Introduction

Navigating the complexities of back tax services can be particularly challenging for individuals with disabilities. We understand that you may face unique hurdles in managing your financial obligations. This article explores ten essential back tax services in Los Angeles, specifically designed to empower those with disabilities. These services offer tailored solutions that address your distinct needs.

However, with so many options available, it’s common to feel overwhelmed. How can you determine which services provide the most effective support in alleviating tax burdens and ensuring compliance? We're here to help you find the answers.

Turnout: AI-Powered Tax Debt Relief Services

Turnout understands the challenges that individuals with disabilities face when seeking back tax services in Los Angeles to manage tax debt. That’s why we utilize the power of artificial intelligence to offer customized back tax services Los Angeles that are tailored just for you. By automating essential processes like document management and case tracking, we ensure that you receive timely assistance and support when you need it most.

This innovative approach not only simplifies the tax resolution process but also empowers you to navigate the complexities of tax systems with confidence. We know that understanding Turnout's fee structure is important. Some services are complimentary, while others may involve service charges. Plus, government fees must be settled before we can submit any paperwork on your behalf.

With AI leading the way, Turnout is transforming consumer advocacy in back tax services Los Angeles, making these services more accessible and effective for those who truly need them. We also assist clients with SSD claims, using trained nonlawyer advocates to help you through these processes.

The IRS's launch of the Direct File program for the 2024 filing season, developed in partnership with disability organizations, shows how AI can enhance accessibility and support for taxpayers with disabilities. Remember, you are not alone in this journey. We're here to help you every step of the way.

