Introduction

Navigating the complexities of state taxes can feel overwhelming, especially for individuals with disabilities in Pennsylvania. We understand that unique financial challenges often intersect with state tax obligations, making this journey even more daunting. This article aims to shed light on essential facts about Pennsylvania's tax landscape, highlighting the crucial benefits and resources available to disabled residents.

As tax policies evolve and new relief programs emerge, it’s vital to stay informed - especially when financial stability is at stake. How can you ensure that you’re maximizing your benefits while effectively managing your tax responsibilities in this intricate system? You are not alone in this journey, and we’re here to help you find the answers you need.

Understand Pennsylvania's Income Tax Rates

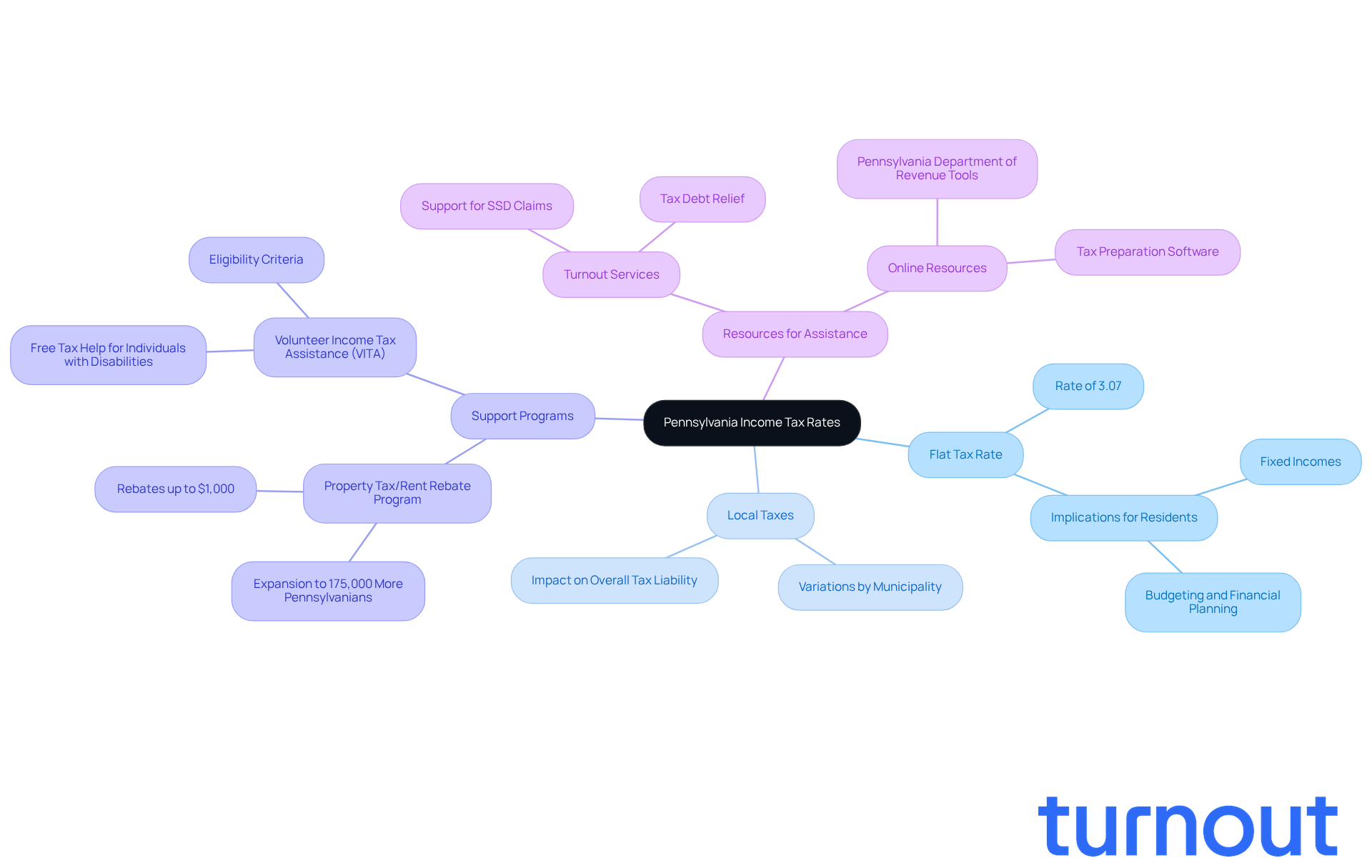

In Pennsylvania, residents are subject to state taxes pa at a flat rate of 3.07%, which applies to everyone, including those with disabilities. This means that no matter how much you earn, you contribute the same percentage of your taxable income. For individuals with disabilities, who often depend on fixed incomes or benefits, understanding this tax structure is crucial for effective budgeting and financial planning.

While this rate is relatively low compared to many other states, it’s important to remember that state taxes pa and additional local taxes may apply based on where you live. This can affect your overall tax liability. We understand that navigating these financial waters can be challenging, but there are resources available to help.

The recent expansion of the Property Tax/Rent Rebate Program is a positive step, allowing nearly 175,000 more Pennsylvanians to qualify for financial support. Eligible individuals can receive up to $1,000 in rebates, which can make a significant difference. Additionally, the Volunteer Income Tax Assistance (VITA) program offers free tax help for people with disabilities, providing a valuable resource during tax season.

Turnout is here to support you, offering tools and services to help you navigate these financial systems, especially for SSD claims and tax debt relief. Their trained nonlawyer advocates and IRS-licensed enrolled agents are ready to assist you. It’s also essential to be aware of the 5% fine incurred for each month a payment is delayed, capped at 25% of the outstanding balance. Turnout's services can help you avoid these penalties, ensuring you stay on track.

