payment plan can feel overwhelming, but there are several straightforward methods to help you navigate this process:

-

Online Application: The most efficient way is to use the IRS Online Payment Agreement tool. This option allows you to apply directly online, making it simple and quick. You’ll receive immediate notifications of approval, which can be a relief. Just keep in mind that there may be some setup fees associated with this method.

-

Form Submission: If you prefer a more traditional approach, you can complete Form 9465 and mail it to the IRS. This method requires careful attention to detail to ensure all necessary information is included, but it’s a reliable option.

-

Phone or In-Person: For those who value personal interaction, you can contact the IRS by phone or visit a local office. It’s important to have all required information ready, including your tax identification number and details about your tax debt.

We understand that dealing with tax issues can be stressful. The IRS has made significant improvements to its application procedures, enhancing accessibility and flexibility for individuals like you. Many tax professionals recommend the Online Payment Agreement tool as the most effective approach to facilitate a long term payment plan IRS, as it streamlines the application process and reduces waiting times.

Additionally, if your tax debt is between $25,000 and $50,000, the IRS encourages you to set up direct debit. This can help you manage your financial commitments more efficiently. If you’re facing economic hardships, remember that the Taxpayer Advocate Service is available to provide assistance and support.

You are not alone in this journey. Exploring all available options can help you find the best fit for your circumstances. We’re here to help you every step of the way.

