Introduction

Navigating the complexities of income tax can feel overwhelming, especially for individuals with disabilities. We understand that the process can be daunting, but knowing about the available deductions can provide significant financial relief. This article highlights ten essential tax deductions specifically designed for disabled taxpayers. These insights into credits and benefits can truly ease financial burdens.

It's common to overlook many opportunities that could help. So, how can eligible individuals ensure they’re maximizing their benefits and avoiding costly mistakes? Let’s explore these options together, because you are not alone in this journey.

Credit for the Elderly or Disabled

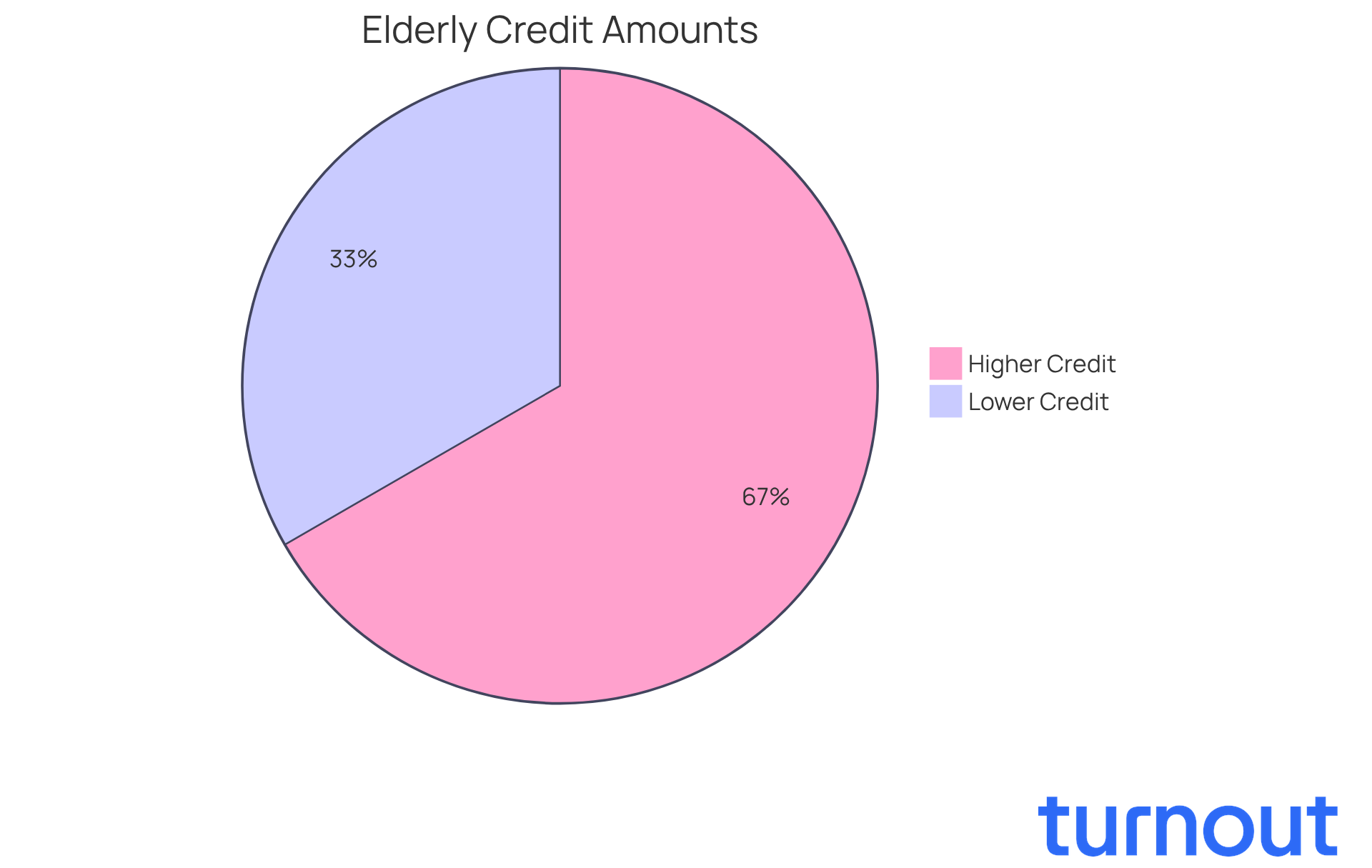

Are you or someone you know aged 65 or older, or perhaps living with a permanent disability? If so, the Credit for the Elderly or Disabled could be a lifeline for you. For the 2025 tax year, this credit ranges from $3,750 to $7,500, depending on your income level.

To qualify, you need to have received taxable disability income during the year. This credit isn’t just a number; it can significantly ease your tax burden, providing essential financial support when it’s needed most. Imagine being able to keep more of your hard-earned income, allowing you to manage your living expenses more effectively.

With an estimated 2.5 million people eligible for this credit in 2025, it’s clear that it plays a crucial role in enhancing the financial stability of many seniors and disabled individuals. You are not alone in this journey, and there are resources available to help you achieve greater economic security.

We understand that navigating financial assistance can be overwhelming, but this credit is here to support you. Don’t hesitate to explore this opportunity - it could make a meaningful difference in your life.