Dimov Tax Attorney: Expert Back Tax Filing and Resolution

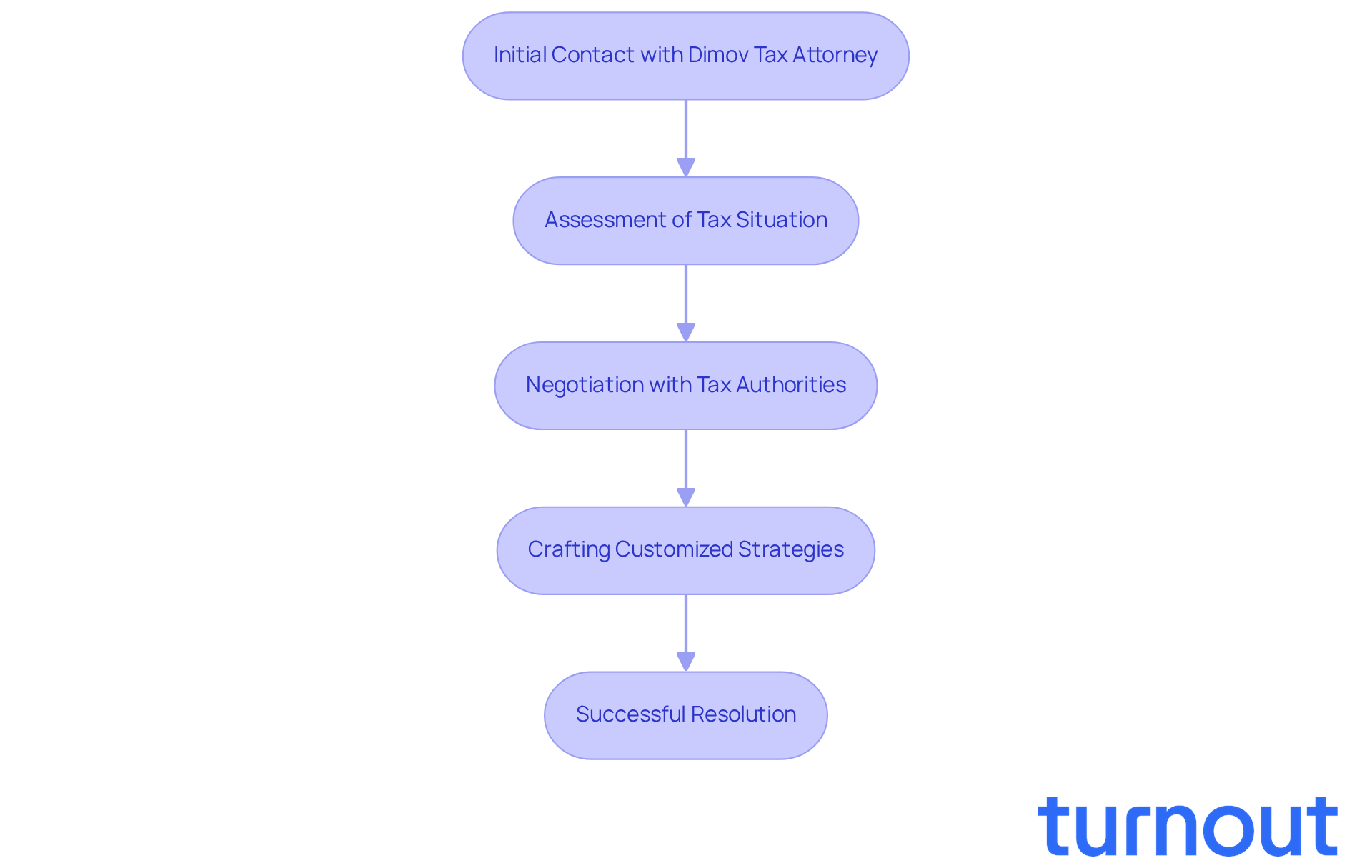

Are you feeling overwhelmed by back tax services Los Angeles offers? Dimov Tax Attorney is here to help. We specialize in back tax services Los Angeles, offering compassionate legal assistance tailored specifically for individuals with disabilities. Our dedicated team prioritizes personalized service, ensuring you fully understand your options and receive the best possible outcomes.

We know how challenging it can be to navigate tax debt, especially when seeking back tax services Los Angeles. That’s why we negotiate effectively with tax authorities and craft customized strategies just for you. Dimov Tax Attorney stands as a crucial ally for those grappling with tax issues, offering back tax services Los Angeles to provide the support you need during this difficult time.

Additionally, Turnout is here to assist you with Social Security Disability (SSD) claims and tax debt relief. Our trained nonlawyer advocates and IRS-licensed enrolled agents enhance the resources available to help you manage your financial challenges.

On average, tax resolution cases can take between six to twelve months. But with our expert guidance, clients with disabilities often experience successful outcomes. Imagine alleviating your financial burdens and restoring your peace of mind. You are not alone in this journey; we’re here to help.

Neumeister & Associates: Comprehensive Tax Preparation and Compliance

Neumeister & Associates is more than just an accounting firm; it’s a caring partner dedicated to helping individuals with disabilities navigate the often complex world of tax preparation and compliance. We understand that managing taxes can be overwhelming, especially when unique challenges arise. That’s why our team is here to provide personalized solutions that simplify the intricacies of tax regulations.

Imagine maximizing your deductions and credits, which can significantly improve your financial situation. Many disabled taxpayers can benefit from deductions related to medical expenses, including costs for assistive devices and necessary home modifications, as long as they meet IRS thresholds. Our commitment to you means we focus on these opportunities to enhance your financial well-being.

We’re proud of our track record, filled with success stories of individuals who have secured substantial tax credits, like the Earned Income Tax Credit (EITC) and the Saver's Credit for contributions to ABLE accounts. Our dedication ensures that you not only meet your tax obligations but also take full advantage of the benefits available to you.

But we don’t stop there. Turnout complements our efforts by offering tools and back tax services Los Angeles that help you navigate complex financial and governmental systems, including SSD claims and tax debt relief. With trained nonlawyer advocates and IRS-licensed enrolled agents working alongside Neumeister & Associates, you can rest assured that you’re receiving comprehensive support tailored to your unique needs.

Remember, you are not alone in this journey. We’re here to help you every step of the way.

H&R Block: Local Tax Preparation Services in Los Angeles

H&R Block stands out as a top choice for back tax services in Los Angeles, especially for those seeking reliable support. We understand that navigating taxes can be overwhelming, and that’s why our team of skilled tax experts provides back tax services in Los Angeles to help. They’re adept at handling various tax situations, including providing back tax services in Los Angeles, ensuring you receive personalized assistance tailored to your unique needs.

Accessibility is a priority for us. We strive to make it easier for individuals with disabilities to access the support they deserve. This commitment to customer service shines through in the high satisfaction ratings from our clients, who value the personalized attention and expertise we provide during the tax filing process.