Understanding these nuances can empower residents with disabilities to manage their finances more effectively and take advantage of available tax relief programs. Utilizing online resources and tools provided by the Pennsylvania Department of Revenue can further simplify tax management for you. Remember, you are not alone in this journey; we’re here to help.

Explore Local Income Tax Implications in Pennsylvania

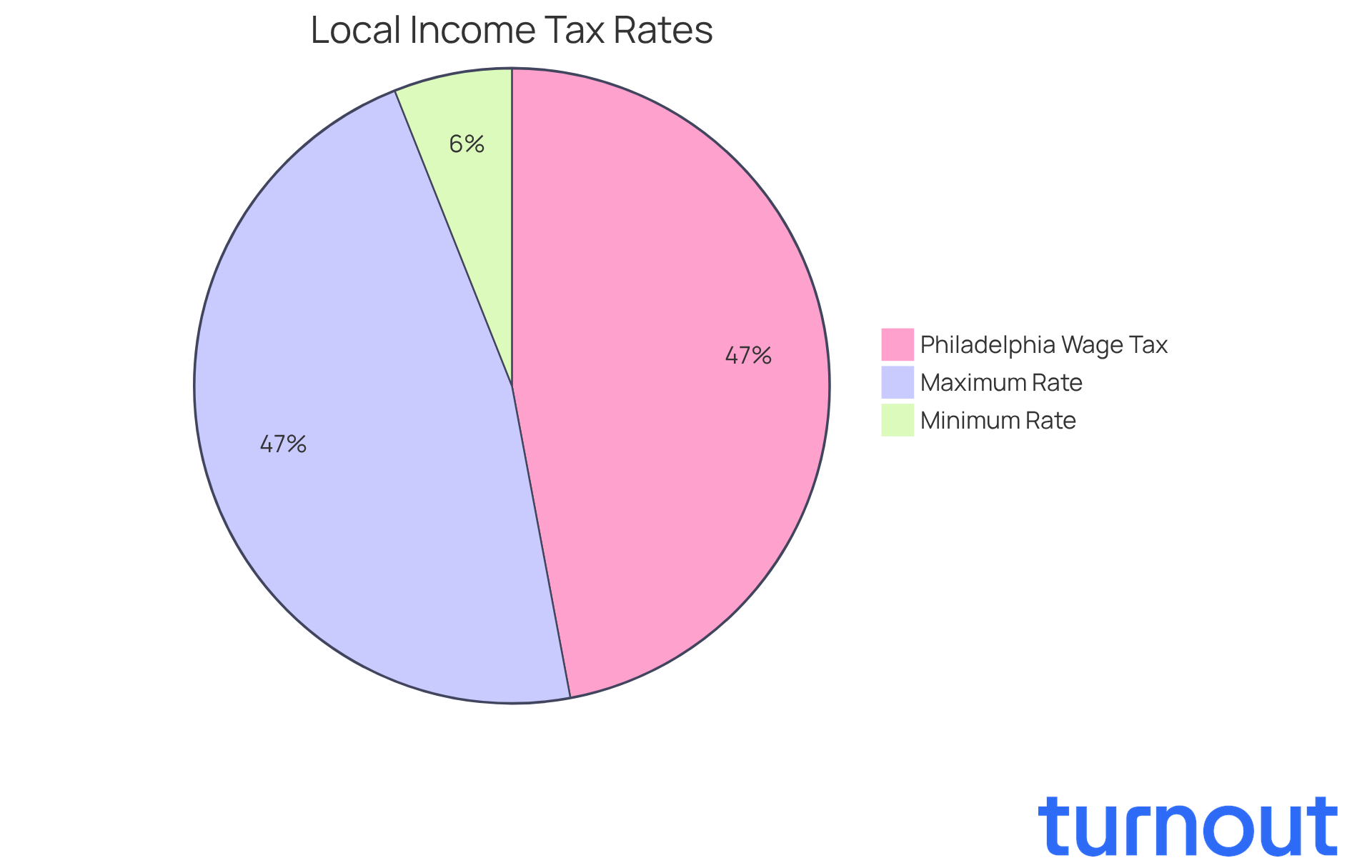

In Pennsylvania, state taxes pa and local income levies can be a heavy burden for individuals with disabilities. The range of 0.5% to 3.9% is applicable to state taxes pa imposed by municipalities. For instance, state taxes pa include Philadelphia's local wage tax, which is set at 3.91% for 2026 and can significantly impact residents with disabilities.

We understand that navigating these local tax rates can be overwhelming. It's essential to know that state taxes pa can vary widely and may include specific exemptions for persons with disabilities. For example, if you qualify for tax forgiveness under PA 40 Schedule SP, you could benefit from a reduced Wage Tax rate of just 1.5%, which may help lower your state taxes pa.

You're not alone in this journey. We encourage you to reach out to local tax authorities to clarify the applicable rates and explore potential exemptions. This could help ease your tax responsibilities and provide some much-needed relief.