Earned Income Tax Credit (EITC) for Disabled Workers

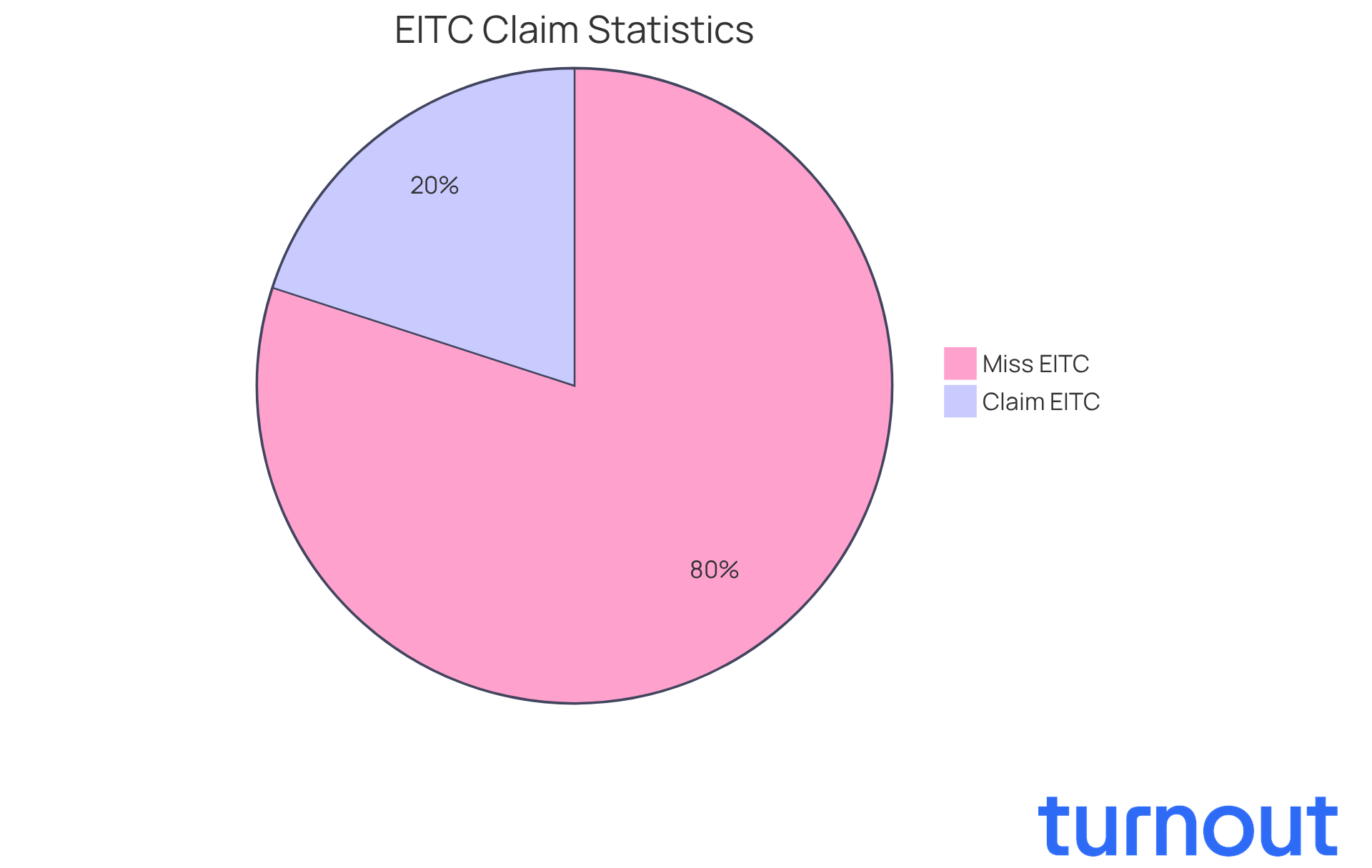

The Earned Income Tax Credit (EITC) is more than just a tax benefit; it’s a vital financial lifeline for many low- to moderate-income workers, including those with disabilities. For the 2025 tax year, eligible individuals can claim a credit of up to $8,046. This can significantly boost their financial stability, providing much-needed relief.

It’s important to note that certain disability payments may qualify as earned income, allowing recipients to benefit from this credit. However, many eligible individuals overlook this opportunity. To claim the EITC, you must submit a tax return. Missing out on this could mean losing out on substantial financial assistance.

In 2023, around 23 million workers and families received the EITC, yet one in five eligible taxpayers did not claim it. We understand that navigating these processes can be overwhelming, particularly for those with disabilities who are affected by disabled deductions on income tax. This highlights the need for awareness and action regarding eligibility for this valuable assistance.

At Turnout, we’re committed to making access to government assistance and financial support easier for everyone, including help with SSD claims and tax debt relief. By working with trained nonlawyer advocates, we help clients understand their eligibility for the EITC and other financial assistance programs. Remember, you are not alone in this journey, and we’re here to help ensure you don’t miss out on the benefits you deserve.

Medical Expense Deduction for Disability-Related Costs

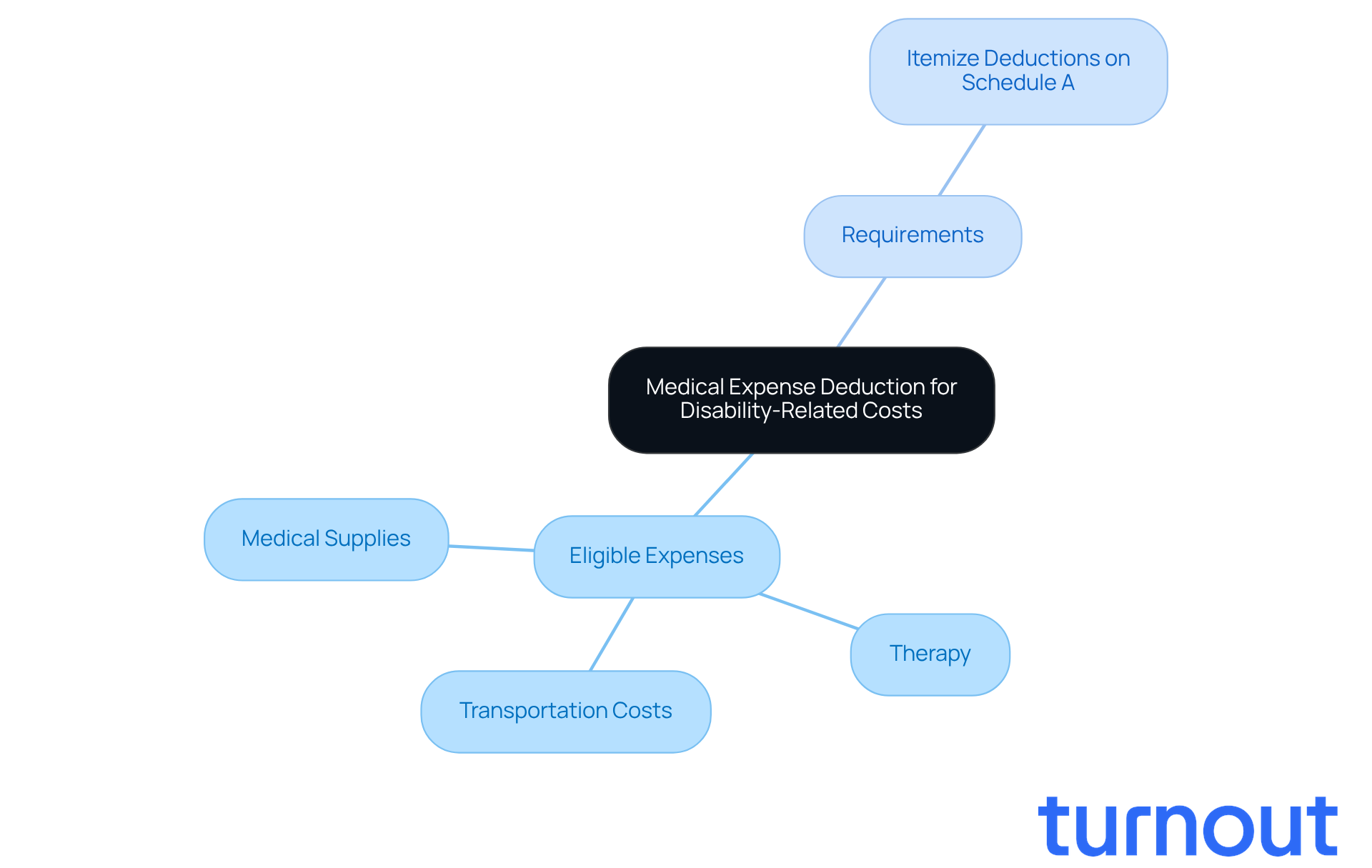

We understand that managing medical expenses can be overwhelming. Taxpayers have the opportunity to subtract medical costs that exceed 7.5% of their adjusted gross income (AGI), as well as utilize disabled deductions on income tax. This includes essential expenses for the diagnosis, treatment, and prevention of disabilities, potentially impacting disabled deductions on income tax.