Additionally, Turnout offers valuable services like assistance with Social Security Disability (SSD) claims. This partnership enhances H&R Block's tax preparation services, creating a more comprehensive support system for those with disabilities.

We’re dedicated to transforming the often daunting task of tax preparation into a manageable and supportive experience. Remember, you are not alone in this journey; we’re here to help you every step of the way.

Joffe Tax: Specialized Debt Relief Services

Are you feeling overwhelmed by your tax responsibilities? At Joffe Tax, we understand that managing taxes can be especially challenging, particularly for individuals with disabilities. That’s why we offer customized debt relief services designed to help you navigate these tough times with compassion and care.

Our experienced team excels in negotiating with the IRS, using effective strategies to reduce tax debt and alleviate financial stress. We prioritize tailored solutions that empower you to regain control over your financial situation. You are not alone in this journey; we’re here to help.

Many of our clients have experienced substantial debt reductions, with an average decrease of 50% in their tax obligations. This highlights the effectiveness of professional representation in these intricate matters. Imagine what it would feel like to lift that burden off your shoulders.

If you’re facing tax-related challenges, consider our back tax services in Los Angeles for support. Reach out today, and together we can find a way forward.

My IRS Tax Relief: Virtual Back Tax Help and Accounting

At My IRS Tax Relief, we understand that navigating tax challenges can be particularly daunting for disabled individuals. That’s why we excel in offering back tax services in Los Angeles and virtual accounting services tailored just for you. Our online platform allows you to seek help from the comfort of your home, effectively removing mobility-related barriers that can make this process even more stressful.

We prioritize personalized service because we know that each situation is unique. With our dedicated support, you can confidently tackle your tax challenges. This approach not only enhances accessibility but also significantly improves your financial situation, empowering you to manage your tax obligations more effectively.

Imagine the convenience of online assistance fostering a sense of independence. You deserve to take control of your financial future without the added stress of physical limitations. Remember, you are not alone in this journey; we’re here to help you every step of the way.