Clarify Residency Requirements for Pennsylvania State Tax Filing

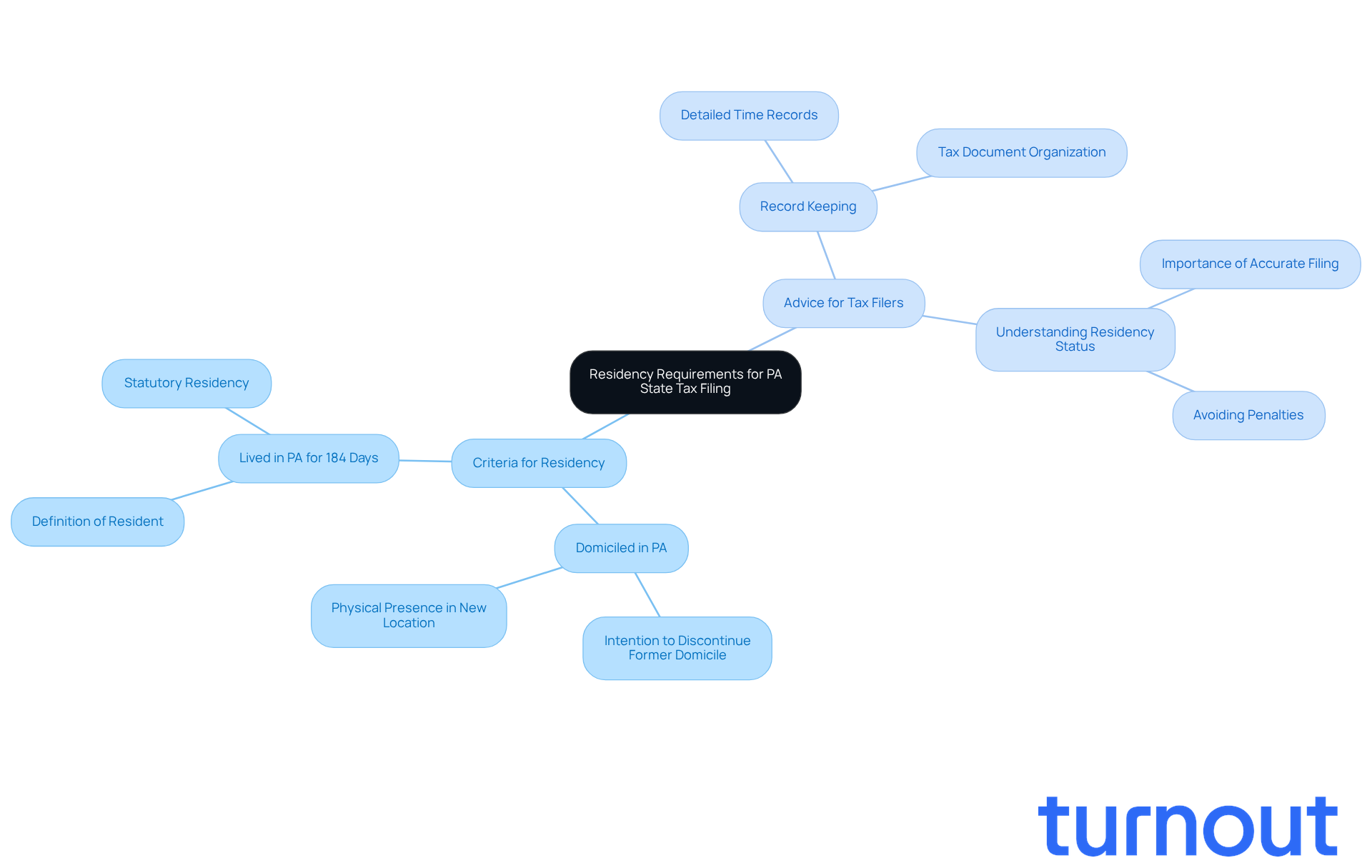

Filing state taxes PA can feel overwhelming, especially when it comes to determining your residency status. We understand that this is a crucial step for many. A resident is someone who is either domiciled in Pennsylvania or has lived in the state for at least 184 days during the tax year.

If you’re a disabled person who moves or travels frequently, it’s common to feel uncertain about meeting these residency requirements. Keeping detailed records of your time spent in Pennsylvania can help ensure you’re on the right track. Remember, understanding your residency status is vital for filing the correct forms for state taxes PA and avoiding any penalties.

You’re not alone in this journey. We’re here to help you navigate these requirements with confidence. Take a moment to reflect on your situation and gather your records. This proactive step can make a significant difference in your tax filing experience.