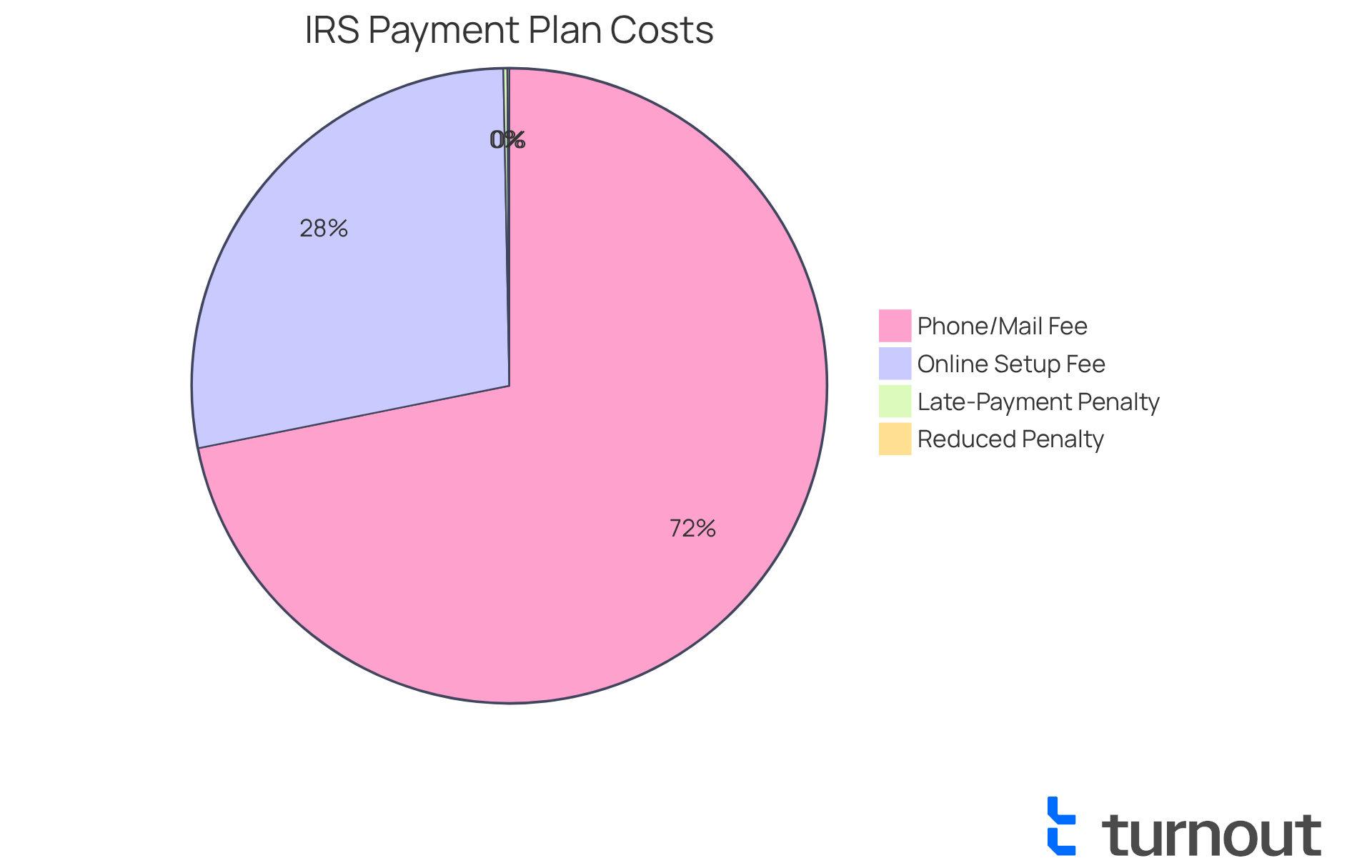

Understanding Costs and Fees of IRS Long-Term Payment Plans

Establishing a long term payment plan with the IRS can feel overwhelming, particularly when trying to understand the fees involved. For those applying online, the setup fee is typically $69. If you choose to apply via phone or mail, that fee rises to $178. But don’t worry - if you’re facing financial challenges, you might qualify for fee waivers or reductions. This can significantly ease your burden. Specifically, if your adjusted gross income is at or below 250% of the federal poverty level, you can have your setup fees waived, provided you agree to make electronic debit transactions.

We understand that managing finances can be stressful, especially when interest and penalties continue to accumulate on any unpaid balance during the settlement period. The late-payment penalty is generally 0.5% per month, which can add up to a maximum of 25% of the unpaid taxes. However, if you submitted your return on time while an installment agreement is in effect, the penalty rate drops to 0.25% per month. This ongoing buildup can significantly increase the total amount due over time, making it crucial to handle your contributions efficiently.

It's also important to know that the IRS won’t initiate enforced collection measures while your long term payment plan with the IRS is under evaluation or active. By utilizing available resources and understanding your options, you can navigate these costs more successfully. Remember, you’re not alone in this journey, and we’re here to help you every step of the way.