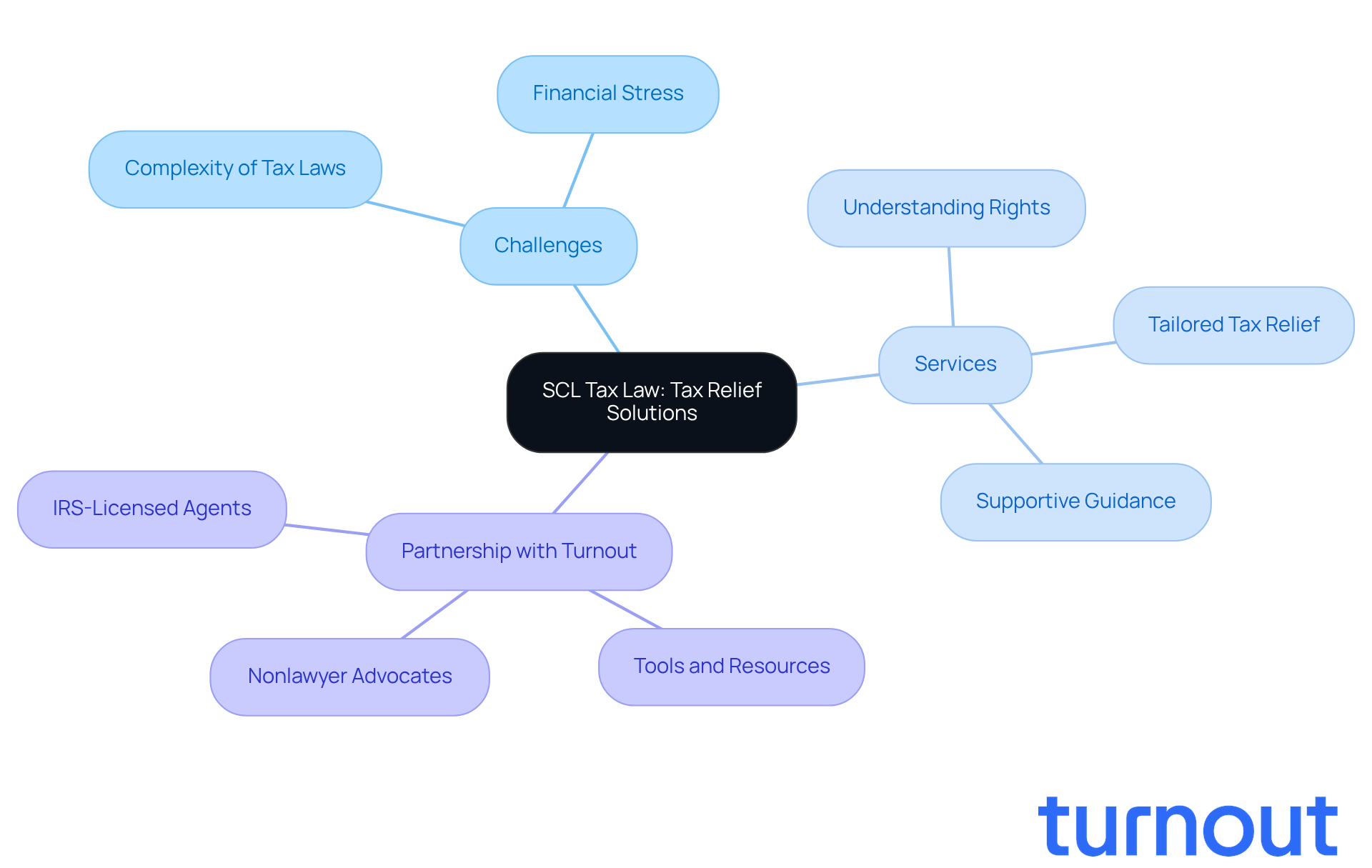

SCL Tax Law: Expert Tax Relief Solutions

At SCL Tax Law, we understand that navigating tax issues can be particularly challenging for individuals with disabilities. With about 1 in 4 adults in the U.S. living with a disability, the complexity of tax laws can feel overwhelming, often leading to significant financial stress. Our dedicated team of experienced attorneys is here to help you tackle these unique challenges. We focus on providing tailored tax relief solutions that empower you to achieve positive results.

We’re committed to ensuring you understand your rights and secure the benefits you deserve. Our approach is compassionate and supportive, guiding you through every step of the resolution process. You are not alone in this journey; we’re here to provide the comprehensive support you need.

In addition to our services, Turnout complements our efforts by offering tools and resources to help you navigate government-related processes, such as back tax services Los Angeles, Social Security Disability (SSD) claims, and tax debt relief. With trained nonlawyer advocates and IRS-licensed enrolled agents, Turnout ensures you have access to the guidance you need without the pressure of legal representation. This partnership allows you to benefit from both legal expertise and practical support in managing your tax and disability claims.

Together, we can help you find the relief you seek. If you’re feeling overwhelmed, reach out to us today. Let’s work together to secure the support you need.

Tonden & Associates: Informative Resources on Tax Issues

Tonden & Associates is truly a beacon of hope for anyone feeling overwhelmed by tax matters. We understand that navigating the complexities of taxes can be daunting, and that’s why we’re here to help. Our commitment to education shines through in our range of informative workshops, guides, and personalized consultations designed to empower you.

These initiatives not only clarify your tax rights and obligations but also equip individuals with disabilities with the essential tools to confidently navigate the tax landscape. Imagine feeling informed and capable, ready to tackle your financial responsibilities with ease.

By fostering a nurturing learning environment, Tonden & Associates helps you make informed choices that can lead to better financial outcomes. The success stories of individuals who have gained confidence and knowledge through our educational efforts are a testament to the transformative power of accessible tax resources.

You are not alone in this journey. Let us support you in achieving clarity and confidence in your tax matters.