Identify Common Tax Deductions in Pennsylvania

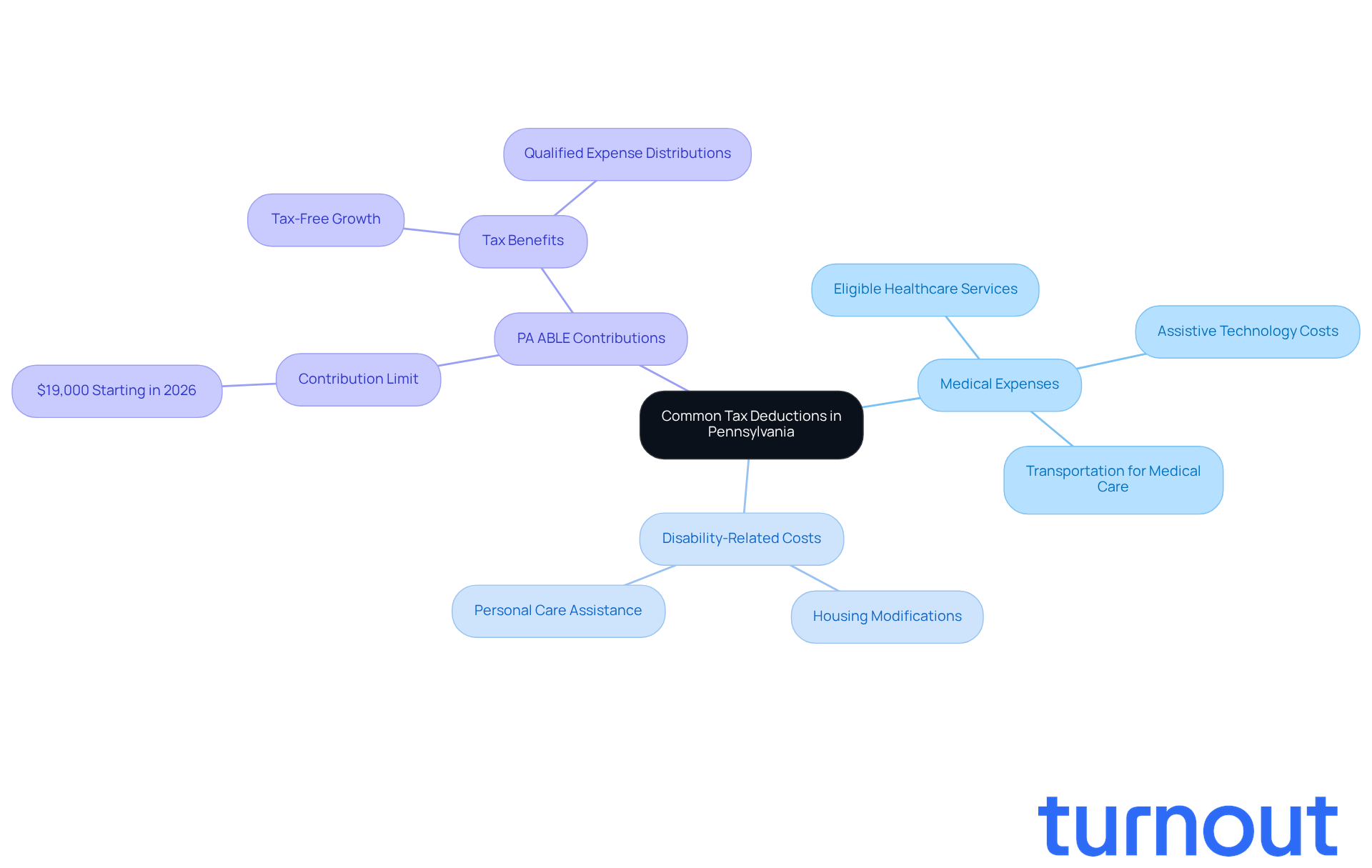

If you’re a disabled person in Pennsylvania, you might be eligible for various tax deductions that can ease your financial burden. These include deductions for medical expenses, disability-related costs, and contributions to PA ABLE accounts. Imagine being able to deduct contributions to a PA ABLE account from your state taxes pa on your taxable income! This not only provides an advantage regarding state taxes pa but also helps you save for essential disability-related expenses.

Starting in 2026, the PA ABLE program will allow participants to contribute up to $19,000 each year. This significant increase can greatly enhance your savings potential. Plus, the maximum standard rebate has risen to $1,000, benefiting over 511,000 seniors and people with disabilities who received rebates totaling more than $314 million last year.

We understand that keeping track of eligible expenses can feel overwhelming. It’s crucial to maintain thorough records of all your healthcare services, assistive technology, and transportation related to medical care. This way, you can maximize your deductions and truly benefit from the available support.

Remember, you’re not alone in this journey. Turnout's trained nonlawyer advocates are here to help you navigate these financial processes. They can assist you in exploring all available deductions, ensuring you enhance your financial stability and access the resources you need.