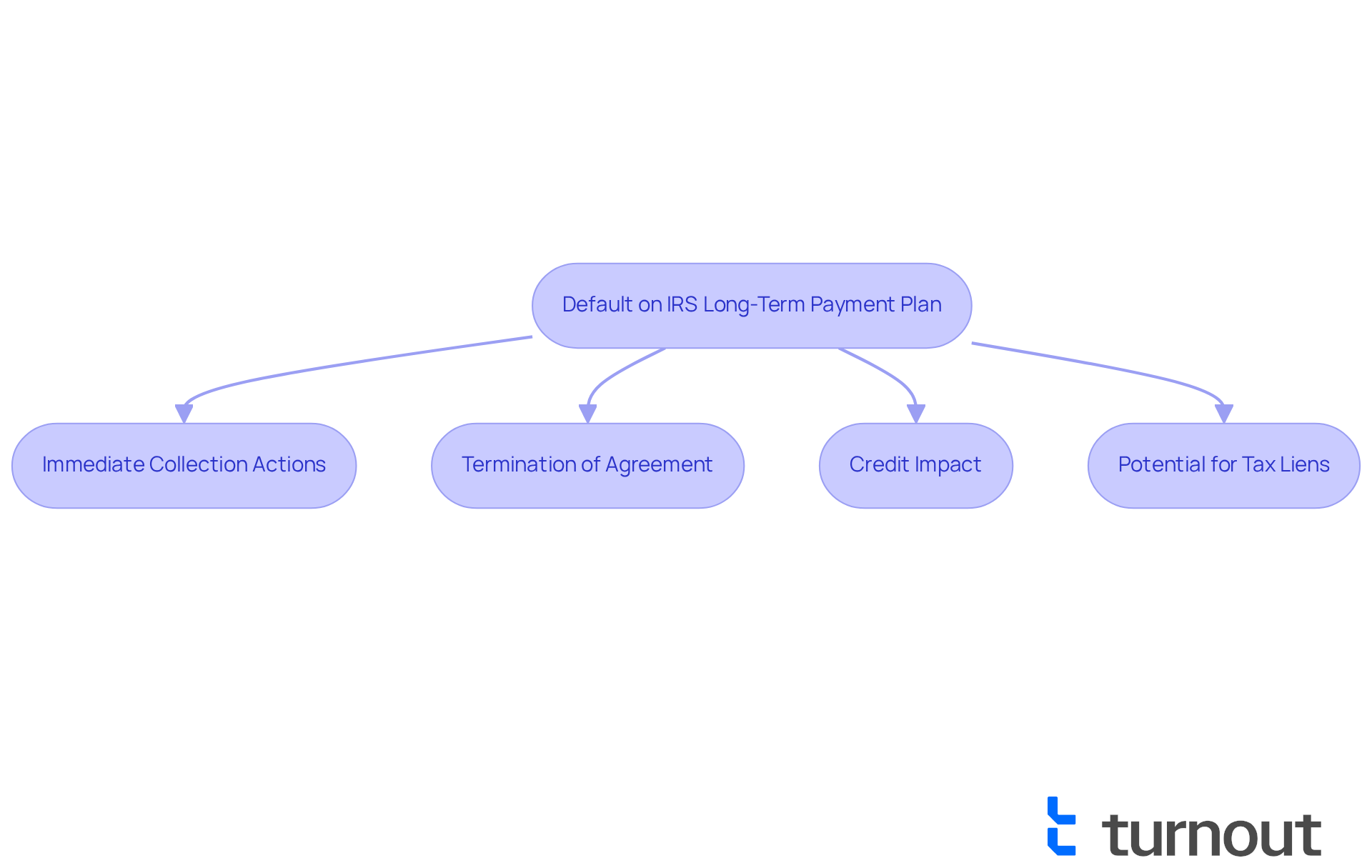

Consequences of Defaulting on IRS Long-Term Payment Plans

Failing to stick to a long term payment plan IRS can lead to serious consequences that may worsen your financial situation. We understand that navigating these challenges can be overwhelming, so here are some key consequences to keep in mind:

-

Immediate Collection Actions: If you default, the IRS may quickly resume collection efforts, which can include wage garnishments and bank levies. This means your income could be directly affected, and funds from your bank account might be frozen for up to 21 days. You’ll have a limited window to resolve the issue before the IRS seizes those funds.

-

Termination of Agreement: Missing installments can lead the IRS to terminate your long term payment plan IRS. This means the entire balance becomes due immediately, which can feel daunting and lead to even more financial stress.

-

Credit Impact: Not adhering to your financial arrangement can also harm your credit score. A lower credit score can make it harder to secure loans or credit in the future. Staying current on your dues is crucial to avoid these long-term repercussions.

-

Potential for Tax Liens: Under the Non-Streamlined Installment Agreement (NSIA), the IRS may file a tax lien against you. This can complicate your financial situation further and negatively impact your credit.

Tax experts emphasize the importance of sticking to your financial arrangement. As one expert shared, "Investing in professional legal help ensures your tax problems are resolved effectively, offering invaluable peace of mind." This highlights the need to seek assistance in managing the complexities of tax responsibilities and avoiding the risks of failing to meet an IRS agreement.

Remember, you’re not alone in this journey. Taxpayers can request a Collection Appeal Program (CAP) hearing to contest a default or termination of their installment agreement, providing a path for recourse. It’s also worth noting that the IRS has the discretion to reinstate a defaulted or terminated installment agreement based on various factors, which can offer hope to those facing financial difficulties.