Free Tax Prep Los Angeles: Affordable Tax Preparation Services

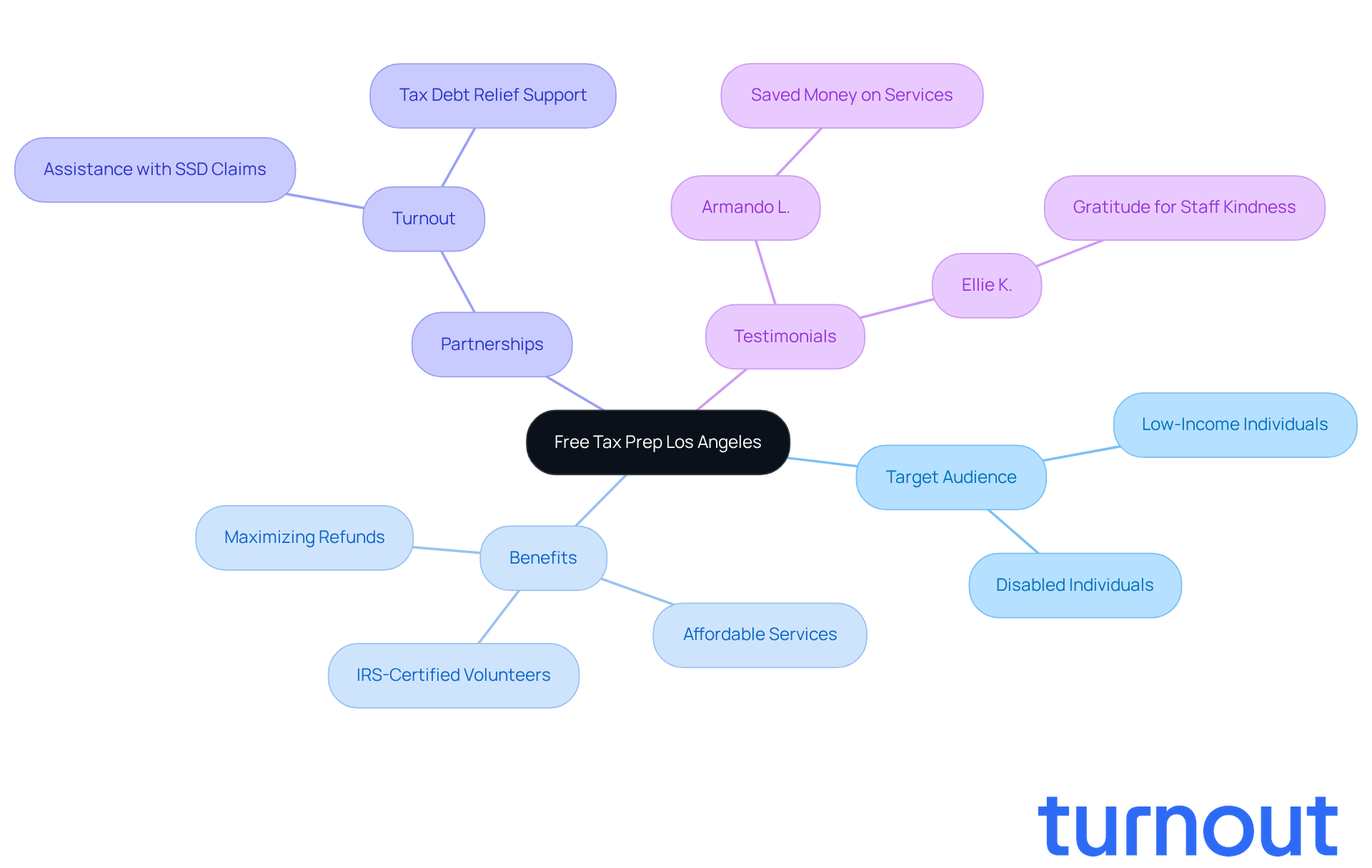

Free Tax Prep Los Angeles is here to help you with affordable tax preparation services tailored for low-income individuals, including those with disabilities. We understand that navigating the tax system can be overwhelming, but our dedicated team of IRS-certified volunteers is committed to assisting you in accurately filing your taxes and maximizing your refunds. We believe that financial obstacles shouldn’t stand in the way of accessing essential support.

By offering complimentary services, we empower disabled individuals to approach tax preparation with confidence, easing the stress that often accompanies this process. We know that every bit of support counts, and we’re here to guide you through it.

In partnership with Turnout, we enhance our services by helping you navigate complex financial systems. Turnout’s trained nonlawyer advocates are available to assist with Social Security Disability (SSD) claims and tax debt relief, ensuring you receive the help you need without the complications of legal representation. Remember, Turnout is not a law firm and does not provide legal advice, but they are here to support you.

Success stories from our clients, like Armando L., show just how impactful our services can be. Armando shared how Free Tax Prep saved him money on services he would have otherwise paid for. Ellie K. also expressed her gratitude, highlighting the kindness of our staff and her eagerness to recommend us to others. These testimonials underscore the significant impact of free tax preparation on the financial well-being of individuals with disabilities, allowing them to claim credits and refunds they deserve, such as the California Earned Income Tax Credit (CalEITC).