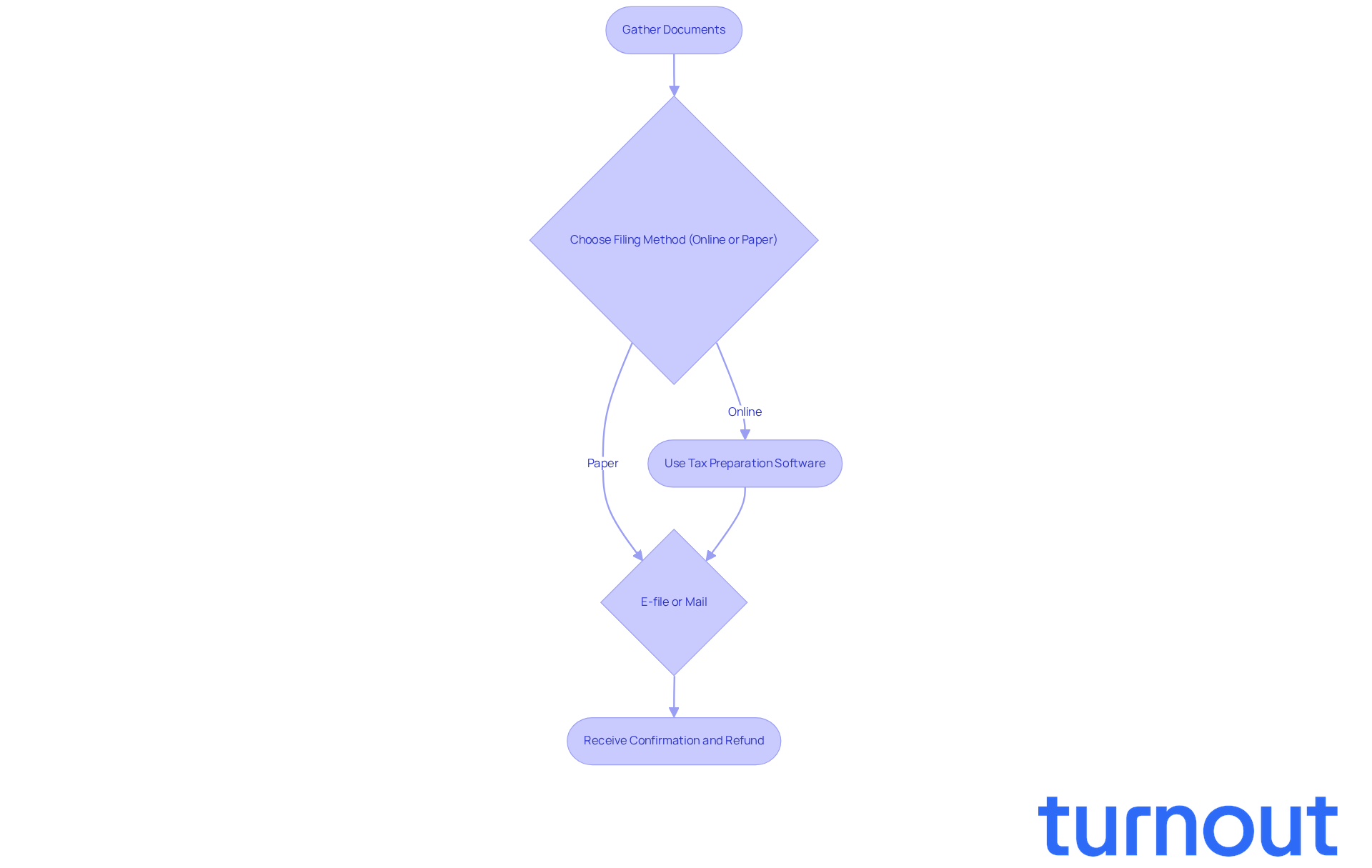

Learn How to File Pennsylvania State Income Tax

Filing your state taxes pa can feel overwhelming, but the myPATH portal makes it easier, especially for persons with disabilities. You can submit your returns online or stick to the traditional paper PA-40 form. If you earn more than $33 in total gross taxable income in 2025, remember that you’ll need to file your Pennsylvania personal income tax return and address your state taxes pa by April 15, 2026.

We understand that gathering all necessary documents can be a hassle. Make sure you have your W-2s, 1099s, and any records of deductions ready. It’s important to note that state taxes pa do not offer a standard deduction or exemption, which might impact the effective tax rate for lower-income residents.

Using tax preparation software can really help simplify the process. It ensures that you accurately claim all eligible deductions and credits. In 2026, many individuals with disabilities are expected to take advantage of e-filing options. These options provide immediate confirmation of successful submissions and quicker refund processing.

E-filing also comes with benefits like automatic calculators that reduce errors, making it easier to navigate the complexities of tax preparation. We know that understanding eligibility for various credits can be challenging, especially when dealing with complex forms. That’s why it’s great to know that Spanish-language resources for tax filing assistance are available, ensuring that everyone feels included in this process.

Remember, you’re not alone in this journey. We’re here to help you every step of the way.

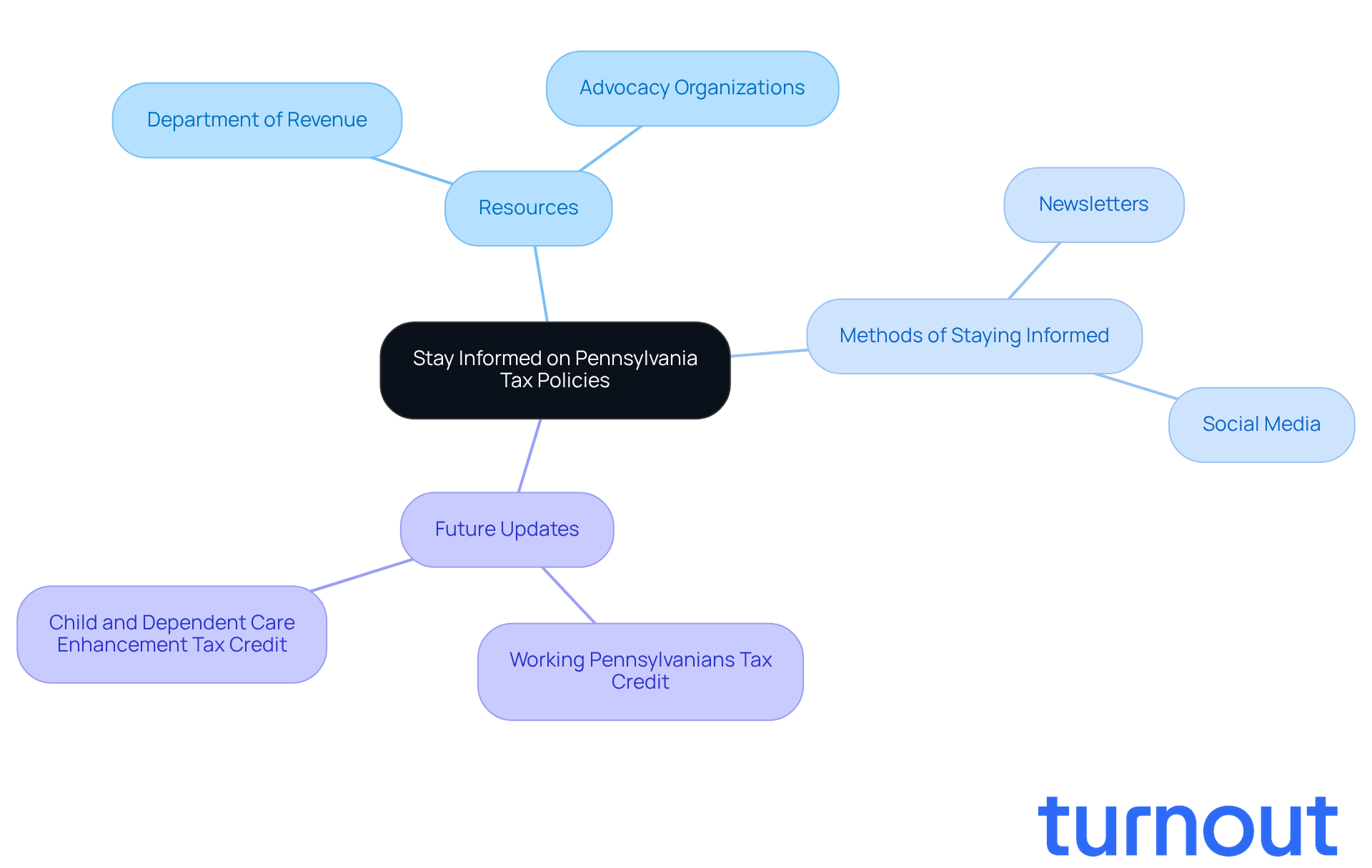

Stay Informed on Pennsylvania Tax Policies

Navigating state taxes pa in Pennsylvania can feel overwhelming, especially with the frequent changes that impact rates, deductions, and credits for those with disabilities. We understand that this can be a challenging journey, but there are resources available to help you along the way.