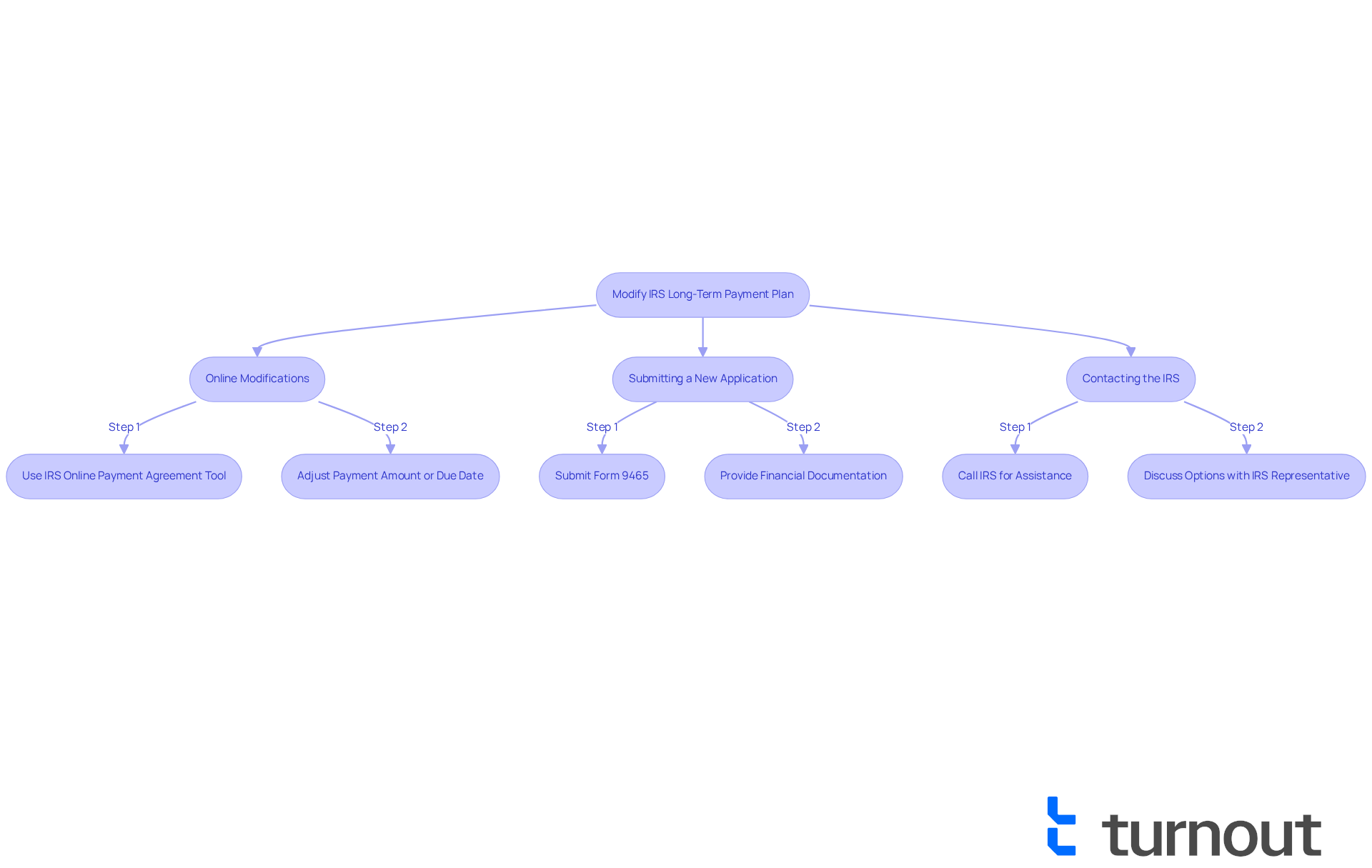

Modifying Your IRS Long-Term Payment Plan: What You Need to Know

If your financial situation changes, adjusting your IRS long-term arrangement is not only possible but can also help you manage your tax responsibilities more effectively. We understand that navigating these changes can be overwhelming, so here are some key steps and considerations to guide you:

- Online Modifications: You can easily adjust your payment amount or due date using the IRS Online Payment Agreement tool. Most taxpayers qualify for this streamlined process, allowing for prompt updates that align with your current circumstances.

- Submitting a New Application: In some cases, you may need to submit a new Form 9465 to accurately reflect your financial status. This form is essential for formalizing any changes to your agreement, especially if you owe less than $50,000, which allows for online modifications.

- Contacting the IRS: For personalized assistance, consider reaching out to the IRS directly. Their representatives are there to guide you through your options and help ensure that your revised strategy remains compliant with IRS requirements.

It's common to feel anxious about adjusting your financial arrangement, especially during tough times like job loss, increased living expenses, or unexpected medical bills. Taxpayers who proactively address these changes often find it easier to maintain compliance and avoid penalties. For instance, many individuals have successfully modified their financial arrangements by demonstrating their economic difficulties, leading to lower monthly contributions or extended repayment terms.

Experts from TaxRise emphasize the importance of early communication with the IRS. Engaging with them before missing a payment can help you avoid complications and negotiate better terms. Remember, the IRS allows changes to financial arrangements, and most taxpayers are eligible for these revisions, especially if they can provide proof of their altered financial circumstances. However, keep in mind that interest and penalties continue to accrue during the modification process, so it’s crucial to act promptly. Additionally, ensure that you are up-to-date on all tax filings to qualify for any changes.

You are not alone in this journey; we're here to help you navigate these challenges.