Eligible expenses can encompass a variety of needs, such as:

- Medical supplies

- Therapy

- Transportation costs related to your medical appointments

It’s common to feel uncertain about what qualifies, but knowing these details can help ease some of that stress.

To benefit from the disabled deductions on income tax, remember that you must itemize your deductions on Schedule A of your tax return. We're here to help you navigate this process and ensure you get the support you deserve.

ABLE Accounts for Tax-Advantaged Savings

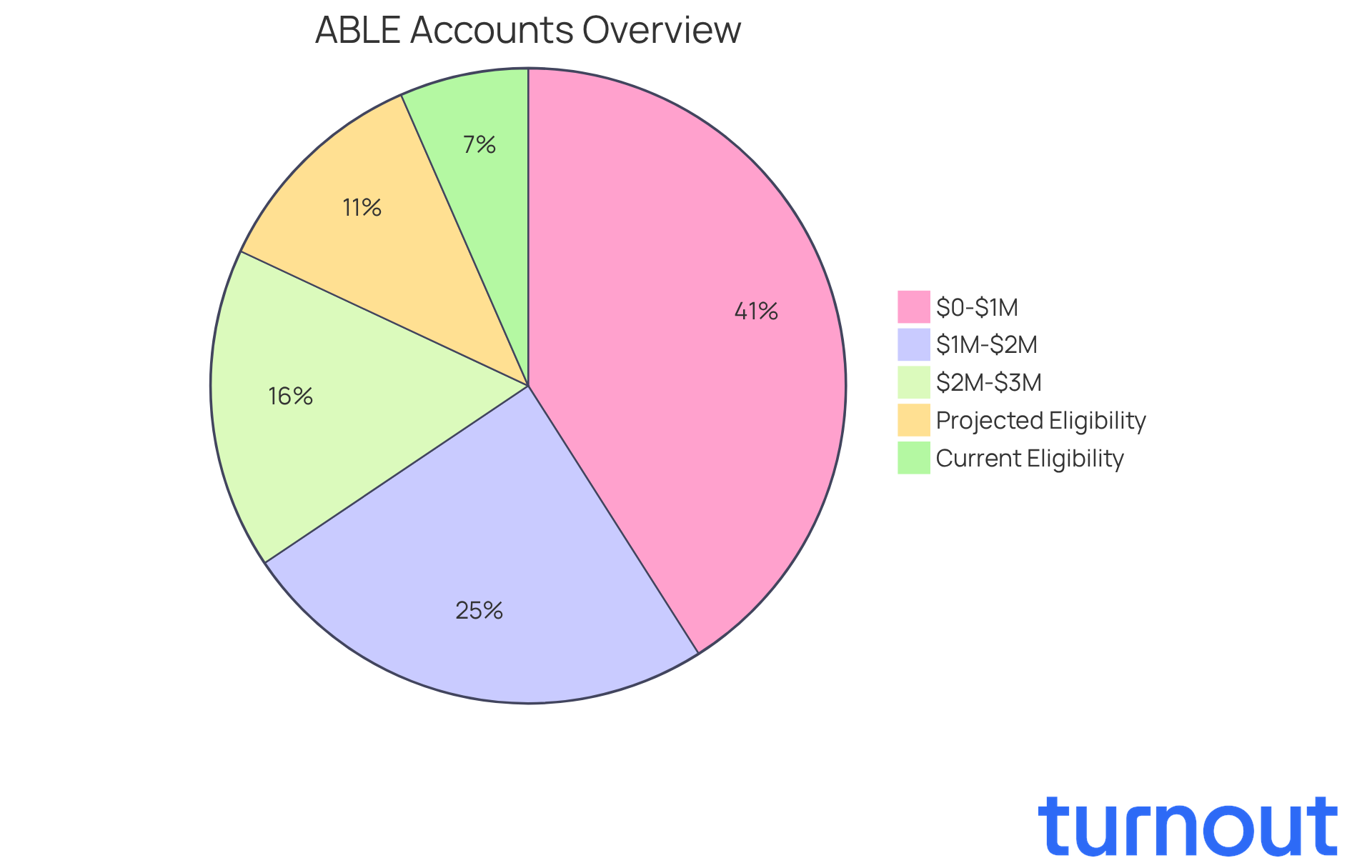

ABLE accounts are a lifeline for people with disabilities, allowing them to save money while keeping their essential government benefits intact. In 2025, individuals can contribute up to $19,000 each year to their ABLE accounts. If you're employed, you might even be able to add more based on your earnings. The best part? Funds in these accounts grow tax-free and can be withdrawn without penalties when used for qualified disability expenses like education, housing, and healthcare.

Starting January 1, 2026, the eligibility age for ABLE accounts will expand from 26 to 46. This change could increase the number of qualified individuals from 8 million to 14 million. It’s especially beneficial for adults who acquire disabilities later in life due to accidents or chronic illnesses. We understand that this can be a challenging transition, and we're here to help.

You can save as much as $100,000 in your ABLE account without jeopardizing your Supplemental Security Income (SSI) and Medicaid services. Plus, contributions to these accounts qualify for the Saver's Credit, offering a tax credit for lower-income workers. This is a fantastic way to encourage savings and financial stability.

Turnout plays a vital role in simplifying access to these government benefits. They provide guidance and support through trained nonlawyer advocates and IRS-licensed enrolled agents, helping you navigate the complexities of SSD claims and tax relief without needing legal representation. Many have successfully used ABLE accounts to manage essential costs, enhancing their financial independence and quality of life.

As of September 2025, there were 223,182 ABLE accounts open, collectively holding nearly $2.87 billion in assets. This reflects a growing awareness and utilization of this valuable financial tool. Remember, you are not alone in this journey. Together, we can explore the possibilities that ABLE accounts offer.