The Pennsylvania Department of Revenue website is a vital source for official information, providing essential details on tax laws and filing requirements. Additionally, local advocacy organizations are here to support you. They offer valuable advice on how to navigate updates in tax policies. For example, organizations focused on disability rights often share insights and resources tailored to the unique needs of their communities.

Staying informed is crucial, and one way to do this is by subscribing to newsletters from these advocacy groups or following their social media accounts. They frequently post timely updates that could impact your tax obligations. Engaging with tax professionals who specialize in disability-related tax issues can also provide personalized advice, ensuring you remain compliant with the latest regulations.

Looking ahead to 2026, there are notable updates that could benefit you. The expansion of the Working Pennsylvanians Tax Credit offers up to $805 in relief for eligible taxpayers, including those with disabilities. This initiative, along with the Child and Dependent Care Enhancement Tax Credit, which can provide up to $2,100 to qualifying families, highlights the importance of being aware of available credits and deductions.

By utilizing these resources and remaining proactive, you can navigate the complexities of state taxes pa more effectively. Remember, you are not alone in this journey; we're here to help.

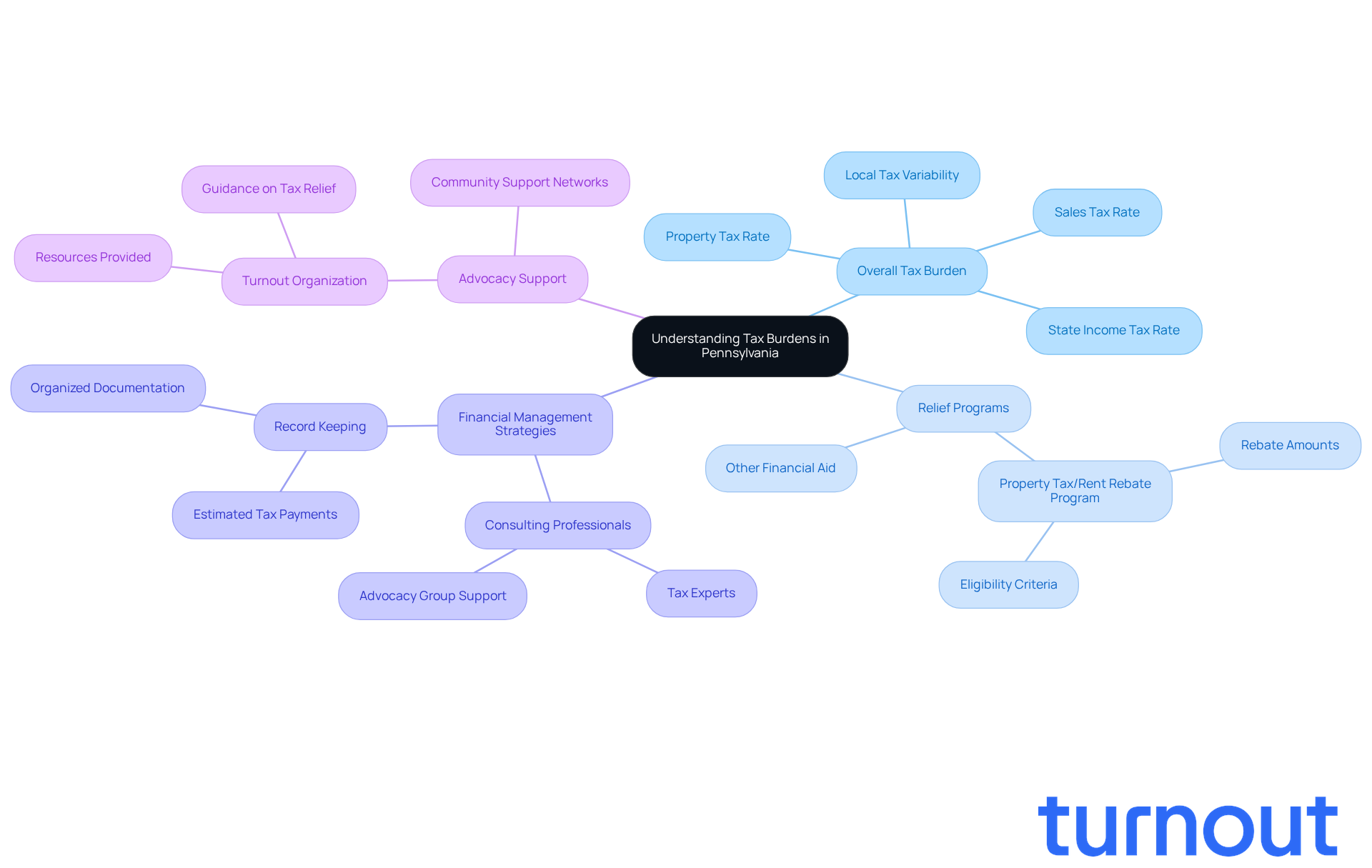

Understand Tax Burdens in Pennsylvania

State taxes pa contribute to Pennsylvania ranking among the states with the highest overall tax burdens, which can significantly impact those with disabilities. We understand that the combination of state taxes pa, local taxes, and property taxes can create financial strain. It’s essential for disabled residents to grasp their tax responsibilities and explore available relief options. For instance, the Property Tax/Rent Rebate Program offers financial aid to seniors and persons with disabilities, potentially providing rebates of up to $1,000 based on earnings.

Effective financial management strategies can help ease these burdens. We encourage disabled individuals to keep organized records of their income and expenses. This practice can simplify tax preparation and ensure compliance. Consulting with tax professionals can also offer valuable insights into maximizing deductions and credits, especially for those with complex financial situations.