Our program not only improves financial outcomes but also fosters a sense of community and support. We’re here for you, making this an essential resource for anyone looking to enhance their financial health. You are not alone in this journey.

Reliable Tax Lawyers: Essential Legal Support for Back Taxes

Facing back tax services Los Angeles can be daunting, especially for individuals with disabilities. We understand that navigating the complexities of tax law can feel overwhelming. With initial Social Security Disability application denial rates hovering around 65-70%, it’s crucial to grasp your tax obligations for financial security.

That’s where trustworthy tax attorneys come in. Their knowledgeable team is dedicated to providing essential legal assistance tailored to your unique situation. By offering personalized representation, reliable tax lawyers empower individuals with disabilities to effectively navigate the tax system. This ensures your rights are protected and enhances your chances of achieving favorable outcomes.

Imagine having expert guidance by your side during tax disputes. Successful legal representation can significantly improve your situation, making it vital for disabled taxpayers to seek the back tax services Los Angeles offers that they deserve. Remember, you are not alone in this journey. We’re here to help you every step of the way.

Conclusion

Navigating the world of back tax services can feel overwhelming, especially for individuals with disabilities. But in Los Angeles, there’s a wealth of resources and support available to help you. This article shines a light on essential services that not only tackle tax debt but also empower you to manage your financial obligations with confidence. From innovative AI-powered solutions to compassionate legal assistance, these services are tailored to meet your unique needs and provide personalized support.

Key players like Turnout, Dimov Tax Attorney, and Neumeister & Associates are dedicated to making tax resolution accessible and effective. They offer tailored strategies, educational resources, and expert guidance to help you understand your rights and maximize available benefits. These services not only ease financial burdens but also foster a sense of community and support, ensuring that you don’t have to face your tax challenges alone.

Ultimately, the message is clear: if you have a disability in Los Angeles, you have access to a range of back tax services that can significantly improve your financial well-being. It’s vital to seek out these resources-whether through professional representation, virtual assistance, or community support-to navigate the complexities of tax obligations. By taking action and utilizing the available services, you can reclaim control over your financial future and achieve the peace of mind you deserve. Remember, you are not alone in this journey; we’re here to help.

Frequently Asked Questions

What services does Turnout provide for individuals with disabilities regarding tax debt?

Turnout offers AI-powered customized back tax services in Los Angeles, including document management and case tracking, to help individuals with disabilities manage their tax debt effectively.

How does Turnout utilize artificial intelligence in its services?

Turnout uses artificial intelligence to automate essential processes such as document management and case tracking, simplifying the tax resolution process and empowering clients to navigate tax complexities with confidence.

Are there any fees associated with Turnout's services?

Yes, some services provided by Turnout are complimentary, while others may involve service charges. Additionally, government fees must be settled before any paperwork can be submitted on behalf of clients.

What is the Direct File program mentioned in the article?

The Direct File program, launched by the IRS for the 2024 filing season in partnership with disability organizations, aims to enhance accessibility and support for taxpayers with disabilities.

How does Dimov Tax Attorney assist individuals with back tax services?

Dimov Tax Attorney provides compassionate legal assistance tailored for individuals with disabilities, offering personalized service, effective negotiation with tax authorities, and customized strategies for tax resolution.

How long do tax resolution cases typically take?

On average, tax resolution cases can take between six to twelve months, but with expert guidance, clients with disabilities often achieve successful outcomes.

What role does Neumeister & Associates play in tax preparation for individuals with disabilities?

Neumeister & Associates offers personalized solutions for tax preparation and compliance, helping individuals with disabilities navigate tax regulations and maximize deductions and credits.

What types of deductions can disabled taxpayers benefit from?

Disabled taxpayers may benefit from deductions related to medical expenses, including costs for assistive devices and necessary home modifications, provided they meet IRS thresholds.

How do Turnout and Neumeister & Associates work together?

Turnout complements Neumeister & Associates by offering tools and back tax services that assist clients in navigating complex financial and governmental systems, including SSD claims and tax debt relief.

What support can clients expect from these services?

Clients can expect comprehensive support tailored to their unique needs, with trained nonlawyer advocates and IRS-licensed enrolled agents working alongside the organizations to help them manage financial challenges.