Impairment-Related Work Expenses Deduction

Impairment-Related Work Expenses (IRWEs) are crucial costs that individuals with disabilities face to help them in their employment journey. These expenses can include:

- Specialized equipment

- Transportation modifications

- Attendant care services

We understand that keeping track of these costs can feel overwhelming, but it’s essential to maintain comprehensive records that demonstrate how these expenses support your work. This documentation might consist of receipts, invoices, and clear explanations of how each cost directly relates to your employment needs.

Claiming IRWEs can significantly lower your gross income, which in turn reduces your overall tax liability. For many, this has been a game-changer. In 2025, numerous individuals successfully claimed IRWEs, showcasing their vital role in achieving financial stability while working. The IRS continues to recognize disabled deductions on income tax, which provide a crucial financial lifeline for disabled workers navigating the complexities of employment.

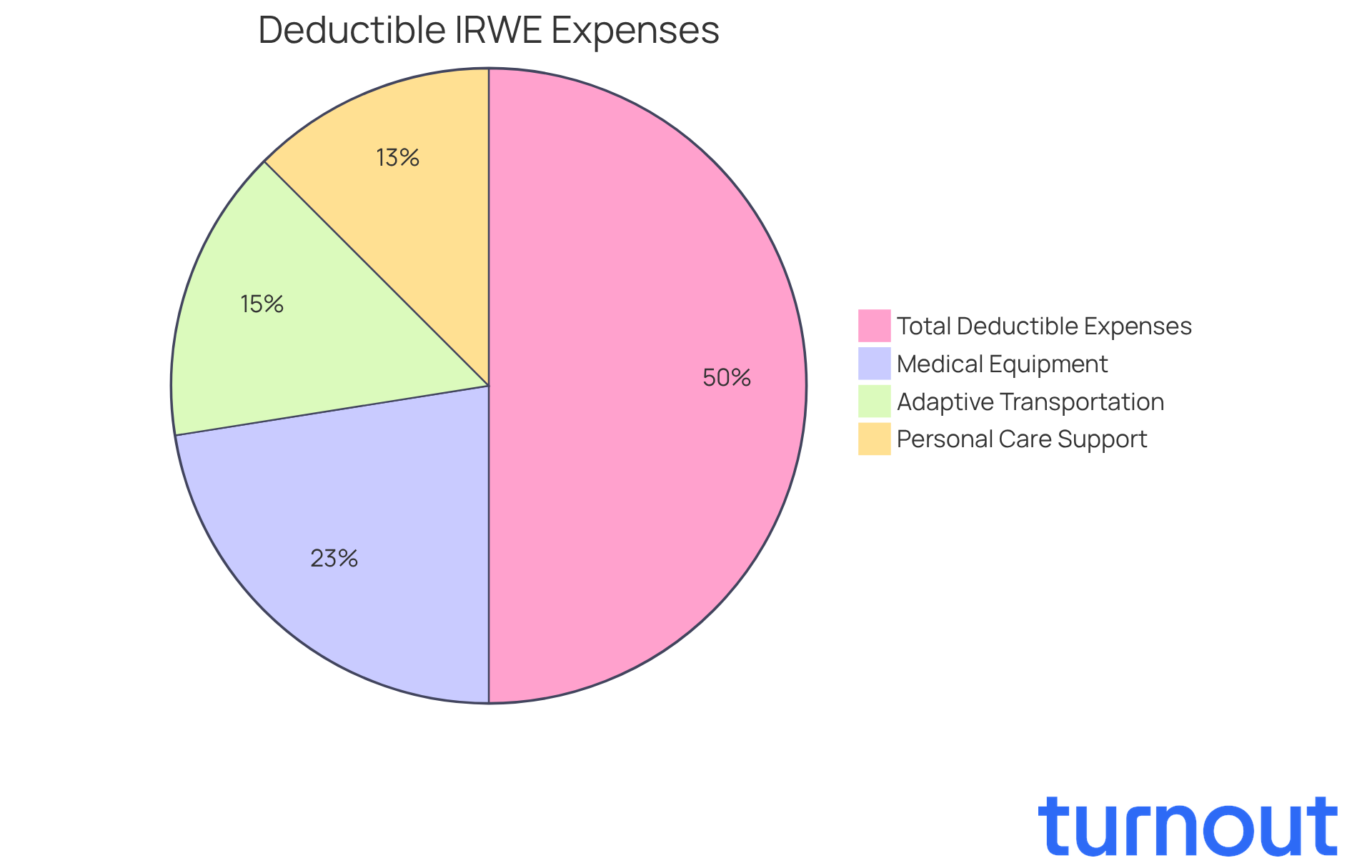

Consider the potential benefits of successful IRWE claims: individuals have reported deductions for costs like:

- $450 for medical equipment

- $300 for adaptive transportation

- $250 for personal care support

This totals $1,000 in deductible expenses. This not only leads to tax savings but also empowers individuals to pursue their professional aspirations with greater confidence and agency.

You are not alone in this journey. We’re here to help you navigate these options and ensure you can make the most of the resources available to you.