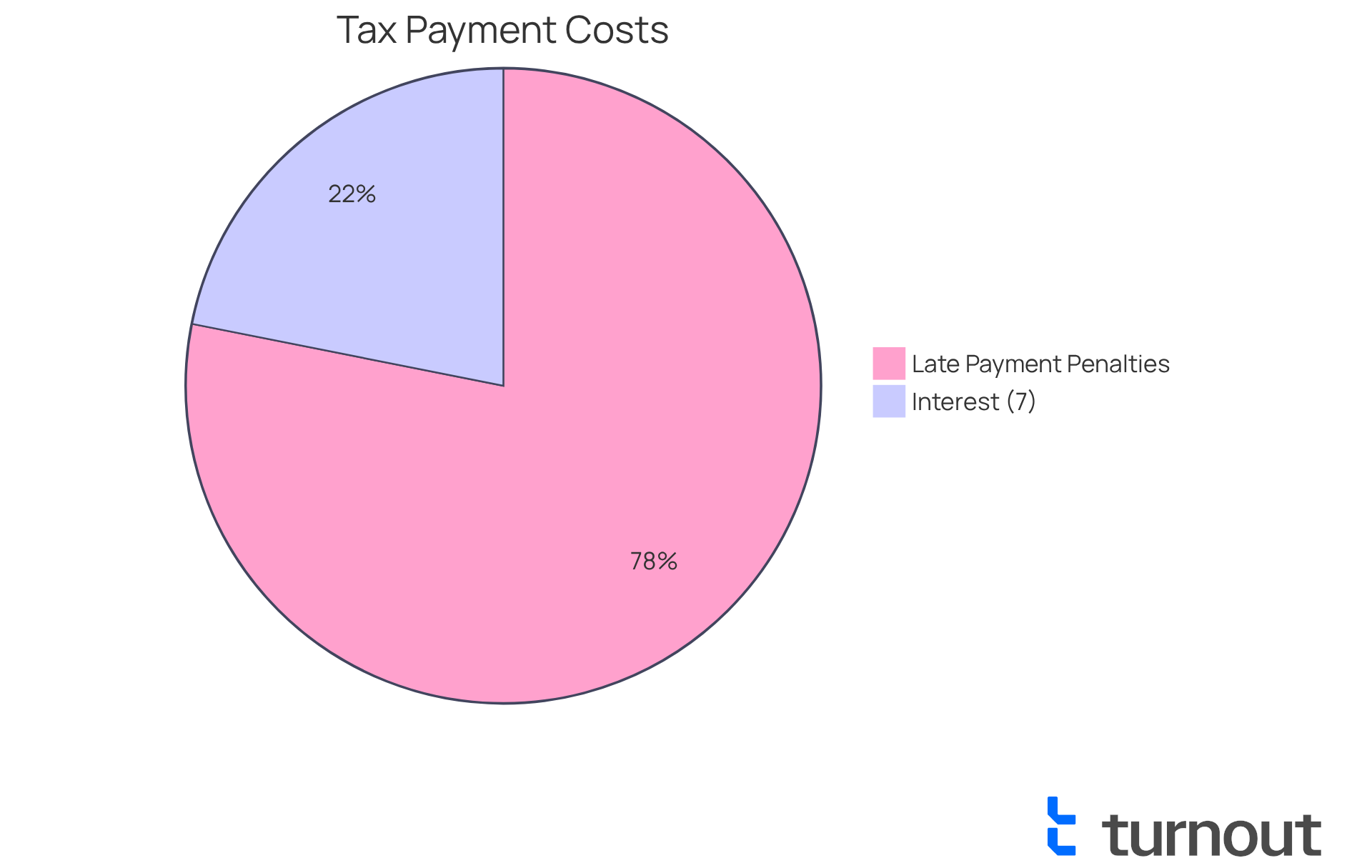

Interest and Penalties on IRS Long-Term Payment Plans

We understand that managing unpaid balances can be stressful. Interest and penalties can add to your worries, especially during a long term payment plan with the IRS.

- Interest Rate: As of 2025, the IRS interest rate is 7% per year, compounded daily.

- Late Payment Penalties: A penalty of 0.5% per month applies to unpaid balances, up to a maximum of 25%.

It's common to feel overwhelmed by these costs. That's why it's essential for consumers to factor these ongoing expenses into their financial planning. By doing so, you can avoid unexpected surprises and take control of your financial journey. Remember, you're not alone in this - we're here to help.