Advocacy groups, like Turnout, play a vital role in supporting residents with disabilities. They provide resources and guidance on navigating the tax landscape. Turnout’s services include assistance with understanding service fees and government fees related to financial assistance, ensuring clients are informed about any costs involved. Additionally, they offer support for SSD claims and tax relief processes through trained nonlawyer advocates and IRS-licensed enrolled agents.

Engaging with community support networks can enhance understanding and compliance, making the tax journey less daunting. As Pennsylvania's tax landscape evolves in 2026, staying informed about state taxes pa changes and utilizing available resources will empower disabled individuals to manage their tax obligations effectively. Remember, you are not alone in this journey. Notably, Pennsylvania ranks 36th overall on the 2026 State Tax Competitiveness Index, highlighting the importance of understanding state taxes pa.

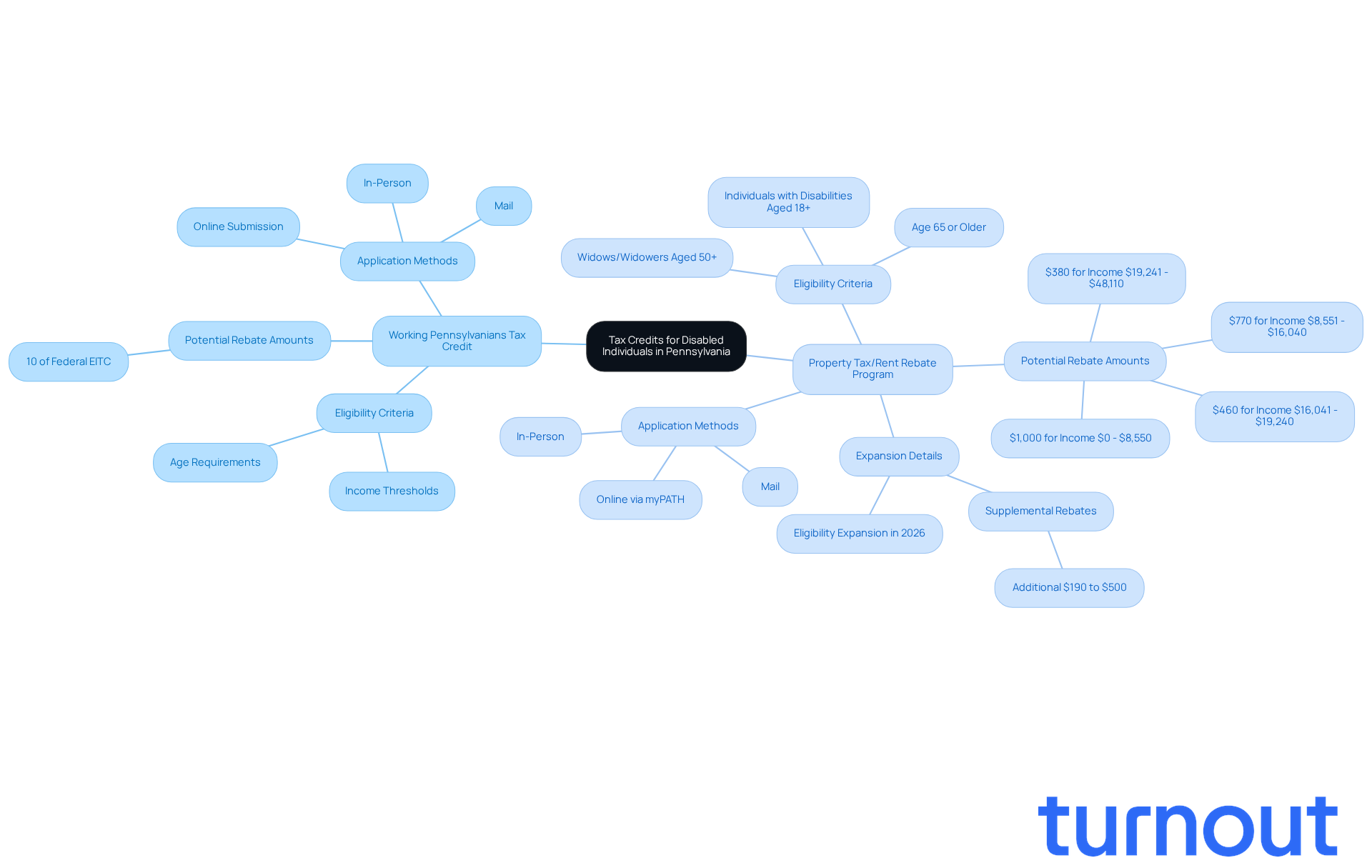

Discover Available Tax Credits in Pennsylvania

If you're a disabled person in Pennsylvania, you might be feeling the weight of financial pressures. Thankfully, there are significant credits for state taxes pa available to help lighten that load, such as the Working Pennsylvanians Tax Credit and the Property Tax/Rent Rebate program. These credits are designed to provide relief, especially for those who rely on fixed incomes.

Exciting news is on the horizon! In 2026, the Property Tax/Rent Rebate program will expand eligibility, allowing nearly 175,000 more Pennsylvanians to qualify. If you're 65 or older, a widow or widower aged 50 and above, or a person with a disability aged 18 and above, you could receive rebates ranging from $380 to $1,000, depending on your earnings. For instance, if you earn between $0 and $8,550, you may qualify for the maximum rebate of $1,000. Even if your earnings fall between $19,241 and $48,110, you can still receive up to $380.

The Working Pennsylvanians Tax Credit is another way to support disabled residents and help alleviate state taxes pa. It offers a tax credit equal to 10% of the federal Earned Income Tax Credit (EITC), which can provide significant financial relief. To qualify, you'll need to meet specific income thresholds and other eligibility criteria.