Additional Standard Deduction for Blind Taxpayers

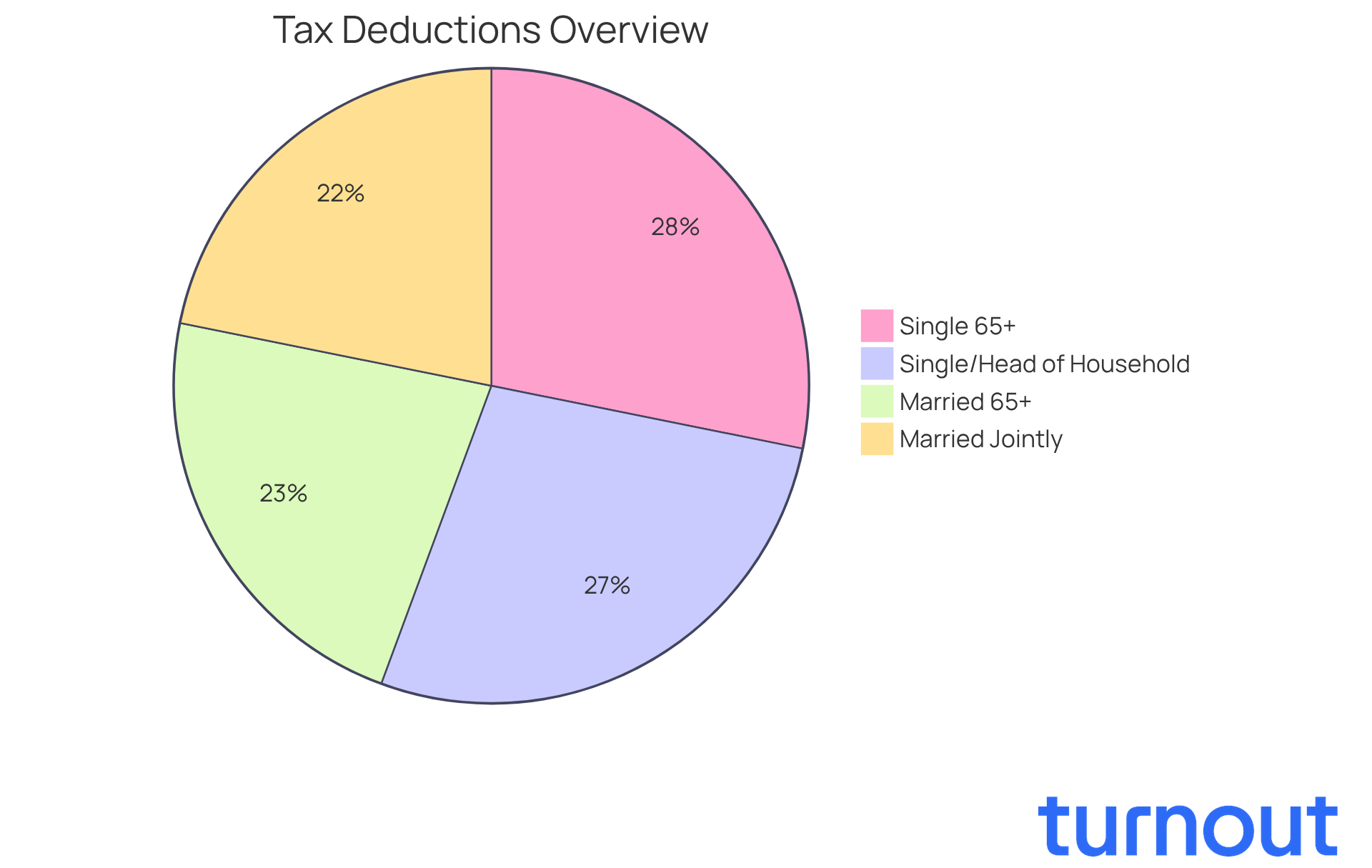

If you're navigating the complexities of taxes as a blind taxpayer, we want you to know that there’s support available. For the 2025 tax year, you can claim an additional standard deduction of $1,950 if you’re filing as single or head of household. If you’re married and filing jointly, that extra deduction is $1,550.

It’s heartening to note that married couples aged 65 and older filing jointly will see an increase in this extra deduction from $1,550 to $1,600 for each qualifying spouse. This adjustment is designed to provide you with some financial relief, especially if you face additional costs due to blindness.

Moreover, if you’re aged 65 or older or blind, you qualify for a larger standard deduction of an extra $2,000 if you’re a single filer or head of household. To take advantage of the disabled deductions on income tax, you just need to indicate your blindness status on your tax return.

As tax expert Rocky Mengle wisely points out, "You can subtract a larger Standard Deduction from your adjusted gross income if you meet the legal definition of being blind." We understand that tax season can be overwhelming, so it’s advisable to consult a tax professional. They can help ensure you maximize your deductions and navigate this process with ease. Remember, you’re not alone in this journey.

Child and Dependent Care Credit for Caregivers

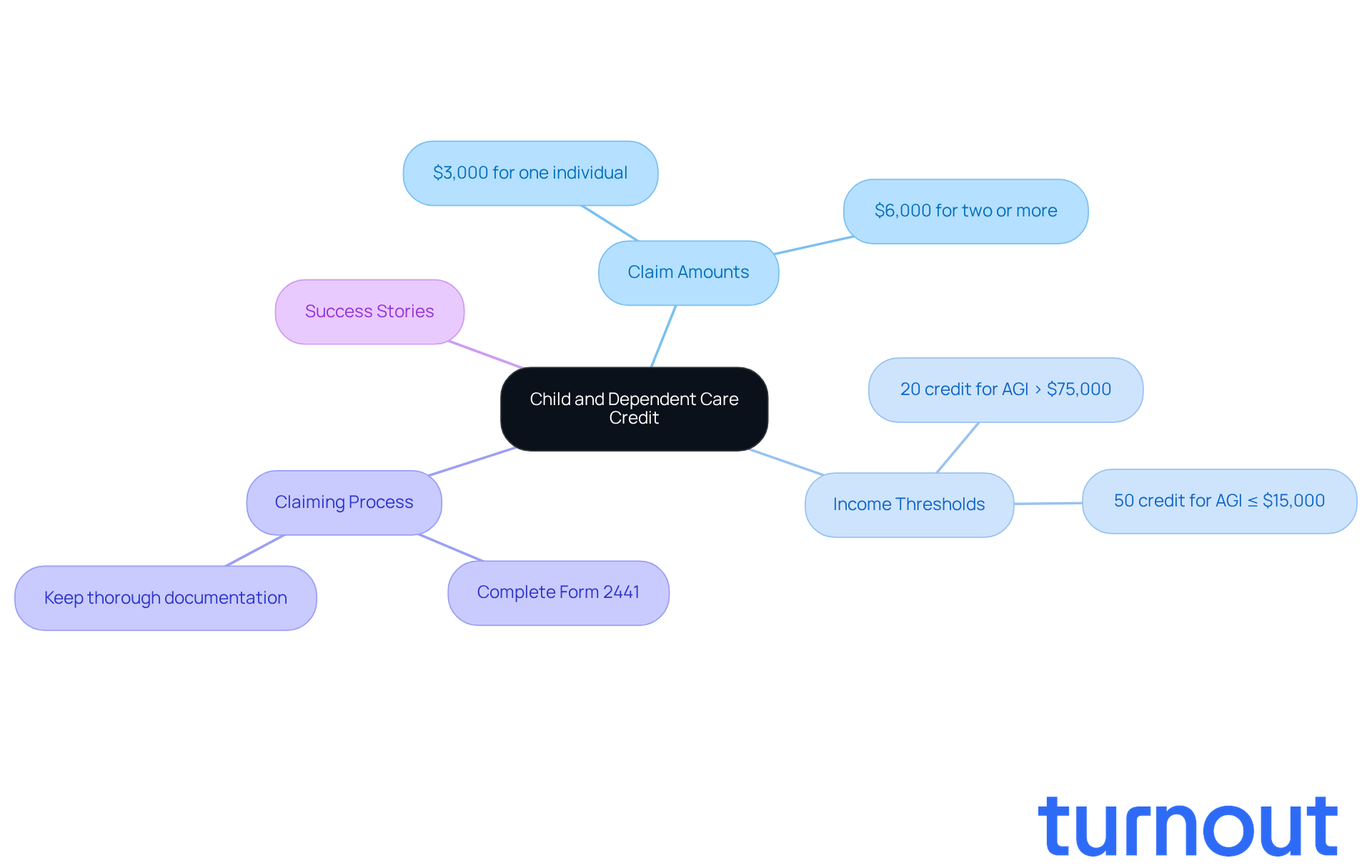

The Child and Dependent Care Credit offers vital financial support for caregivers, allowing them to claim a credit for costs related to the care of a qualifying person, such as a disabled child or spouse. For the 2025 tax year, caregivers can claim up to $3,000 for one qualifying individual or $6,000 for two or more. This credit is essential as it helps ease the financial burden of care, enabling caregivers to keep their jobs or explore new opportunities.