Common Mistakes to Avoid with IRS Long-Term Payment Plans

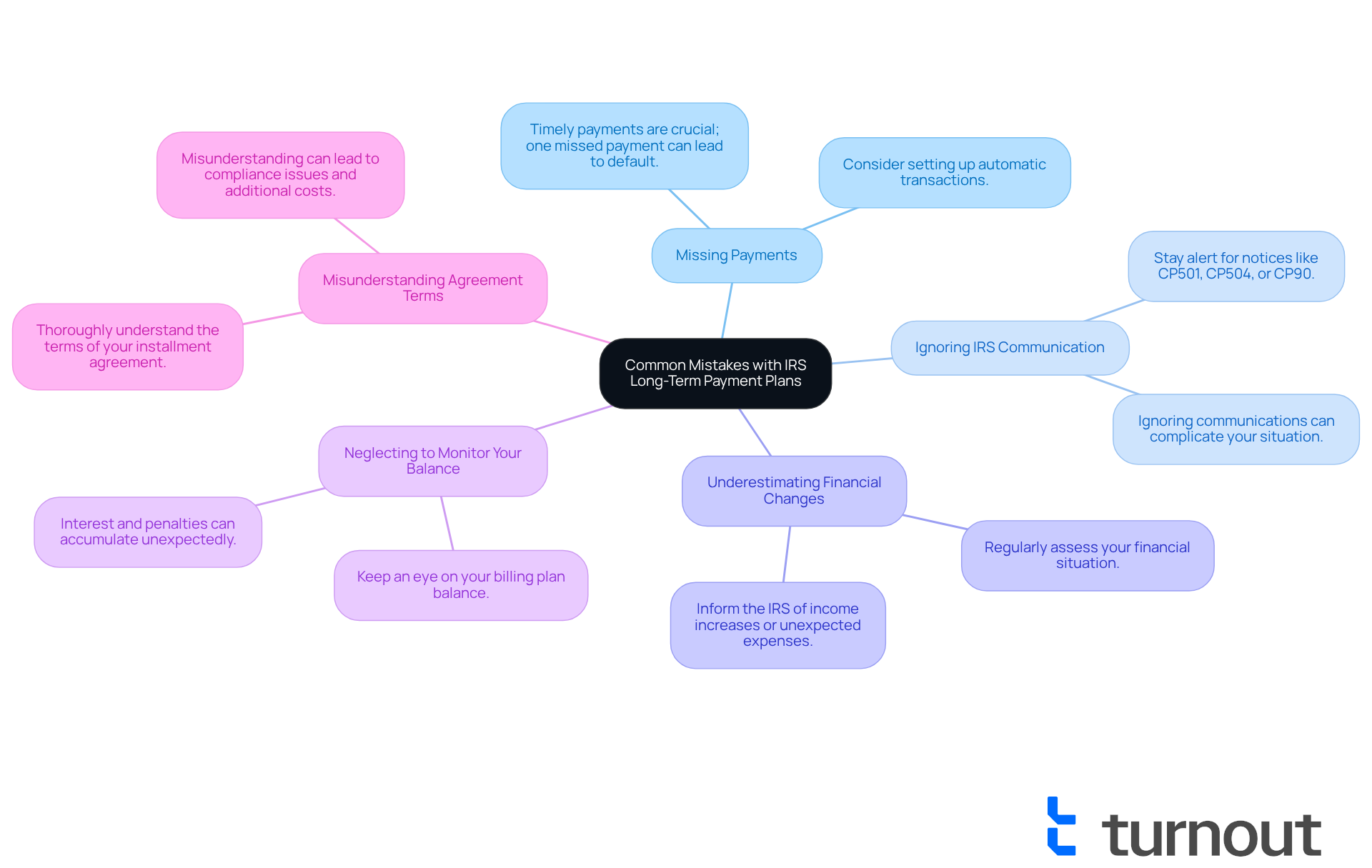

Managing a long term payment plan IRS can feel overwhelming, but you’re not alone in this journey. To help you navigate this process successfully, let’s explore some common pitfalls to avoid:

-

Missing Payments: Timely payments are crucial. Just one missed installment can lead to default, resulting in serious collection actions like wage garnishments or bank levies. Consider setting up automatic transactions to ensure you never miss a deadline.