Navigating these benefits can feel overwhelming, but Turnout is here to help. They offer tools and services that simplify access to financial assistance. With trained nonlawyer advocates and IRS-licensed enrolled agents, Turnout can assist you with SSD claims and tax debt relief, ensuring you can apply for these credits without needing legal representation.

It's crucial to understand these credits and apply during tax season to maximize your potential savings on state taxes pa. You can submit your applications online through myPATH without creating an account, by mail, or in person, making it accessible for everyone. Plus, automated notifications will keep you informed about your application status, enhancing your experience.

Real stories from residents with disabilities highlight the positive impact of these credits. Many have reported receiving substantial rebates that help cover essential living expenses, allowing them to maintain their independence and stability. By leveraging these tax credits, you can navigate financial challenges more effectively. Remember, you're not alone in this journey, and we're here to help you every step of the way.

Examine Tax Filing for Non-Residents in Pennsylvania

If you're a non-resident earning income in Pennsylvania, it's important to know about the PA-40NR form. This form means you’ll be subject to state tax on the money you make here. It covers various income sources, like wages, rental income, and royalties.

We understand that for individuals with disabilities working in Pennsylvania while living in another state, these filing obligations can feel overwhelming. It’s crucial to grasp these requirements to avoid any potential penalties. In 2026, many individuals with disabilities are navigating these tax responsibilities, which highlights the need for awareness and compliance.

Consulting with a tax professional can be a great step. They can offer personalized guidance, ensuring that you complete all necessary forms accurately and on time. The PA-40NR form requires detailed reporting of income earned in Pennsylvania, and it’s essential to be aware of any deductions or credits related to state taxes that might be available to you.

By staying informed and proactive, you can effectively manage your tax responsibilities and maximize your benefits. Remember, you’re not alone in this journey; we’re here to help!

Consult Tax Experts for Personalized Guidance in Pennsylvania

Navigating state taxes pa can be challenging, especially for disabled individuals in Pennsylvania. We understand that seeking help can feel overwhelming. That's why consulting with a tax expert can be a game-changer. Turnout connects you with trained nonlawyer advocates and IRS-licensed enrolled agents who specialize in assisting clients with government-related processes, including tax debt relief.

These experts offer tailored guidance on deductions, credits, and filing strategies that fit your unique circumstances. For instance, in 2026, if your income falls between $0 and $8,550, you could receive a maximum rebate of $1,500 through the Property Tax/Rent Rebate Program. If you earn between $8,551 and $16,040, you may qualify for up to $1,155.

Many organizations and advocacy groups, including the Department of Revenue, are here to help connect you with qualified tax professionals who truly understand your needs and challenges related to state taxes pa. Personalized tax guidance not only simplifies the filing process but also ensures that you receive the full range of benefits available to you. Rebates can range from $380 to $1,000, significantly enhancing your financial well-being.

Remember, you are not alone in this journey. We're here to help you navigate these complexities and ensure you get the support you deserve.

Conclusion

Understanding state taxes in Pennsylvania is crucial for individuals with disabilities, as it plays a significant role in their financial stability and planning. We recognize that navigating this landscape can feel overwhelming. That’s why it’s important to be informed about the flat income tax rate, local tax implications, and the deductions and credits available to ease financial burdens.

The flat income tax rate of 3.07% is a key point to consider, along with the variations in local tax rates. There are also potential rebates through various programs that can make a real difference. It’s common to feel uncertain about residency requirements for tax filing or eligibility for deductions related to disability. Consulting with tax experts can provide personalized guidance, empowering you to manage your tax obligations effectively.

Staying informed and proactive about Pennsylvania's tax landscape is essential. Engaging with advocacy groups and utilizing available resources can lead to better financial outcomes. Remember, you are not alone in this journey. By taking these steps, individuals with disabilities can navigate the often complex tax system, ensuring they receive the support and relief they truly deserve.

Frequently Asked Questions

What is the income tax rate in Pennsylvania for residents?

Pennsylvania has a flat income tax rate of 3.07% that applies to all residents, including those with disabilities.

How does the flat tax rate affect individuals with disabilities?

The flat tax rate means that individuals with disabilities contribute the same percentage of their taxable income as everyone else, which is important for budgeting and financial planning, especially for those on fixed incomes.

Are there additional local taxes that may apply in Pennsylvania?

Yes, in addition to the state tax, local income taxes can range from 0.5% to 3.9%, depending on the municipality where you live.

What is the Property Tax/Rent Rebate Program in Pennsylvania?

The Property Tax/Rent Rebate Program has been expanded to allow nearly 175,000 more Pennsylvanians to qualify for financial support, with eligible individuals receiving up to $1,000 in rebates.

What resources are available for individuals with disabilities during tax season?

The Volunteer Income Tax Assistance (VITA) program offers free tax help for people with disabilities. Additionally, organizations like Turnout provide tools and services for navigating tax systems and SSD claims.

What penalties are associated with delayed tax payments in Pennsylvania?

There is a 5% fine for each month a payment is delayed, capped at 25% of the outstanding balance.

How can residents with disabilities manage their tax responsibilities more effectively?

Residents can utilize online resources and tools provided by the Pennsylvania Department of Revenue, and they are encouraged to reach out to local tax authorities for clarification on applicable rates and potential exemptions.

What are the residency requirements for filing state taxes in Pennsylvania?

A resident is defined as someone who is either domiciled in Pennsylvania or has lived in the state for at least 184 days during the tax year.

What should individuals do if they frequently move or travel?

Keeping detailed records of time spent in Pennsylvania can help ensure compliance with residency requirements for tax filing.

How can individuals get assistance with understanding their residency status?

Individuals can seek help from organizations and resources that provide guidance on navigating residency requirements and tax filing.