We understand that managing caregiving costs can be overwhelming. In 2025, taxpayers with an adjusted gross income (AGI) of $15,000 or less can receive a maximum credit of 50%, which gradually decreases to 20% for those with an AGI over $75,000. This structure ensures that lower-income families benefit more significantly from the credit, especially since many family caregivers spend an average of over $7,000 each year on caregiving expenses.

To claim the Child and Dependent Care Credit, caregivers need to complete Form 2441 and file it with their federal income tax return. It's important to keep thorough documentation of all caregiving costs, including invoices for childcare, medical devices, and home modifications. These records can be crucial in maximizing your potential tax benefits.

Many caregivers have shared their success stories about claiming the Child and Dependent Care Credit to lighten their financial load. Families have reported receiving credits that significantly lower their tax liabilities, allowing them to invest more in their loved ones' care. As the landscape of caregiver tax credits evolves, staying informed about these benefits can empower you to manage your financial responsibilities more effectively. Remember, you are not alone in this journey; we're here to help.

Deduction for Home Accessibility Improvements

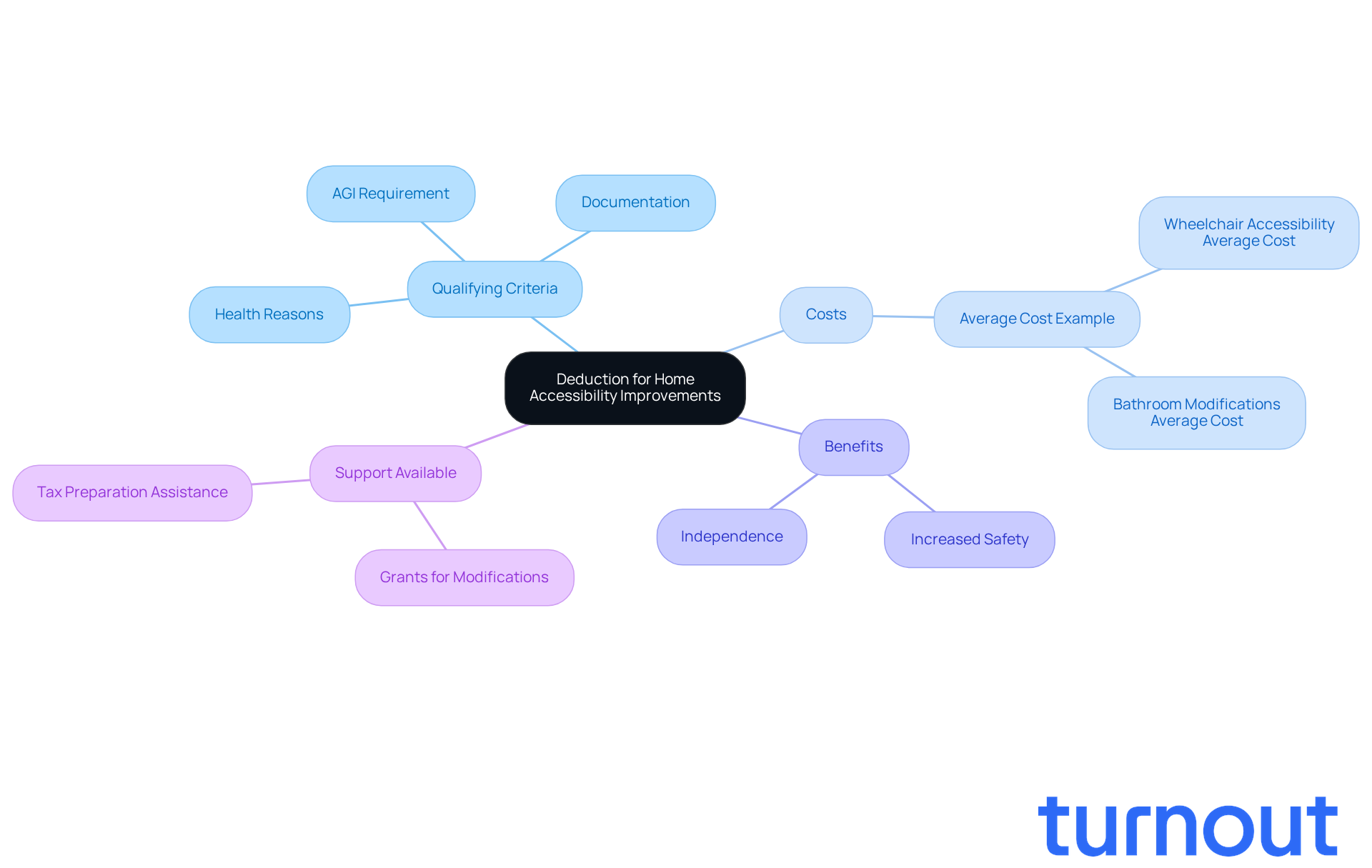

Home enhancements made for health reasons, like improving wheelchair accessibility, can qualify for disabled deductions on income tax as medical costs on your tax return. We understand that navigating these financial aspects can be overwhelming, but there’s good news! To qualify for disabled deductions on income tax, the modifications must primarily assist the person with a disability and be thoroughly documented.

It's important to note that the total costs must exceed 7.5% of your adjusted gross income (AGI) to qualify for disabled deductions on income tax. This can lead to significant reductions in your taxable income through disabled deductions on income tax, offering essential financial relief for necessary modifications. For instance, the average cost to make a home wheelchair accessible is around $4,348, which can be fully deductible if it meets IRS criteria.

Many individuals who have made such enhancements report increased safety and independence in their living spaces, which may also allow them to benefit from disabled deductions on income tax. This highlights the dual advantages of these changes-both financial and personal.

We’re here to assist you in navigating these processes. Understanding the documentation required can help you maximize your deductions and access the financial assistance available to you. Our trained nonlawyer advocates and IRS-licensed enrolled agents are ready to support you in claiming these deductions effectively. Remember, you are not alone in this journey.