-

Ignoring IRS Communication: It’s essential to stay alert for any notices or updates from the IRS regarding your financial arrangement. Ignoring communications, such as IRS Notices CP501, CP504, or CP90, can complicate your situation and lead to misunderstandings about your obligations.

-

Underestimating Financial Changes: Regularly assess your financial situation. If your income increases or unexpected expenses arise, it’s important to inform the IRS promptly to adjust your repayment plan. Neglecting this can lead to flawed agreements and potential defaults.

-

Neglecting to Monitor Your Balance: Keep an eye on your billing plan balance to avoid surprises from accrued interest. Many people overlook this, which can create unexpected financial pressure. Being aware that interest and penalties accumulate can help you manage your dues more effectively.

-

Misunderstanding Agreement Terms: Take the time to thoroughly understand the terms of your installment agreement, including interest rates and penalties. This knowledge is vital to avoid overpaying and ensure compliance with the IRS. Misunderstanding these terms can lead to compliance issues and additional costs.

By being proactive and informed, you can successfully manage your long term payment plan IRS and avoid the common pitfalls that many individuals face. Remember, we’re here to help you every step of the way.

Getting Help: Resources for Managing IRS Long-Term Payment Plans

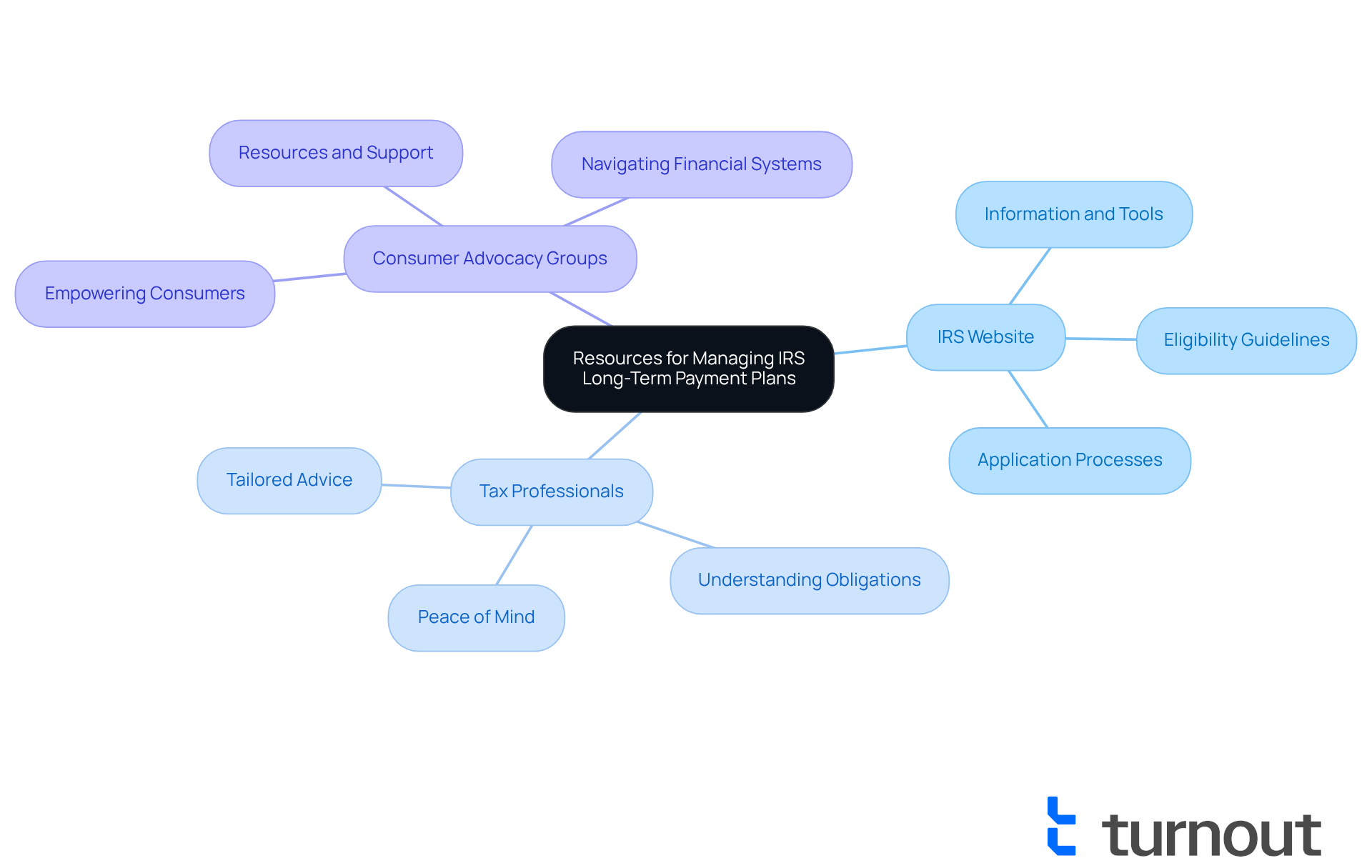

Navigating IRS long-term payment plans can feel overwhelming, but rest assured, there are resources available to help you through this journey:

- IRS Website: The IRS provides a wealth of information and tools to assist you in managing your payment plans effectively. You’ll find detailed guidelines on eligibility and application processes, making it easier to understand your options.

- Tax Professionals: Connecting with a tax professional can offer you tailored advice and support. They can help ensure you fully grasp your options and obligations under IRS regulations, giving you peace of mind.

- Consumer Advocacy Groups: Organizations like Turnout play a vital role in empowering consumers. They provide resources and advocacy to help you navigate the complexities of financial systems, ensuring you access the support necessary to manage your tax obligations effectively.

We understand that seeking help can be daunting. Recent statistics show that consumer satisfaction with IRS support resources has improved significantly. Many individuals report a better understanding of their payment options and increased confidence in managing their tax debts. Advocacy groups have been instrumental in this positive shift, offering essential updates and insights that keep you informed about your rights and available assistance.

Remember, you are not alone in this journey. We're here to help you find the support you need.

Conclusion

Navigating the complexities of IRS long-term payment plans can feel overwhelming, but it doesn’t have to be. These installment agreements offer a structured way to manage tax debts, allowing you to meet your obligations without the weight of financial strain. By understanding the key features, eligibility requirements, and application processes, you can take meaningful steps toward financial recovery.