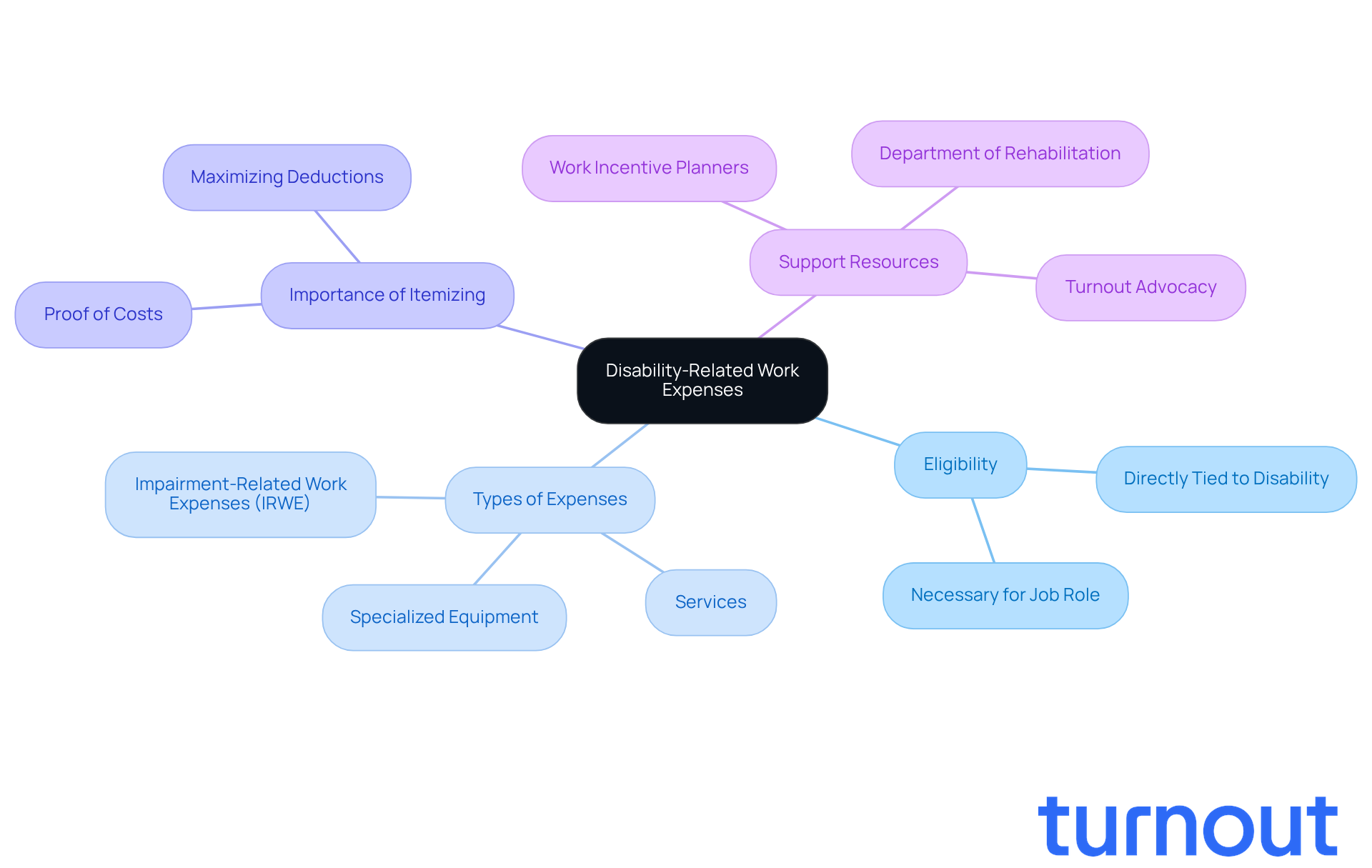

Deduction for Disability-Related Work Expenses

If you have a disability, you might be eligible for disabled deductions on income tax for certain costs related to your work, like specialized equipment or services that are essential for your job. These expenses must be directly tied to your disability and necessary for your role in order to qualify for disabled deductions on income tax. To benefit from the disabled deductions on income tax, it’s important to itemize your deductions and keep proof of the costs you’ve incurred.

Understanding disabled deductions on income tax is crucial for effective financial planning. They not only provide financial relief through disabled deductions on income tax but also promote independence and self-sufficiency for individuals with disabilities. For instance, disabled deductions on income tax include impairment-related work expenses (IRWE), which allow you to exclude specific disability-related costs from your income assessments. This can help you maintain your eligibility for assistance while you’re employed. In fact, recent estimates show that a significant number of individuals with disabilities are taking advantage of disabled deductions on income tax in 2025, highlighting a growing awareness of the tax benefits available.

Turnout plays a vital role in helping individuals navigate these complexities. By connecting clients with trained nonlawyer advocates, Turnout ensures that you understand your rights and options regarding SSD claims and tax relief. As tax regulations evolve, staying informed about the latest disabled deductions on income tax related to job costs is essential. Engaging with resources like Work Incentive Planners can provide personalized guidance, helping you maximize your benefits while managing the intricacies of tax laws. Remember, as the SSA states, "Impairment-related work expenses are crucial for individuals to retain their employment and benefits."

We’re here to help you through this journey. You are not alone in navigating these challenges.