We understand that dealing with tax obligations can be stressful. That’s why it’s important to highlight the benefits of these plans:

- Affordability

- Flexibility

- The ability to stop aggressive collection actions

Remember, timely payments and open communication with the IRS are crucial to avoiding penalties and staying compliant. You’re not alone in this journey; resources and support are available, from online tools to professional advocacy groups.

Ultimately, managing IRS long-term payment plans is about empowerment and informed decision-making. By leveraging the resources at your disposal and grasping the intricacies of the process, you can navigate your tax obligations with confidence. Taking action now not only brings immediate relief but also sets the stage for a more secure financial future. We're here to help you every step of the way.

Frequently Asked Questions

What is the purpose of Turnout in relation to IRS long-term payment plans?

Turnout aims to simplify the process of establishing long-term payment plans with the IRS by using advanced technology and tailored support to help consumers manage their tax obligations more effectively.

What is an IRS long-term payment plan?

An IRS long-term payment plan, commonly known as an installment agreement, allows individuals to manage their tax obligations over an extended period, typically up to 72 months.

What are the key benefits of an IRS long-term payment plan?

The key benefits include affordability through spreading payments over time, avoidance of aggressive IRS collection actions, and flexibility in tailoring payment amounts to fit one's financial situation.

What is the maximum tax debt allowed to qualify for a long-term payment plan?

To qualify for a long-term payment plan, your total tax debt, including penalties and interest, must be $50,000 or less.

What are the eligibility requirements for an IRS long-term payment plan?

The eligibility requirements include having all required tax returns filed, being able to demonstrate the capability to make consistent monthly payments, and ensuring your total tax debt is within the $50,000 limit.

How can one initiate the process for an IRS long-term payment plan?

You can initiate the Installment Agreement process by calling the IRS or submitting Form 9465. Additionally, immediate approval can be obtained by completing the online application through the Online Payment Agreement (OPA).

What happens if you do not file your tax returns on time?

Failing to file tax returns on time can lead to a penalty of 5% of the tax due for each month the return is overdue, up to a maximum of 25%.

How does Turnout assist consumers in managing their tax responsibilities?

Turnout provides support throughout the repayment process, helping individuals feel confident and informed about their tax responsibilities and ensuring they remain proactive in their financial journey.

What should individuals do if they cannot pay their full tax amount?

Individuals are encouraged to file their returns on time, even if they cannot pay in full, to avoid additional penalties and interest.