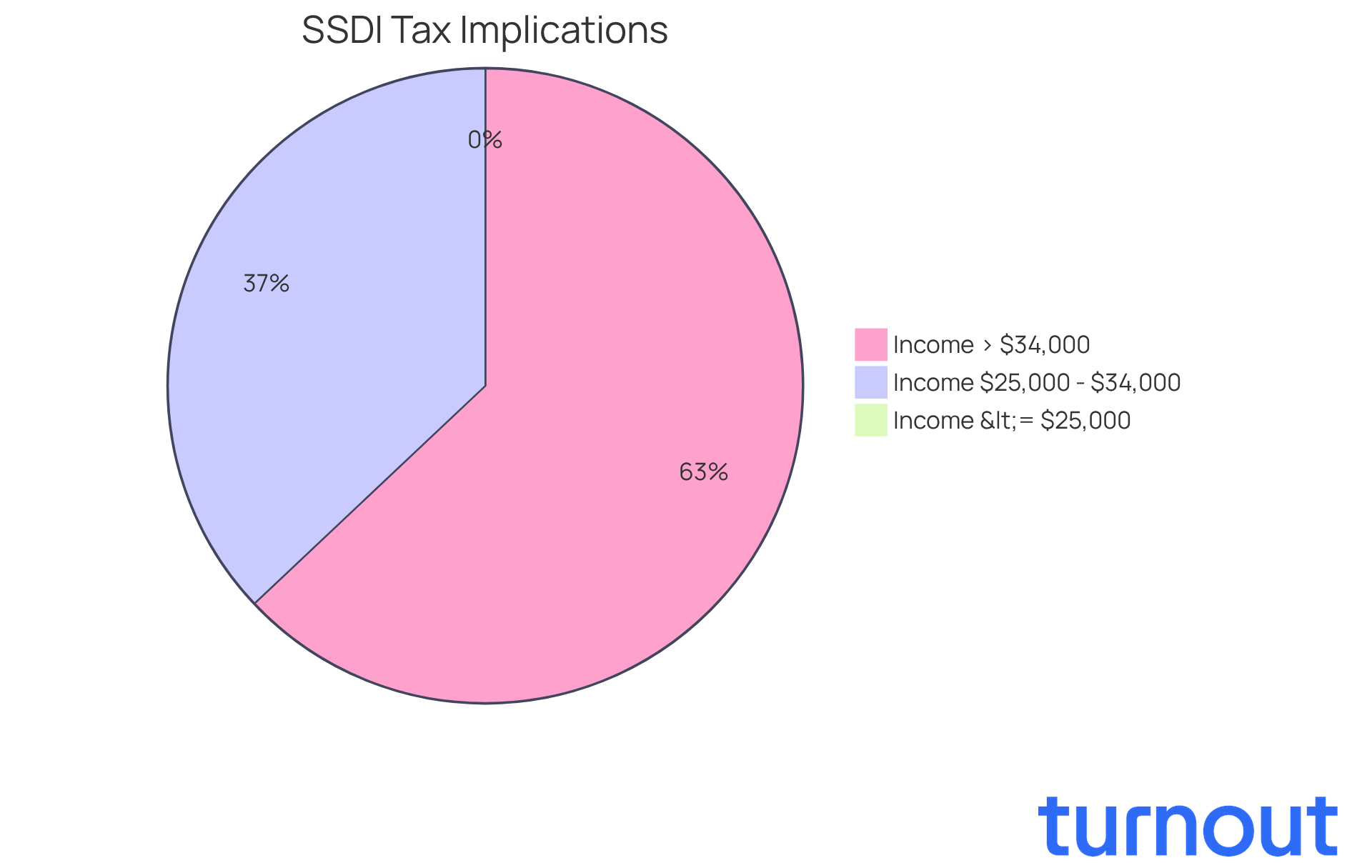

Tax Implications of Disability Income

Disability income can significantly impact your tax situation, especially when considering disabled deductions on income tax related to Social Security Disability Insurance (SSDI) payments. We understand that navigating these waters can be challenging. For the 2025 tax year, if your combined income exceeds $25,000, you might face tax implications. Specifically, if your combined income falls between $25,000 and $34,000, you could be required to include up to 50% of your SSDI payments in your taxable income. And if your total income exceeds $34,000, as much as 85% of your SSDI payments may be taxable.

Comprehending these thresholds is crucial for effective tax planning. Many SSDI recipients may not realize how their assistance and the disabled deductions on income tax can influence their taxable income. For example, consider a single filer receiving $18,000 in SSDI and earning an additional $10,000 from part-time work. Their combined income would be $28,000, placing them within the taxable range.

Real-life examples highlight the importance of being proactive. Many individuals have successfully managed these tax implications by seeking advice from tax experts or utilizing resources like Form SSA-1099, which outlines the benefits received and helps determine tax responsibilities. We’re here to help you navigate these tax implications without needing legal representation. Our trained nonlawyer advocates and IRS-licensed enrolled agents provide valuable resources to assist you.

Staying informed about these tax laws, including disabled deductions on income tax, can prevent unexpected liabilities and ensure that SSDI recipients maximize their financial benefits. Proactively submitting Form W-4V to voluntarily withhold taxes from SSDI payments can also help you avoid large tax bills. Remember, you are not alone in this journey; we’re here to support you every step of the way.

Conclusion

Navigating the landscape of tax deductions for individuals with disabilities is crucial for maximizing financial benefits and ensuring economic stability. We understand that this can feel overwhelming, but knowing your options can make a significant difference. Here, we outline ten critical deductions that can ease the tax burden for disabled taxpayers in 2025. Being informed and proactive in claiming these benefits is essential.

Key deductions include:

- Credit for the Elderly or Disabled

- Earned Income Tax Credit (EITC)

- Various medical expense deductions

Each of these plays a vital role in enhancing financial security. Whether through direct credits that reduce tax liabilities or deductions that alleviate costs associated with disability-related needs, awareness of these options is crucial. Many eligible individuals may overlook these opportunities, potentially missing out on substantial financial assistance.

Ultimately, understanding and utilizing these tax deductions is not just about reducing tax bills; it’s about empowering individuals with disabilities to achieve greater independence and financial security. We’re here to help you navigate these complexities. Engaging with resources and support systems can provide the necessary guidance. By taking action and exploring the available deductions, you can significantly enhance your financial well-being and ensure you receive the benefits you rightfully deserve. Remember, you are not alone in this journey.

Frequently Asked Questions

What is the Credit for the Elderly or Disabled?

The Credit for the Elderly or Disabled is a tax credit available for individuals aged 65 or older or those living with a permanent disability. For the 2025 tax year, the credit ranges from $3,750 to $7,500, depending on income level.

Who qualifies for the Credit for the Elderly or Disabled?

To qualify for the Credit for the Elderly or Disabled, you must have received taxable disability income during the year.

How does the Credit for the Elderly or Disabled benefit individuals?

This credit can significantly reduce your tax burden, allowing you to keep more of your income and manage living expenses more effectively.

How many people are estimated to be eligible for the Credit for the Elderly or Disabled in 2025?

It is estimated that around 2.5 million people will be eligible for this credit in 2025.

What is the Earned Income Tax Credit (EITC) for Disabled Workers?

The Earned Income Tax Credit (EITC) is a tax benefit aimed at low- to moderate-income workers, including those with disabilities, providing a credit of up to $8,046 for the 2025 tax year.

What qualifies as earned income for the EITC?

Certain disability payments may qualify as earned income, allowing recipients to benefit from the EITC.

How can individuals claim the EITC?

To claim the EITC, you must submit a tax return. Failing to do so could result in missing out on substantial financial assistance.

What percentage of eligible taxpayers claimed the EITC in 2023?

In 2023, around 23 million workers and families received the EITC, but one in five eligible taxpayers did not claim it.

What can taxpayers deduct under the Medical Expense Deduction for Disability-Related Costs?

Taxpayers can deduct medical expenses that exceed 7.5% of their adjusted gross income (AGI), including costs for diagnosis, treatment, and prevention of disabilities.

What types of expenses qualify for the Medical Expense Deduction?

Eligible expenses can include medical supplies, therapy, and transportation costs related to medical appointments.

How can taxpayers benefit from disabled deductions on income tax?

To benefit from disabled deductions on income tax, you must itemize your deductions on Schedule A of your tax return.